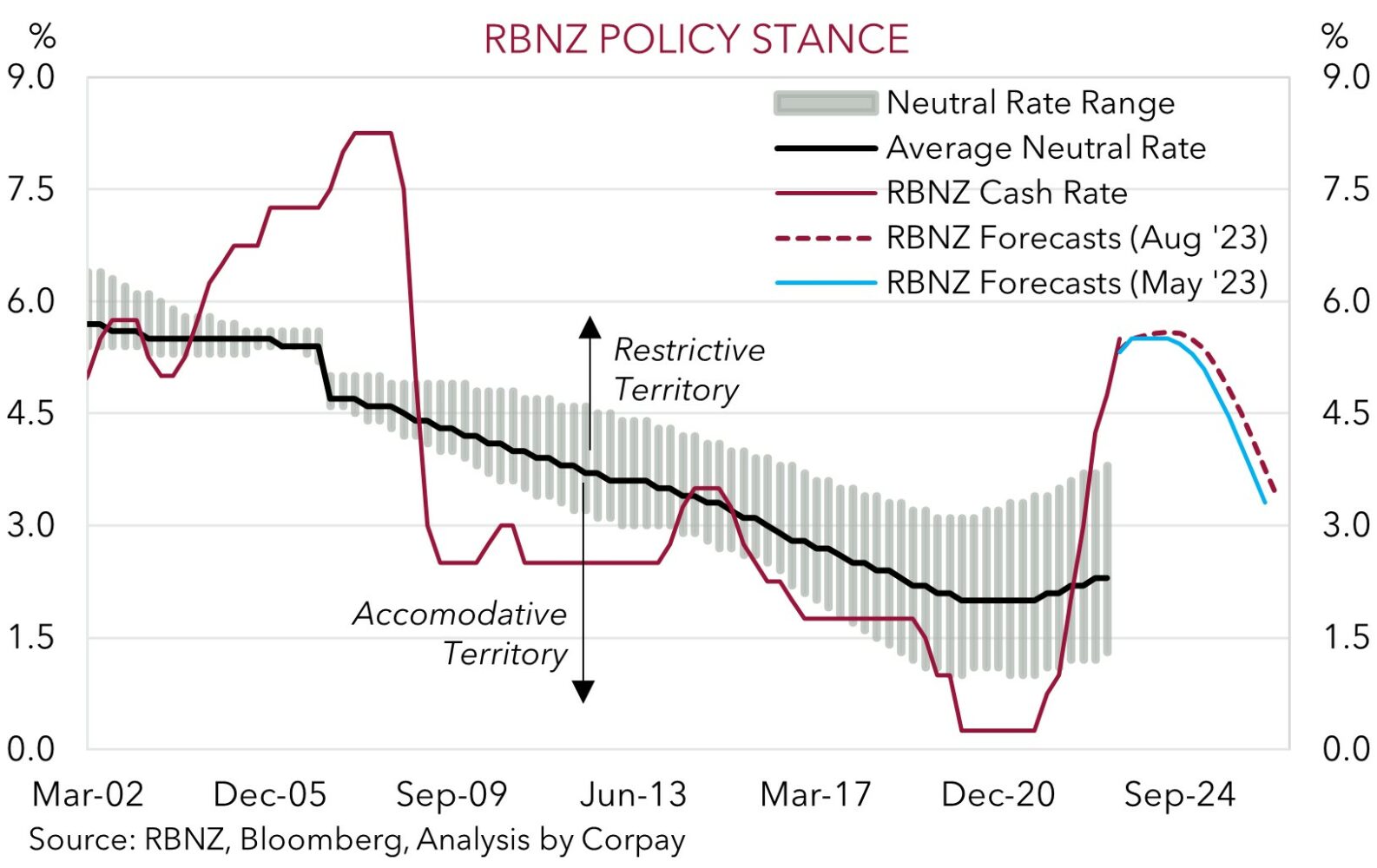

As was widely expected the RBNZ kept its Official Cash Rate at 5.5% once again at today’s meeting. After moving early and going harder than its peers the RBNZ has now held rates steady for two straight meetings. The RBNZ delivered a substantial 525bps worth of rate hikes between October 2021 and May 2023 and the negative economic effects of these moves are starting to manifest. We expect these negative trends to continue as the cashflow hit on the NZ household sector intensifies and slowdown in other interest rate sensitive sectors like housing/construction spills over into the broader economy and labour market. The RBNZ remains under no illusion to the challenges that exist and the price that needs to be paid to win the battle against inflation. According to the RBNZ “a prolonged period of subdued spending growth is still required to better match the supply capacity of the economy and reduce inflation pressure”, and the committee is confident that with rates “remaining at a restrictive level for some time” inflation will fall back into the 1-3% target band. The RBNZ is forecasting this to happen by Q3 2024.

