• Positive vibes. Cooling US labour market conditions & US Fed hints that a rate cut in September is possible boosted risk sentiment & weighed on the USD.

• AUD reversal. AUD recouped its post AU CPI losses. Core inflation still a long way from home. RBA hike risks extinguished but cuts still some time away.

• BoJ moves. Larger than anticipated BoJ rate rise. Policy divergence is reviving the JPY. USD/JPY back below 150. AUD/JPY ~10% below July peak.

A positive night for risk assets with signs of a cooling US labour market, moderating wage pressures, and signals from the US Fed that rate cuts are nearing supporting sentiment. Equities powered ahead with the S&P500 (+1.6%) and NASDAQ (+2.6%) jumping up. A surge in the megacap Nvidia (+13%) also helped the index. By contrast, US yields fell ~10-12bps across the curve with the 2-year rate (now ~4.26%) hitting its lowest point since early-February. Base metal prices increased (copper and iron ore rose +2.7%), while news from the Middle East that Iran may retaliate against Israel for the death of a Hamas leader saw oil prices spike even higher (WTI crude +5.2%).

Expectations that the US Fed’s easing cycle is coming into view were bolstered. ADP employment undershot expectations with only 122,000 jobs added (the smallest gain since January), and the employment cost index (a broad wages gauge) slowed (now 4.1%pa compared to a peak of 5.1%pa in 2022). This is a positive sign US inflation remains on the right path. Importantly, although the US Fed kept interest rates steady, the post meeting statement showed a heightened focus on the weakening employment part of its dual mandate. In the press conference Fed Chair Powell also noted that the upside risks to inflation have receded and outlined that a continuation of recent trends would be consistent with a rate cut being “on the table at the September meeting”. Markets are more than fully pricing in a Fed rate cut in September, with close to three moves being assumed over the final three meetings of the year.

The drop in US bond yields exerted downward pressure on the USD. This compounded developments on the other side of the ledger. At yesterday’s meeting the Bank of Japan delivered a larger than predicted 15bp rate hike, and flagged more policy normalisation was probable if the inflation outlook pans out as projected. The JPY’s revival extended. USD/JPY, which is the second most traded currency pair and influences broader USD trends, has dipped below ~150 for the first time since mid-March to now be ~7.4% from its early-July multi-decade peak. Elsewhere, EUR nudged up (now ~$1.0825), as has GBP (now ~$1.2855) ahead of tonight’s Bank of England meeting (9pm AEST) where we believe the first rate cut may be announced (markets are assigning a ~60% chance). USD/SGD lost ground (now ~1.3360), NZD appreciated (now ~$0.5952), and the AUD unwound its Australian CPI-inspired losses (now ~$0.6545).

In addition to the BoE announcement, the US ISM manufacturing survey (12am AEST) is due, with US non-farm payrolls out on Friday night. In our opinion, a softer ISM and/or weaker non-farm payrolls/higher unemployment (this is where we feel the risks reside because of slower activity and Hurricane Beryl disruptions) could continue to drag on US yields and the USD.

AUD Corner

The AUD has undergone a round trip over the past 24hrs with the knee-jerk dip following the slightly lower than projected Q2 Australian core CPI unwinding overnight as US yields tumbled and the USD declined (see above). At ~$0.6545 the AUD is inline with where it started the week. The swings over the past day reinforce the fact FX is a relative price (i.e. both sides of the story matter), but Australia is a ‘price taker’ with offshore developments (particularly in the US) typically having a greater influence than domestic trends.

On the crosses the AUD has weakened against the NZD (now ~1.0995), CAD (now ~0.9033) and CNH (now ~4.7285) to differing degrees, with the biggest move coming through against the JPY. At ~98 AUD/JPY is where it was trading in March with the pair over 10% from its 11 July multi-decade highs. The larger than anticipated BoJ rate hike, and prospect of more to come should, in our view, continue to revive the undervalued JPY. Even after its substantial retracement we see more downside in AUD/JPY given it still looks too high compared to longer-dated interest rate differentials.

