The AUD is battered and bruised. A combination of factors such as better-than-anticipated US data and a stronger USD, economic struggles in China and a weaker CNH, a lower JPY, some subpar local economic prints, and shaky risk sentiment on the back of the jump up in bond yields recently pushed the AUD to 2023 lows. While the extent of the USD strength and AUD weakness has been a bit of a surprise, the direction of travel was not. We repeatedly flagged that the AUD was set to go through a rough patch over Q3 as global inflation lingered and growth stalled, with negative AUD seasonality also strong in August (see Market Musings: History doesn’t repeat, but…).

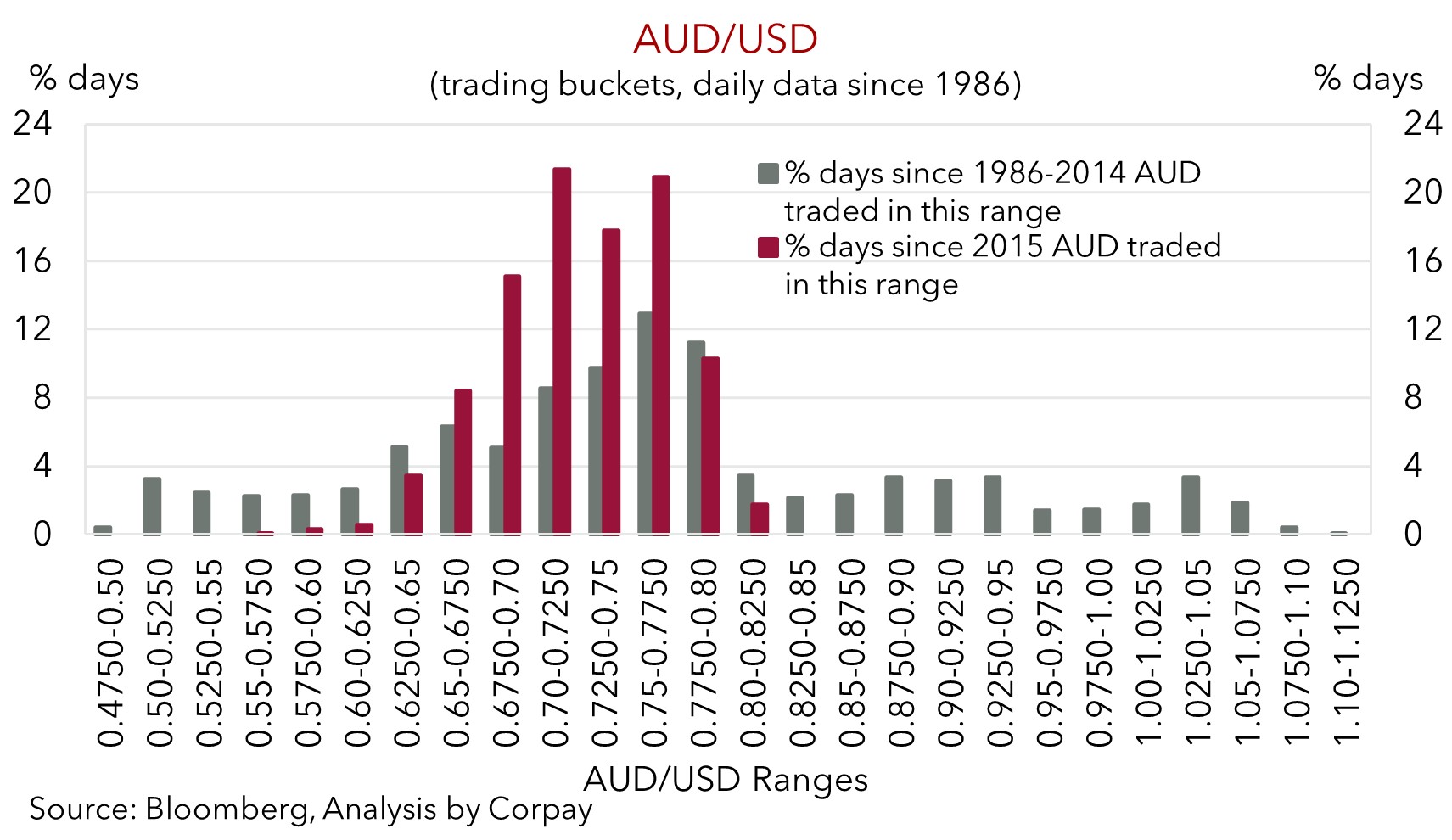

The sentiment pendulum has clearly swung against the AUD. But as it is often the case it can appear darkest before the dawn. Our assessment of various intertwined AUD drivers suggests a lot of negativities may now be baked in, and that there are uneven medium-term risks from here with far more upside than downside potential. The AUD should continue to be whipped around by incoming news over the near-term, but in the main, we think the bulk of the pull-back has played out. Outside of exogenous shocks the AUD hasn’t sustainably tracked much below current levels over the past decade. Since 2015, because of supports such as Australia’s high terms of trade and shift to a current account surplus (now ~1.2% of GDP), the AUD has traded sub ~$0.6350 less than 2% of the time. In our judgement, the AUD could soon begin to pick itself up off the canvas and may edge back up into the high $0.60’s over coming quarters.

