• Market rebound. Partial reversal in risk sentiment. US equities & bond yields rose overnight. USD index ticked up, while the AUD outperformed.

• RBA hold. No change in rates from the RBA. But another hike was considered. Rate cuts still some time away. Policy divergence should be AUD supportive.

A sense of calm has returned to markets with a partial reversal of the burst of risk aversion coming through over the past 24hrs. The Japanese Nikkei rebounded sharply with the index up over ~10% yesterday. US equities rose overnight, albeit more modestly (S&P500 +1%), with the VIX volatility index dropping back. Elsewhere, US bond yields also reversed course with the benchmark 10yr rate rising ~10bps (now ~3.89%) and the 2yr rate up ~5bps (now 3.98%). Markets have pared back some of the extreme ‘emergency style’ easing expectations with a 50bp rate cut by the US Fed no longer factored in in September. That said, over 125bps worth of US Fed rate cuts are still being discounted by January. In FX, the USD index edged a little higher, with EUR (now ~$1.0930), GBP (now ~$1.2695), and the JPY (now ~144.40) losing ground. By contrast, USD/SGD consolidated (now ~1.3255) and cyclical growth linked currencies like the AUD outperformed (now ~$0.6520). ‘Hawkish’ vibes from the RBA at yesterday’s meeting also provided a helping hand (see below).

