• Cross-currents. Sell-off in US tech stocks resumes. US bond yields lower, while in FX the USD consolidated. AUD range bound over the past 24hrs.

• Q2 CPI. Australian inflation due today. Data will make or break the case for another RBA hike. Consensus forecasts are above the RBA’s assumptions.

• Global events. Offshore the China PMIs, EZ CPI, & US ECI are due. The BoJ also meets, while tomorrow morning the US Fed delivers its decision.

There were a few renewed wobbles in markets overnight ahead of a jam-packed 24hrs of economic releases and central bank decisions. The sell-off in US tech stocks resumed with underwhelming earnings results (this time from Microsoft) weighing on the NASDAQ (-1.3%) and S&P500 (-0.5%). That said, it wasn’t all one-way with the rotation out of tech into small cap US equities continuing. The NASQAD is now ~8% from its early-July peak. Over the same period the Russell2000 (the benchmark small cap index) has risen by more than 10%. Bond yields continue to lose altitude with rates down ~4bps across the US curve (the US 10yr yield is now at 4.14%, a low since mid-March). Signs the US labour market is losing steam continue to come through. In the latest US JOLTS report, the ‘hiring rate’ dropped to a cycle low (pointing to slower employment over coming months), and the ‘quits rate’ (a gauge of jobs churn and leading indicator for wages and inflation) is below levels prevailing before COVID.

