• Mixed markets. US equities a little higher, with long-end bond yields also rising. USD firmer against EUR & GBP. AUD consolidated near ~$0.6580.

• China stimulus. Reports of measures aimed at supporting equities gave Chinese stocks & CNH a shot in the arm. BoJ holds steady but gave a ‘hawkish’ hint.

• NZ CPI. Headline NZ inflation slowed as expected, but domestic inflation remains sticky. AUD/NZD dipped post this mornings NZ CPI release.

A varied performance across markets over the past day, though most moves have been modest. US equities ended the day higher. The S&P500 (+0.3%) is just shy of its record high with the large jump in Chinese stocks not replicated (see below). Commodities were mixed with WTI oil easing a little (-0.2%) and copper increasing by over 1%. Long end bond yields rose and curves steepened. The benchmark US 10yr rate ticked up ~3bps (now 4.13%) with relatively larger moves coming through in Europe (UK 10yr +8bps and Germany 10yr +6bps). Markets are assigning a ~45% chance of a US Fed rate cut in March with a move fully discounted by May.

The start of the uptick in bond yields coincided with yesterday’s Bank of Japan post meeting press conference. Although the BoJ kept its policy settings steady comments that it sees a ‘higher certainty’ of reaching its price target has kept the door open to tweaks down the track. The late-April BoJ meeting, which follows the release of the Spring wage negotiations and includes an updated set of economic projections, is being looked at by analysts as a possible stepping off point. USD/JPY whipped around intra-day as cross-currents washed through, but on net it is only marginally higher compared to this time yesterday (now ~148.40). By contrast EUR eased (now ~$1.0845) as did GBP (now ~$1.2682) and this propped up the USD Index.

Elsewhere, USD/CNH dipped under 7.17 as reports of more support being injected by Chinese policymakers to boost the equity market underpinned sentiment. Following comments by Premier Li urging ‘forceful’ steps a ~CNY 2trn (~US$278bn) stabilization fund is being touted and the stories saw the Hang Seng China Enterprises index rise 2.8% yesterday. Steps to put a floor under and/or bolster equities can help boost confidence and this in turn can have positive spillovers across China’s economy via wealth effects. And as our chart shows increased capital inflows and an equity market revival can be a CNH tailwind. The AUD also exhibited some intra-day volatility, but the firmer CNH and higher base metal prices helped the AUD hold its ground against the USD (now ~$0.6575). Similarly, USD/SGD consolidated (now ~1.3413). In addition to CNH related support higher-than-expected Singapore inflation (core CPI quickened to 3.3%pa) raised risks the MAS is more ‘hawkish’ at the 29 January meeting.

The latest Eurozone/US business PMIs are released tonight (Eurozone 8pm AEDT, UK 8:30pm AEDT, US 1:45am AEDT). In our view, signs the Eurozone downturn is levelling off and/or growth momentum in the US is moderating could give the EUR a lift and exert a bit of pressure on the USD. Though with the ECB meeting, US GDP, and US PCE deflator due later this week moves may not be overly pronounced.

AUD corner

The AUD consolidated around its 200-day moving average (~$0.6580) with the USD uptick offset by a lift in base metal prices, jump in Chinese stocks, and firmer CNH following reports policymakers in China are looking at fresh measures to support equities and boost sentiment (see above). These factors helped the AUD outperform the EUR, JPY, and GBP with gains of 0.2-0.4% recorded over the past 24hrs. By contrast, AUD/CNH slipped below its 100-day moving average (~4.7197) for the first time since early-December.