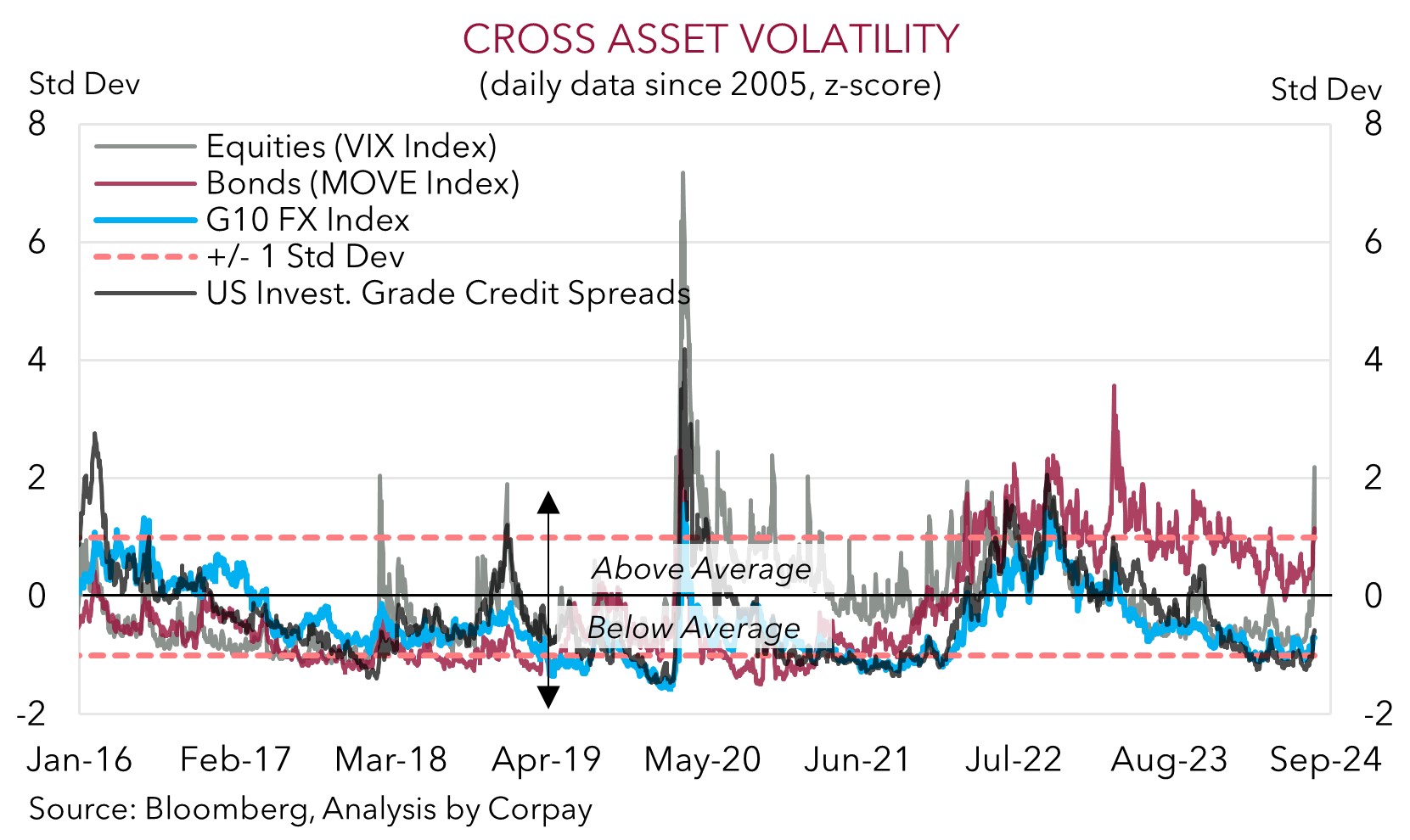

Economic news flow has been relatively light, but over the past couple of sessions what has been released and articulated by central bankers has helped sooth fears a disruptive downturn is looming. Following on from the positive surprise in the US services ISM survey, German factory orders broke a sequence of five straight falls by increasing in June. US Fed policymakers Daly and Goolsbee also downplayed the need for extraordinary measures such as an intra-meeting rate cut, with Daly noting that the details of the recent US jobs report indicated “we are slowing but not falling off a cliff”. Similarly, RBA Governor Bullock stated that the volatility is something to keep an eye on but it feels like an “overreaction”. We share these views. As discussed yesterday (and as shown in our chart below) while there was a spike in equity market volatility, credit spreads (which are a more important cog in the US policy transmission mechanism as these markets are a source of corporate funding) haven’t moved a great deal. This is a sign the underlying fundamentals haven’t deteriorated dramatically.

Looking ahead, further market swings are likely. Markets seldom move in straight lines. As pointed out before August-October is often the trickiest time of the year to navigate. Turning points in the economic and monetary policy cycle, and the upcoming US Presidential Election are added factors to throw into the mix this year. However, on net, we believe calls that something more sinister than a vanilla policy induced slowdown is unfolding are misplaced. As the dust settles we think a refocus on relative fundamentals and outlook for US Fed policy easing should see the USD weaken.

AUD Corner

The AUD has clawed back some ground with the improvement in risk sentiment generating a bit of renewed support for cyclical assets. At ~$0.6520 the AUD is a touch above where it ended last week, with the AUD also bouncing back on the crosses. Beaten down pairs like AUD/EUR (now ~0.5965), AUD/JPY (now ~94.15), AUD/GBP (now ~0.5135) and AUD/CNH (now ~4.6690) have risen by ~0.6-1% over the past 24hrs. By contrast, AUD/NZD (now ~1.09) has slipped back a little this morning after the Q2 NZ jobs report came in slightly better than consensus forecasts. That said, the data continues to show that slack is increasing in the NZ labour market (unemployment rose to 4.6%, ~1%pt above where it was a year ago), suggesting that it is a matter of time before the RBNZ starts to lower interest rates. We think there is still some chance the RBNZ kicks things off at next week’s meeting.

