We began to be more vocal about our thoughts the USD (and resultant weakness in the AUD) was looking on shaky foundations and was set to reverse course in mid-September (see Market Musings: AUD: Always darkest before the dawn). In hindsight we were a few weeks early, but nevertheless the macro landscape has evolved as we predicted causing the USD to lose ground (and the AUD to rebound) over the past month or so. As it was stressed at the start of my career, in financial markets it is better to make the right calls early, rather than hold the line too long and miss a trend change.

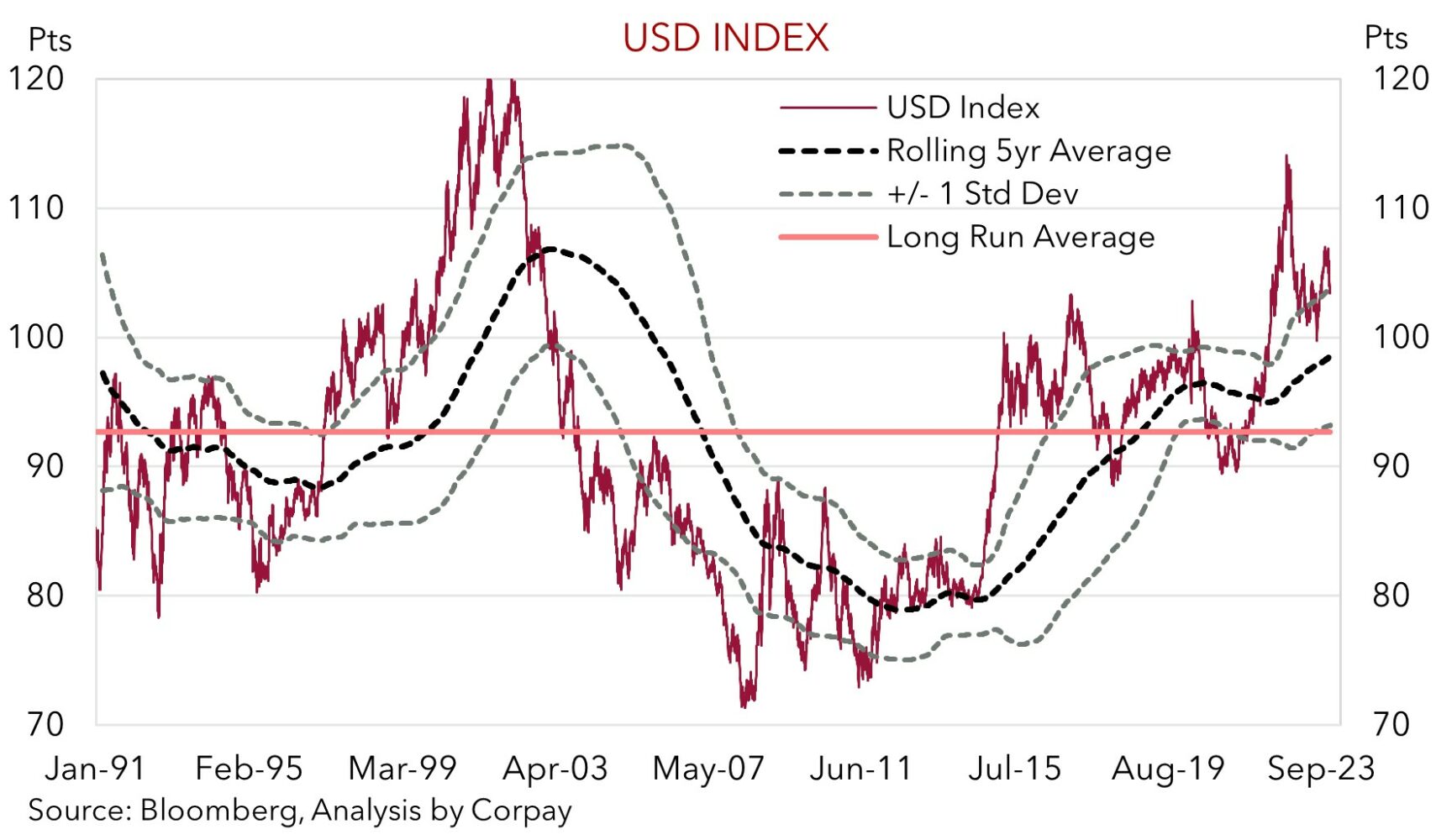

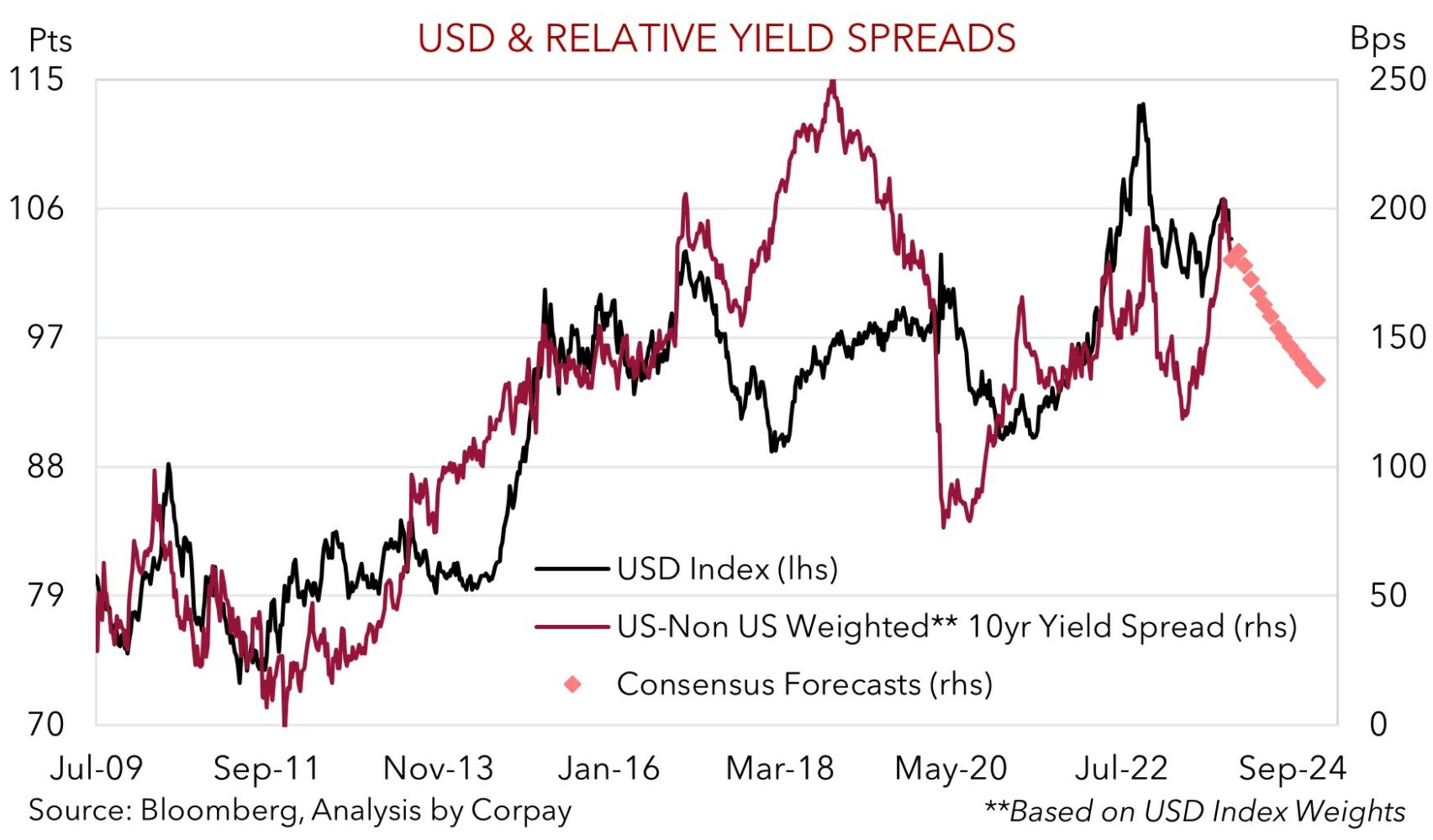

While it is unlikely to nosedive given the pockets of lingering uncertainty across the global economy and the US’ still handsome absolute interest rate/yield advantage over its major peers like Japan and the Eurozone, we believe the fundamental drivers for the still ‘over-valued’ USD to continue to gradually deflate over coming quarters are falling into place.

