• JPY trends. The weaker JPY boosted sentiment yesterday. Asian/European equities rose, as did long-end bond yields. AUD hovering near ~$0.6520.

• NZD bounce. Better than feared NZ jobs report supported the NZD. But ‘slack’ is still increasing. A matter of time before the RBNZ starts to cut rates.

The market nervousness from earlier this week has continued to subside. Asian and European equities rose 1-2%, with Japan’s Nikkei effectively back to where it was ahead of Monday’s dramatic sell-off. That said, it hasn’t been all one-way with US stock markets fading as the overnight session rolled on (S&P500 -0.8%). Bond yields rose with the benchmark US 10yr rate ~5bps higher. At ~3.94% the US 10yr is where it was prior to last Friday’s lackluster US jobs report. Elsewhere, energy prices increased with WTI crude oil up ~3% (now US$75.50/brl). Improved risk appetite has been compounded by lingering Middle East risks and comments by former President Trump that he will look to immediately replenish the US Strategic Petroleum Reserve (which is at its lowest level since the early 1980s) if he wins the election.

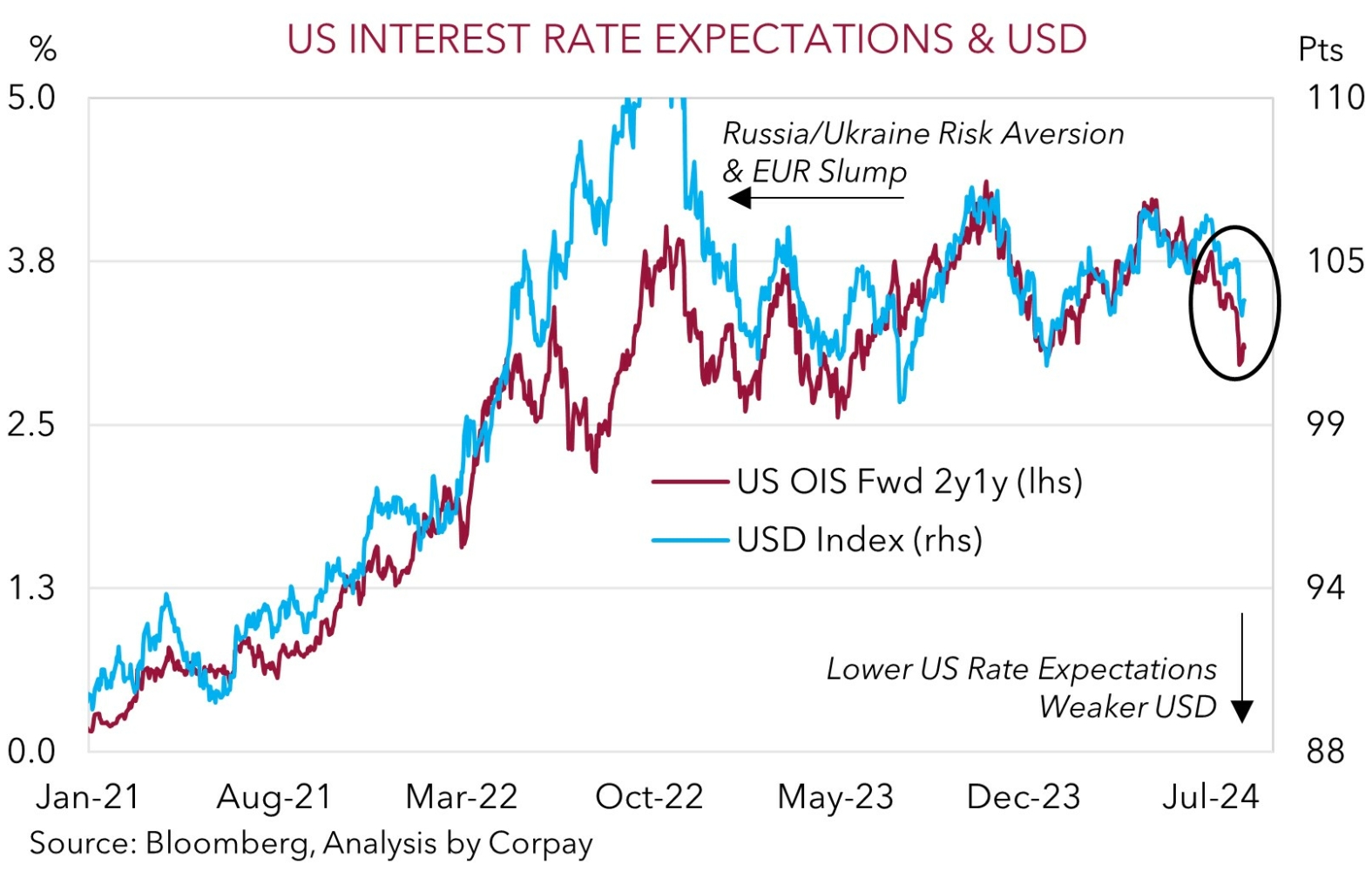

In FX, the USD index has ticked, though this reflects a softer JPY, which itself was a driver underpinning yesterday’s better market mood. USD/JPY has edged up towards ~146.70, ~3.4% above Monday’s low. Comments by Bank of Japan Deputy Governor Uchida that the bank “will not” raise rates when “markets are unstable” has seen traders pare back rate hike bets. Given the substantial revival in the JPY over recent weeks looks to have been a trigger behind the broader market turbulence as JPY-funded cross-asset carry trades were unwound, the BoJ comments have acted like a safety net. However, this might be creating a ‘rinse and repeat’ circular argument. Rhetoric that calms markets down may put further BoJ policy normalisation back on the table. This