• Mixed markets. Equities dip again & while long-end yields declined base metal & energy prices ticked up. USD consolidates but AUD still under pressure.

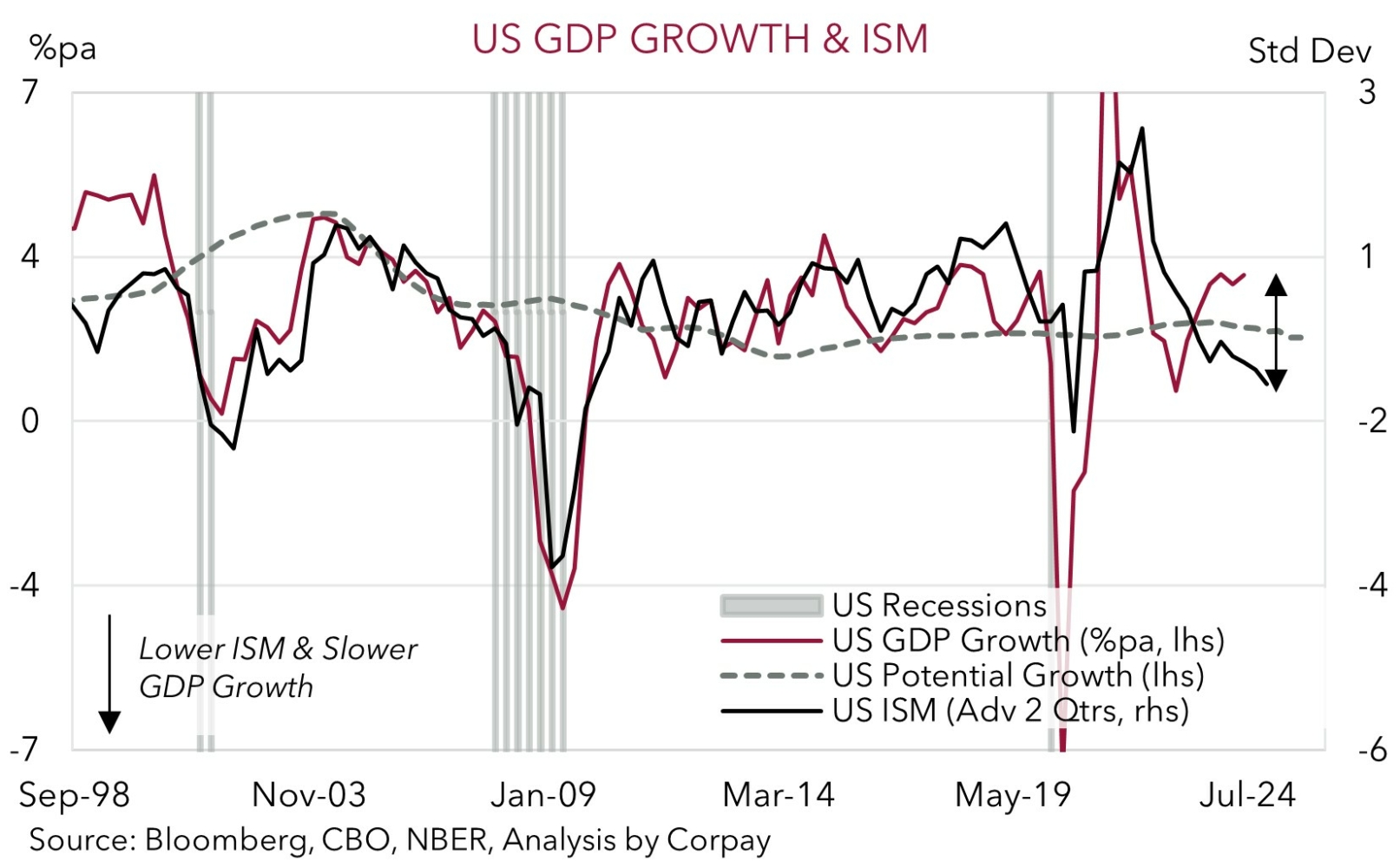

• US data. Q2 US GDP higher than predicted. But forward indicators suggest this is a false dawn. US PCE deflator due tonight. US Fed meets next week.

