• Risk off. Weaker US data dampened sentiment. Equities & bond yields declined. USD ticked up, with cyclical assets like the AUD under pressure.

• BoE cut. BoE delivered its first cut of the cycle. Further easing likely. US rate cut expectations have ramped up. More than 4 moves priced in by January.

• US jobs. US jobs report released tonight. A softer print could drag US yields even lower. But would this generate a negative or positive market spillover?

The positive tone in markets reversed overnight with concerns about the economic environment in the US dampening sentiment. US and European equities declined with falls of ~1-2.3% recorded across the major indices. The tech-sector underperformed with a few more megacap stocks delivering underwhelming earnings updates. Base metals and energy prices lost ground with copper (-2.6%) unwinding yesterday’s bounce and WTI crude ~1.3% lower. By contrast, the flight to safety and uptick in rate cut expectations pulled down bond yields. The benchmark US 10yr rate shed ~5bps to be at 3.98% (a low since early February) with the 2yr rate tumbling another ~11bps to be at year-to-date lows (now ~4.15%).

In FX, the USD index edged a little higher with it currently trading close to where it started the week. EUR has dipped back under ~$1.08, while the JPY’s revival extended with USD/JPY approaching ~149 for the first time in a few months. The negative market vibes exerted downward pressure on the AUD (now ~$0.6495) which is back near levels touched in the wake of this week’s AU CPI data. The NZD (now ~$0.5945) also softened. GBP underperformed (now ~$1.2740) with the Bank of England coming through with its first rate cut of the cycle. Ahead of the event markets were assigning a ~60% chance of it occurring. The 25bp reduction, which was a year on from the last hike, puts the BoE rate at 5%. It was a split decision with the committee voting 5-4 in favour. More easing is anticipated given underlying UK economic trends, however the cautious rhetoric from Governor Bailey suggests a rapid series of cuts probably shouldn’t be anticipated without a further deterioration in conditions. Markets are fully discounting the next step to be taken at the November BoE meeting.