in turn could trigger renewed JPY strength that feeds more volatility which subsequently requires policymakers to settle things down once again. Indeed, ‘hawkish’ comments in today’s BoJ meeting minutes (9:50am AEST) could see the JPY reverse course, particularly as the decline in US interest rate expectations is also suggesting the USD should be lower than where it is (see chart below).

EUR (now ~$1.0920) and GBP (now ~$1.2695) consolidated, USD/SGD is marginally higher (now ~1.3280), AUD is treading water around ~$0.6520, and the NZD (now ~$0.5995) has held onto yesterday’s post NZ labour data gains. While the Q2 NZ jobs report wasn’t as bad as feared, it still confirmed ‘slack’ is increasing as the harsher economic climate stemming from the RBNZ’s aggressive policy tightening continues to manifest. NZ unemployment has risen to ~4.6%, ~1%pt above where it was a year ago, with the broader signals pointing to a further lift over coming months. In our view this should see the RBNZ shift course and begin to lower interest rates over the period ahead. We still see a possibility the RBNZ kicks things off as soon as next week.

AUD Corner

The AUD has consolidated near ~$0.6520 over the past 24hrs, broadly inline with where it ended last week, as underlying risk sentiment has continued to recover. The backdrop has helped the AUD nudge up against the EUR (now ~0.5970) and CNH (now ~4.6760), with renewed falls in the JPY stemming from yesterday’s BoJ comments about not raising rates when markets are unstable pushing AUD/JPY ~1.6% higher (now ~95.65). By contrast, the better than feared NZ jobs data has seen AUD/NZD slip below ~1.09. We don’t expect this trend to extend much further or be sustained given the relatively weaker NZ economic environment and with the RBNZ looking set to cut rates well ahead of the RBA. Indeed, we believe there is still a chance the RBNZ kicks things off next week.