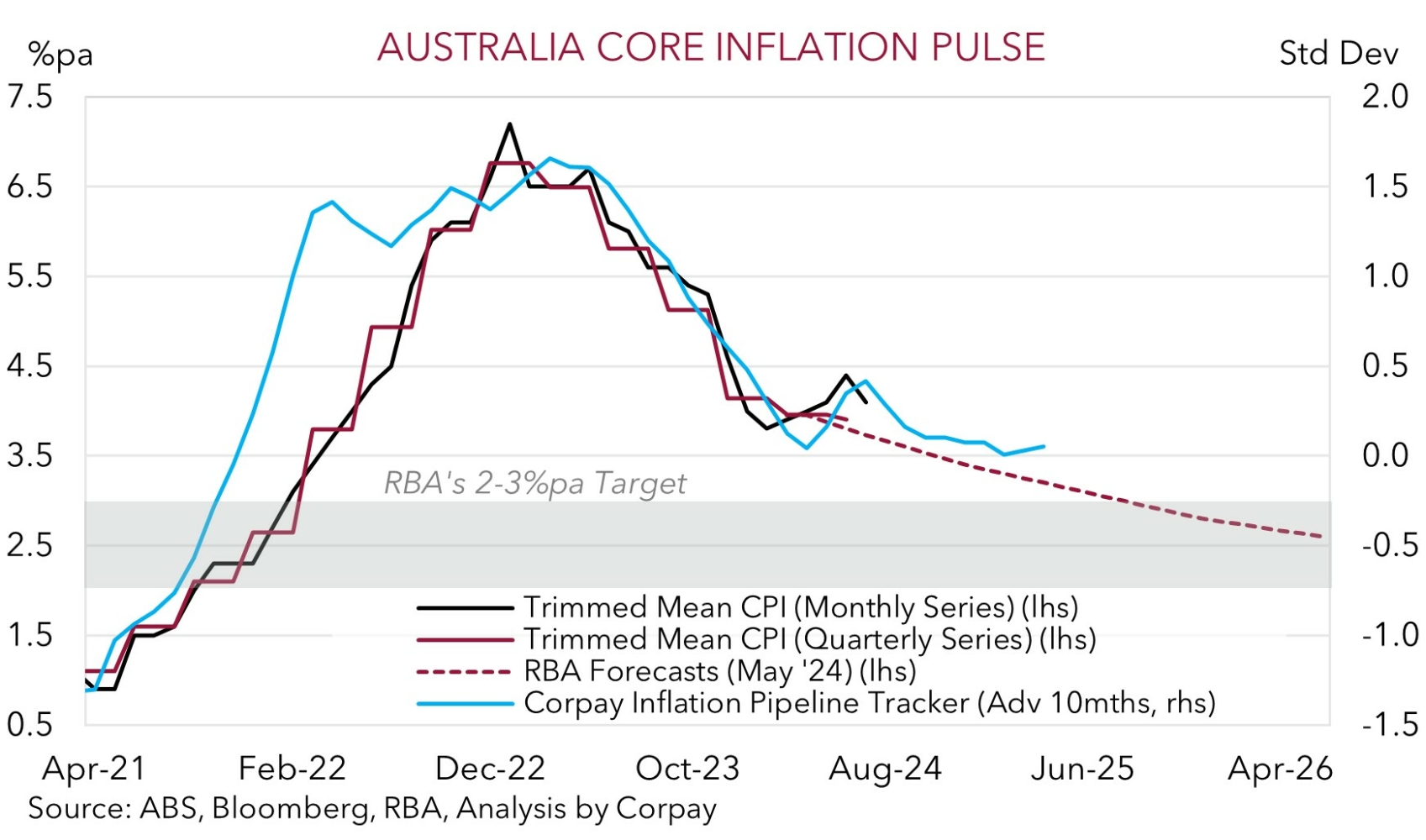

Locally, attention was on yesterday’s Q2 CPI report. While headline inflation nudged up inline with consensus to 3.8%pa, the important core measure (i.e. the trimmed mean) was a touch weaker than built up expectations (3.9%pa). We think this should see the RBA hold fire at its 6 August meeting. That said, a closer look at the underlying impulses continues to suggest RBA rate cuts are probably some time away, in our opinion. Headline inflation will be artificially depressed over the next few quarters by government cost of living measures such as electricity rebates, however the last leg of the downtrend in underlying inflation might take an extended period to play out given labour market conditions, the stage 3 tax cuts, and support to aggregate demand from the larger population. That is the signal coming from our Inflation Pipeline Tracker. For more see Market Musings: CPI washes away RBA rate hike prospects

