• Upbeat tone. US S&P500 closed at a record high. Base metals prices lifted. The USD drifted a little lower & the AUD clawed back a bit more ground.

• Bond yields. US yields were, on net, little changed. Ahead of the blackout period a few Fed members spoke. Odds of a March rate cut below ~50%.

• Event radar. Offshore, the macro focus this week will be on the BoJ, Q4 NZ CPI, the Eurozone PMIs, ECB decision, Q4 US GDP, & US PCE deflator.

The relatively more upbeat mood in markets continued Friday with the tech sector inspired upswing in US equities continuing. The S&P500 (+1.2%) hit a record high close with US markets shrugging off the consolidation across the European indices. Elsewhere, US bond yields were on net little changed with the 10yr rate failing to hold onto its early lift (-2bps to 4.13%) while the policy expectations driven 2yr yield ticked up a touch (+3bps to 4.38%).

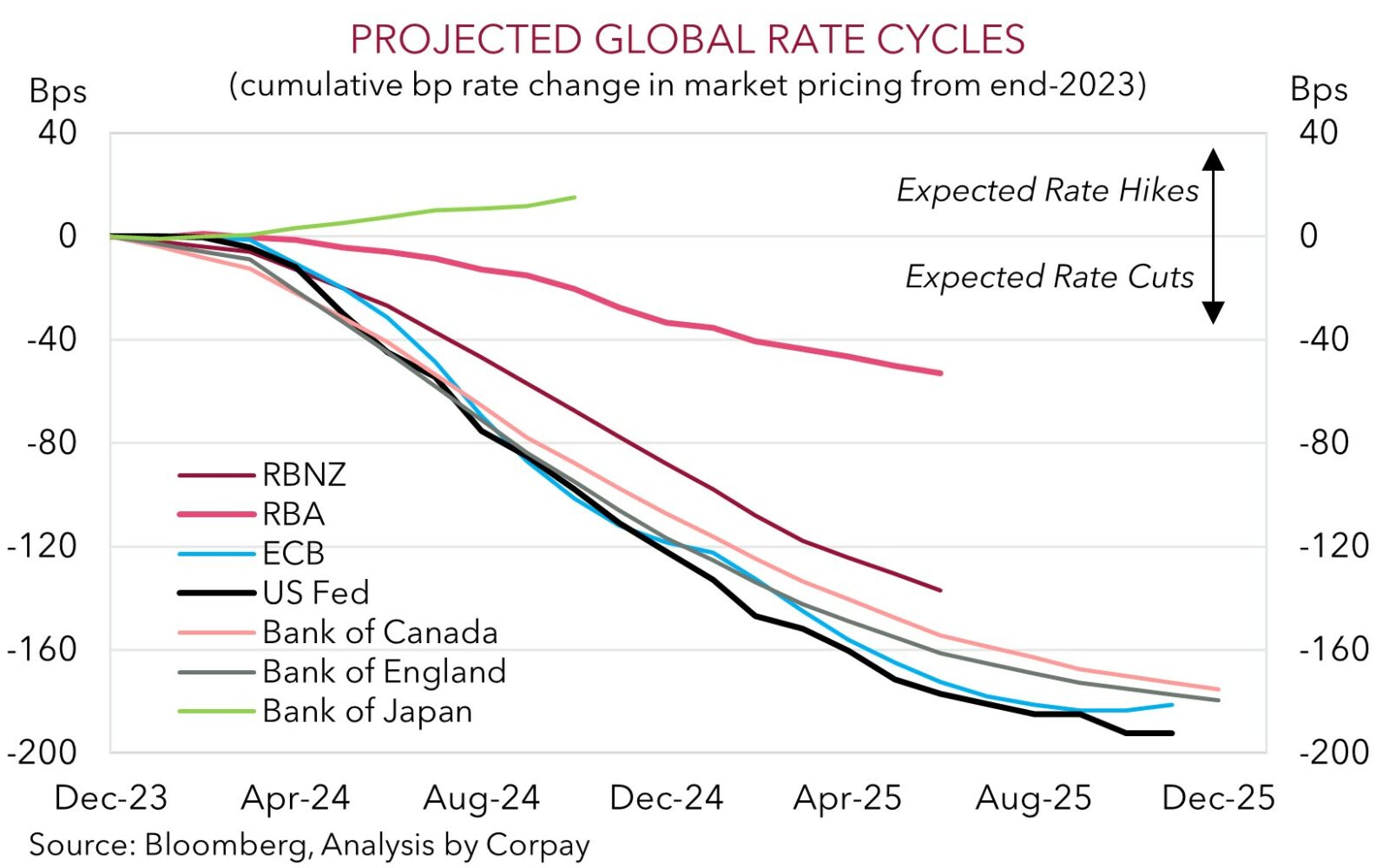

There were a few Fed speakers ahead of the blackout period for the upcoming FOMC meeting. On the one hand, San Fransico Fed President Daly stressed that it’s premature to think rate cuts are around the corner, while Atlanta Fed President Bostic reiterated that he wants to see more evidence of falling inflation and that they should proceed cautiously when it comes to easing. By contrast, Chicago Fed President Goolsbee noted that the Fed should consider cutting rates as inflation falls to avoid keep policy too tight. This is something we have highlighted previously with central banks focused on the gap between real rates compared to the equilibrium neutral level, and if settings aren’t recalibrated as inflation falls conditions would mechanically become more ‘restrictive’ (see Market Musings: US Fed pivot has further to run). The probability the Fed begins to lower rates in March has slipped under 50%, with a full cut discounted by the May meeting.