FX is a relative price, and the USD is quite sensitive to how the US economy is tracking compared to the rest of the world. The USD’s Q3 resurgence largely reflected the US’ relative economic strength. The run of stronger than anticipated US data saw 2023 growth forecasts revised higher. Robust US labour market and slow progress on the inflation front also saw the US Fed tighten policy further causing US bond yields to shoot up to cyclical highs. At the same time, other major economies such as the Eurozone and China were stumbling along, policy settings in China were being loosened, and the Bank of Japan maintained its ultra-accommodative stance.

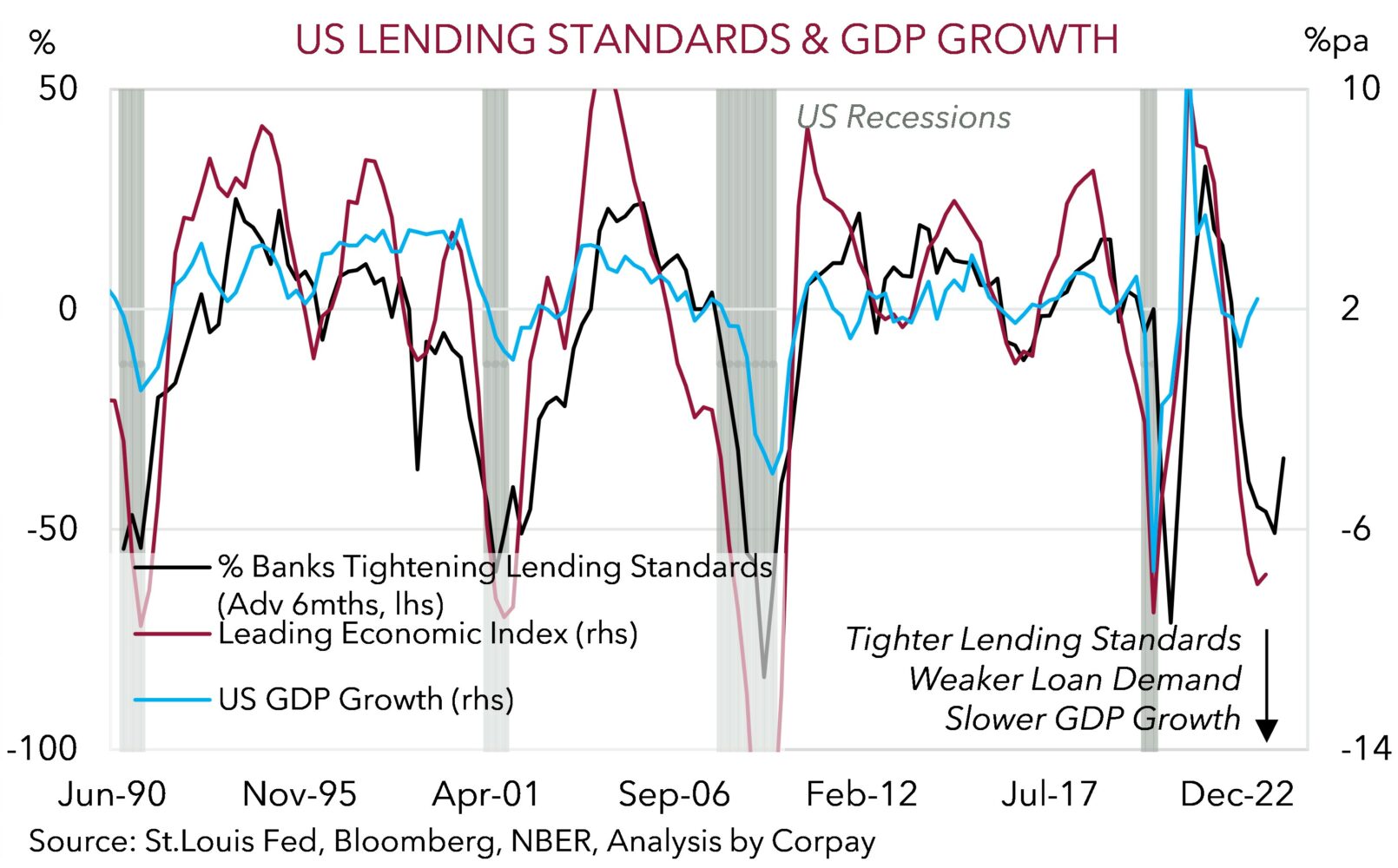

In our mind, the Q3-October period was likely to be ‘as good as it gets‘ for the USD. The US economy and US Fed policy impulses that propelled the USD higher look to have passed pivotal inflection points. Growth wise, we think signs the Fed’s ‘restrictive’ settings are biting are starting to pile up, and this should act as sand in the gears over the period ahead. Consumer spending, the engine room of the US economy given it accounts for ~3/4’s of GDP, is slowing. And with consumer sentiment below average, the pool of ‘excess savings’ that helped prop up activity over the past few quarters being run-down, student loan repayments that were put on ice during COVID restarting, and credit standards tightening, we believe a further slowdown is in train.

The latter is quite significant as credit and financial conditions are key cogs in the US Fed’s monetary policy transmission mechanism to the real economy and ‘main street’. While existing mortgage holders in the US don’t really feel the pinch of Fed interest rate changes as Australian households do when the RBA hikes given they are fixed for 30-years, new borrowers and people that refinance are facing substantially higher and prohibitive rates. Credit is the lifeblood of the US economy, and these signals, coupled with forward indicators such as the Leading Economic Index are all aligning to a step down in growth from here. Indeed, activity across the cyclical and interest rate sensitive housing market which has spillovers into other areas such as consumption is under pressure. Housing starts are near post-COVID lows and existing home sales have tumbled to the lowest since 2010. On top of that manufacturing looks to be in recession and with capital goods shipments decelerating the outlook for business CAPEX is darkening after a rather rosy period.