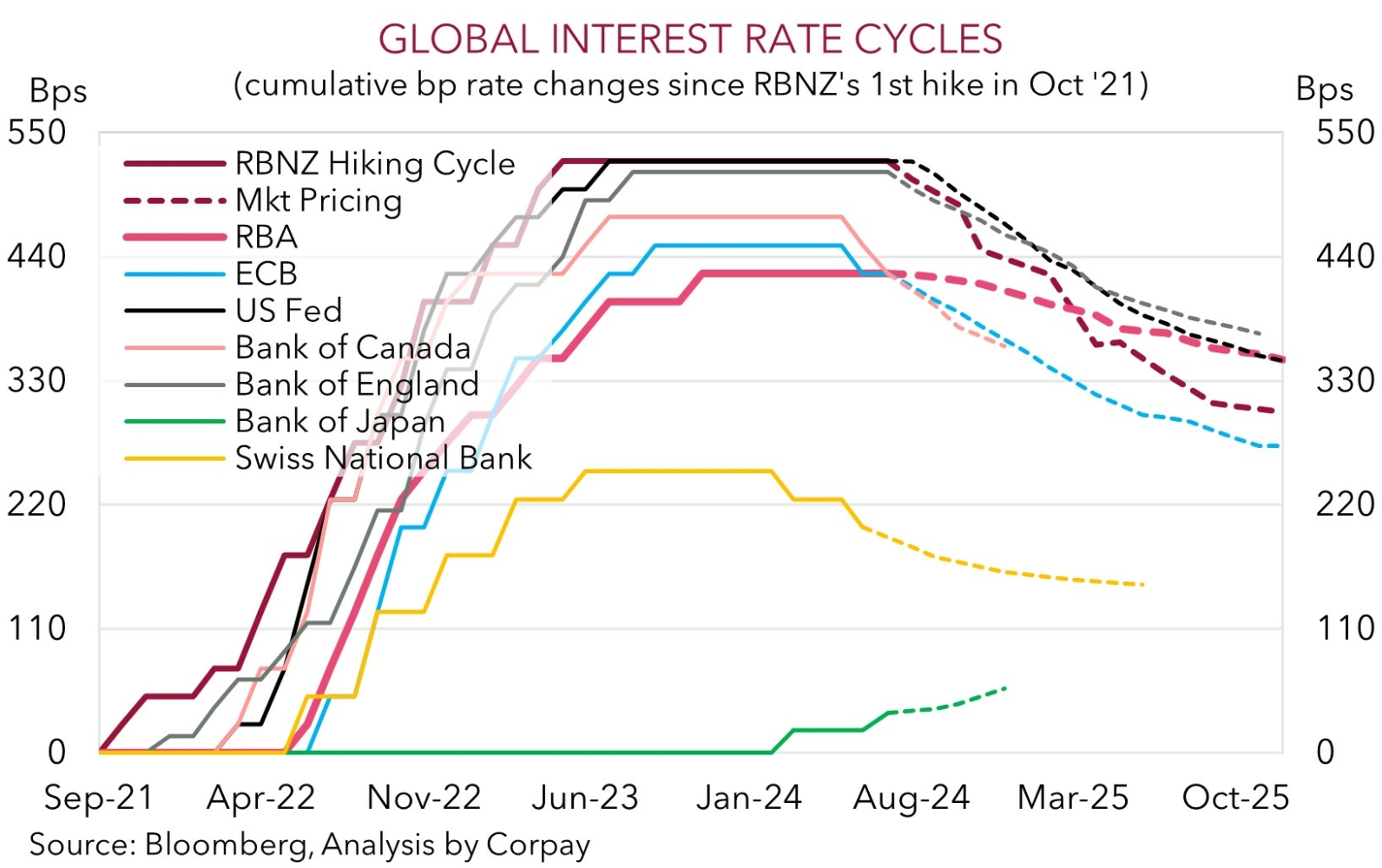

Hence, although RBA rate hike prospects have faded, we feel our long-held thesis that the RBA is set to lag its global peers in terms of when it starts and how far it goes during the next easing cycle remains intact. We think the first RBA cut is a story for Q1 2025, at the earliest. This is on par with updated market pricing. As such, over time, relative yield spreads should progressively turn more in Australia’s favour as the RBA holds firm and other central banks like the ECB, Bank of England, and US Fed lower rates further or start the process. We believe this should help the beleaguered AUD, which has been weighed down recently by wobbles in risk sentiment to the point it is ~1.5-2 cents under our modelled ‘fair value’ estimate, rebound.