• Positive tone. Improved risk sentiment. Equities rebound. Bond yields lower. Backdrop helps the AUD claw back a little lost ground.

• Volatility bursts. It is a jam-packed week of events. We think more market volatility is likely as the macro cross-currents wash through.

• Event radar. Q2 AU CPI due (Weds). BoJ (Weds), BoE & US Fed (both Thurs) meet. US payrolls are released (Fri), as is the China PMI & EZ CPI (Weds).

After a challenging spell risk sentiment improved a bit at the end of last week. European and US equities rose on Friday with the S&P500 up over 1%. That said, despite the bounce, on the back of the steeper decline over prior days (particularly across the tech-sector) the S&P500 still recorded its first back-to-back weekly fall since April. Bond yields also lost ground with the benchmark US 10yr rate shedding ~5bps (now 4.19%) while the policy expectations driven US 2yr rate is tracking around its lowest level since early-February (now 4.38%). In FX, the JPY stabilized with USD/JPY treading water just below ~154 (~5% from its recent multi-decade peak). EUR (now ~$1.0860) and GBP (now $1.2865) nudged up, with the improved tone also generating a little support for the beleaguered NZD (now ~$0.5890) and AUD (now ~$0.6555).

Data wise, the US PCE data was released on Friday. The annual run-rate of the PCE deflator (the Fed’s preferred inflation gauge) decelerated to 2.5%pa, matching its slowest pace since Q1 2021. Notably, the 3-month annualised pulse of the market-based core measure, a subset focused on by Fed Chair Powell, is running below 2%. Added to that, personal income and spending lost steam, another sign past Fed policy steps, tighter credit conditions, and below average confidence are having an impact.

It is a jam-packed week with several potential volatility triggers. On top of Q2 Australian CPI (Weds), the Bank of Japan (Weds), the Bank of England (Thurs night AEST), and US Fed (Thurs morning AEST) meet. China PMIs are due (Weds), as is Eurozone GDP (Tues) and CPI (Weds), while in the US there are several labour market indicators with the non-farm payrolls report rounding things out (Fri night AEST). Earnings from Microsoft (Tues), Amazon and Apple (both Thurs) are also on the radar.