Nothing lasts forever. Expectations matter

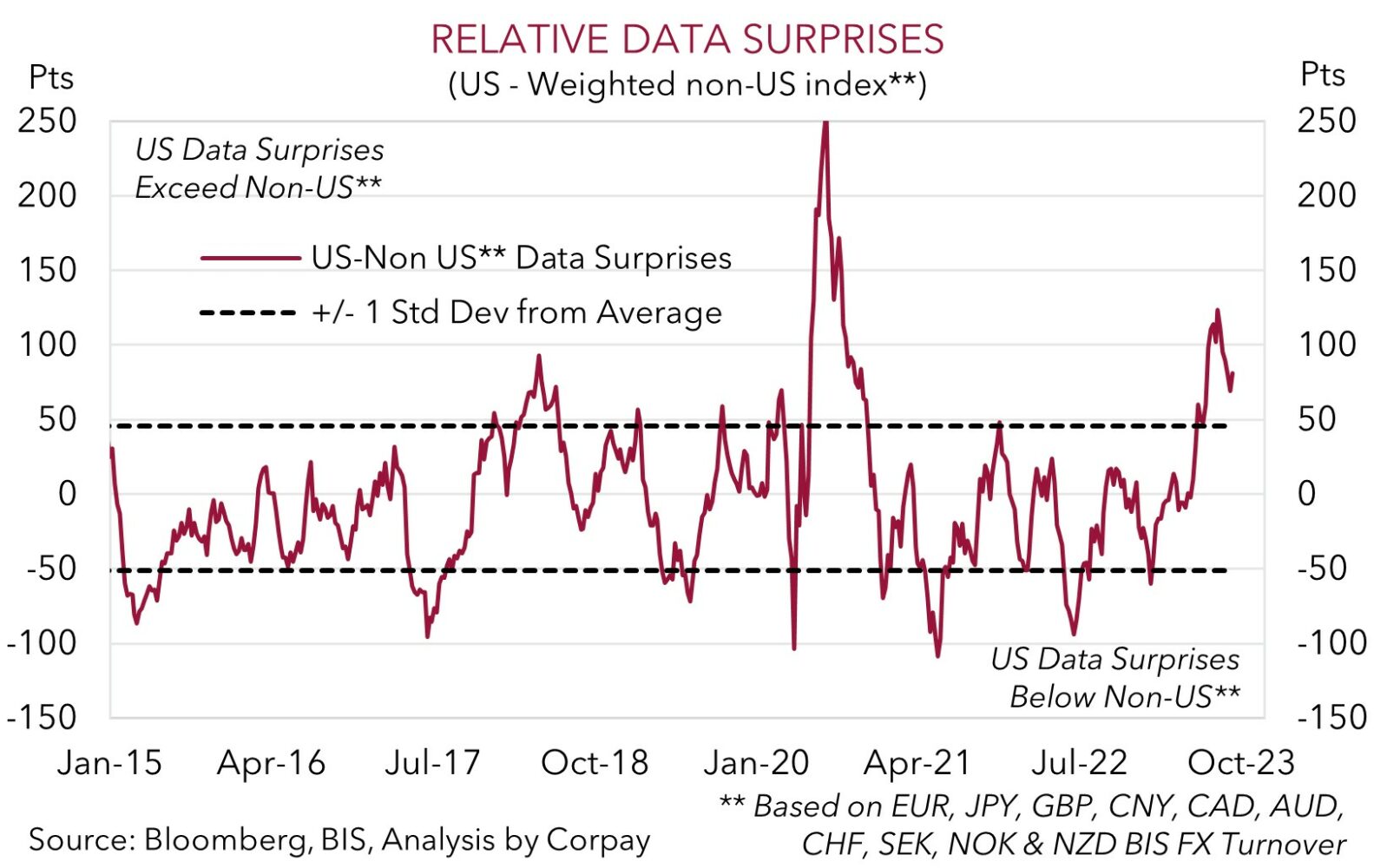

FX is a relative price and outcomes compared to expectations drive markets. With this in mind, we think the USD’s upswing could be running out of puff. US activity has recently been stronger than predicted, while at the same time other major economies such as the Eurozone and China have stumbled. But we doubt this degree of US economic outperformance will be sustained. The gap between US and non-US data surprises is now wide. We see this spread narrowing via the US data underwhelming more optimistic predictions and/or non-US conditions jumping lower hurdles.

