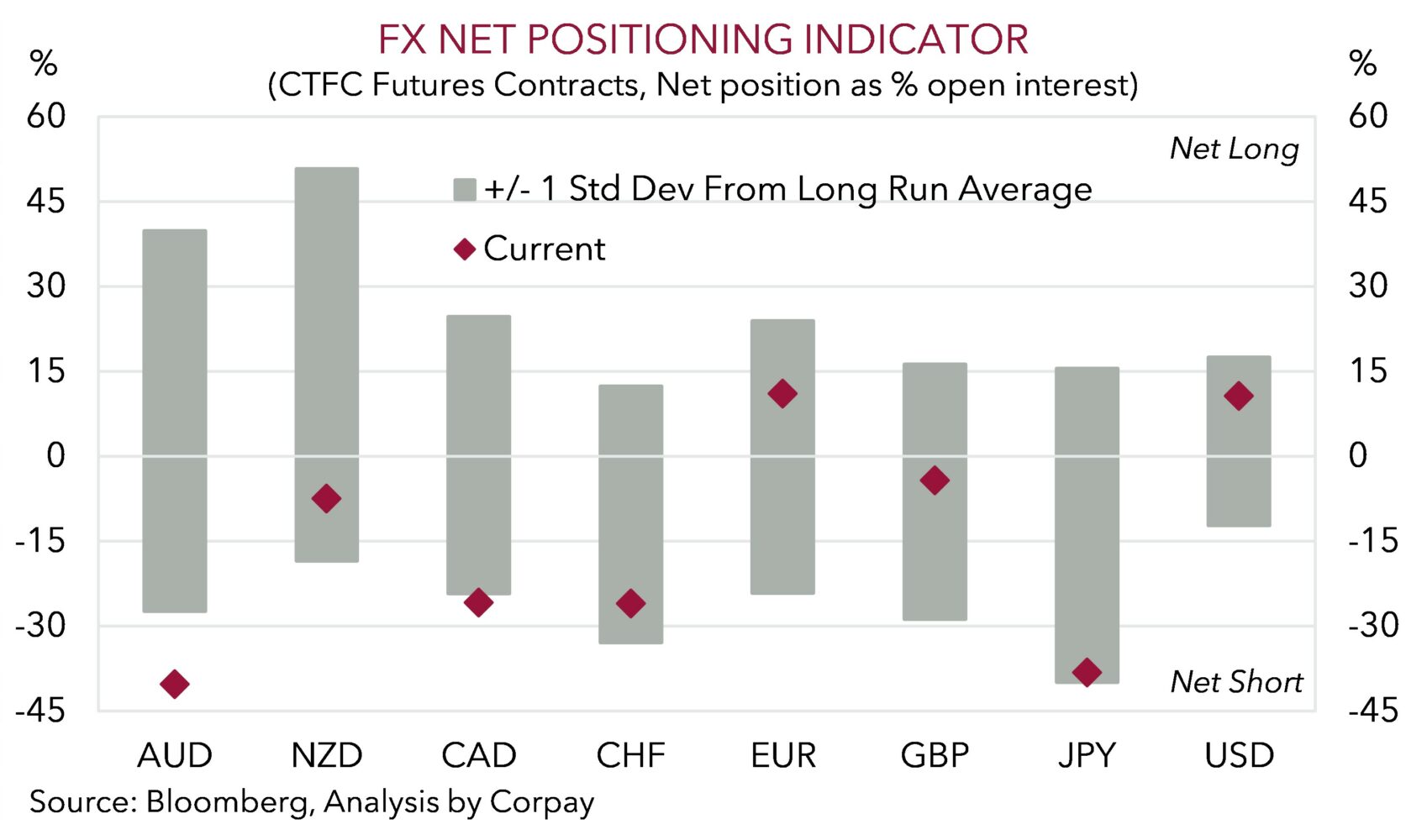

The AUD and financial markets have been on a wild ride over recent weeks. Risk sentiment is waxing and waning on the back of the unfolding developments in the Middle East, and as markets grapple with lingering inflation risks and moderating growth. While some further near-term AUD volatility and weakness could occur if the Middle East conflict worsened and risk appetite deteriorated, in the main, we believe a lot of negatives are now already reflected in the AUD price (see Market Musings: AUD: Always darkest before the dawn). Market positioning metrics such as CFTC futures contracts are already quite bearish AUD, with ‘short’ positioning historically stretched. When this level of extreme positioning is in place it often doesn’t take much of a change in sentiment for the AUD to bounce back. And this is where we think the greater odds on a fundamental basis reside, particularly against the EUR and GBP. We are forecasting the rebound in AUD/EUR and AUD/GBP to continue with the pairs projected to edge up to ~0.6230 and ~0.54 respectively over the next few months.