FX markets were rather subdued with the USD drifting a bit lower. EUR edged up towards ~$1.09 and GBP consolidated (now ~$1.2695) despite a sizeable drop in UK retail sales in December (volumes fell 3.3% in the month) which raised the odds the economy slid into a recession at the end of last year. USD/JPY is treading water just above ~148, near the top of its ~6-week range, with another moderation in Japanese core inflation (now 3.7%pa) further tempering already low expectations about a potential policy tweak by the Bank of Japan at tomorrow’s first meeting of 2024. The improved risk sentiment has helped the AUD claw back more lost ground with the currency poking its head above its 200-day moving average (~$0.6581).

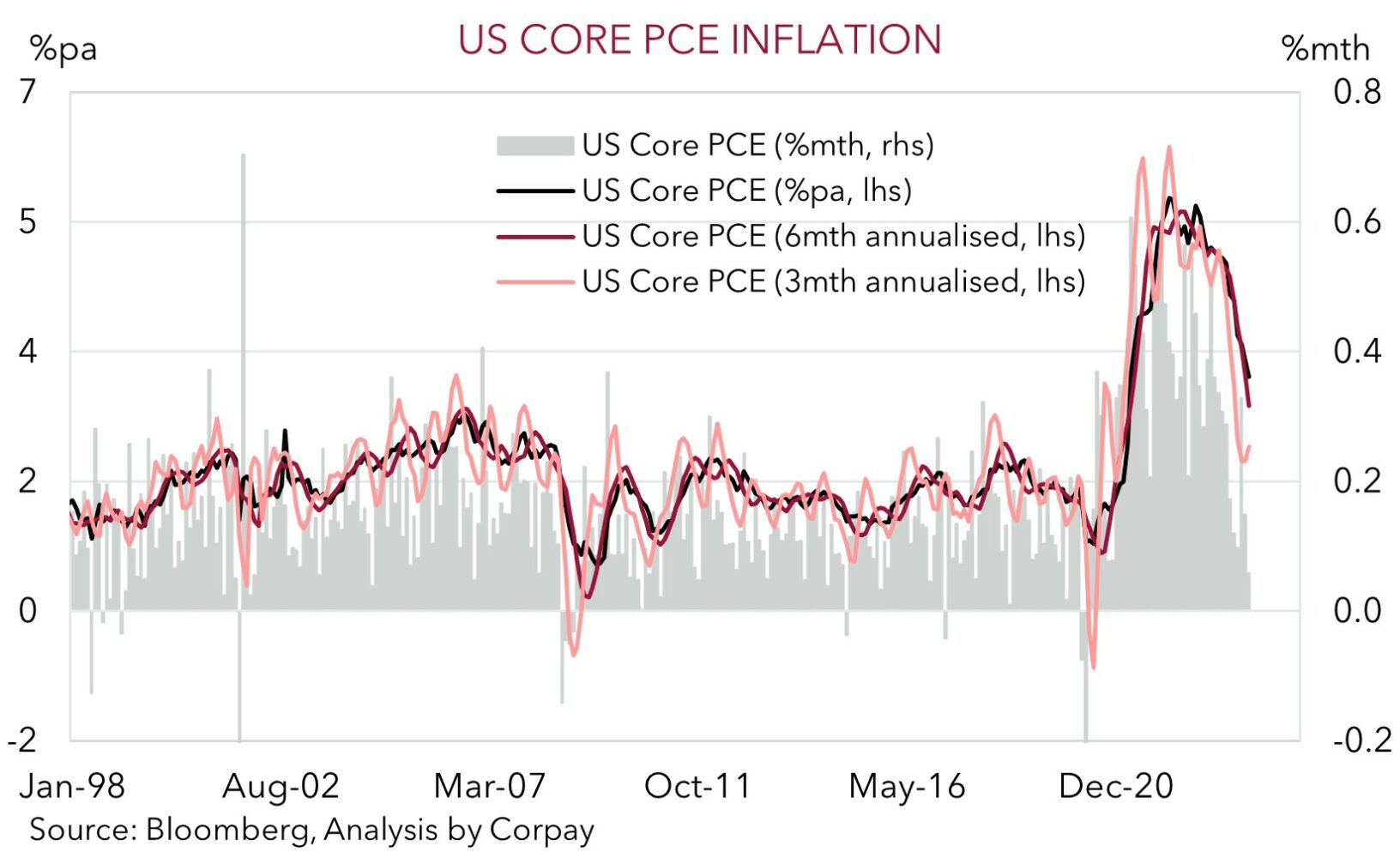

In addition to the BoJ meeting (Tues AEDT), global market attention this week will also be on the latest Eurozone/US business PMIs (Weds AEDT), the ECB decision (Thurs AEDT), the first estimate of Q4 US GDP (Fri AEDT), and the US PCE deflator (the Fed’s preferred inflation gauge) (Sat AEDT). Given the macro run sheet we think intra-day USD volatility could lift this week, although on balance, we believe the USD may end the week lower. In our view, while confirmation of another solid quarter of US growth might generate some USD support, a deceleration in the US core PCE deflator, signs of improvement in the Eurozone PMIs, and/or push back by the ECB on aggressive near-term rate cut pricing may be a larger offsetting force.

AUD corner

The AUD continued to grind higher on Friday with the lift in US equities and firmer base metal prices supportive (copper rose ~1% while iron ore increased by ~1.7%). At ~$0.6586 the AUD is trading above its 200-day moving average with the AUD also strengthening a little on most of the major crosses. The AUD appreciated by ~0.3-0.4% against GBP, NZD, and the JPY, with gains of ~0.1-0.2% recorded against EUR and CNH. Ahead of tomorrow’s BoJ announcement, where no major changes are anticipated, AUD/JPY is hovering near ~97.70 (less than 1% below its late-November cyclical peak). We remain of the view that over the medium-term AUD/JPY has more downside than upside potential from current levels (since 2010 AUD/JPY has only traded above where it is currently ~3% of the time) with a renewed downtrend in global bond yields as policy easing outside of Japan kicks off a factor.

Locally, it is a pretty limited data calendar in the holiday shortened week with the latest read on business conditions (Tues) the only release of note. As such global trends and events will be in the AUD drivers seat. As flagged, over the next few days the market focus will be on the BoJ (Tues AEDT), Q4 NZ CPI (Weds AEDT), Eurozone/US business PMIs (Weds AEDT), the ECB outcome (Thurs AEDT), Q4 US GDP (Fri AEDT), and the US PCE deflator (the Fed’s preferred inflation measure) (Sat