That said, the RBNZ does appear a bit unsure about the near-term stating that there is a “risk that activity and inflation measures do not slow as much as expected”. The offshore experience where ‘sticky’ services inflation has held up longer than anticipated is clearly on its mind. As such, the updated forecast track provided by the RBNZ shows there is a partial chance of another rate rise factored in by Q1 2024 (~40% possibility). We doubt the RBNZ will have to crystallise this risk given the extended period of very weak/negative activity projected in NZ on the back of ‘restrictive’ settings, and as amplifiers such high debt burdens, low confidence, and/or rising unemployment take hold. Indeed, when asked about it RBNZ Governor Orr stated that the adjustment to the OCR track “is not a strong signal on the next move”, with the bank still very much in “watch, worry, and wait mode”. In our judgement, the NZ recession/weak underlying state of the economy, and pullback in inflation should mean that the next move by the RBNZ is a rate cut rather than another hike.

The beleaguered NZD received a bit of a boost from the slight upward tweak in the RBNZ’s interest rate profile. AUD/NZD has dipped ~0.3% to ~1.0820. As mentioned above, we don’t believe the RBNZ will need to tighten policy any further and think the modest support for the NZD should soon fade. We remain of the belief that as rate hiking cycles move into the rear-view mirror (as we assume they now have in both Australia and NZ) FX markets should begin to focus more on other relative factors such as growth and labour market trends, when the next policy easing cycle could start, commodity prices, and capital flows.