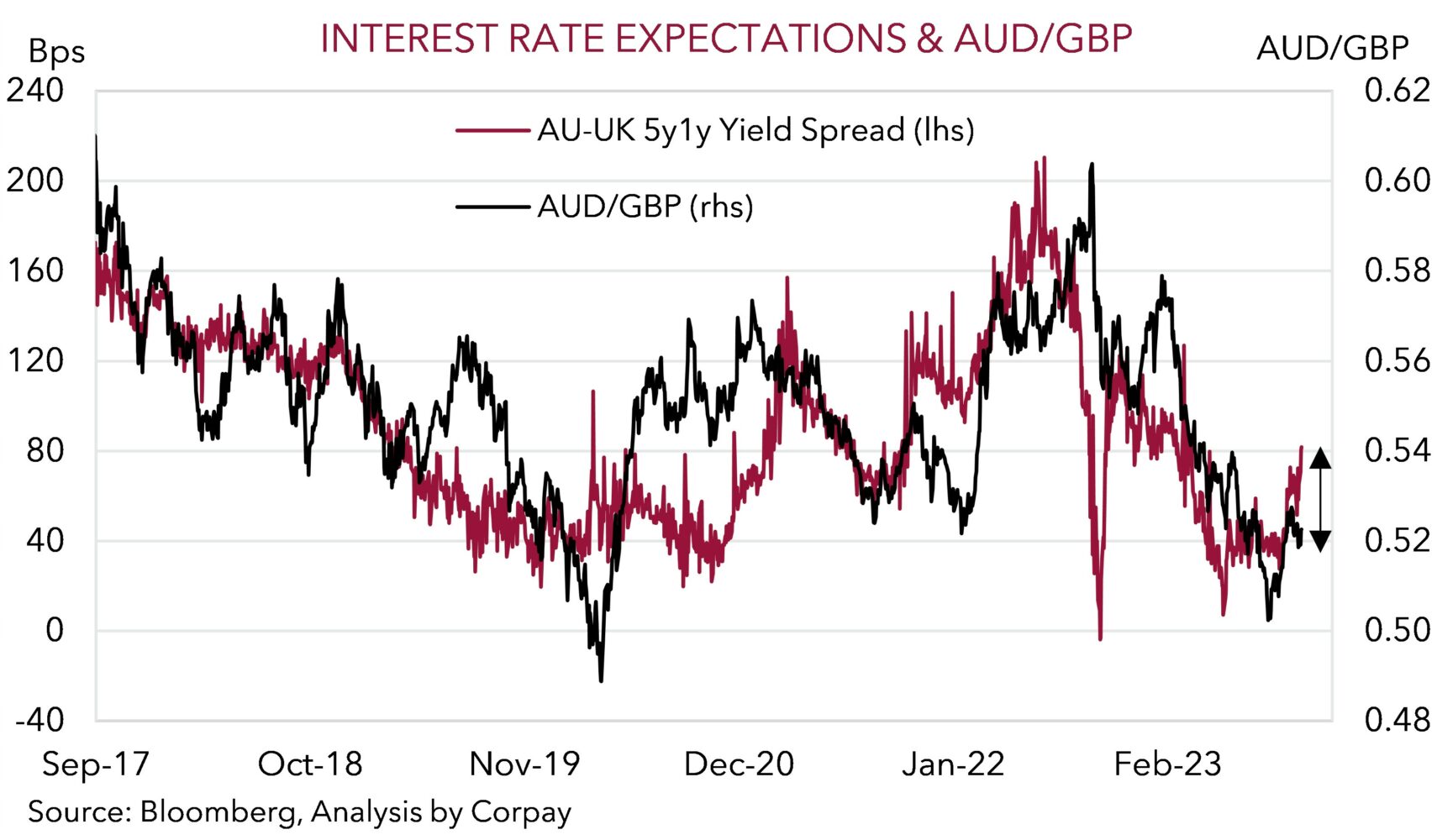

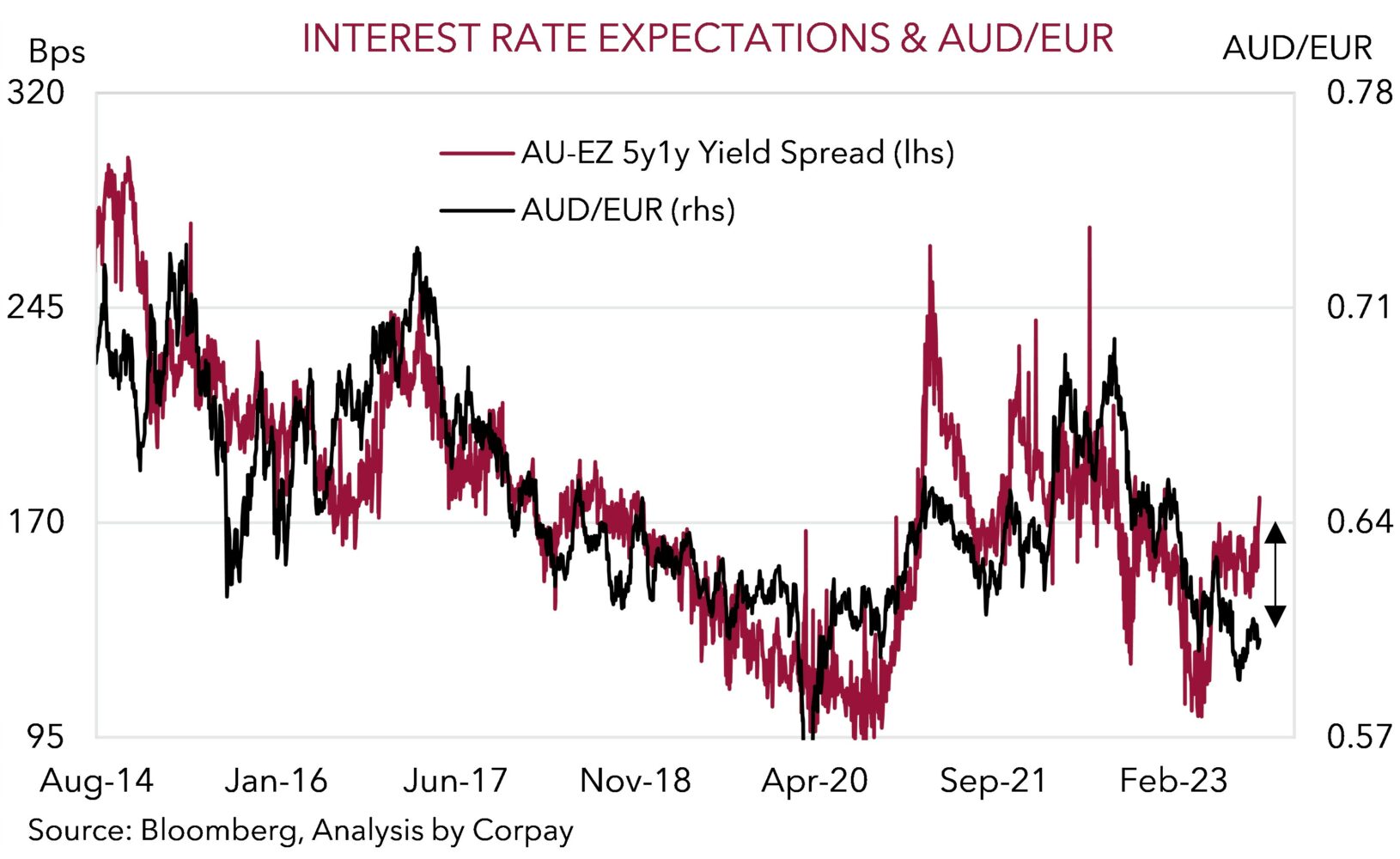

As the charts show, AUD/EUR and AUD/GBP appear to be too low compared to our measure of comparative ‘terminal’/longer-dated interest rate expectations between Australia and the Eurozone/UK. We think these gaps are more likely to close via a lift in the respective currency pairs with the incoming economic information expected to reaffirm that the European Central Bank and the Bank of England have reached the end of their rate hiking cycles and/or that the prospect of further action by the Reserve Bank of Australia is still alive.