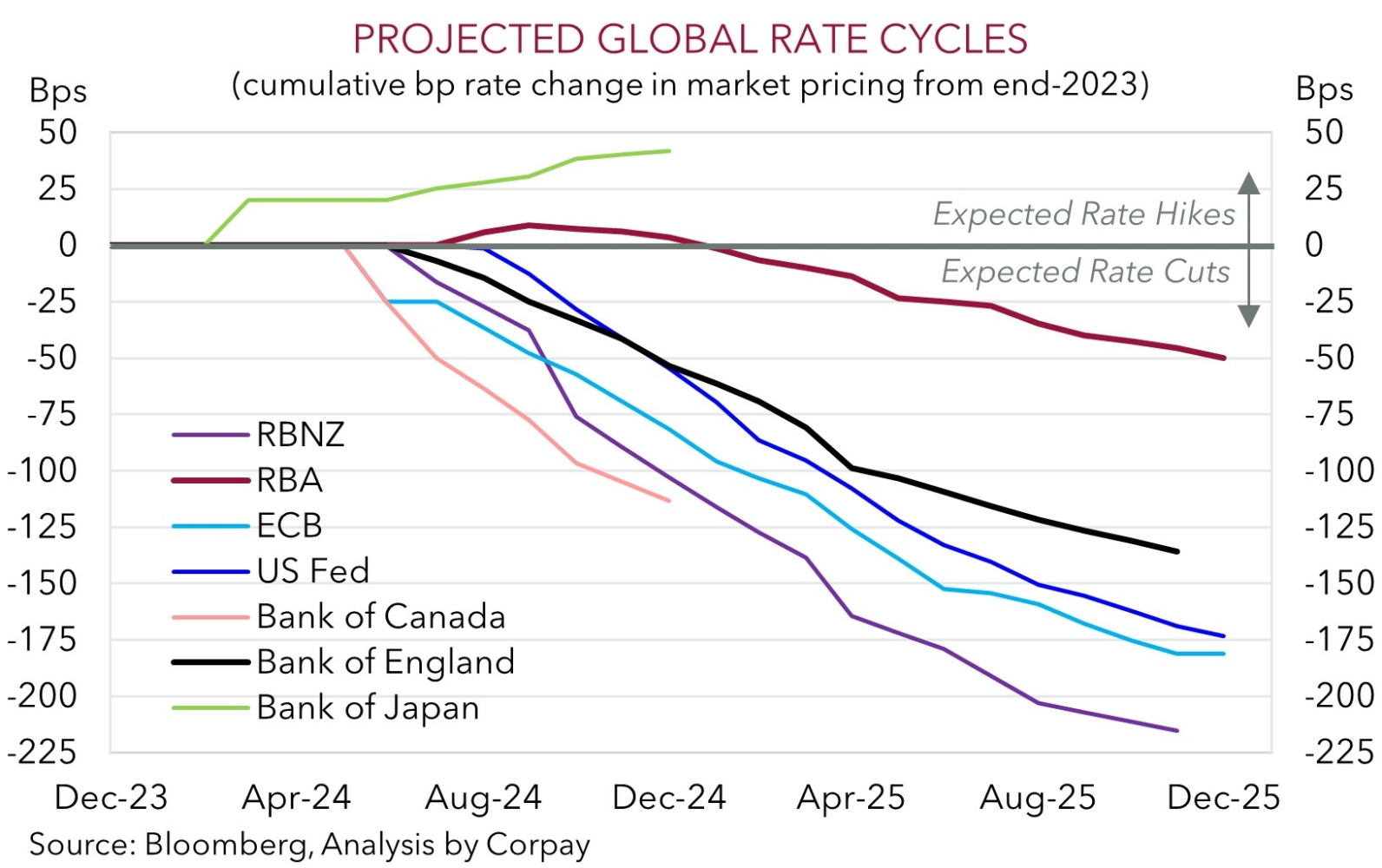

In FX, push-pull forces saw the USD index consolidate. EUR drifted a bit lower (now ~$1.0815) with a marginally better than predicted Q2 Eurozone GDP print (+0.3%qoq) generating limited impact. GBP (now ~$1.2835) eased with participants focusing in on Thursday nights Bank of England meeting where the first-rate cut will be a finely balanced decision (markets are assigning a ~55% chance the BoE delivers a 25bp cut). The AUD is a touch softer (now ~$0.6540) ahead of today’s Q2 Australian CPI data (11:30am AEST), while the beleaguered NZD outperformed, though at ~$0.59 it is still near the bottom of its year-to-date range. Elsewhere, the JPY’s revival extended with USD/JPY near ~152.70 (~5.7% from its early-July multi-decade top). Media reports out of Japan suggest the BoJ will discuss raising rates by 15bps to 0.25%, a slightly bigger move than what has been assumed (markets have been discounting a ~50% chance the BoJ delivers a smaller 10bp hike). We think the BoJ is behind the curve and further policy normalisation is a matter of when, not if.

There is plenty of economic news coming up which could spark more volatility. In addition to Q2 AU CPI (11:30am AEST), the China PMIs are due (11:30am AEST). The BoJ also meets today (no set time for announcement), while tonight Eurozone CPI (7pm AEST) and the US employment cost index (10:30pm AEST) are released. The US Fed decision (Thurs 4am AEST) and Chair Powell’s press conference (Thurs 4:30am AEST) are also on the schedule. As outlined over recent days, in our opinion another BoJ rate hike looks likely. If realised, this may generate JPY support and drag on the USD. This in turn may be compounded if the US ECI indicates wages pressures are moderating and/or the US Fed gives hints that its easing cycle might start “soon” based on the improvement in inflation and cooling jobs market.

AUD Corner

The AUD has traded in a tight ~0.5% range centered on ~$0.6545 over the past 24hrs as participants await the scheduled laundry list of economic events. On the crosses the AUD has generally slipped back. Outside of AUD/GBP (now ~0.5095, near the lower end of its 2024 range) and AUD/EUR (now ~0.6045) which consolidated, the AUD underperformed the NZD (-0.5% to ~1.1080), CNH (-0.5% to 4.7370), CAD (-0.2% to ~0.9055), and JPY (-1%). At ~99.90 AUD/JPY is near three-month lows, ~8.5% from its 11 July multi-decade peak. We continue to see more downside potential in AUD/JPY given it still looks too high compared to longer-dated interest rate expectations even after its recent retracement. Today the Bank of Japan meets (no set time). We think the macro environment and Japan’s inflation impulses could see the BoJ raise interest rates for the second time this cycle, with overnight reports indicating a larger than anticipated 15bp hike is being considered (see above).