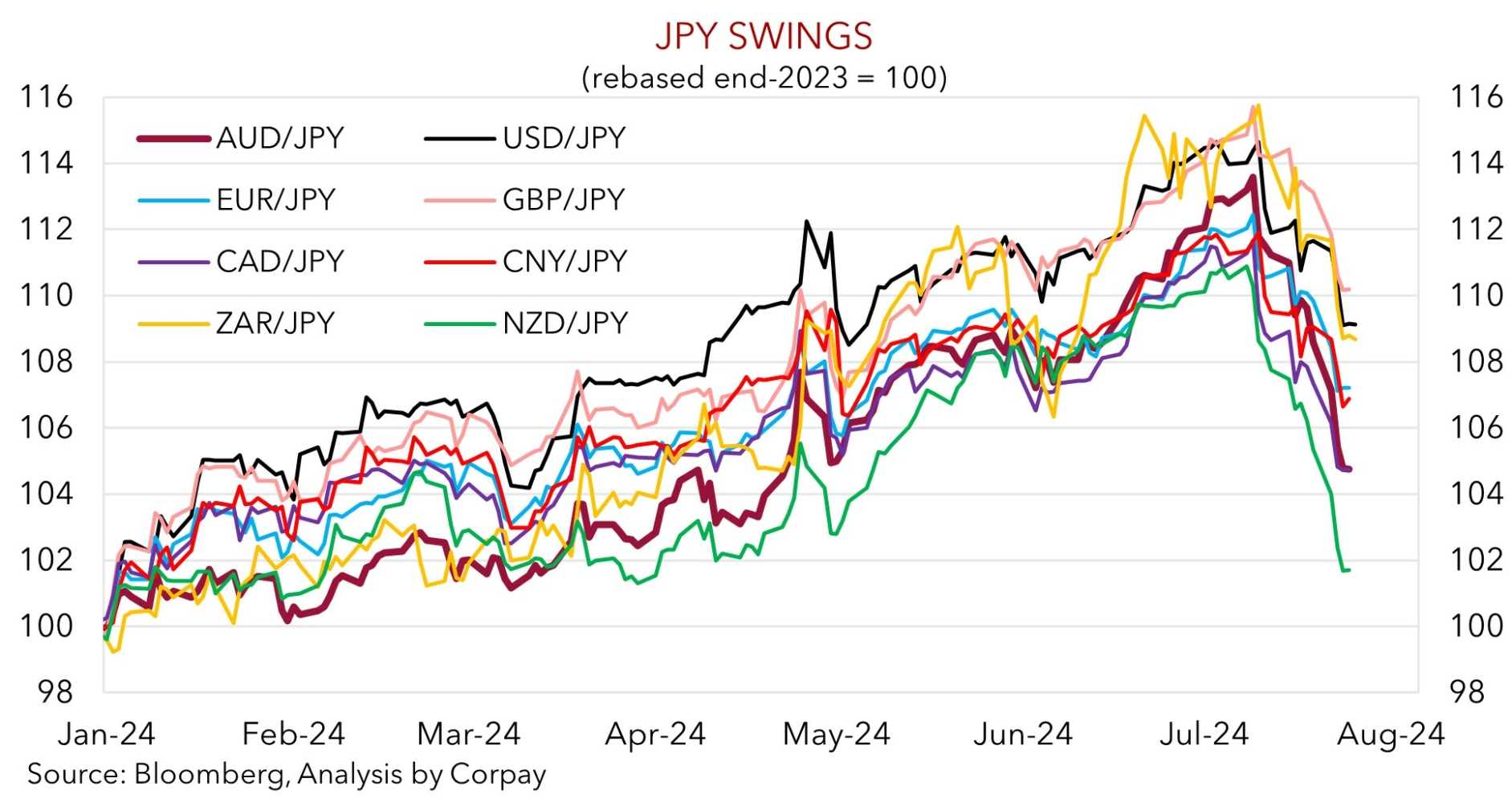

• JPY trends. JPY’s sharp rebound has been a factor weighing on the AUD. Q2 Australian CPI released next week. Will this help the AUD recover?

Negative vibes across risk assets have generally continued, though there were a few positive signs starting to emerge. Q2 US GDP was the main macro focus overnight and the data suggested the ‘soft landing’ scenario is still in play. Growth quickened more than predicted in Q2 with the US economy expanding at a 2.8% annualised pace. This was double the projected speed with strength in household spending, business investment, and net exports the drivers. That said, while there was a pickup in momentum in Q2, the underlying run-rate has stepped down compared to last year, and forward indicators such as the ISM surveys point to a slowdown in US growth over coming quarters as tighter credit conditions, subpar sentiment, and a weakening labour market bite.