Economic storm clouds are gathering over Europe. The UK economy is starting to feel the weight of the BoE’s rapid-fire policy tightening. The jump up in mortgage rates is impacting the UK housing market and mortgage lending, while the squeeze on household incomes, which is being compounded by below average confidence and rising oil prices, is a headwind for consumer spending. Importantly, the UK labour market is cracking. Employment has started to contract, the rise in firm insolvencies points to unemployment lifting, and the increased slack should see wages and core inflation slow. It appears increasingly probable, in our opinion, that the next move by the BoE could be a rate cut, albeit late next year. Similarly, Eurozone growth momentum is stalling. The Eurozone business PMIs are tracking in ‘contractionary’ territory and retail sales have begun to decline. The tightening in Eurozone lending standards stemming from macro concerns and higher interest rates is indicative of tepid activity continuing for a while. With Eurozone core inflation beginning to turn down, the need for further ECB rate rises has faded.

By contrast, although growth has slowed the Australian economy is in a better spot than many where fearing following the steep jump up in interest rates put through by the RBA over the past few quarters. The burgeoning population has been an offsetting supportive factor for aggregate demand and the housing market. In our judgement, this resilience, coupled with the stickiness in services inflation, Australia’s poor productivity growth, slow-moving wage dynamics due to multi-year enterprise bargaining agreements, and income supportive tax cuts coming in in mid-2024 mean that the chances of another rate rise by the RBA this cycle shouldn’t be discounted. Indeed, the minutes of the October RBA meeting had more of a ‘hawkish’ tinge than anticipated with comments that the Board has “a low tolerance for a slower return of inflation to target than currently expected” an indication that it may not take much of a positive surprise in the Q3 CPI data (released 25 October) to trigger a policy response. At the very least, we believe the dynamics flagged point to the RBA maintaining its tightening bias for some time and/or lagging its peers when the global interest rate cutting cycle (eventually) unfolds. Relative yield differentials, which have been an AUD headwind over the past year or so look set to progressively turn more AUD positive over the medium-term.