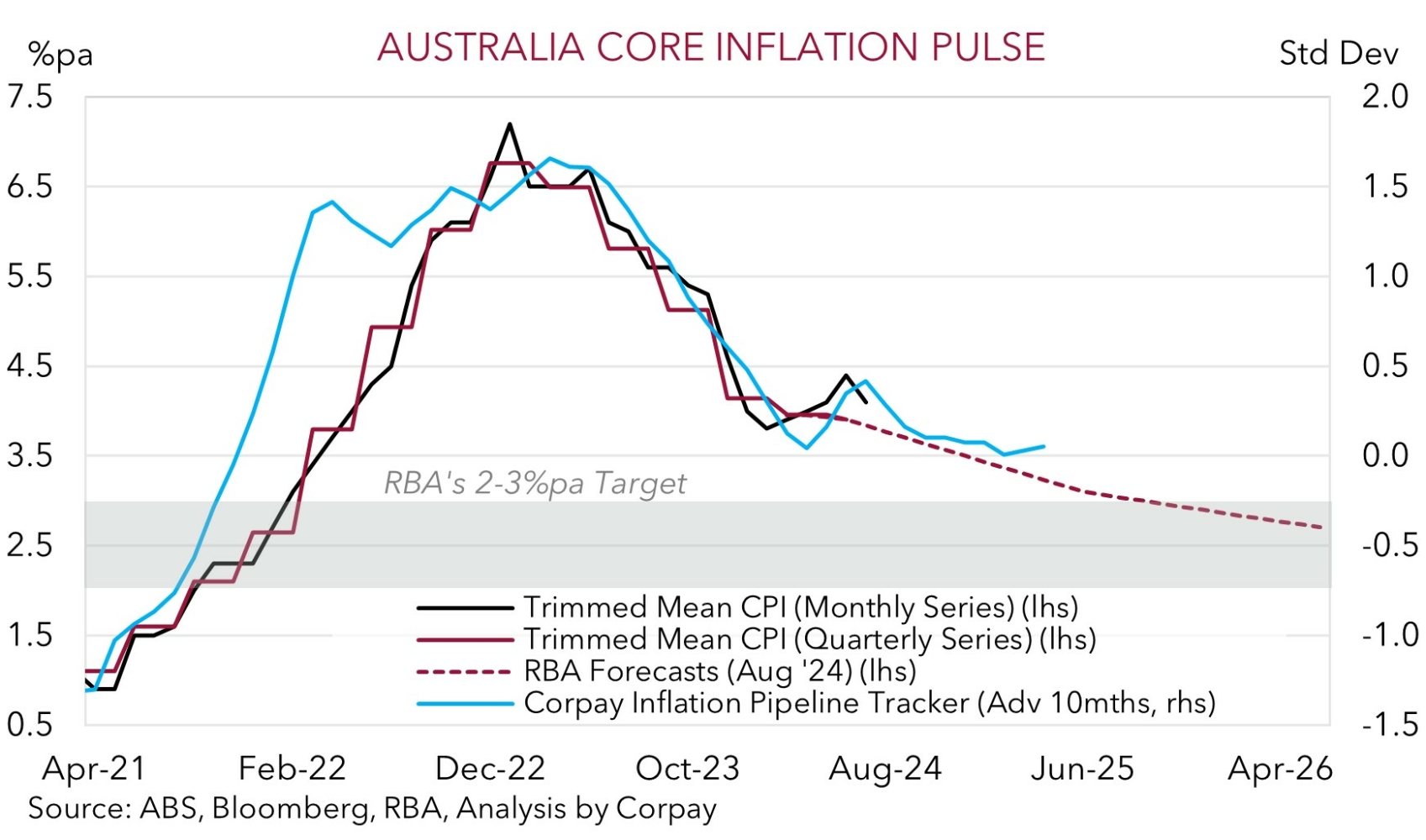

Also providing AUD support was the ‘hawkish’ tilt by the RBA at yesterday’s meeting. Interest rates were kept steady at 4.35%, where they have been since last November, with inflation still front of mind. In its updated projections, while the RBA lowered its near-term headline CPI forecasts to take into account of the relief measures such as energy rebates put in place by Federal and State governments, core inflation is only seen returning to where it needs to be in late-2026. a reflection of still tight labour market conditions (unemployment is below full-employment) and elevated levels of activity across the economy (particularly services-providing sectors). Based on these trends Governor Bullock outlined that the Board “did consider” another rate rise. While another rate hike doesn’t look probable, in our view, RBA rate cuts still look some time away. Indeed, in a shot across the bow of markets Governor Bullock proclaimed a near-term cut isn’t on the agenda with pricing for a December reduction “not aligned” with the RBA’s thinking. For more see Market Wire: RBA: Hold your horses.

These comments and the underlying inflation pulse support our long-held thesis that the RBA is set to lag its global counterparts in terms of when it starts and how far it goes during the next easing cycle. As risk sentiment stabilises we expect the AUD to bounce back, in line with the signal from various indicators like real/nominal yield spreads. We believe there are also an uneven distribution of risks for the AUD down near current levels. As discussed before, Australia is running a broad basic balance of payments surplus with the terms of trade also above average. On our figuring, since these positive AUD flow and valuation dynamics swung into gear in 2015 the AUD has only traded sub $0.65 in ~6% of trading days.