• Equity slump. Large falls in global equities. Japan’s Nikkei plunged ~12% yesterday. Fears of a ‘hard landing’ have rattled nerves. Volatility spikes.

• Driving factors. Soft US jobs report, lofty valuations, & an unwind of built-up Japan/JPY trades have combined. But credit spreads haven’t moved much.

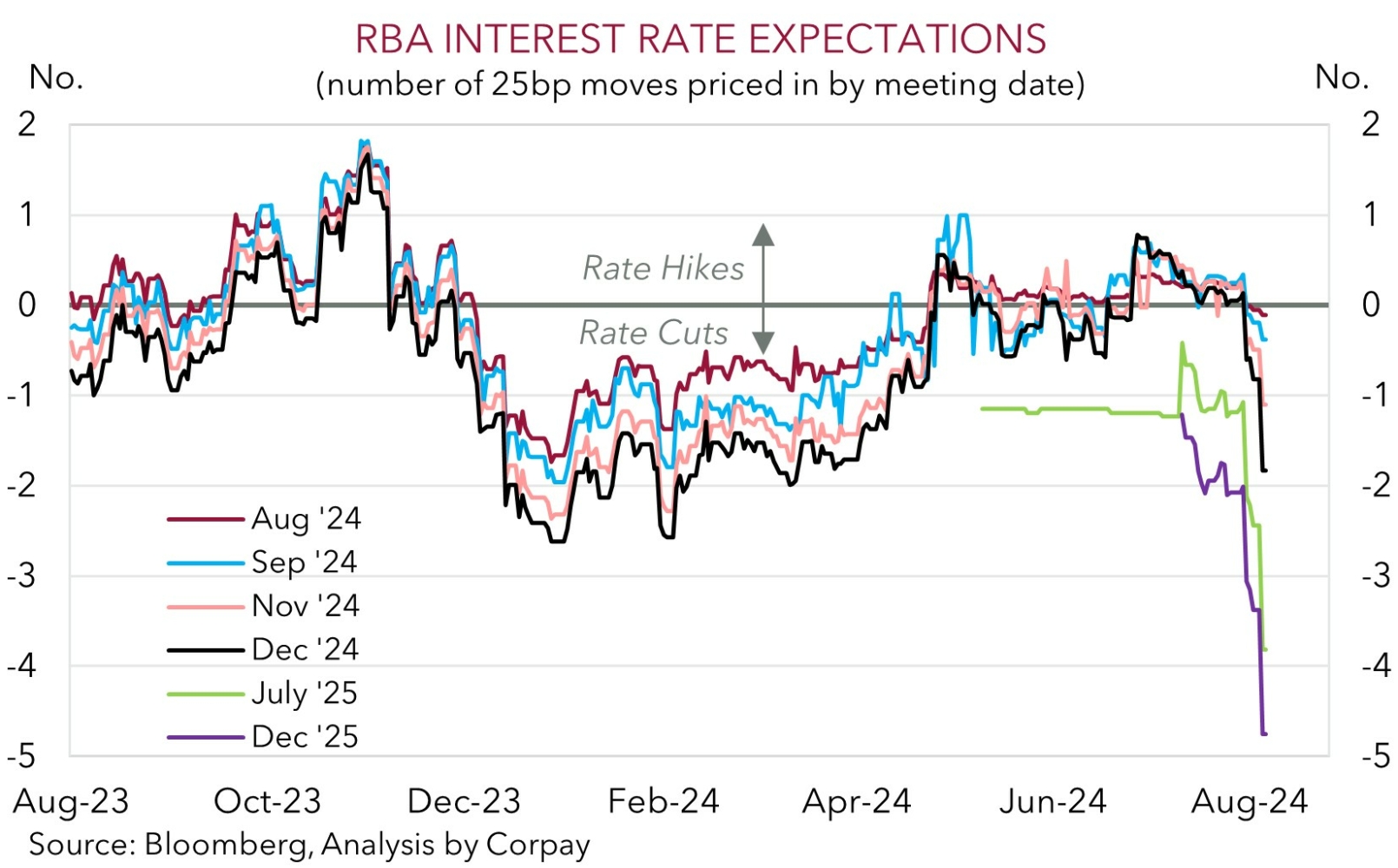

• RBA today. AUD near ~$0.65. Negative sentiment has seen markets factor in rapid-fire RBA rate cuts. We think things may have moved too far, too fast.

