• Improved sentiment. Equities took the latest uptick in the US 10yr yield in their stride. Limited FX moves with the AUD a relative outperformer for a change.

• AU jobs. The ‘labour force lottery’ lived up to its volatile nature. Following a few strong months employment fell sharply but unemployment held steady.

• Vol. to continue. The laundry list of uncertainties and macro/geopolitical flashpoints suggests the recent volatility could be a taste of things to come.

Risk sentiment improved overnight with a further modest rise in long-end bond yields not causing the same market turbulence as it has recently. On the back of some more positive US data (weekly initial jobless claims fell 16,000 to 187,000 last week, the lowest level in 16 months, and monthly housing starts and building permits were better than anticipated) the benchmark US 10yr yield rose another 4bps. At 4.14% the US 10yr rate is at its highest since mid-December, though it remains nearly 90bps below its late-October cyclical peak.

That said, the more policy expectations driven US 2yr yield consolidated (now ~4.35%) with 2024 FOMC voter Bostic a little less forceful in his pushback of market rate cut pricing compared to some others. According to Bostic, while he doesn’t see the Fed beginning to cut rates until Q3, he is open to moving earlier if inflation falls “well faster” than predicted. Markets have tempered their thoughts recently, however a ~50% chance of a rate cut by the Fed at the March meeting is still factored in. As outlined before, we think this is too soon for the Fed (and other central banks) to start reversing course, with a kick off data towards mid-year more likely (see Market Musings: US Fed pivot has further to run). As market interest rate expectations continue to swing around over the coming weeks renewed bouts of volatility wouldn’t be a surprise.

Equities took the latest uptick in the US 10yr yield in their stride with a tech-sector led rally pushing the S&P500 higher (+0.8%). Despite recent gyrations the S&P500 is within 1% of its record high. FX moves have been limited. The USD Index has tread water with EUR hovering around ~$1.0860 and USD/JPY above ~148 (the top end of its ~6-week range). USD/SGD is tracking just below its 200-day moving average (~1.3462), while the beleaguered AUD has been a relative outperformer in quite currency markets. The AUD has nudged up to ~$0.6566 as firmer equities, energy (WTI crude +1.9%), and base metal prices (copper +0.4% and iron ore +1.8%) generated a bit of support.

The latest read on Japanese inflation (10:30am AEDT), UK retail sales (6pm AEDT), US consumer sentiment (2am AEDT), and appearances by ECB President Lagarde (9pm AEDT), the Fed’s Goolsbee (12:30am AEDT), and the Fed’s Daly (3:15am AEDT) are on the calendar today. While we think the USD’s revival should eventually lose steam as the positioning adjustment runs its course and the medium-term theme for lower US interest rates re-asserts itself, in the short-term the USD can hold up as markets continue to pare back their views looking for cuts to start in March.

AUD corner

After a torrid spell the AUD has found a little a support over the past 24hrs. The more positive tone across risk markets (as illustrated by the lift in equities, oil, and base metal prices) has helped the AUD edge up to ~$0.6566. The AUD has also recouped some lost ground on the crosses with gains of ~0.2-0.4% recorded against the other major currencies.