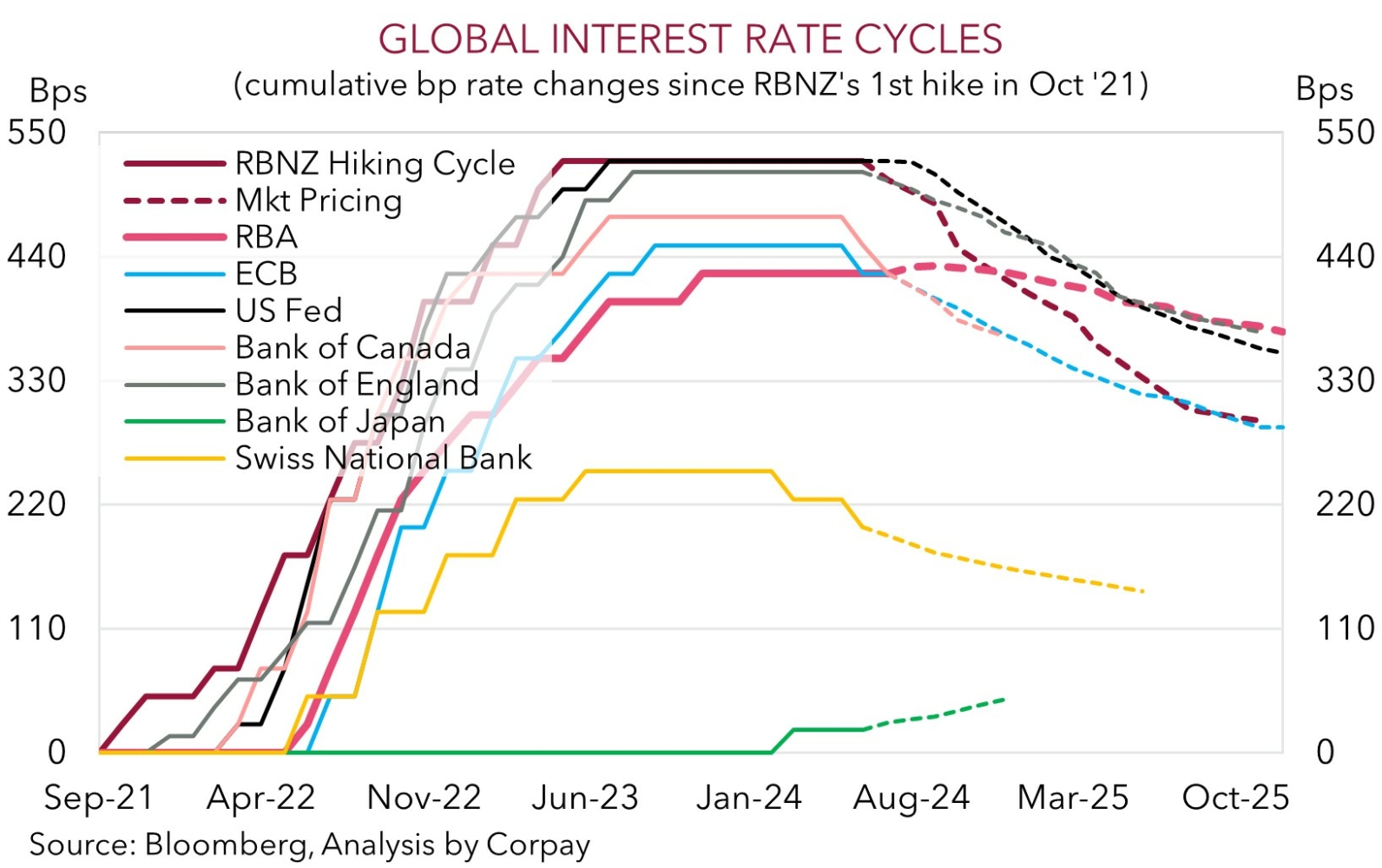

In terms of the central banks markets are assigning a ~70% chance the BoJ delivers another hike. In the UK, things are delicately poised with a BoE cut viewed as a 50/50 bet. On balance we believe UK macro trends should tip the scale in favour of the BoE delivering its first cut. If realised, this type of mix could help the JPY extend its revival and/or exert pressure on GBP. In the US, no changes by the Fed are looked for with focus on its guidance. While the Fed probably won’t explicitly state a cut in September is coming, based on cooling inflation and labour market conditions it may hint easing might commence “soon” if things stay on track. This type of message, coupled with softer US non-farm payrolls growth/higher unemployment (which is where we think the risks reside because of slower activity and Hurricane Beryl disruptions) would solidify US rate cut expectations. In our opinion, this could drag on US yields and the USD.

AUD Corner

The modest improvement in risk appetite on Friday, as illustrated by the rebound in equities, helped the AUD find some support (see above). However, at ~$0.6555 the AUD is still near the lower end of its three-month range and ~3.6% from its 11 July peak. The backdrop has also given the AUD a slight boost on the crosses with gains of ~0.1-0.2% coming through against the EUR, JPY, GBP, and NZD, while the AUD has clawed back a little more lost ground versus the CAD (+0.3%) and CNH (+0.5%).