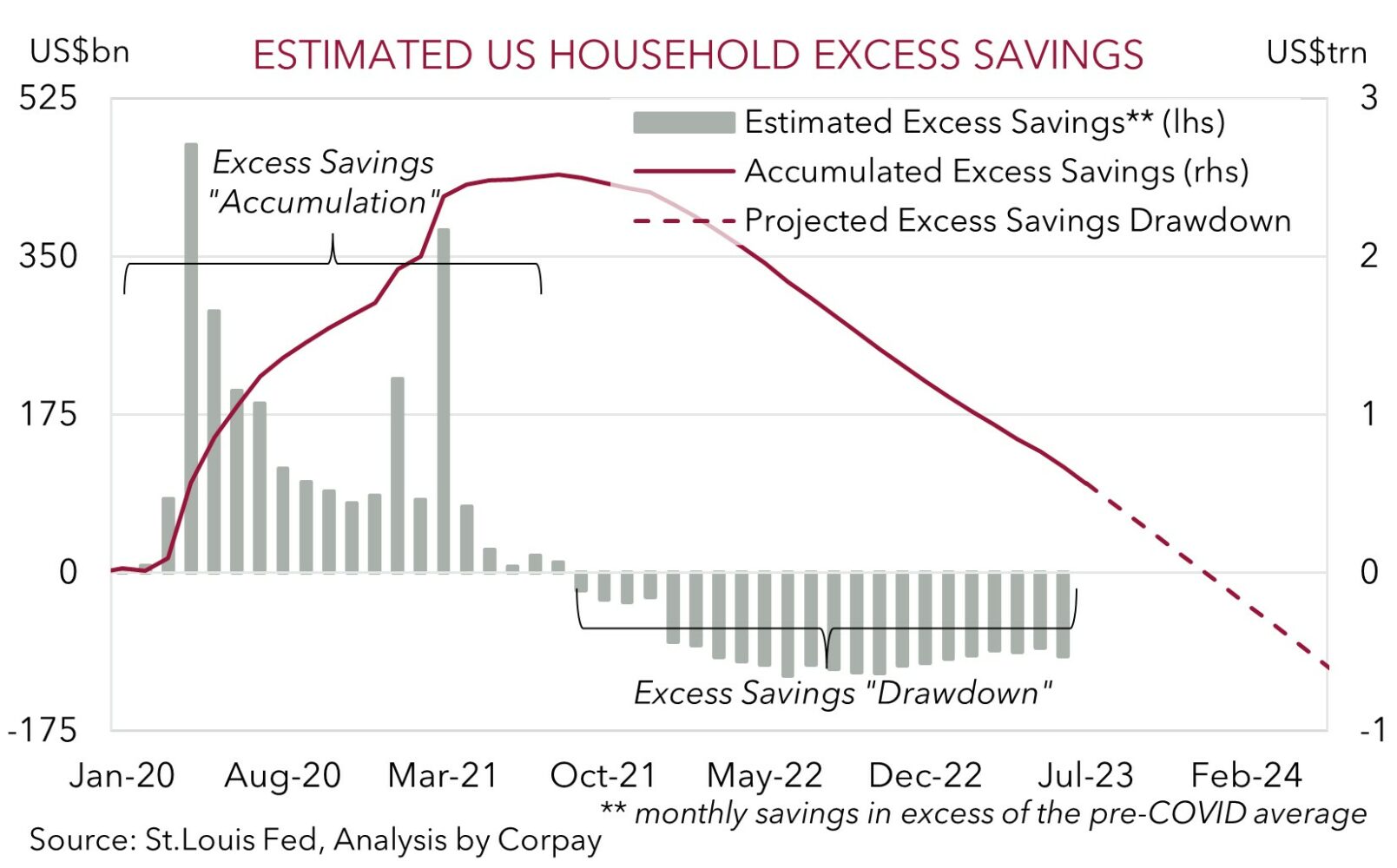

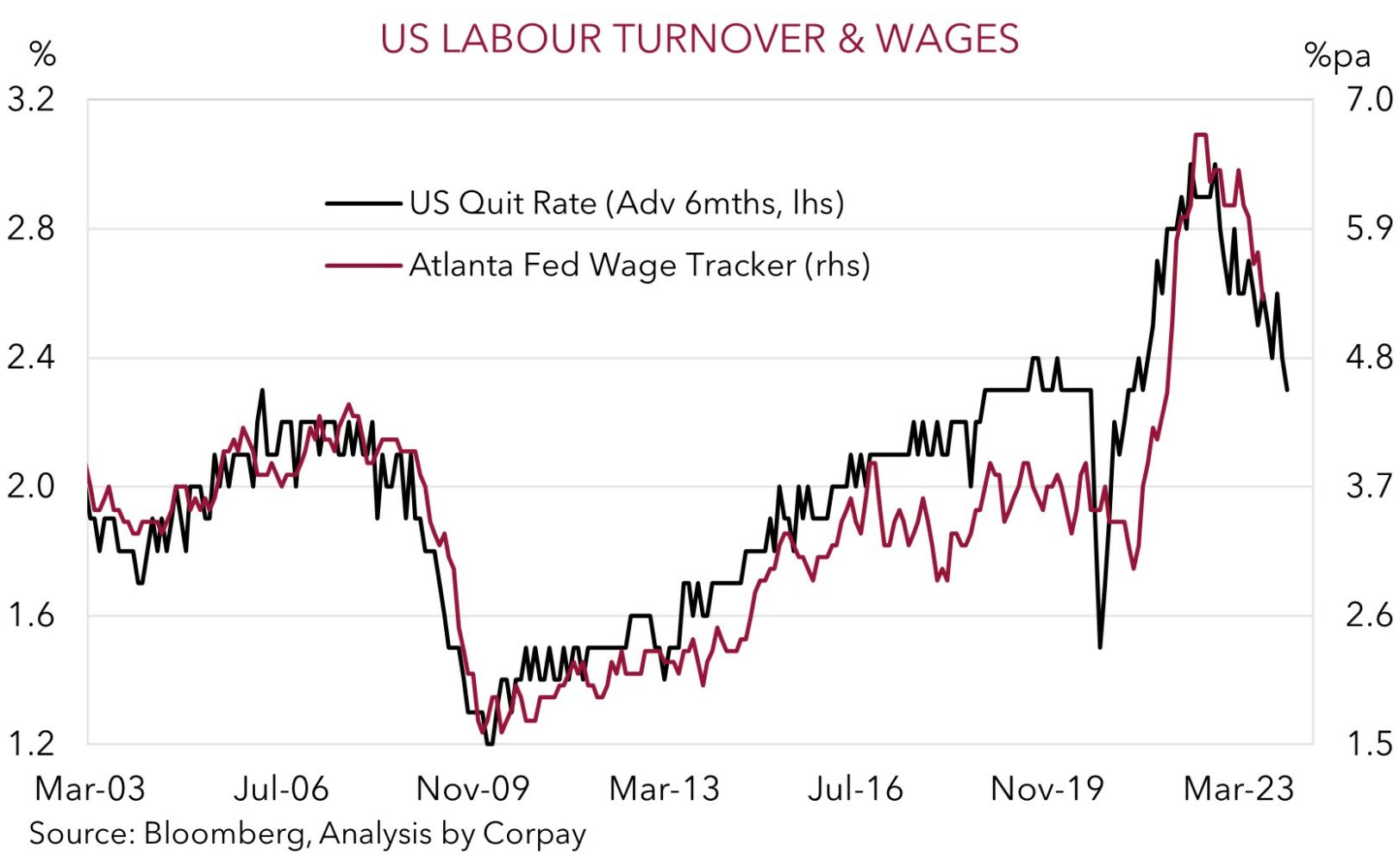

Importantly, we judge that the US economy may be nearing an inflection point. Excess savings, which have helped US households weather the inflation storm and maintain spending levels, have largely been depleted. Lending standards have tightened and credit demand is drying up, consumer sentiment is below average, and there are signs the heat is coming out of the labour market. Labour demand is moderating, while concurrently supply is improving with the US participation rate at a multi-year high. This bodes well for wages and core inflation moderating over time. Underlying components within the August US CPI report show that progress is being made. On a 3-month annualised basis, US core inflation is now tracking at ~3.2%, the slowest pulse since early 2021.

With markets now assigning a ~50% chance of another US Fed rate hike by year-end and a modest rate cutting cycle, by historical standards, only anticipated from H2 2024 we believe a ‘higher for longer’ view is well priced. The USD tailwind from an upward adjustment in US interest rate expectations and widening yield differentials looks to nearing an end. Indeed, should the US growth soften, which is where we think the risks are skewed, lofty US rate assumption (and the USD) may fall back.

