Australian GDP data is notoriously backward looking. We are now ~2/3’s of the way through Q4 and the print for Q3 was only released today. Nevertheless, the detailed national accounts are still useful in providing a guide to the underlying picture across a broad range of areas and helps us benchmark how trends are unfolding compared with our thoughts.

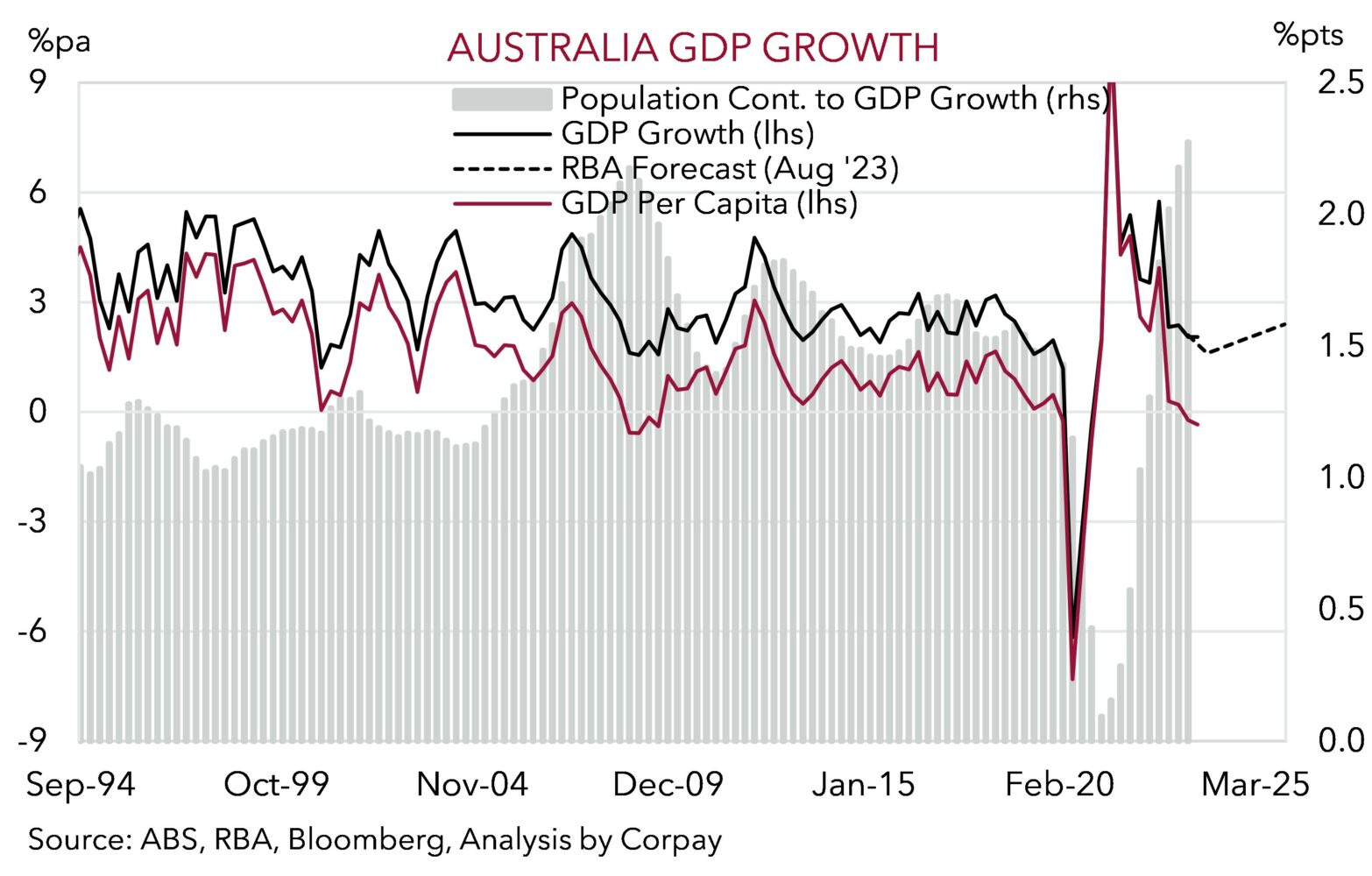

The GDP report illustrates that momentum across the economy has stepped down, unsurprising given the 425bps worth of rate hikes put through by the RBA this cycle and other cost of living factors that are hitting the private sector. The economy expanded by just 0.2% in Q3, down from an average of 0.5%qoq in H1 2023 and H2 2022, and 0.6% over H1 2022. A closer look shows that government spending and capital investment were the main drivers of growth in Q3 with household consumption (the largest part of the Australian economy) stalling. There was some statistical jiu-jitsu at play here which exacerbated the slowdown as government benefits and rebates designed to provide relief also meant that there was less household spending on services like electricity. But nevertheless, the headwinds from high inflation, jump up in interest rates, and additional tax obligations have led to a sharp drop in real household disposable income, and this in turn is constraining consumption.

Notably, a fair amount of support to aggregate demand continues to come via Australia’s rapidly expanding population. It shouldn’t be forgotten that GDP is a volume measure. In contrast to the modest overall economic expansion, in per capita terms GDP fell again in Q3, the 4th fall in the past 5 quarters, the worst run since the early-90’s recession. So, on average people are clearly doing it tough as tighter conditions squeeze households and interest rate sensitive sectors like construction, but there are just more of us floating around the economy day to day which is propping up volumes.

