• Subdued markets. US equities added to their gains, bond yields drifted a bit lower, & the USD ticked up. AUD slipped back towards ~$0.6570.

• BoJ decision. No changes by the BoJ anticipated today. But there is always scope for a surprise. If it were to occur, the ‘under-valued’ JPY would lift.

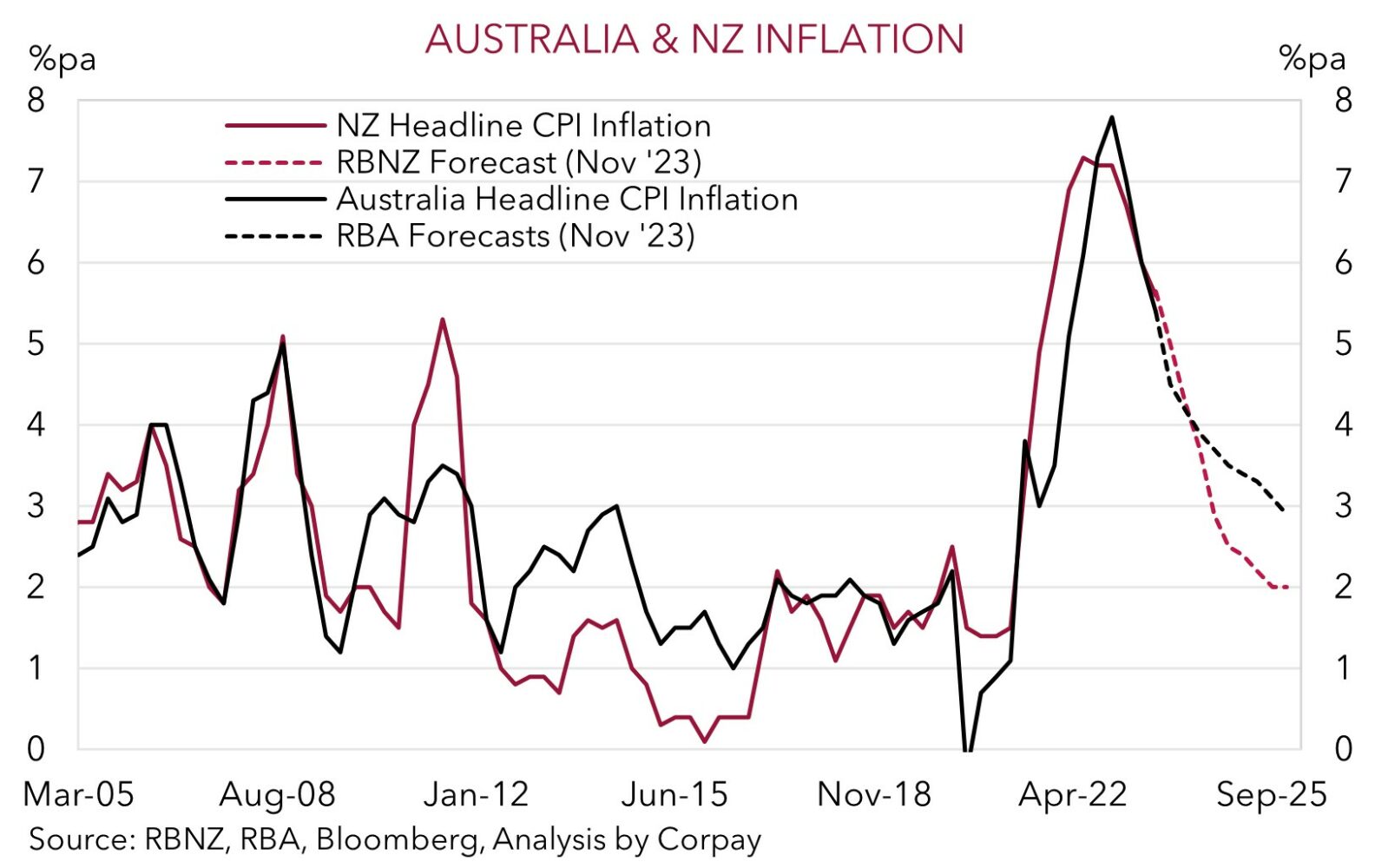

• NZ inflation. Q4 NZ CPI due tomorrow. Inflation slowdown set to extend. A large drop could reinforce RBNZ rate cut views, a support for AUD/NZD.

It has been quiet start to the week across markets. This isn’t surprising given the lack of economic data releases and with members of the US Fed in a black out period ahead of the upcoming meeting (announcement 1 Feb AEDT). The positive run in US equities has continued with the S&P500 eking out another gain (+0.3%). This has pushed the index to fresh highs. US earnings season kicks into high gear this week with firms like Netflix, Tesla, IBM, and Intel reporting results.