Across markets equities remained on the backfoot with the pullback in the US tech-sector dragging on the overall index (NASDAQ -0.9%, S&P500 -0.5%). At the same time industrial metals and energy prices found some support. After a negative run, copper, iron ore, and WTI crude oil ticked up over the past 24hrs. Time will tell whether this will continue given underlying concerns about growth in China. Bond yields dipped with 10yr rates in the US, UK and Germany shedding ~3-4bps. At ~4.24%, the benchmark US 10yr yield is hovering towards the bottom end of its three-month range with markets factoring in a US Fed rate cut by September and more than two additional moves between then and January.

In FX, it was a mixed bag particularly given some of the moves in other asset classes. The USD Index consolidated with EUR treading water near ~$1.0850. USD/JPY also stabilised after its recent steep drop. At ~153.90 USD/JPY is almost ~5% from its early-July multi-decade peak. GBP slipped back (now ~$1.2855) and ahead of today’s quarterly MAS review (10am AEST) where policy settings are expected to be held steady USD/SGD tracked sideways (now ~1.3435). By contrast, despite the uptick in commodities the downward pressure on the AUD and NZD has remained in place. At ~$0.5890 the NZD is approaching its April year-to-date lows, while the AUD (now ~$0.6535) is at levels last traded in early-May. As discussed below and yesterday, the relatively sharper retracement in AUD/JPY and NZD/JPY has been a factor weighing on AUD and NZD.

Today, inflation will be in focus with Tokyo CPI (a leading indicator for the national measure) (9:30am AEST) and the US PCE deflator (the Fed’s preferred gauge) (10:30pm AEST) due. Tokyo data in line with consensus could give the Bank of Japan more food for thought and solidify expectations looking for another rate hike at next Wednesday’s meeting. This in turn could see the JPY’s revival continue. In the US, based on the already released CPI and PPI data, the PCE deflator is expected to moderate. In our opinion, cooling US inflation pressures could bolster views the Fed’s easing cycle is approaching, dragging on US yields and the USD.

AUD Corner

The AUD’s pull-back has continued with the currency back at levels last traded in early-May (now ~$0.6535). This is despite some signs of stabilization coming through in global industrial metals and energy prices overnight, and consolidation in the USD index (see above). Weakness on the crosses is a factor with AUD shedding ~0.7% against the EUR (now ~0.6030), nearly 1% versus the CNH (now ~4.7340), ~0.5% relative to the CAD (now ~0.9035), and another ~0.6% against the JPY. At ~100.60 AUD/JPY is around a three-month low and over 8% from its mid-July cyclical highs.

As discussed over recent days, and as our chart below illustrates, the relatively larger drop in AUD/JPY (and NZD/JPY) compared to other JPY crosses has been a driving force behind the AUD’s (and NZD’s) retracement. We believe we are now approaching levels where the JPY’s outsized influence on the AUD should fade, and the more normal inverse relationship between USD/JPY and AUD/USD may re-assert itself.

Moreover, when we throw everything into the melting pot, we think the AUD’s recent underperformance is unjustified from a fundamental perspective. Based on our ‘fair value’ modelling which incorporates a range of inputs such as nominal/real yield spreads, and the level of equity markets/commodity prices, the AUD now looks to be trading ~2 cents too low, in our view. Over the next week we feel that the AUD positive macro divergence between Australia and others could be rekindled. Tonight the US PCE deflator is released (10:30pm AEST), next Wednesday’s the Bank of Japan meets, Q2 Australian CPI inflation is also due (Weds AEST), and the US Fed holds its policy meeting (Thurs morning AEST).

Unlike the rate cuts being factored in for most other major central banks, markets are assigning a ~20% chance the RBA hikes again by September, with the first RBA rate reduction not fully discounted until May 2025 because of the resilience in the Australian labour market, sticky inflation, and fiscal/income support flowing to the household sector. The Q2 CPI report will be a deciding factor if the RBA hikes rates again or not. But even if the RBA holds fire on 6 August and maintains its “not quite as high for longer” strategy yield differentials should still progressively shift in an AUD supportive direction over time as the RBA lags its peers in terms of when it starts and how far it goes during the next easing cycle. In our judgement, as market volatility subsides this dynamic can help the AUD claw back ground, particularly on the crosses.