• Quiet start. No major data or news overnight. Major asset classes contained to recent ranges. AUD hovering near its 1-year average, NZD a bit weaker.

• Busy few days. Several events looming. In the US there are a few jobs indicators due over coming days, with the US Fed also meeting.

• AU CPI. Quarterly inflation due tomorrow. This is a more detailed set of figures. Consensus looking for core inflation to come in above the RBA’s forecasts.

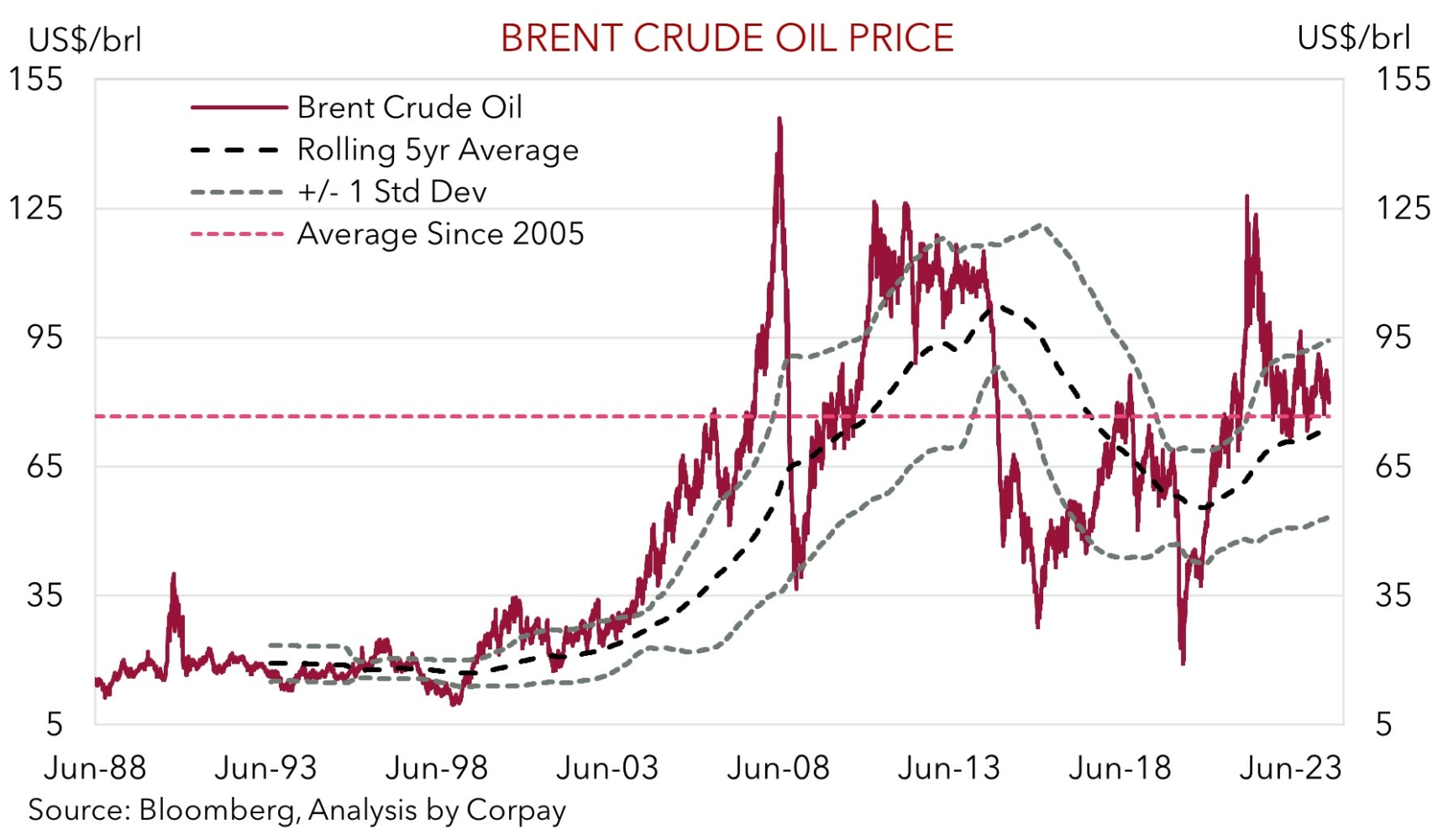

It has been a quiet start to the week, unsurprising given the lack of economic data and news. In contrast to Eurozone equities which dipped (EuroStoxx50 -1%) the US stock market tread water (S&P500 +0.1%). In bonds there were modest falls in yields with the benchmark US 10yr rate shedding ~2bps (now 4.17%, towards the bottom of its four-month range). Across commodities, industrial metals lost a bit of ground (copper -0.7%), as did oil with WTI and Brent crude declining ~1.6% as demand concerns overshadow Middle East geopolitical risks. As our chart shows, brent crude is back sub US$80/brl. That said, some perspective is also needed. Brent crude is where it was tracking ~six-weeks ago, with prices still above their respective five-year and long-run averages. In FX, there have been small gains for the USD against the EUR (now ~$1.0825), GBP (now ~$1.2860), the JPY (now ~154), and the CAD (now ~1.3850). USD/SGD has consolidated (now ~1.3435), the AUD is hovering close to its one-year average (now ~$0.6550), and the NZD has weakened with the flightless kiwi within striking distance of its 2024 lows (now ~$0.5877).

This sense of calm may not last due to the laundry list of events on the radar. In addition to Q2 Australian CPI (Weds), the Bank of Japan (Weds), the Bank of England (Thurs night AEST), and US Fed (Thurs morning AEST) meet. China PMIs are due (Weds), while in the Eurozone CPI is out (Weds) and Q2 GDP is released tonight (7pm AEST). Another