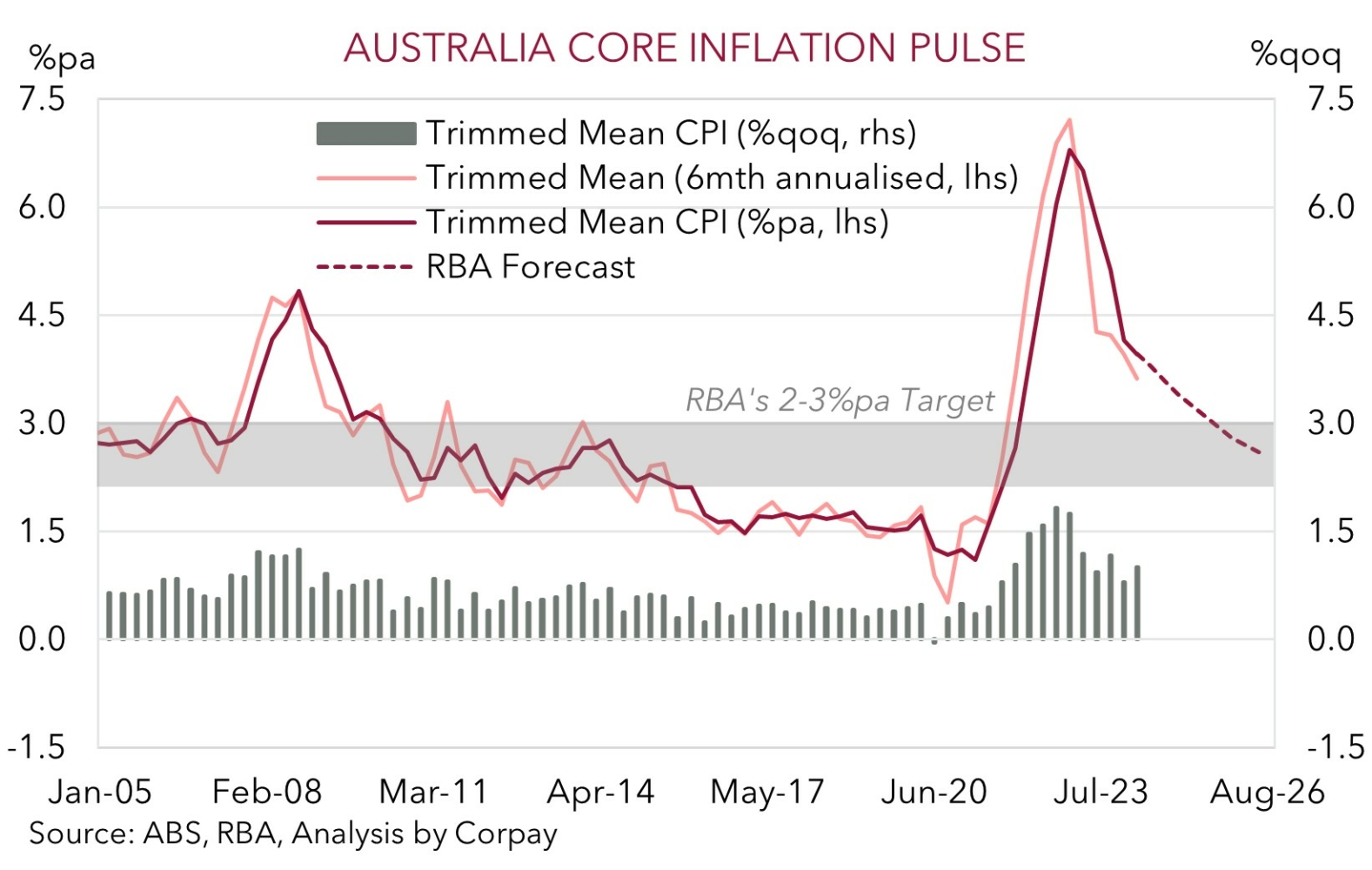

As discussed, there are several macro events on the radar that might generate volatility. Offshore, in addition to the BoJ, the China PMIs are released (11:30am AEST), while tonight Eurozone CPI (7pm AEST) and the US employment cost index (10:30pm AEST) are due ahead of tomorrow mornings US Fed decision (4am AEST) and Chair Powell’s press conference (4:30am AEST). Locally, all eyes will be on the Q2 CPI data (11:30am AEST). The quarterly CPI report is more comprehensive than the monthly series. Some items, especially around important services prices which the RBA has been lasering in on, are only measured once in the last month of the quarter. For most analysts Q2 inflation looks set to come in above the RBA’s forecasts. Core inflation (i.e. the trimmed mean) is projected to rise by 1% in Q2, keeping the annual run rate at 4% (the RBA is forecasting 0.8%qoq/3.8%pa). A quarterly result stronger than consensus would likely see the RBA hike rates again on 6 August, in our view, while a result in line with analysts forecasts may or may not trigger another increase (the detail around services prices will be a swing factor). That said, it could still see odds of a near-term RBA rate hike tick up. By contrast, a surprisingly softer result should see the mild RBA rate hike expectations pared back.

Overall, we believe signs of sticky domestic inflation pressures, combined with another rate rise by the BoJ/firmer JPY, cooling US wage pressures, and/or signals from the US Fed that its easing cycle is coming into view may help the AUD recoup lost ground. Throwing everything into the mix we remain of the view that the AUD’s recent pull-back isn’t fundamentally justified with the average across our suite of ‘fair value’ models suggesting the AUD might now be ~2 cents too low.