AEDT). Further bursts of AUD volatility are likely as global interest rate expectations are pushed and pulled by the incoming data flow. However, on net, we think the AUD should nudge up a bit more with the USD expected to lose steam if we are right in thinking that the Eurozone PMIs could show some improvement, the ECB leans against the markets rate cut bets, and/or the US PCE deflator undershoots forecasts which in turn reinforces calls for the Fed’s easing cycle to start towards mid-year.

As outlined before, although we don’t see the RBA raising interest rates again, we see it lagging its counterparts in terms of when it starts and how far it goes during the next easing cycle given the stickiness across services inflation and other dynamics such as the support to aggregate demand from the larger population and incoming stage 3 tax cuts. The narrowing in short-dated yield differentials, coupled with a sturdier Chinese economy as stimulus measures gain traction should give the AUD a helping hand over the medium-term, in our opinion. That said, while our central forecast is looking for the AUD to edge up to ~$0.70 in Q3 given where we are in the global economic cycle and the long list of uncertainties and macro/geopolitical flashpoints in 2024, more volatility looks likely. It should be remembered that in the 40-years since the float the AUD has, on average, traded in a ~20% (or ~13 cent) calendar year range. Within that the AUD has, on average, experienced a ~8.5% intra-year rally and a ~9.5% intra-year drawdown relative to its opening levels (see Market Musings: AUD volatility: a taste of things to come?).

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6620, 0.6660

SGD corner

Over the past week the upward adjustment in US bond yields stemming from better than anticipated US retail sales data and relatively more ‘hawkish’ comments by a few Fed officials has pushed USD/SGD higher. At ~1.3411, USD/SGD is near the upper end of the range it has occupied since December. On the crosses, EUR/SGD has tracked sideways (now ~1.4605) with the pair hovering a bit above its ~3-month average. By contrast, SGD/JPY (now 110.50) has extended its move higher with the upswing in global bond yields weighing on the JPY.

As discussed, there are a few global economic events this week that may generate some further market volatility such as the BoJ meeting, the Eurozone/US business PMIs, the ECB decision, Q4 US GDP, and the US PCE deflator (the Fed’s preferred inflation measure). In our judgement, indications that the economic slowdown in the Eurozone is levelling off, comments by the ECB pushing back on the markets aggressive near-term rate cut expectations, and/or a further deceleration in the US core PCE deflator could, on net, see the USD and USD/SGD ease back.

SGD levels to watch (support / resistance): 1.3310, 1.3360 / 1.3460, 1.3500