sluggish quarter of Eurozone growth is looked for (mkt +0.2%qoq). In the US there are range of labour market indicators coming out. Tonight’s JOLTS figures kick things off (12am AEST), with the non-farm payrolls report closing out the week (Fri night AEST). Earnings updates from Microsoft (Tues), Amazon and Apple (both Thurs) are also on the schedule.

As outlined yesterday, in terms of the central banks another BoJ rate rise looks likely (markets are assigning a 60% chance of a 10bp increase), while we think underlying UK trends may tip the scale in favour of the BoE delivering its first cut (markets view this as a ~50/50 bet). These types of outcomes could see the JPY’s rebound extend and/or exert downward pressure on GBP. In the US, signs labour market conditions are cooling (e.g. via a step down in JOLTS job openings and/or a further fall in the ‘quits rate’ which is a proxy for jobs churn and leading indicator for wages) would support our assessment the US Fed may hint its easing cycle might start “soon” if things stay on track. This type of message, coupled with softer US non-farm payrolls/higher unemployment (this is where we believe the risks reside because of slower activity and Hurricane Beryl disruptions) should solidify US rate cut assumption, which in turn could drag on US yields and the USD.

AUD Corner

In line with the modest moves across most of the major asset classes, the AUD consolidated overnight with AUD/USD hovering near its one-year average (now ~$0.6550). That said, after being a bit battered and bruised recently the AUD did nudge up a touch on most of the crosses with gains of ~0.1-0.2% recorded against the EUR, JPY, NZD, and CAD over the past 24hrs. AUD/NZD is back near the top of its multi-quarter range (now ~1.1140), and we continue to see more medium-term upside in the pair as the relative economic and policy trends favour the AUD. Our long-held forecast is for AUD/NZD to edge up towards ~1.13 by Q4.