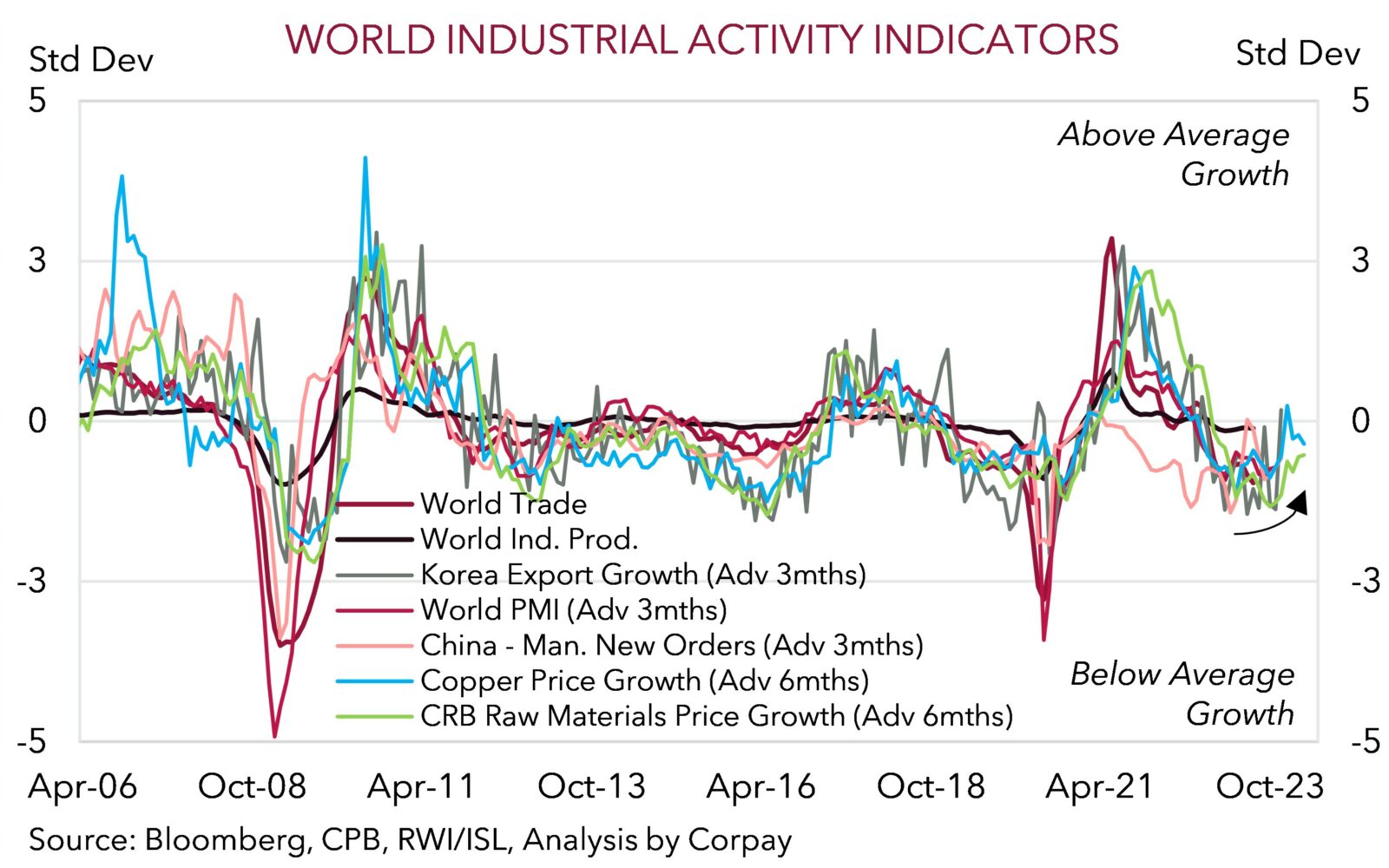

While the Middle East events may be a source of more near-term AUD volatility given its positive correlation to risk sentiment, from a fundamental standpoint we believe there are signs the global backdrop has become a bit more favourable. This looks to have gotten lost in the unfortunate geopolitical noise. A range of forward-looking indicators for global industrial activity that we track such as new orders and raw material prices have started to tick up. The ongoing strength in US consumer spending (the engine room of the US economy and source of global demand), and indications China’s economy has passed its cyclical bottom suggest these improving trends can continue. China’s economy grew more than anticipated in Q3, with GDP expanding by 1.3%qoq. Consumer spending was stronger with retail sales growth accelerating. Industrial production was also firmer. The virtuous cycle policymakers have tried to engineer is starting to gain traction, and more measures aimed at reinforcing the upswing may be forthcoming. Issuance of ‘special’ local government bonds in China has stepped up, and this normally foreshadows a further pick-up in commodity intensive infrastructure spending. This typically bodes well for the cyclical AUD.