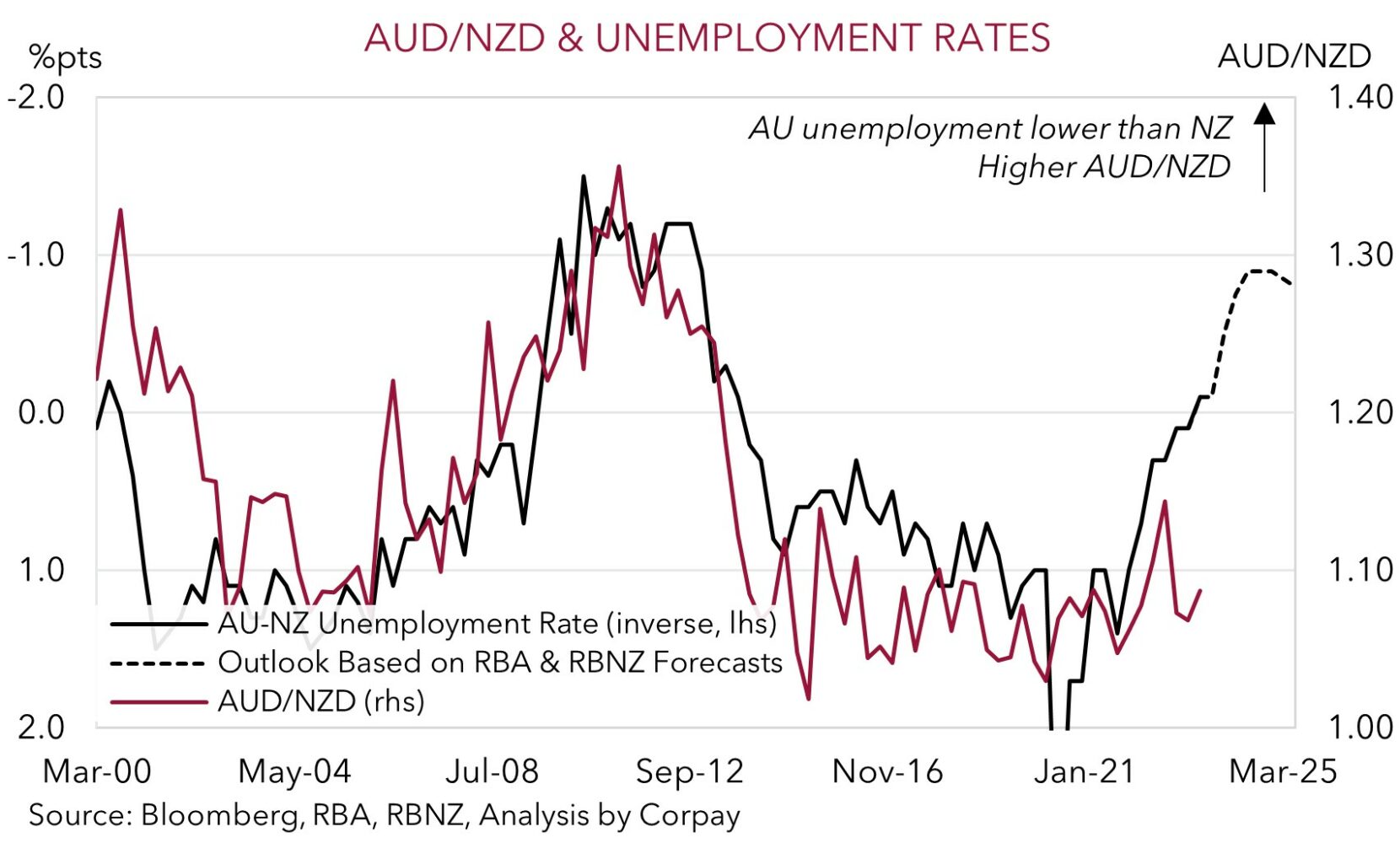

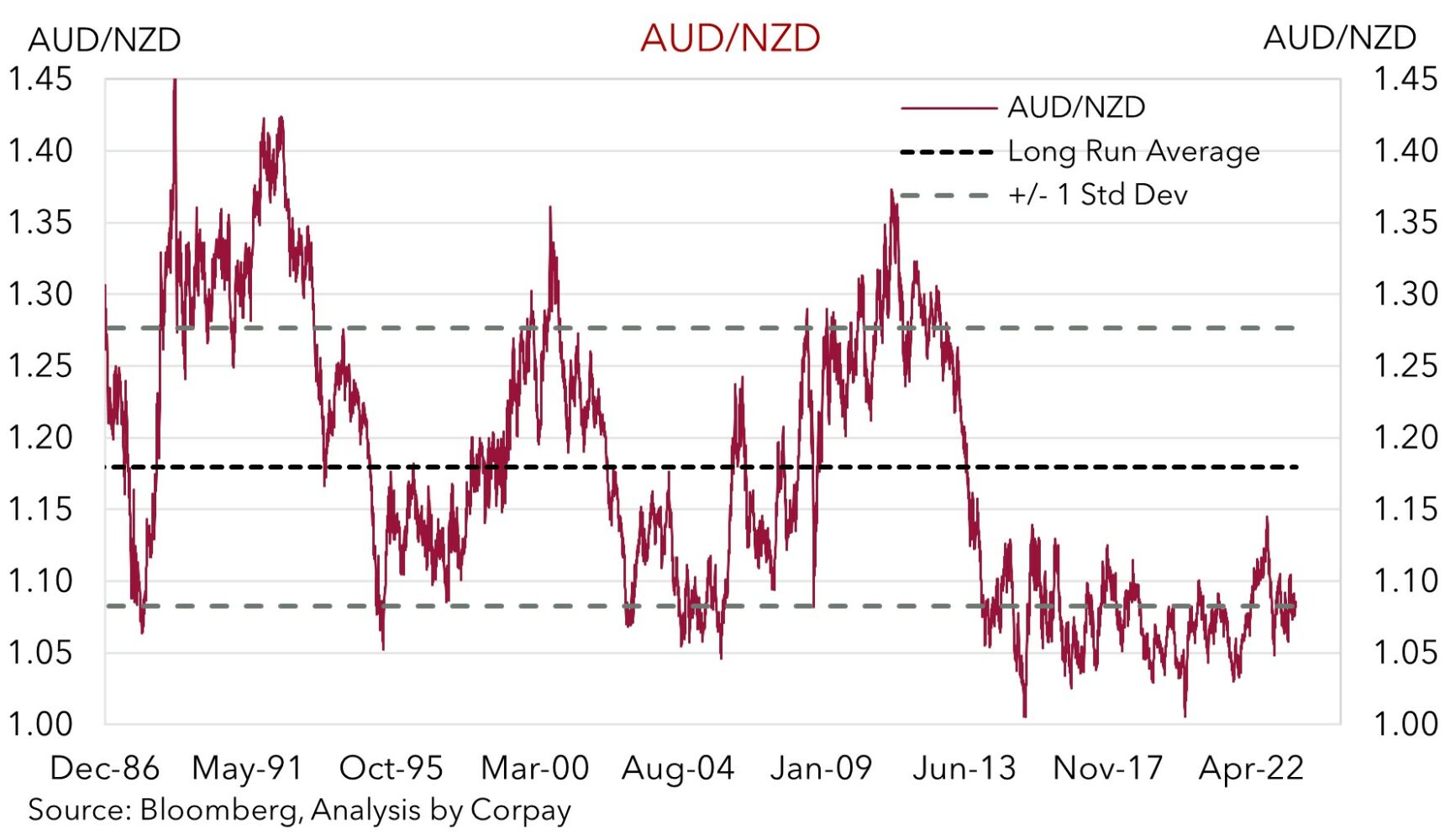

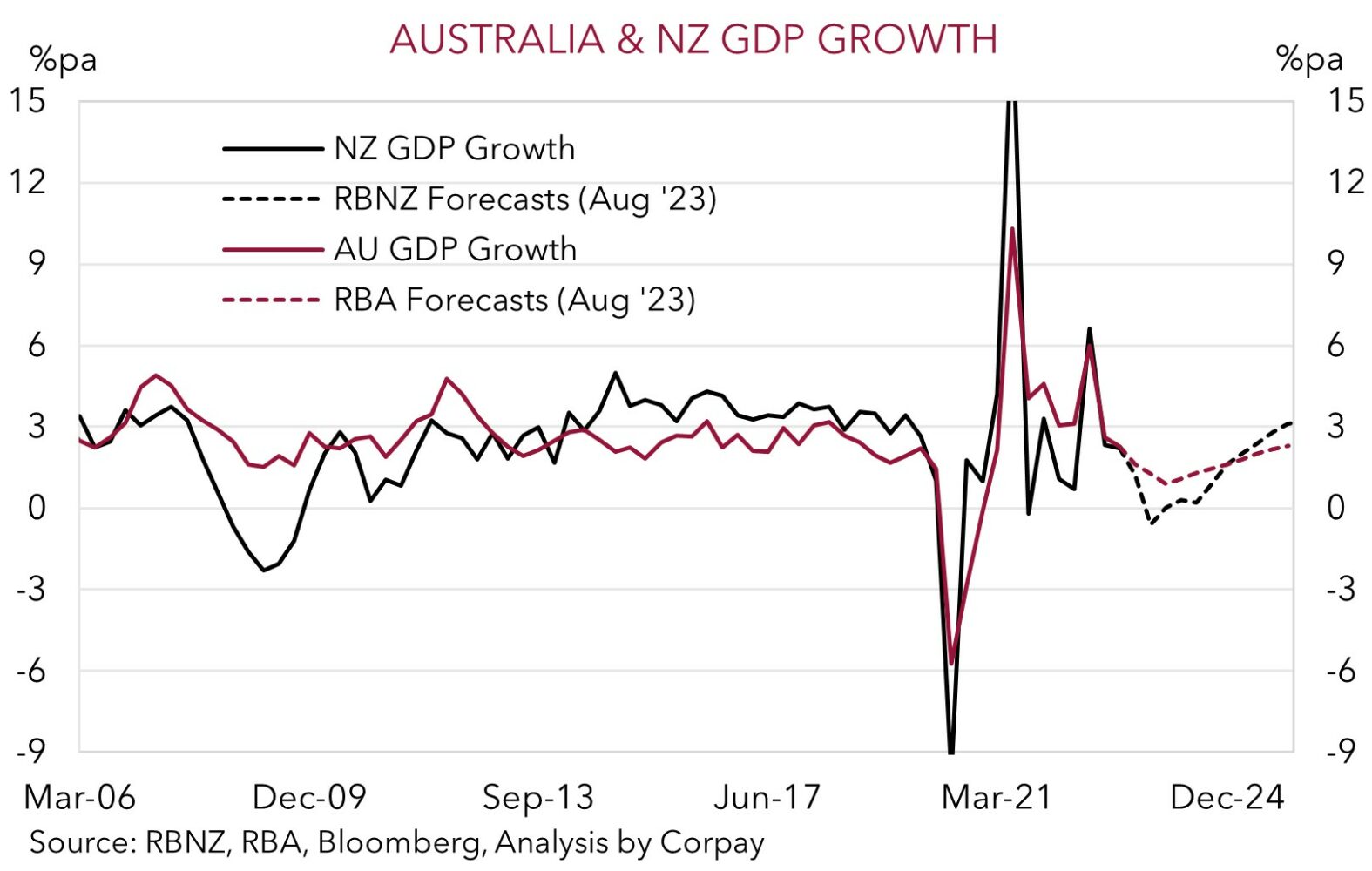

It shouldn’t be forgotten that FX is a relative price and on this broader set of metrics we expect the NZD to underperform. The RBNZ’s more forceful steps to combat inflation compared to the RBA point to bigger downside risks to NZ’s outlook. As shown, relative growth and labour market swings should move in Australia’s favour over the next few quarters and this has historically been associated with a rising AUD/NZD. Added to that, NZ’s sizeable current account deficit (~8.5% of GDP) is quite unfavorable compared to Australia’s surplus position (~1.4% of GDP), and this external imbalance should leave the NZD more vulnerable during bouts of market turbulence. Things won’t move in a straight line and bumps along the way are probable, however, over the medium term we see AUD/NZD trending higher (up towards ~1.14 in a years’ time).