Asian & EM trends

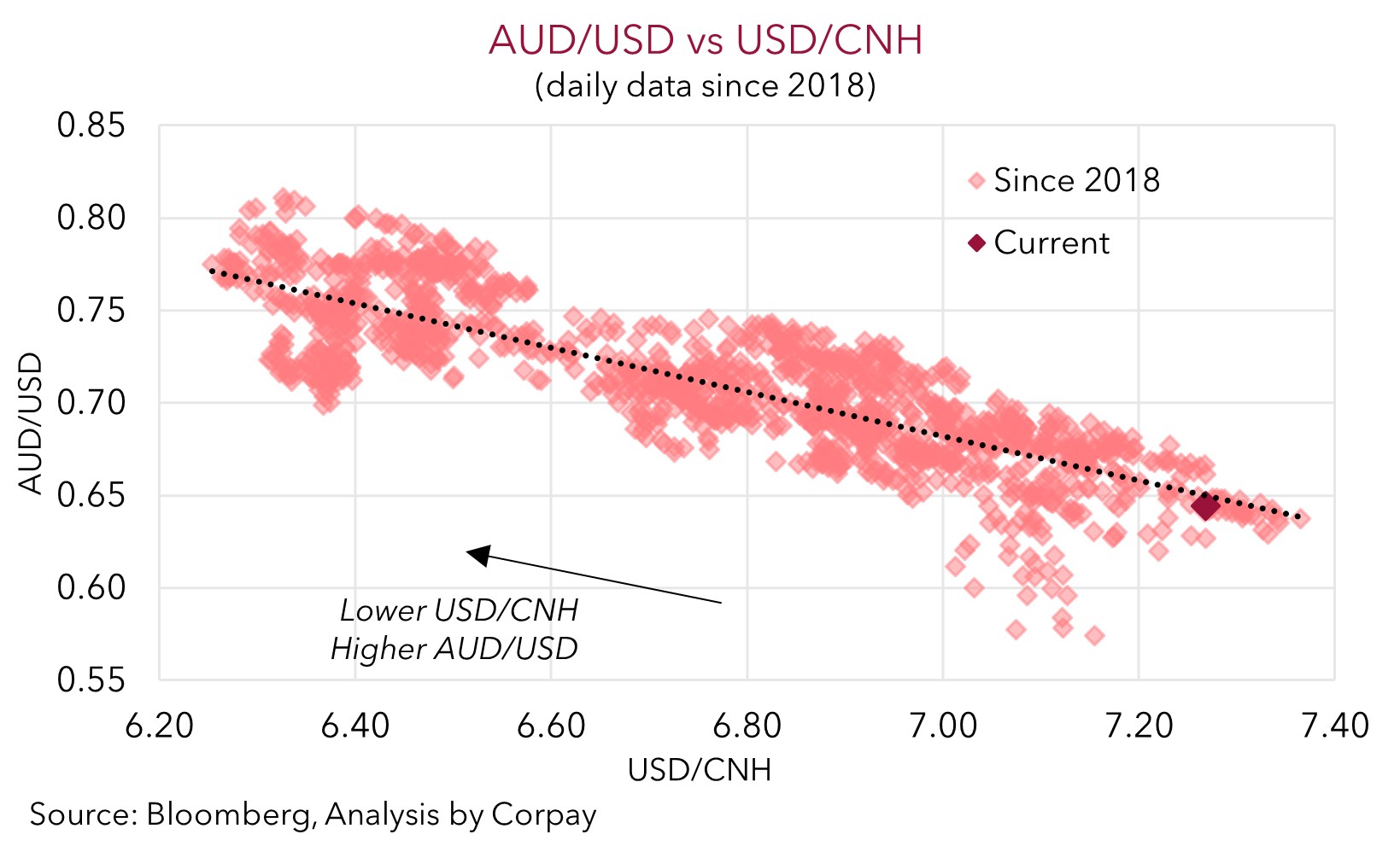

Developments across Asia and Emerging Markets (EM) are also important when it comes to the AUD. And this is where we feel the tide may be turning. In China, a rebound in credit growth, improvement in the manufacturing PMI, and smaller contractions in trade suggests momentum may be bottoming out. The outlook for the property sector is also brightening. For the first time since 2021 policymakers have unveiled a raft of demand side measures and we suspect more could be on the way. The moves are aimed at generating a self-reinforcing virtuous cycle where greater activity and/or positive wealth effects boost sentiment, consumer spending, and jobs. Authorities have also stepped up their efforts to support the CNY by persistently setting the daily fix rate significantly stronger than projected. Given the tight correlation between the pairs we think this should help the AUD level off, with further capital inflow induced CNY strength stemming from an improvement in China’s economic fortunes likely to be AUD supportive.