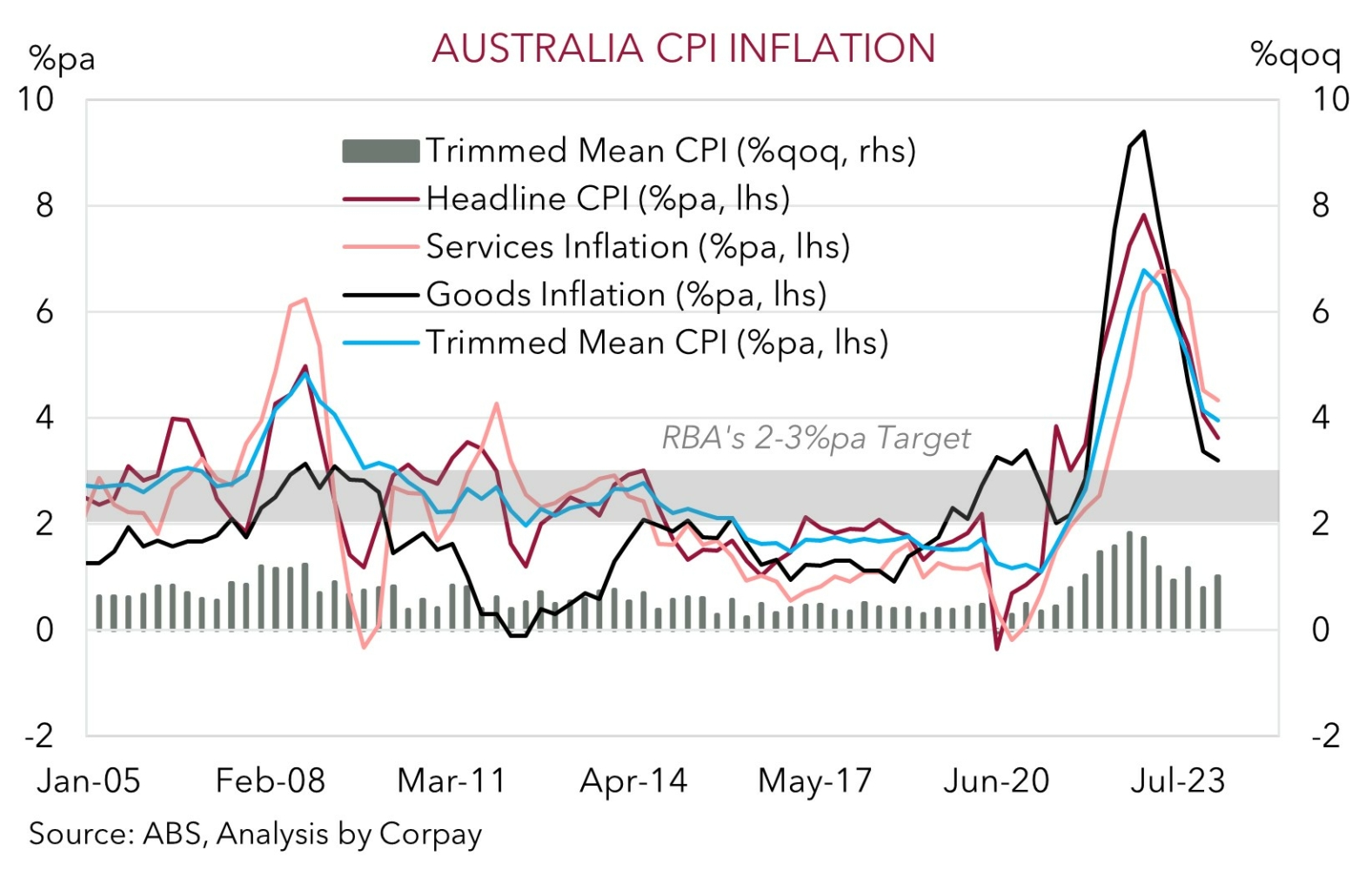

Locally, all eyes will be on the Q2 CPI report (Wednesday). After a couple of hotter than predicted monthly inflation prints and still tight labour market expectations the RBA could deliver another rate hike as soon as the 6 August meeting have risen, with the start of the eventual easing cycle also pushed out to mid-2025. The quarterly CPI data is more comprehensive than the monthly figures. Some basket items, especially around important services prices which the RBA has been lasering in on, are only measured once in the last month of the quarter. For most analysts Q2 Australian inflation looks set to come in above what the RBA was assuming, but the uncertainty is by how much. Core inflation (i.e. the trimmed mean) is projected to rise by 1% in Q2, keeping the annual run rate at 4% (the RBA is forecasting 0.8%/3.8%pa).

This type of result may not automatically trigger another rate hike, a lot will depend on the detail regarding services prices, but we feel RBA market expectations (which are discounting a ~25% chance of an August hike) may get a boost. By contrast, core inflation of less than 1%qoq might see tightening expectations pared back, while a 1.1% or higher outcome would likely mean another hike is more probable than not.

In our opinion, signs of sticky domestic inflation pressures, combined with signals by the US Fed that an easing cycle is coming closer into view (Thurs morning AEST) and/or softer US labour market conditions (non-farm payrolls is released on Friday night AEST) could help the AUD reverse course and converge back up towards ‘fair value’. The average across our suite of models suggests the AUD is now ~2 cents too low. Indeed, even if the RBA holds fire in August and maintains its “not quite as high for longer” strategy yield differentials still look set to progressively shift in an AUD supportive direction over time as the RBA lags its peers in terms of when it starts and how far it goes during the rate cutting phase. Outside of AUD/JPY, which still looks too high based on relative long-term interest rate expectations, we believe the diverging economic/policy trends between Australia and others should also see the AUD bounce back on the other crosses.