Crash, bang, wallop. Markets have been in a tailspin over the past few sessions with larger falls in equities, a spike in volatility, and substantial repricing in interest rate expectations coming through. Last week’s stock market slide ratcheted up over the past 24hrs. Asian equities plunged yesterday with Japan’s Nikkei shedding ~12.4% (its biggest one-day drop since the 1987 crash). Overnight moves in Europe and the US weren’t as pronounced, although even after a modest rebound the S&P500 still ended the session ~3% lower. The tech-focused US NASDAQ underperformed with the index now ~13% from its 11 July peak.

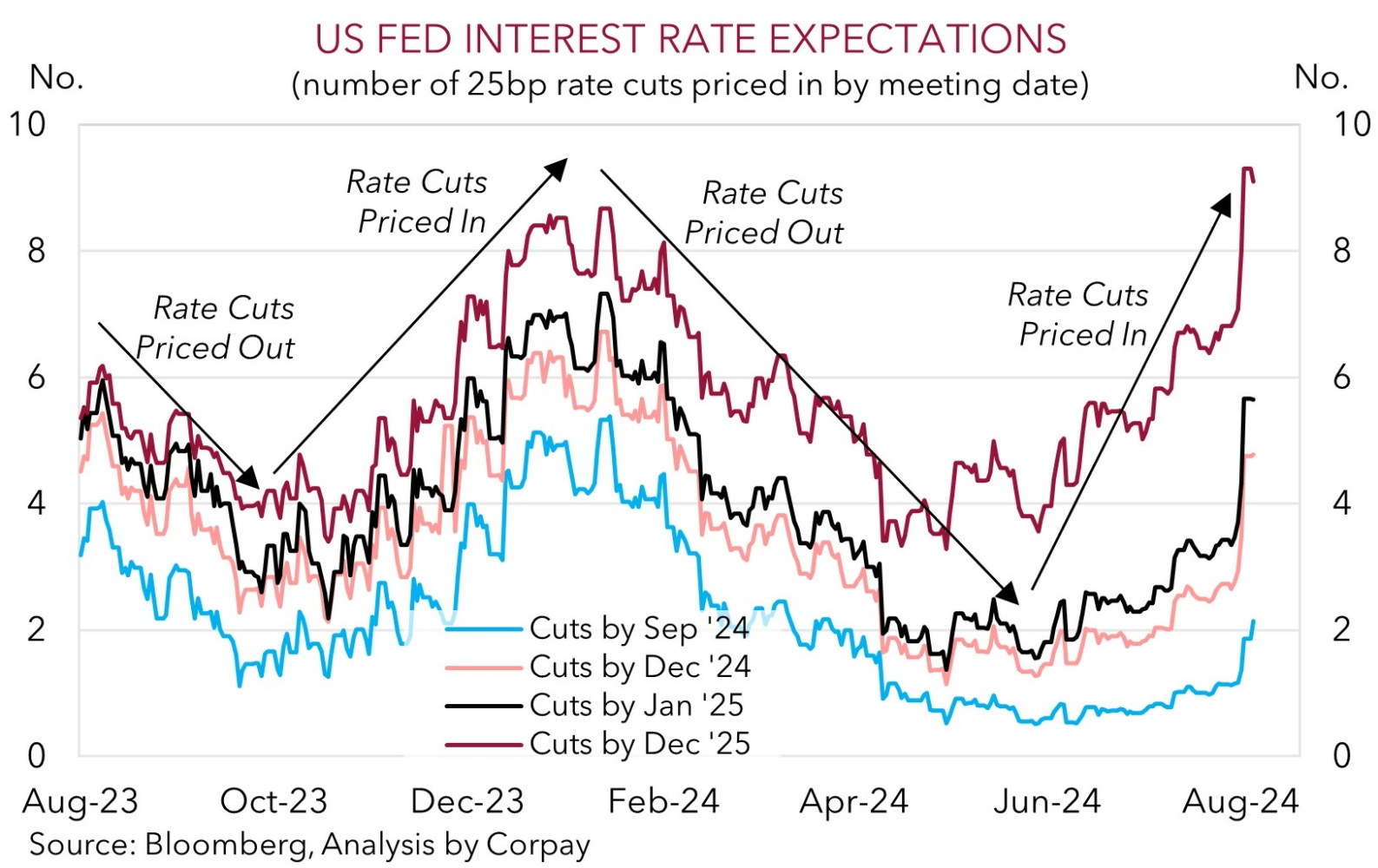

US bonds consolidated, although this follows a rather large pullback last week. At ~3.79% the benchmark US 10yr yield is towards the bottom of its one-year range (~95bps from its April highs). The US 2yr yield has tumbled to 3.92% with markets now factoring in rapid fire policy easing by the US Fed over coming meetings. As our chart shows, markets are discounting ~135bps worth of Fed rate cuts by January, with a ~50bp move penciled in as the first move in September. In FX, lower US yields have exerted downward pressure on the USD Index with EUR edging up to ~$1.0950 (the top of its multi-month range) and USD/JPY extending its retracement. At ~144.10 USD/JPY is at a seven-month low, ~11% from where it was a few weeks back. That said, it hasn’t been all one-way for the USD with high-beta, growth linked currencies like the NZD and AUD held down by the ‘risk off’ tone in markets. Both dropped intra-session yesterday before settling at ~$0.5935 and ~$0.6495 respectively, marginally below where they ended last week.

Concerns the US (and in turn global) economy is experiencing a ‘hard landing’ have risen following last Friday’s lackluster jobs report. Non-farm payrolls increased 114,000 in July and the US unemployment rate rose to 4.3% (a high since October 2021). In the process this triggered the ‘Sahm rule’ suggesting a US recession may already be underway. In our opinion, equity markets, which were seemingly ‘priced for perfection’ given the positive run over the past year and lofty valuations, have hit an air-pocket. As we have pointed out repeatedly the August-October period is often the most volatile and tricky to navigate time of the year. That said, while more volatility looks probable, fears of a disruptive US economic downturn that prompts an ‘emergence style’ response from central banks might be misplaced. A closer look suggests weather disruptions from Hurricane Beryl (something we were flagging) could have played a role in depressing the US jobs data. Indeed, the overnight released US services ISM rebounded into ‘expansionary’ territory. Moreover, despite the equity and bond market swings, credit spreads (which are an important cog in the US policy transmission mechanism as these markets are a source of corporate funding) haven’t moved much. Another sign the underlying fundamentals haven’t dramatically deteriorated.