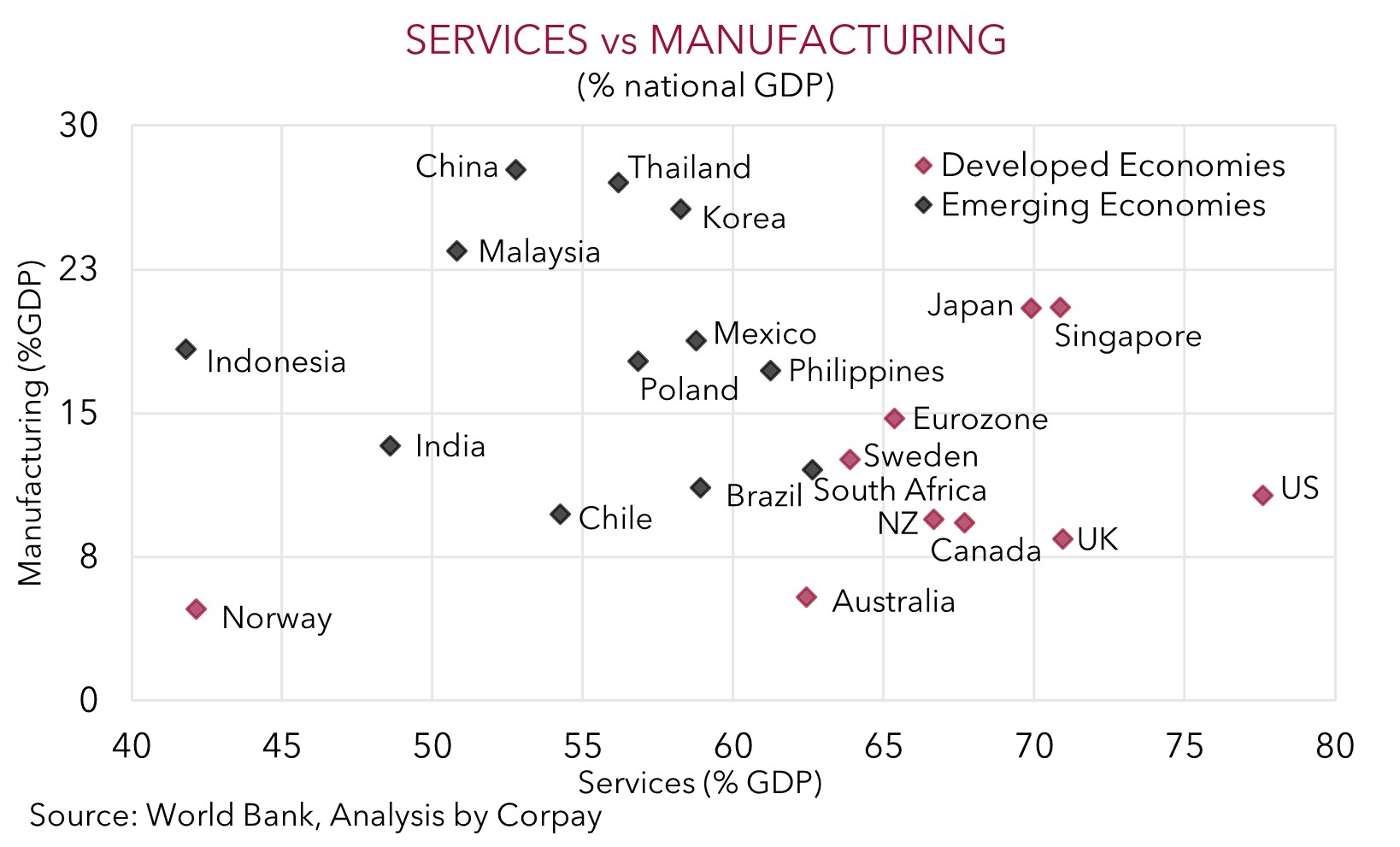

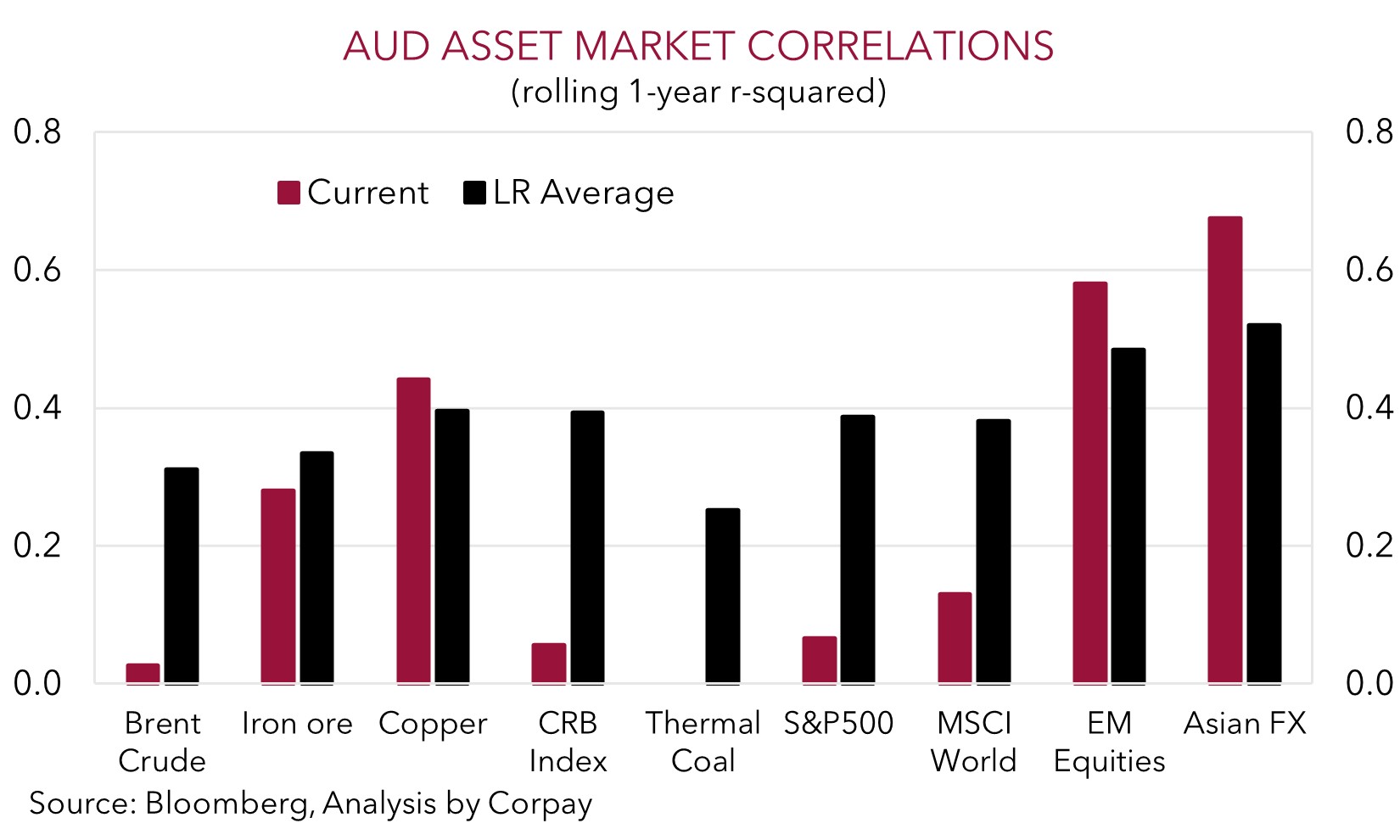

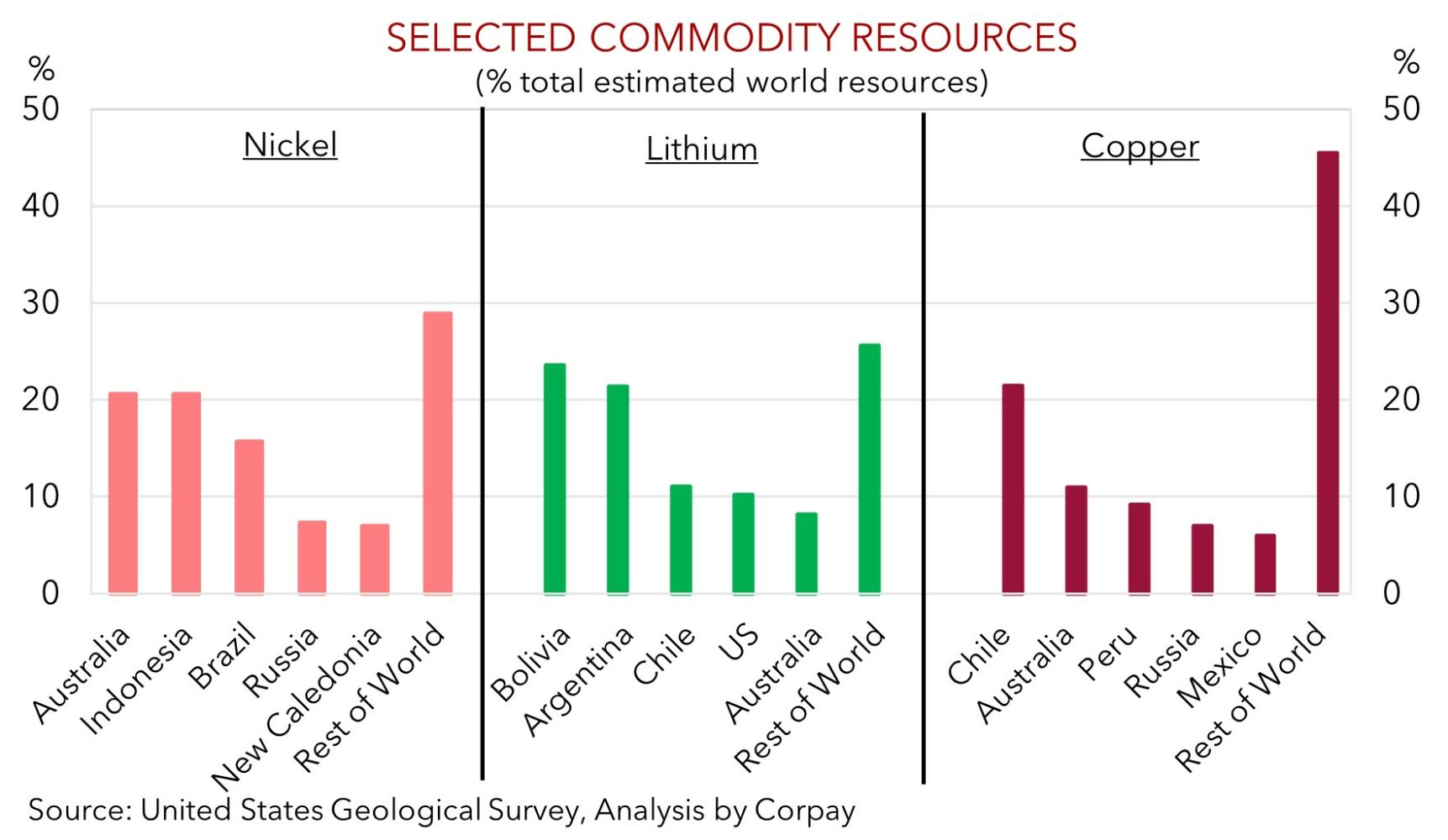

In our assessment, when combined with: (a) signs US interest rates may be at (or very close to) a peak; (b) a softer USD; and (c) signs inflation across EM could be on sustainable downturn thanks to the early aggressive policy tightening and a greater skew towards ‘goods’ rather than ‘services’ in these economies, indications China is turning the corner may be a positive impulse for EM assets. Based on our correlation analysis, if realised, this could benefit the AUD. This could compound the structural supports for a range of commodities, such as copper, lithium, and nickel, leveraged to the move to net zero that Australia produces.