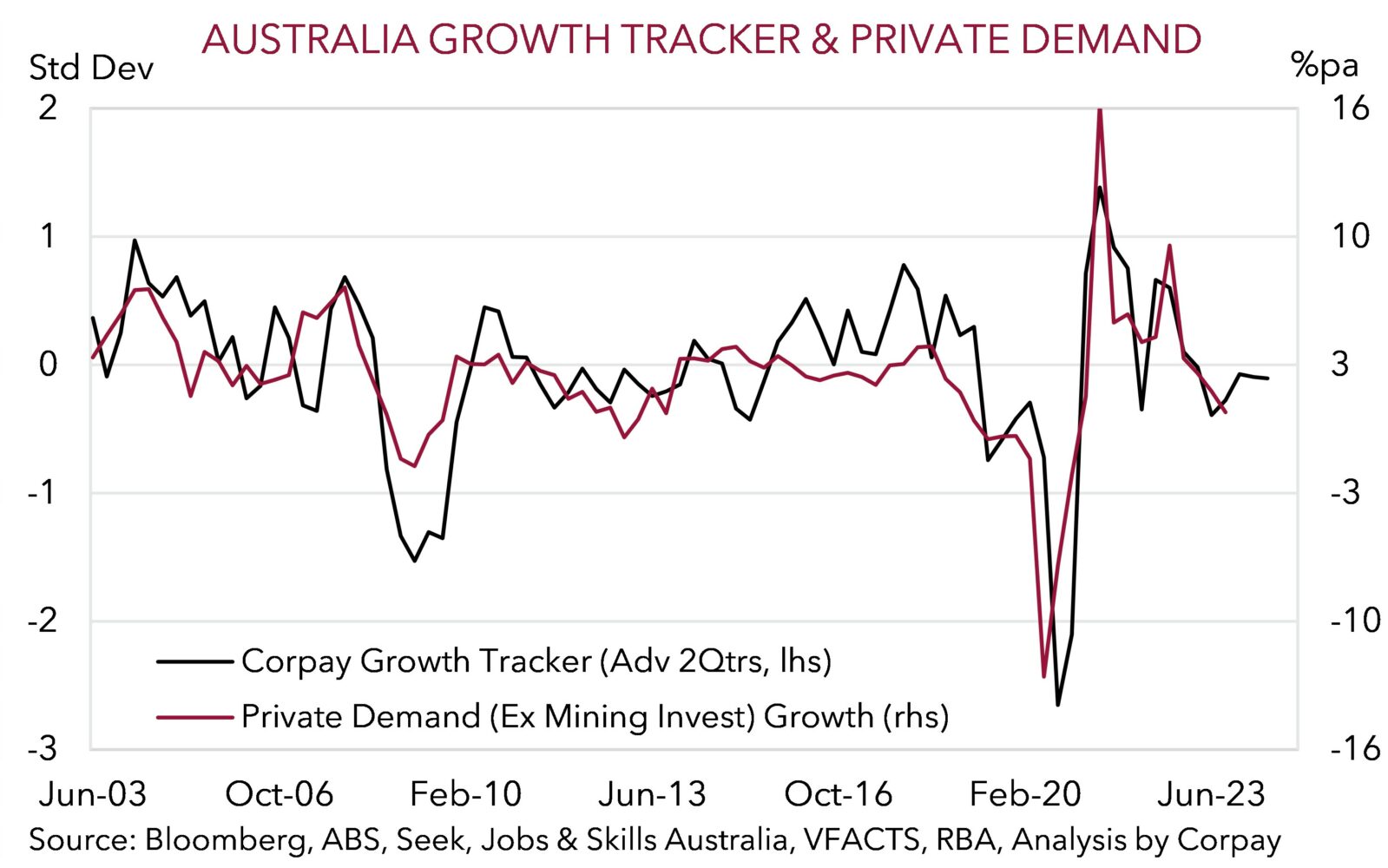

In our view, the outlook for slower economic activity over the period ahead remains firmly intact as the flow through from the RBA’s ‘restrictive’ policy settings continue to gain traction. As shown, our Private Demand Tracker is pointing to sub-trend momentum continuing over the next few quarters. That said, sub-trend doesn’t mean things are about to fall off a cliff, and actual outcomes may come in better than many fear. Consensus forecasts are centered on annual GDP growth decelerating to just 1%pa in mid-2024. This looks too low, and in our judgement the ‘narrow path’ to a soft landing the RBA is trying to navigate still appears achievable. This partly reflects the benefit from the burgeoning population. We also think the pipeline of infrastructure investment, CAPEX spending trends, and a reacceleration in China on the back of its stimulus push should be somewhat supportive for Australia over the next year.