AUD Corner

The negative vibes across markets, with recession fears one of the factors generating a substantial repricing in global interest rate expectations and pressuring equities (see above), has held the AUD back in the face of a softer USD Index. Indeed, the burst of risk aversion during yesterday’s Asian trade saw the currency spike lower before things stabilised, with the AUD (now ~$0.6495) on net little changed from where it ended last week. That said, the underlying dynamics have seen the AUD lose ground on some of the crosses. Pairs like AUD/EUR (now ~0.5930), AUD/CAD (now ~0.8980) and AUD/CNH (now ~4.6340) have fallen ~0.7% over the past 24hrs, with an even larger decline coming through in AUD/JPY (-1.9%). At ~93.65 AUD/JPY is at levels last traded a year ago and ~14.3% from its 11 July multi-decade peak.

In addition to the financial market gyrations the AUD will also have to contend with the RBA decision (2:30pm AEST) and Governor Bullock’s press conference (3:30pm AEST). The Q2 CPI put to bed the chances of another RBA rate hike at today’s meeting. But as our chart shows, deteriorating risk sentiment has seen markets quickly factor in a rapid rate cutting cycle by the RBA (and other central banks). As discussed above, we believe jittery markets may be overzealous in their repricing, particularly when it comes to the RBA. Various major economies are losing momentum on the back of tighter monetary conditions, but things don’t look as though we are on the brink of a major credit event and/or disruptive downturn. We expect the RBA to keep rates on hold today and think that while the market volatility may get a mention, the fundamentals of a still solid Australian labour market, high level of activity, and lingering inflation risks might get more airplay. Indeed, we wouldn’t be surprised if the RBA notes that a rate hike was discussed, and that rate cuts still look some time away. A paring back of newly built-up RBA rate cut pricing could give the AUD some support, in our opinion. AUD/NZD in particularly could rebound should the RBA play a straight bat and the Q2 NZ jobs data (Weds 8:45am AEST) shows another jump in unemployment, solidifying bets the RBNZ’s easing phase is approaching.

More broadly, as the dust settles and sentiment stabilizes we expect the AUD to bounce back. In our judgement, various fundamental drivers suggest the AUD should be tracking higher than where it is. Indeed, history also indicates that participants shouldn’t be overly bearish the AUD down around current levels. Australia is running a broad basic balance of payments surplus with the terms of trade also above average. Since these positive AUD flow and valuation dynamics swung into gear in 2015 the AUD has only traded sub $0.65 in ~6% of trading days.