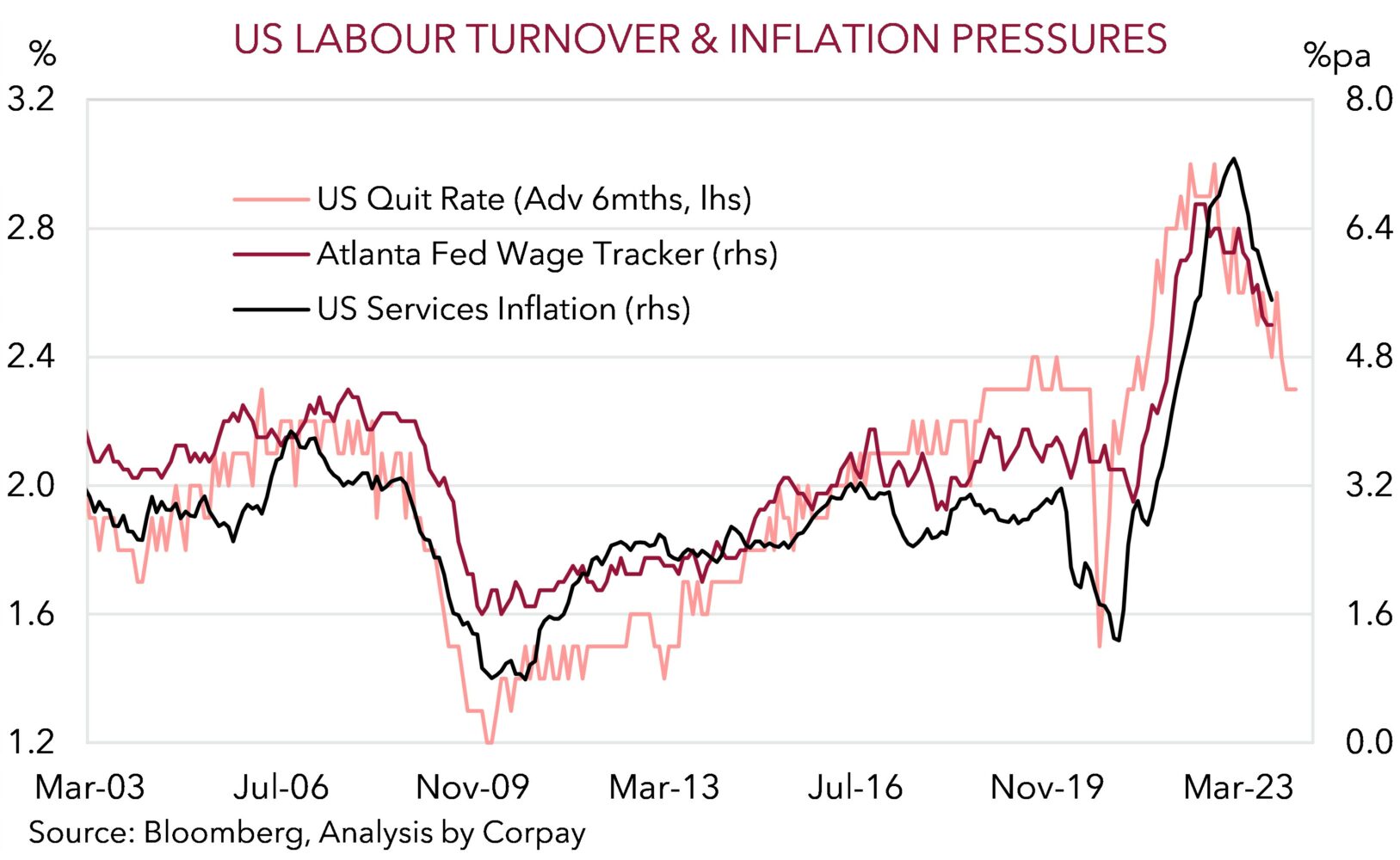

Notably, this is translating to the US labour market. Excess demand is receding as job vacancies are pared back and hiring slows, while supply is improving. The US labour force participation has risen, as has productivity, and the shifting sands has seen continuing claims (a gauge of recurring applications for unemployment benefits) begin to trend up. Labour market churn, as measured by the ‘quit rate’, has also fallen to pre-COVID levels. As our chart shows, reduced labour market turnover tends to go hand in hand with slower wages and services inflation down the track. This is what the US Fed is aiming for.