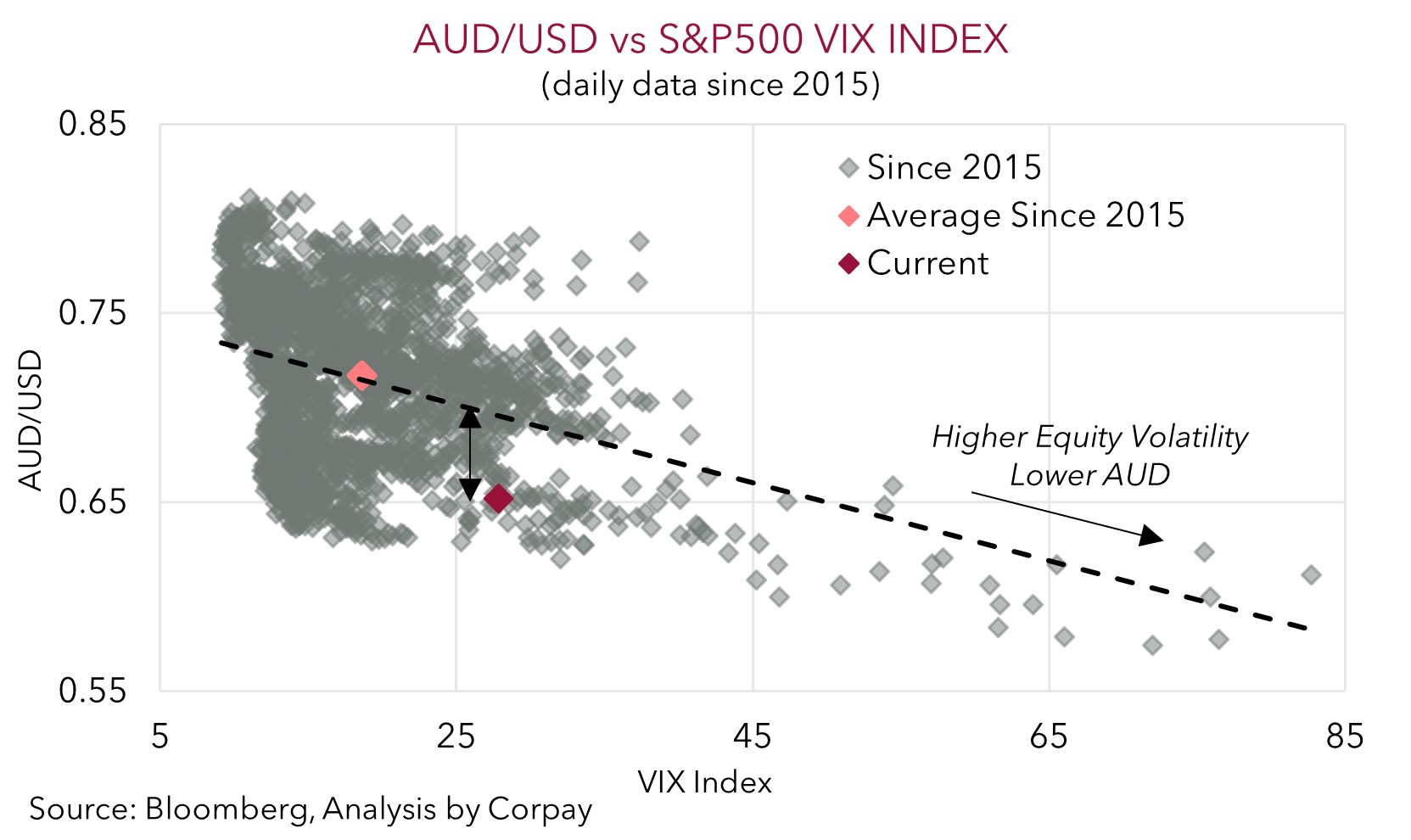

While there will continue to be bumps along the way, the recovery in broader risk appetite over the past few days confirms our initial analysis that markets had gotten ahead of themselves and were overreacting to recent global developments. Importantly, as we flagged, credit spreads (which are an important cog in the US system as these markets are a source of corporate funding) hadn’t moved a great deal. We continue to think the AUD has scope to recover lost ground over the period ahead as the dust continues to settle. As our scatter plot illustrates the AUD looks too low based on the level of the VIX equity volatility index, which itself should continue to fall towards more normal levels.

Added to that the outlook for the RBA continues to diverge from other central banks. The ‘hawkish’ vibes from the RBA earlier this week as it pushed back on the prospect of a rate cut this year and noted it discussed another hike stands apart from its peers. These comments and the underlying Australian inflation pulse support our long-held thoughts that the RBA is set to lag its global counterparts in terms of when it starts and how far it goes during the next easing cycle. As risk sentiment stabilises we see the AUD converging up towards levels implied by relative real/nominal yield spreads. Moreover, we feel there are an uneven distribution of risks for the AUD near current levels. As mentioned previously, Australia is running a broad basic balance of payments surplus with the terms of trade also above average. On our numbers, since these positive AUD flow and valuation dynamics swung into gear in 2015 the AUD has only traded sub $0.65 in ~6% of trading days.