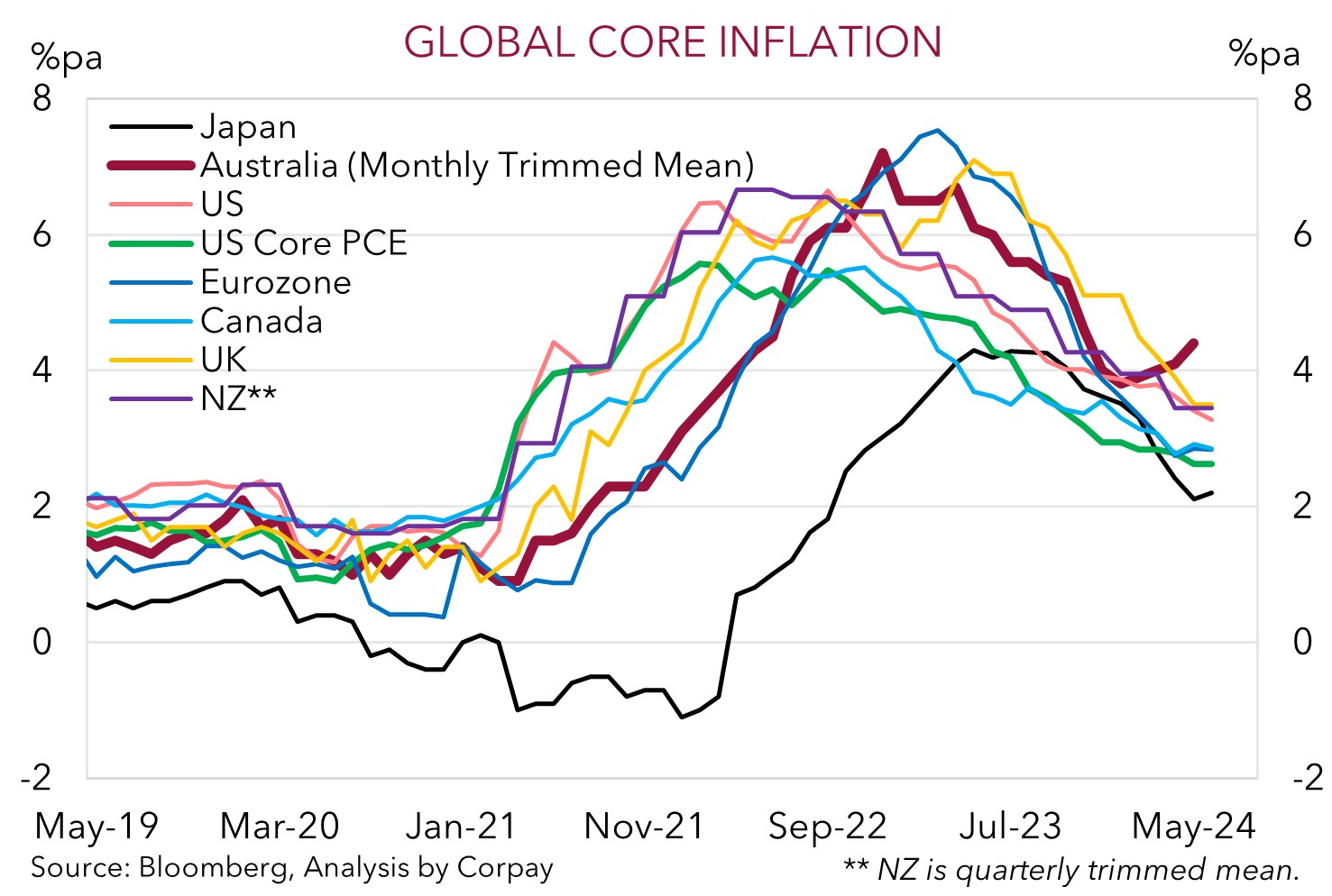

Locally, the next event risk for the AUD is tomorrows Q2 CPI inflation data. The quarterly CPI report is more comprehensive than the monthly figures. Some basket items, especially around important services prices which the RBA has been focused on, are only measured once in the last month of the quarter. For most analysts Q2 inflation looks set to come in above the RBA’s forecasts, but the question is by how much. Core inflation (i.e. the trimmed mean) is projected to rise by 1% in Q2, keeping the annual run rate at 4% (the RBA is forecasting 0.8%qoq/3.8%pa). A quarterly result stronger than that would likely see the RBA hike rates again on 6 August, in our opinion, while a result inline with consensus may or may not trigger another increase, with the detail around services prices a swing factor.

As our chart shows, based on the monthly data, core inflation in Australia has broken from the pack as it has re-accelerated over recent months. This suggests that the RBA’s policy settings may not be ‘restrictive’ enough to get the job done. In our view, signs of sticky domestic inflation pressures, coupled with softening US labour market conditions (the JOLTS report is released tonight (12am AEST)) and/or signals from the US Fed (Thurs morning AEST) that the door to its easing cycle has opened may help the AUD converge towards ‘fair value’. The average across our suite of models suggests the AUD might now be ~2 cents too low. Indeed, even if the RBA holds firm on 6 August, rate cuts still look a while away. Over time, we think the RBA’s “not quite as high for longer” strategy should see yield differentials progressively shift in an AUD supportive direction as the RBA lags its counterparts in terms of when it starts and how far it goes during the rate cutting phase.