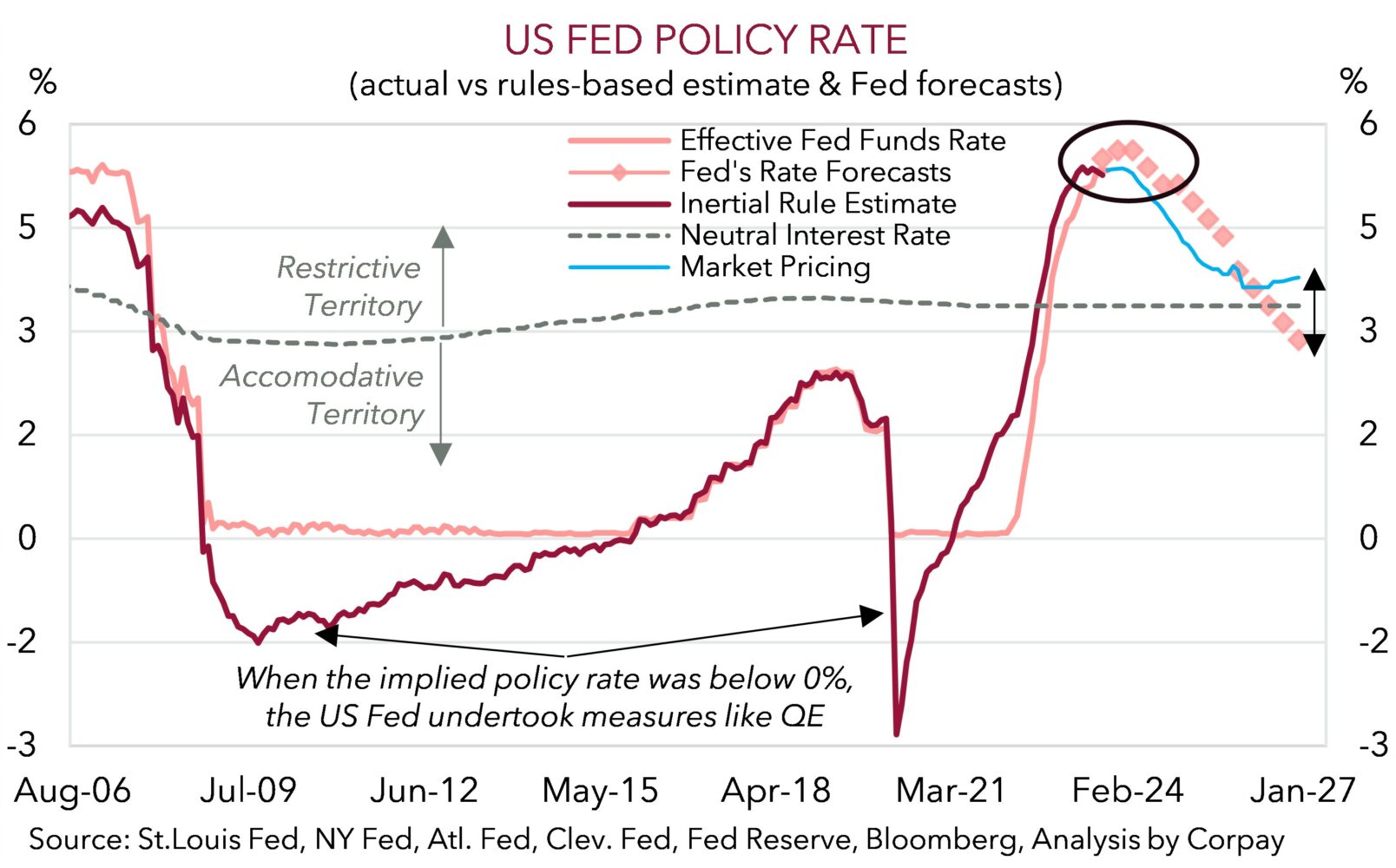

All up, based on our replication of the US Fed’s policy rules, the state of play across the US economy, and with the Fed noting it is “in a position to proceed carefully” odds further steps need to be taken appear low. Barring a surprising reacceleration in US inflation the Fed’s tightening phase looks to have ended, with the next policy move probably a rate cut. In FX monetary policy regime changes are important. Based on the assumption the Fed’s move in July 2023 was the last hike this cycle, thinking some modest easing kicks off around mid to Q3 2024 seems reasonable, in our opinion. The average gap between the last rate rise and first rate cut over the past 4 Fed policy cycles was ~9-months. By mid-2024, with US inflation set to have fallen further, unless nominal settings are loosened in locked step, the Fed’s policy stance (which is measured by the gap between real interest rates and the equilibrium ‘neutral’ rate) would mechanically become progressively more ‘restrictive’. We doubt this is something the Fed wants to see happen.