Elsewhere, bond yields drifted a bit lower with 10yr rates in Germany, the UK, and US down ~2-5bps. The benchmark US 10yr now sits at ~4.10%, near the top of its ~5-week range. Markets have tweaked their near-term interest rate expectations with odds of a rate cut by the US Fed at the March meeting now at ~40% (this is down from ~50% on Friday), while a full 25bp reduction is still factored in by May. Oil has had a positive 24hrs with WTI crude rising ~2.2%. At ~US$75/brl WTI crude is hovering around its 1-year average. In FX, the USD is a touch firmer, although moves have been modest. EUR has ticked under ~$1.09, GBP is tracking just over ~$1.27, USD/SGD is treading water (now ~$1.3420), and the AUD has slipped below its 200-day moving average (~$0.6581).

USD/JPY is just above ~148, close to the top of its ~6-week range, ahead of today’s Bank of Japan decision (no set time). After a run of softer Japanese wages and inflation data, the early January earthquake, and cautious comments by policymakers’ expectations for a change today are largely non-existent. Hence, a surprise tweak in the BoJ’s forward guidance and/or comments by Governor Ueda suggesting some progress towards the sustainable inflation goal has been made and adjustments are possible at future meetings may generate an outsized JPY reaction. As our chart shows, USD/JPY is trading well above our ‘fair-value’ estimates, and we see asymmetric risks over the medium-term with a re-strengthening more likely than further sustained JPY weakness. And given USD/JPY is the 2nd most traded currency pair, this is a factor that can drag on the USD over the longer-term.

As mentioned yesterday in addition to the BoJ, market focus this week will be on the Eurozone/US business PMIs (Weds AEDT), the ECB decision (Thurs AEDT), Q4 US GDP (Fri AEDT), and the US PCE deflator (the Fed’s preferred inflation metric) (Sat AEDT). Based on the calendar we believe USD volatility could lift, but on net, we see downward pressure on the USD returning later this week. In our opinion, while another solid quarter of US growth may generate USD support, a slowdown in the US core PCE deflator, a levelling off in the Eurozone PMIs, and/or push back by the ECB on near-term rate cut assumptions may work in the other direction.

AUD corner

The AUD has drifted back slightly at the start of the new week. The modestly firmer USD and relative weakness in Chinese equities (Shanghai Composite fell 2.7% yesterday compared to the global rally) has seen the AUD’s uptick run out of puff with the currency slipping under its 200-day moving average (~$0.6581). The AUD has also given back a little ground against most of the other currencies with falls of 0.1-0.4% coming through versus the EUR, GBP, JPY, and CNH over the past 24hrs.

By contrast, AUD/NZD has nudged up with the underperformance in the NZD pushing the pair above its 200-day moving average (~1.0806) for the first time since the start of the year. Q4 NZ CPI inflation is due tomorrow morning and expectations are centered on annual headline inflation slowing sharply as global goods prices slide and favourable base-effects kick in (mkt 4.7%pa from 5.6%pa in Q3). As our chart shows, on the back of the RBNZ’s more aggressive policy tightening NZ inflation is projected to fall more quickly than in Australia. In our opinion, a further drop in NZ inflation should support calls looking for the RBNZ to begin cutting rates later this year. We think the divergence with the RBA (which we expect to lag its global peers when the next easing cycle begins) could help AUD/NZD edge higher over coming months.

Today, the latest read on local business conditions is released (11:30am AEDT). Price pressure measures will be looked at by economic boffins to assess how Australia’s inflation pulse is evolving, but we doubt the data will generate any large AUD moves. Also today the BoJ policy decision is announced (no set time). As discussed above, no changes are widely anticipated, so the base case is for little market reaction. However if there were a surprise tweak by the BoJ we would expect the JPY to strengthen. And while this would weigh on AUD/JPY, the impacts on USD/JPY could cascade across the other major currencies with any USD weakness set to be AUD supportive.

Beyond the BoJ announcement and tomorrow mornings Q4 NZ CPI, market focus will be on the Eurozone/US business PMIs (Weds AEDT), the ECB decision (Thurs AEDT), Q4 US GDP (Fri AEDT), and the US PCE deflator (the Fed’s preferred inflation gauge) (Sat AEDT). We think further bursts of short-term market and AUD volatility are likely as global interest rate expectations are pushed and pulled by the economic news flow. But, on net, we see the AUD edging up later in the week with the USD predicted to soften if, as we expect, the Eurozone PMIs improve, the ECB leans against the markets rate cut bets, and/or the US PCE deflator slows, reinforcing views the US Fed’s rate cutting cycle could start towards mid-year.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6620, 0.6660