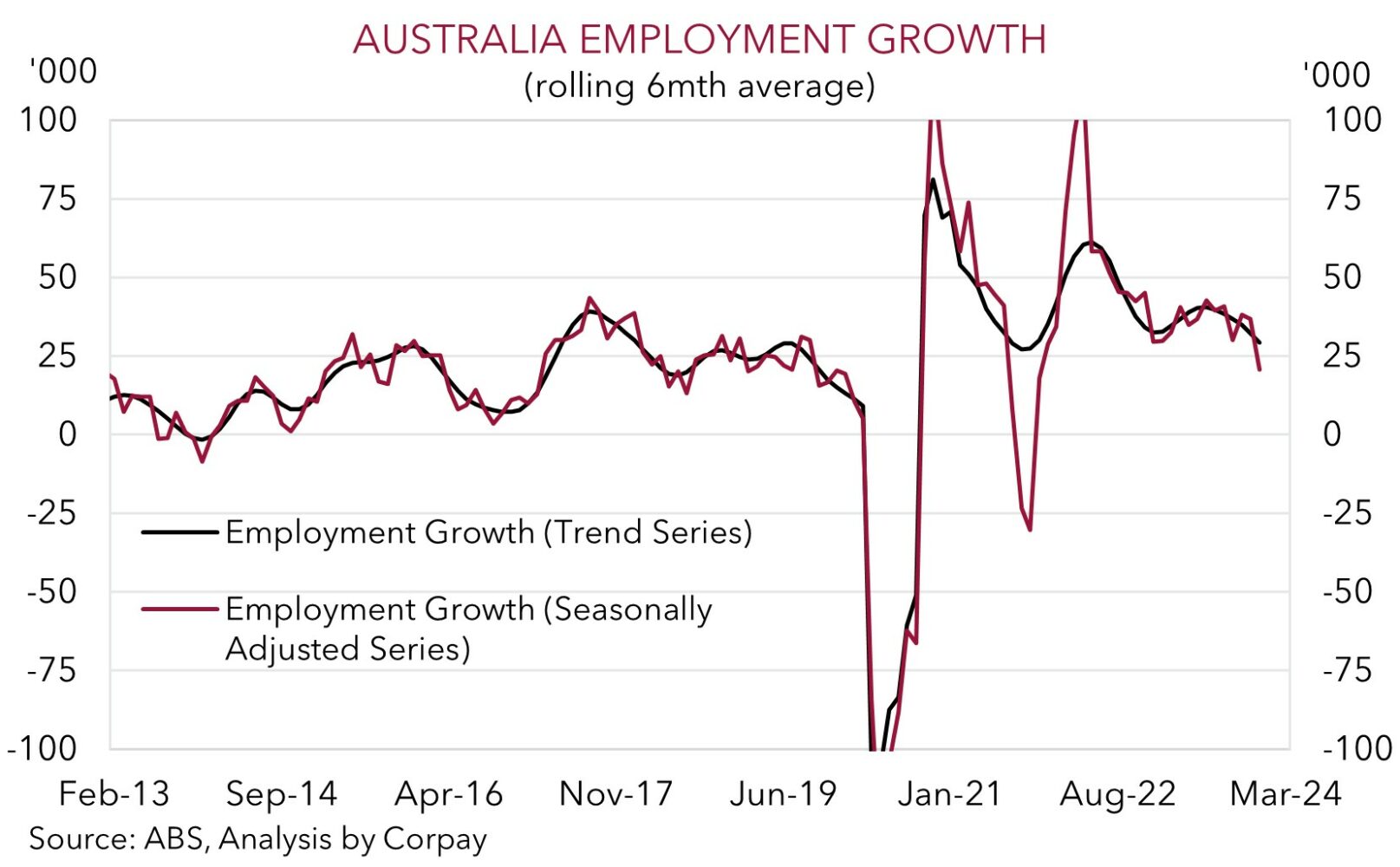

Locally, the December jobs data was released yesterday and the ‘labour force lottery’ lived up to its volatile nature with another wild print coming through. Employment fell by an outsized 65,100 in December, following the upwardly revised ~73,000 jump in November and a ~44,000 October gain. Despite the ‘headline’ job losses, a sharp drop in labour supply helped the unemployment rate (which is less impacted from survey volatility) hold steady at 3.9%. In our opinion, the December results were more noise than signal with seasonal shenanigans related to new work/holiday patterns since Covid playing a role. The ‘trend series’, which strips out this type of volatility, shows that although employment growth has moderated, it remains positive.

The cooling across the economy and reduced labour demand points to the unemployment rate drifting higher over 2024, however conditions are still fairly tight and until the cracks start to widen we believe the RBA is likely to keep its guard up for a while yet. As mentioned previously, though we don’t see the RBA hiking interest rates again, we expect it to lag its peers in terms of when it starts and how far it goes during the next easing cycle given the stickiness across services inflation and other things like the support to aggregate demand from the larger population. In time we expect this divergence and narrowing in yield differentials to give the AUD a helping hand, with our central forecast looking for the AUD to edge back up to ~$0.70 in Q3.

However, while we hold a positive medium-term bias for the AUD, there will be bumps along the way with two-way risks around how important parts of the story might pan out. The laundry list of uncertainties and macro/geopolitical flashpoints in 2024 points to the AUD trading in a wide range once again this year with the volatility observed over the past weeks potentially a taste of things to come. It should be remembered that in the 40-years since the float the AUD has, on average, traded in a ~20% (or ~13 cent) calendar year range. Within that the AUD has, on average, experienced a ~8.5% intra-year rally and a ~9.5% intra-year drawdown relative to its opening levels. Based on where the AUD started 2024, and with these parameters in mind, a conceivable range the AUD could oscillate between this year is ~$0.62 to ~$0.74. For more details on this please see Market Musings: AUD volatility: a taste of things to come?

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6580, 0.6630