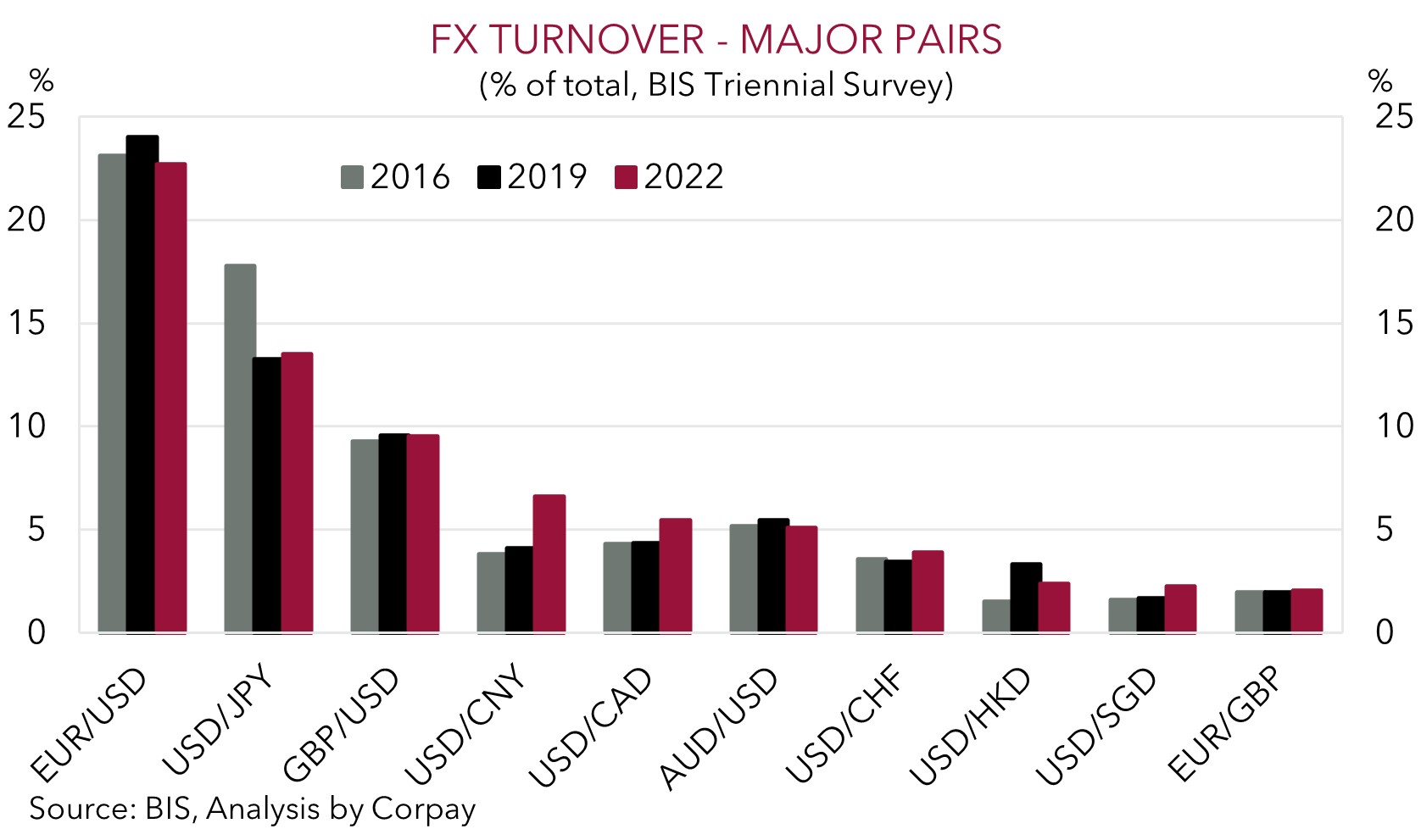

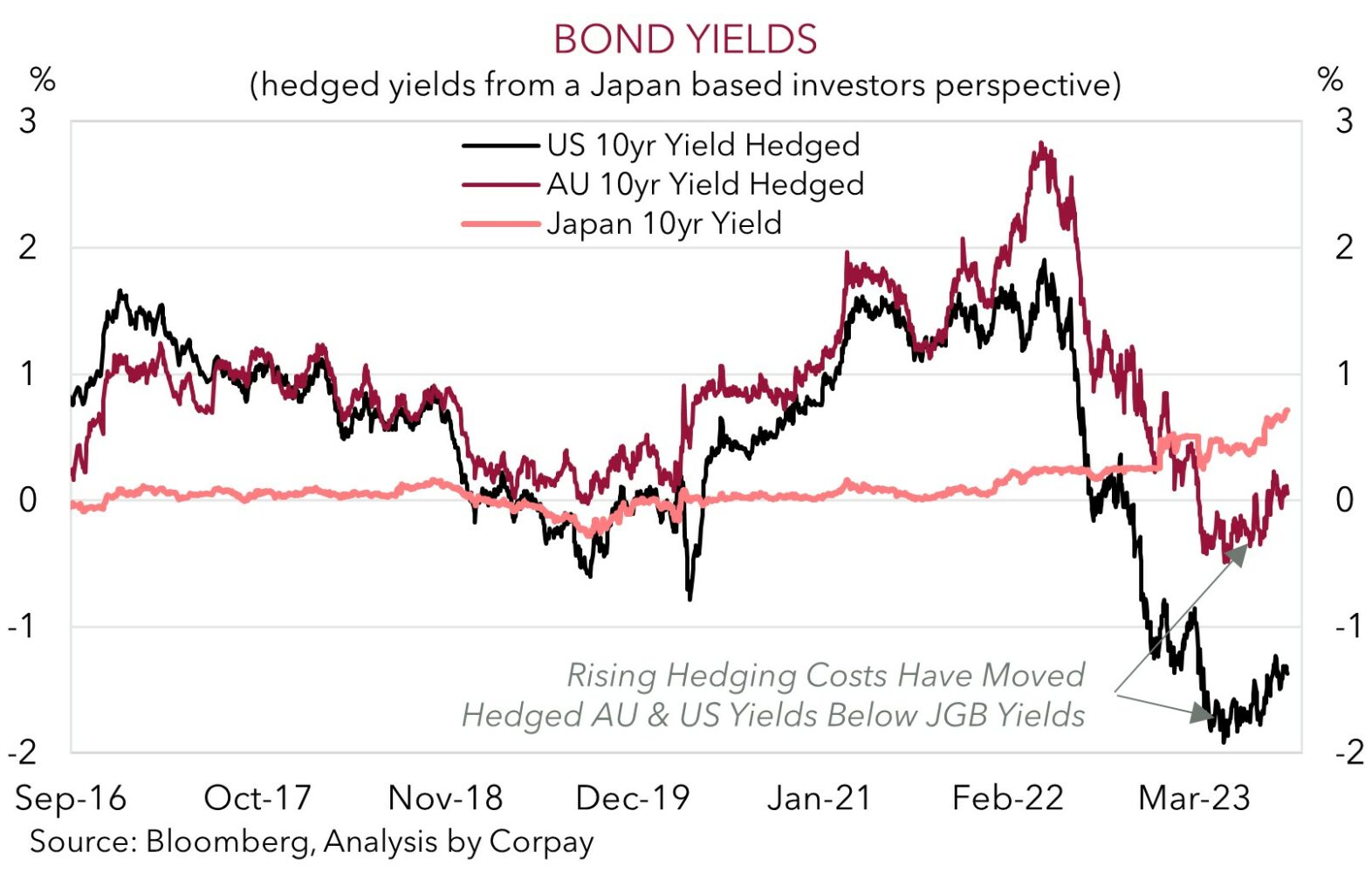

The Bank of Japan (BoJ) is also (finally) making ‘hawkish’ noises with a recent interview by Governor Ueda indicating that the ground may be starting to shift, albeit slowly. Core inflation in Japan is running north of 4%pa (little different from its peers), nominal GDP growth is over 5%pa, and the labour market is tight. From the outside looking in there appears to be little need for the BoJ to maintain its ultra-accommodative stance, especially as the excessively weak JPY makes the inflation fight harder. We believe it is a matter of when, not if the BoJ takes further normalisation steps. Small tweaks such as removing yield curve control, which could occur as soon as the 31 October meeting, could see markets discount bigger leaps down the track. This could be a positive jolt for the undervalued JPY and drag on the USD (USD/JPY is the 2nd most traded currency pair). More so if Japanese investors begin to allocate less funds offshore given the greater returns on offer domestically after FX hedging costs are included.