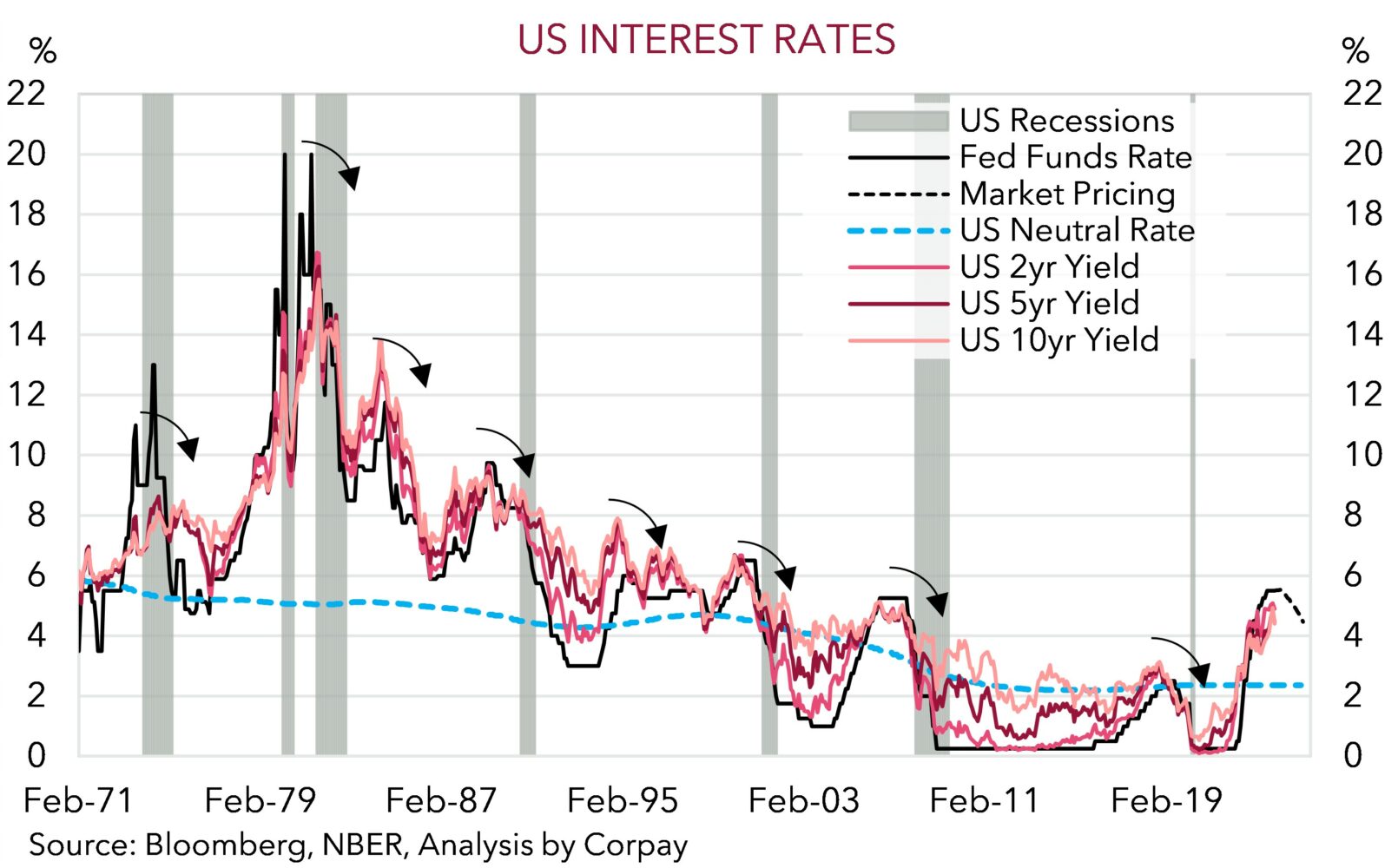

As markets grow in confidence that the ‘peak’ in US interest rates has been reached, and/or as the negative consequences of all the Fed’s past actions continue to manifest in the US activity and labour market data, we are looking for the unfolding downturn in US bond yields to gather pace. Bond markets don’t tend to standstill for long. As our long run chart illustrates, bond markets often quickly factor in the next leg of the policy cycle once the last phase has definitively ended. Things won’t move in a straight line. Twists and turns in risk sentiment should generate volatility and intermittent bouts of some renewed USD strength. However, as the next Fed easing cycle comes closer into view, US bond yields move lower, and US economic growth comes back to the pack not only due to a US slowdown but also as stimulus injections in China gain traction and support activity across Asian and Europe, we are looking for the USD to steadily lose its shine. There will be bumps along the path, but this is one of the factors behind our longstanding forecasts looking for the AUD to edge up to ~$0.68 in Q1 2024 before rising to ~$0.70 around this time next year.