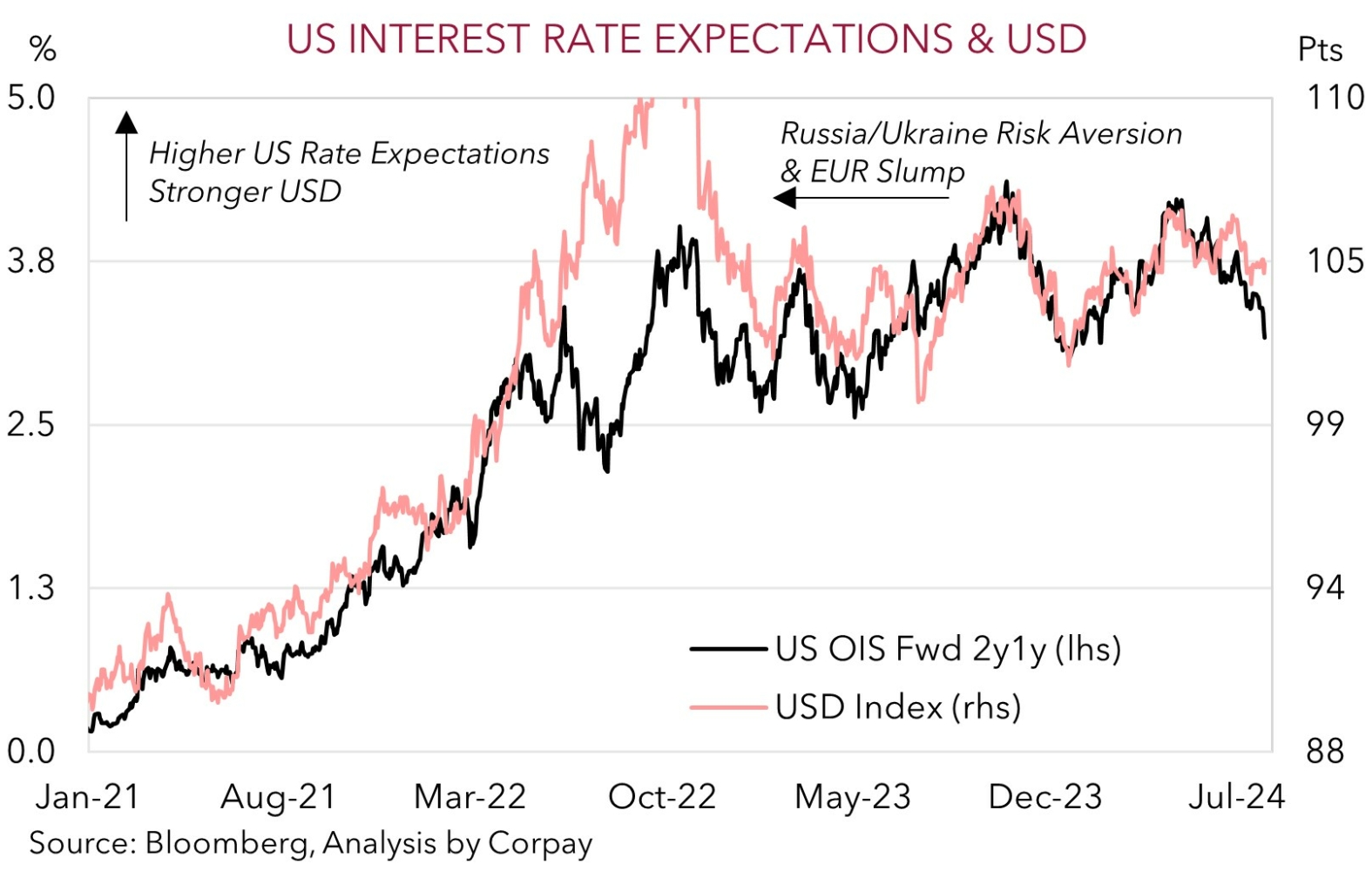

Compounding the ‘surprise’ BoE move was a run of weaker US data. Initial jobless claims (the weekly gauge that tracks the number of people filing for unemployment benefits) rose, and the ISM manufacturing survey dropped further into ‘contractionary’ territory. At ~46.8 the ISM is at its lowest point since last November, with markets rattled by the uncomfortable mix of increased prices paid and slump in employment intentions. Following on from Chair Powell’s guidance yesterday, Fed easing expectations have risen with a close to 30% chance a 50bp cut is delivered in September baked in and more than 4 reductions discounted by January. While the weakness on the manufacturing side should be monitored, we think the scale of the market wobbles may be overdone. Manufacturing only accounts for ~10% of US output and ~8% of the workforce. The US is heavily services orientated.

Tonight, focus will be on the monthly US jobs report (10:30pm AEST). Because of slower activity and Hurricane Beryl disruptions we believe risks reside with weaker non-farm payrolls/higher unemployment (mkt +175,000/4.1%). If realised, this should further reinforce Fed rate cut bets, though we feel we are reaching the point where lower yields drag on the USD.

AUD Corner

The negative tone in global markets overnight, stemming from the batch of weaker US data (particularly the ISM manufacturing gauge) has exerted downward pressure on cyclical assets and the AUD. At ~$0.6495 the AUD has unwound yesterday’s rebound to be back near levels traded following the softer AU CPI data earlier this week. The AUD also weakened on most crosses. The AUD shed ~0.2-0.6% against the EUR, NZD, CAD, and CNH over the past 24hrs. The downturn in AUD/JPY has continued (-1%) with the pair hitting its lowest level since mid-March (it is now more than 11% below its 11 July multi-decade peak). AUD/GBP has been an exception following the BoE’s 25bp rate cut. At ~0.51 AUD/GBP has nudged up a bit, though we think relative interest rate expectations point to a further rebound over the medium-term.

Market attention will be on tonight’s US jobs data (10:30pm AEST). As discussed above, we think the balance of risks are tilted to a weaker report given slower US growth momentum and potential disruptions caused by Hurricane Beryl. We believe a soft US jobs report would bolster Fed rate cut bets, which in turn could drag US bond yields lower. Although we also feel we are nearing the inflection point where lower US interest rate expectations are a negative for the USD. The pulse of the US economy is slowing but it remains far from the disruptive recessionary levels that typically generate safe-haven USD demand.