The RBA’s pragmatic approach

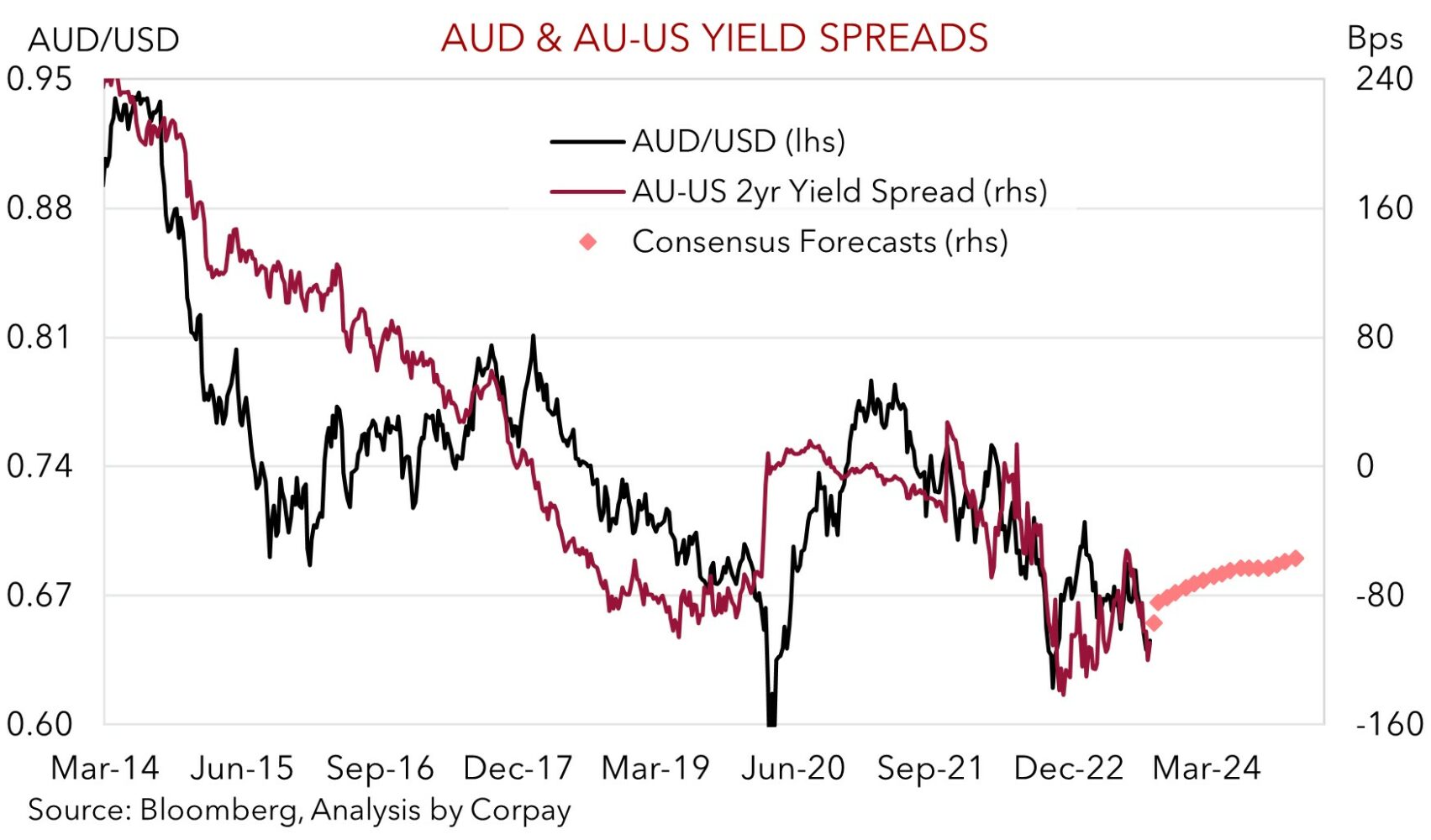

The RBA has pushed through 400bps of rate hikes since kicking things off in Q2 2022. Although it has been the most abrupt local tightening cycle for several decades the RBA has lagged its peers. Other major central banks have, on average, raised rates by ~5%pts. Narrowing yield differentials have been a negative for the AUD. But this trend may have run its course and it could progressively inch in the AUD’s favour over time.

In addition to the risks around the US side of the story (see above) there are domestic factors that also need to be considered. The RBA’s aim to try and achieve a ‘soft landing’, navigate the fixed rate mortgage refinancing roll-off, and preserve as many jobs as possible while getting inflation down to target in a reasonable timeframe has seen the bank do less on the way up. In turn, we think it may also mean rates may not move as early or need to move as far on the way down.

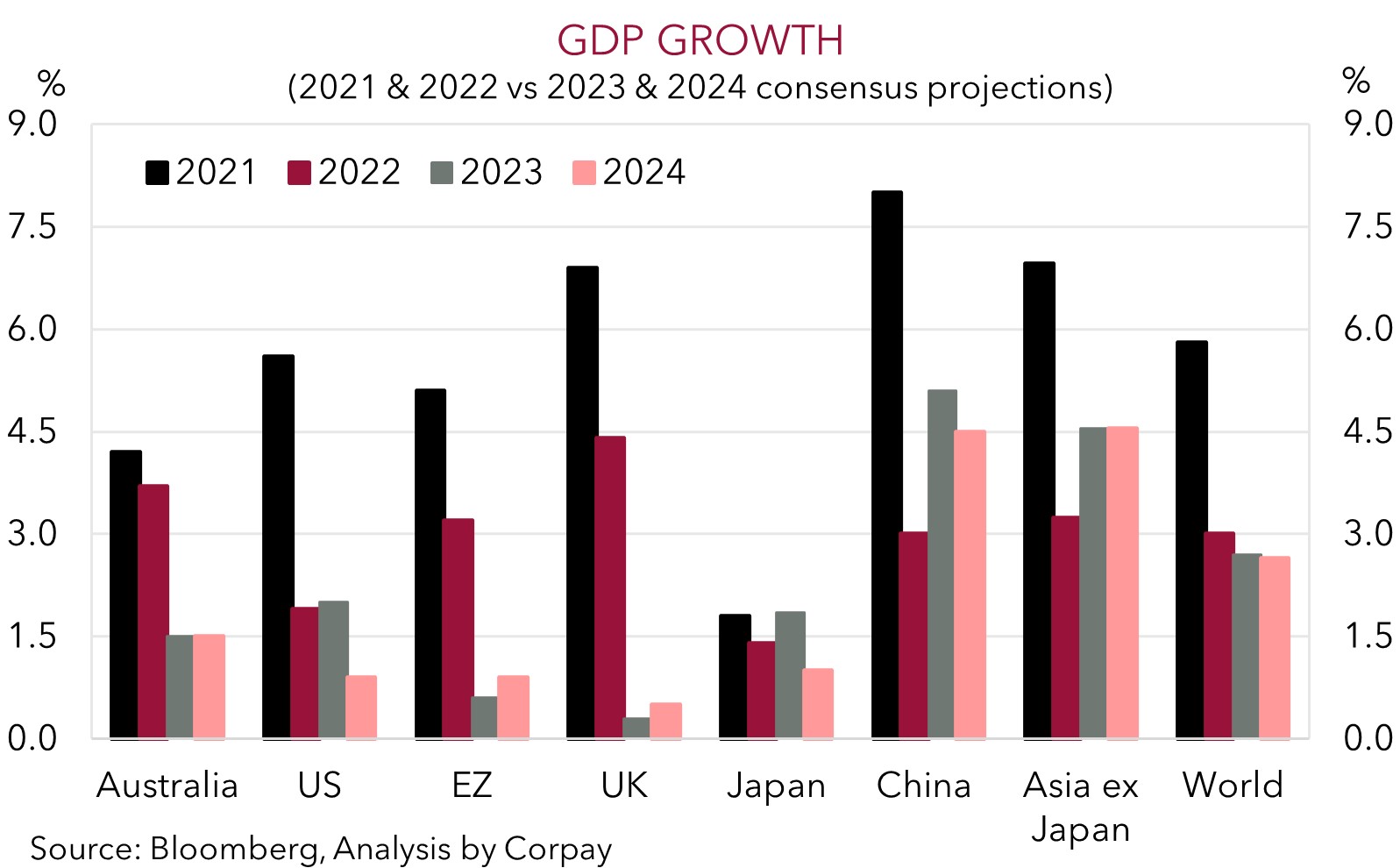

As more households switch back to variable mortgages, RBA rate cuts (whenever they come) should pack more of a punch, lessening the need to do too much. Indeed, on top of that, based on: (a) the stickiness in areas of services inflation like rents; (b) Australia’s poor productivity; (c) tightness in the labour market (unemployment held steady at a low 3.7% in August) and slow moving wage dynamics due to multi-year enterprise bargaining agreements; (d) upturn in house prices; and (e) income supportive tax cuts coming in mid-2024, another rate rise can’t be completely ruled out. Growth wise, while many Australian households and business are feeling the pinch from higher borrowing costs, the population boom is an offsetting force for aggregate demand. Growth expectations for Australia, and broader Asia, for 2024 aren’t great, but they do look more attractive than other major economies. When rate hiking cycles end, other relative differentials such as growth could become more of a focus.