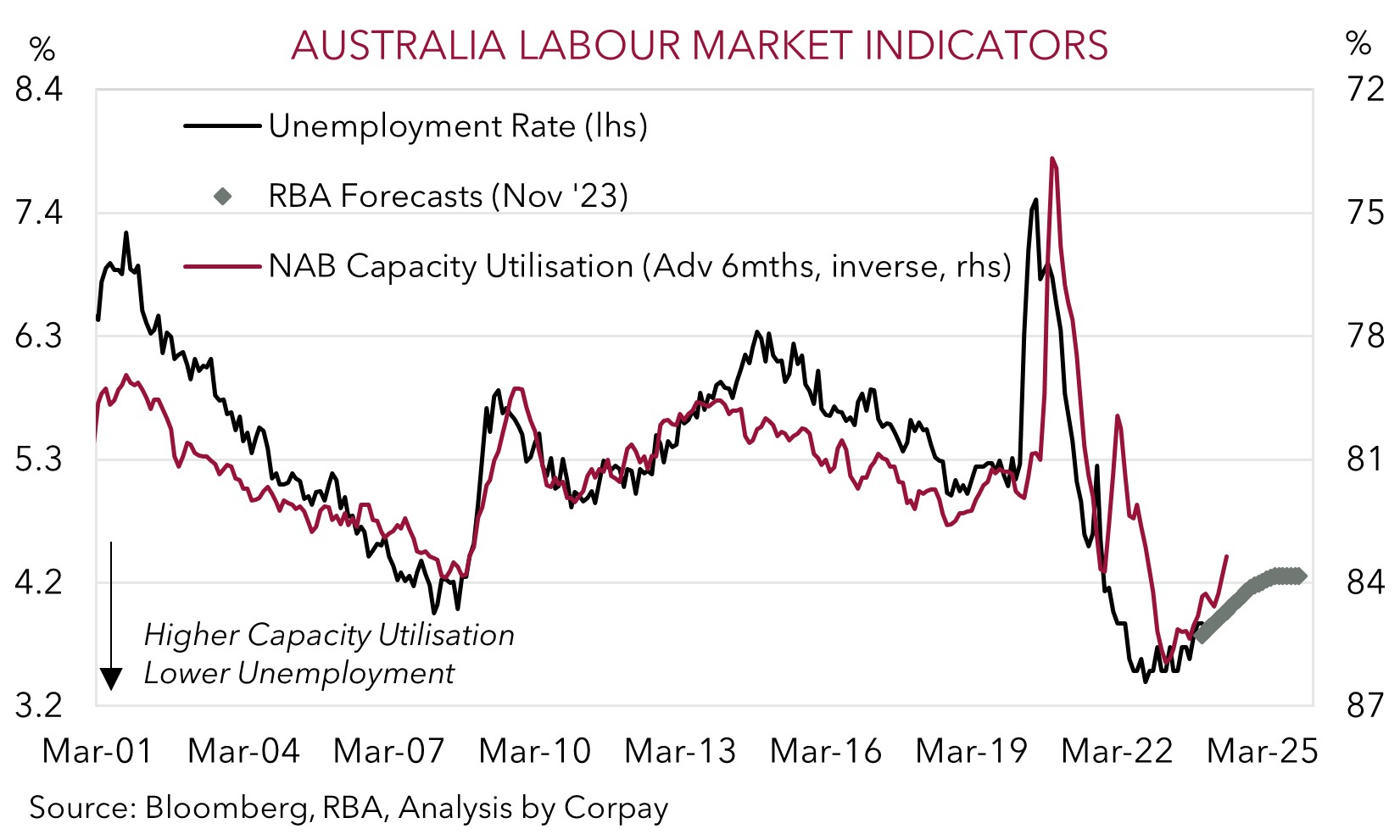

Locally, December business conditions was released yesterday. There was a bit of a bounce in confidence, however businesses remain ‘pessimistic’ with conditions losing steam. That said, the level of conditions is still near its long-run average suggesting that while momentum will continue to slow the support to aggregate demand from the larger population should keep activity positive. Inline with the slowdown and economic rebalancing capacity utilization (a proxy for excess capacity) has fallen. As our chart shows, this points to a gradual lift in the unemployment rate over the next ~6-9 months. Overall, while we don’t see the RBA raising rates again this cycle, cuts are unlikely to come through as quickly as in other countries where central banks were more aggressive during the tightening phase and core inflation is cooling faster. The divergence between the RBA and other central banks should, in our opinion, see short-dated yield differentials move in a AUD supportive direction over the medium-term.

In addition to any more stimulus announcements out of China, market attention over the next few days will be on the Eurozone/US business PMIs (tonight), the ECB decision (Thurs AEDT), Q4 US GDP (Fri AEDT), and US PCE deflator (Sat AEDT). As we have flagged, the list of upcoming global macro events suggests further bursts of market and AUD volatility are possible. However on balance, we see the AUD finding support and edging a little higher with the USD expected to soften if, as we think, the Eurozone PMIs improve, the ECB pushes back on the market rate cut pricing, and/or the US PCE deflator decelerates, reinforcing forecasts looking for the US Fed’s cutting cycle to start towards mid-year.

On the crosses, AUD/NZD dipped this morning following the release of Q4 NZ inflation. At ~1.0780 AUD/NZD is near its 50-day moving average. While annual headline inflation decelerated in line with consensus forecasts (slowing to 4.7%pa), the breakdown is less favourable. A large drop in tradables inflation was the driver with the improvement in global supply chains and lower food prices factors. Non-tradables inflation (i.e. domestic prices) came in a little higher than the RBNZ was anticipating. We believe the result may temper some of the markets enthusiasm looking for a quick reversal in rates by the RBNZ. This in turn may give the NZD a short-term boost.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6620, 0.6660