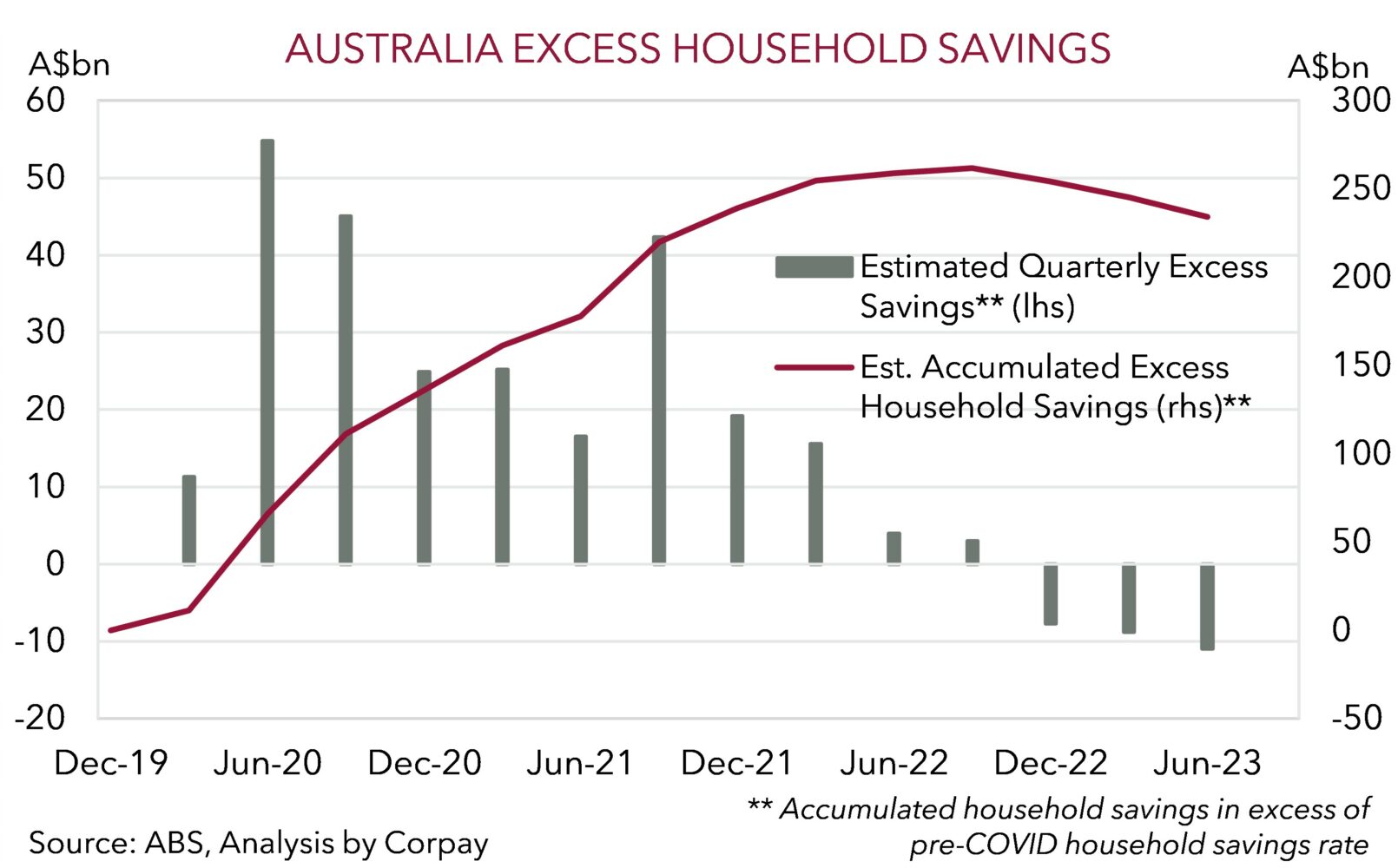

Concurrently, softening but still solid domestic labour market conditions, firmer wages, and moderating inflation should help counteract some of the pressures buffeting the household sector over time. And it should be remembered that it isn’t all one-way. While many are feeling the pinch from higher interest rates and have limited buffers, there are net savers that benefit from the added income. Moreover, a sizeable pool of ‘excess savings’ still exists that parts of the household sector has the capacity to tap into. On our figuring although this war chest has declined it still equates to ~A$215bn, equal to ~20% of spending undertaken by households in 2019.