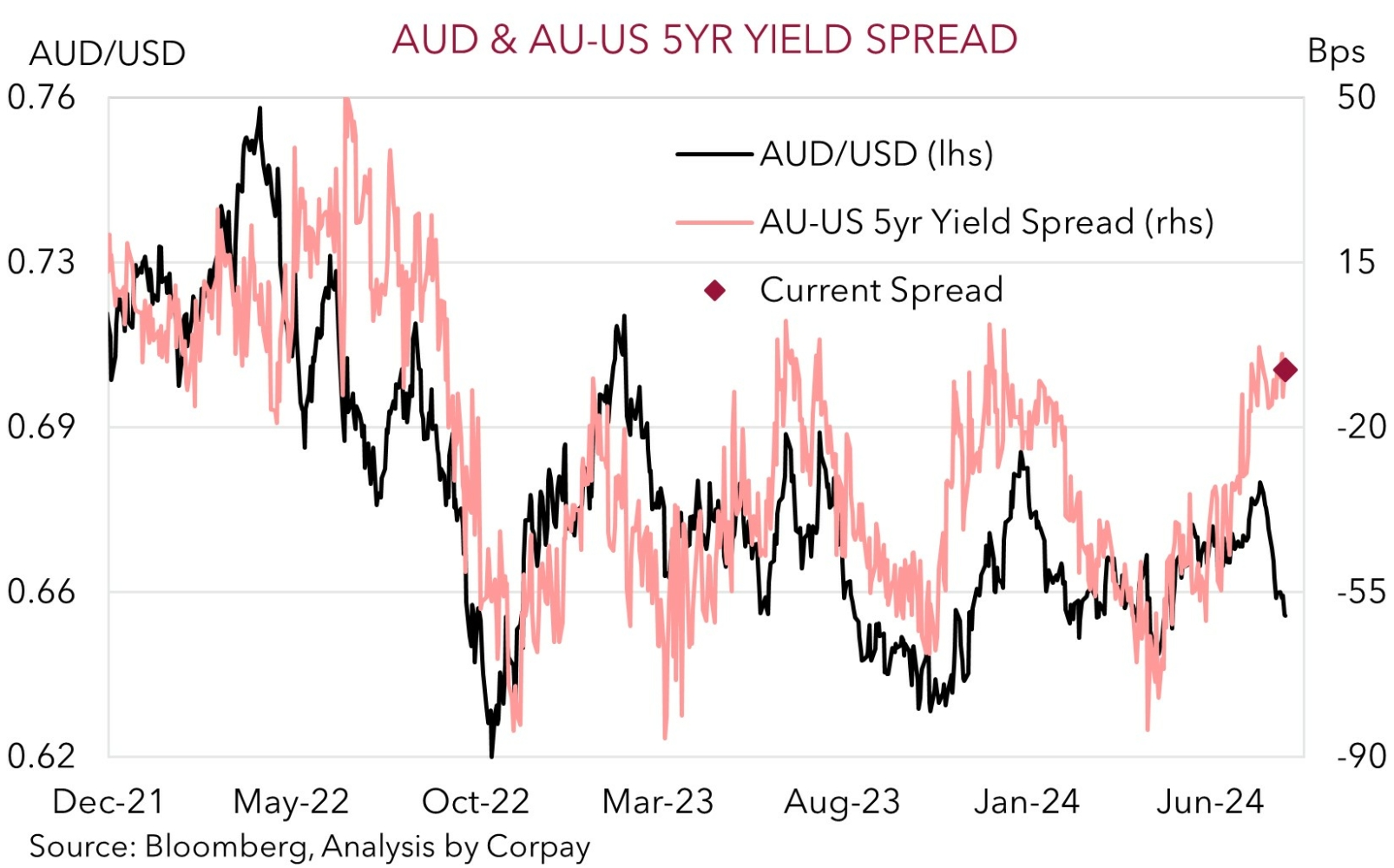

As the dust settles and sentiment stabilizes we expect the AUD to recover ground. In our view, fundamental drivers such as relative bond yield differentials suggest the AUD has been unduly punished recently and should be tracking higher than where it is. The average across our suite of ‘fair value’ models indicates the AUD may now be ~2 cents too low. Indeed, history also indicates that participants shouldn’t be overly bearish the AUD down around current levels. Statistically the AUD is back in a region we deem ‘rarefied air’. Australia is running a broad basic balance of payments surplus with the terms of trade also above average. Since these positive AUD flow and valuation dynamics swung into gear in 2015 the AUD has only traded sub $0.65 in ~6% of trading days. And the bulk of this small pool occurred during acute bouts of market stress such as the start of COVID or when fears of a deep Eurozone recession because of the Ukraine conflict pushed EUR below parity.