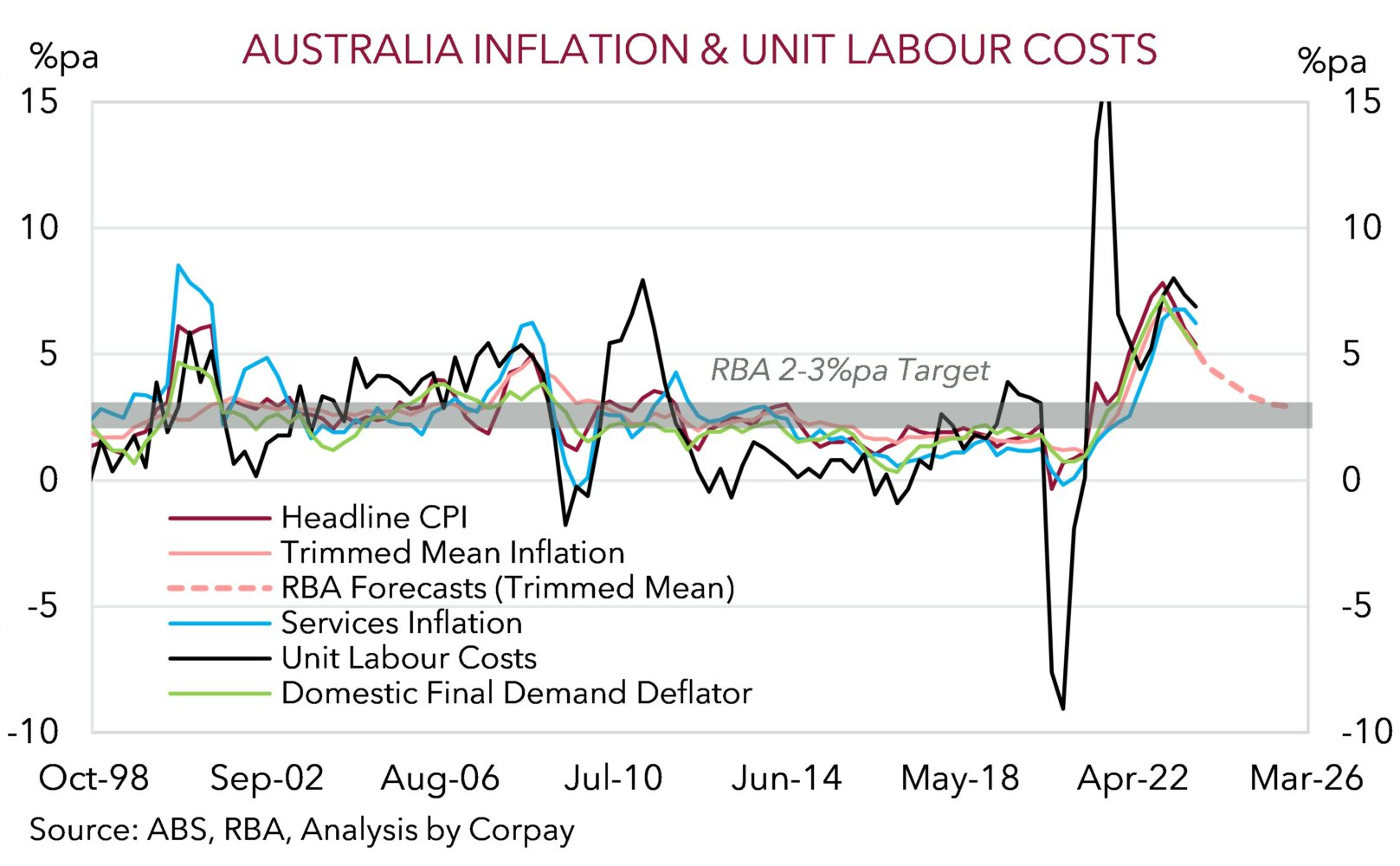

From an inflation perspective, the annual run rate of various broader price metrics contained in the national accounts such as unit labour costs and the domestic demand deflator eased a little in Q3. But as our chart shows though things are heading in the right direction they remain above where they need to be for the RBA to be comfortable the inflation fight has been won, especially given Australia’s lackluster productivity and impulses across sticky services prices. Hence, while the growth trajectory supports a view that the RBA might have reached the top of its interest rate mountain, we think it is unlikely it will shift course and ease policy for some time.

Indeed, as outlined previously, we believe factors such as the RBA’s pragmatic tightening approach, lags in Australia’s wage dynamics due to the prevalence of multi-year enterprise bargaining agreements, support to demand from the expanding population, and incoming income tax cuts are likely to see the RBA lag its peers when the next global easing cycle kicks in. With the RBA set to remain on a slightly different policy path, we are looking for relative yield spreads to continue to trend in a more AUD supportive direction over coming quarters. There will continue to be bumps along the way, but based on our fundamental outlook we continue to project the AUD to edge up to ~$0.68 by Q1 and then onto ~$0.70 by this time next year.