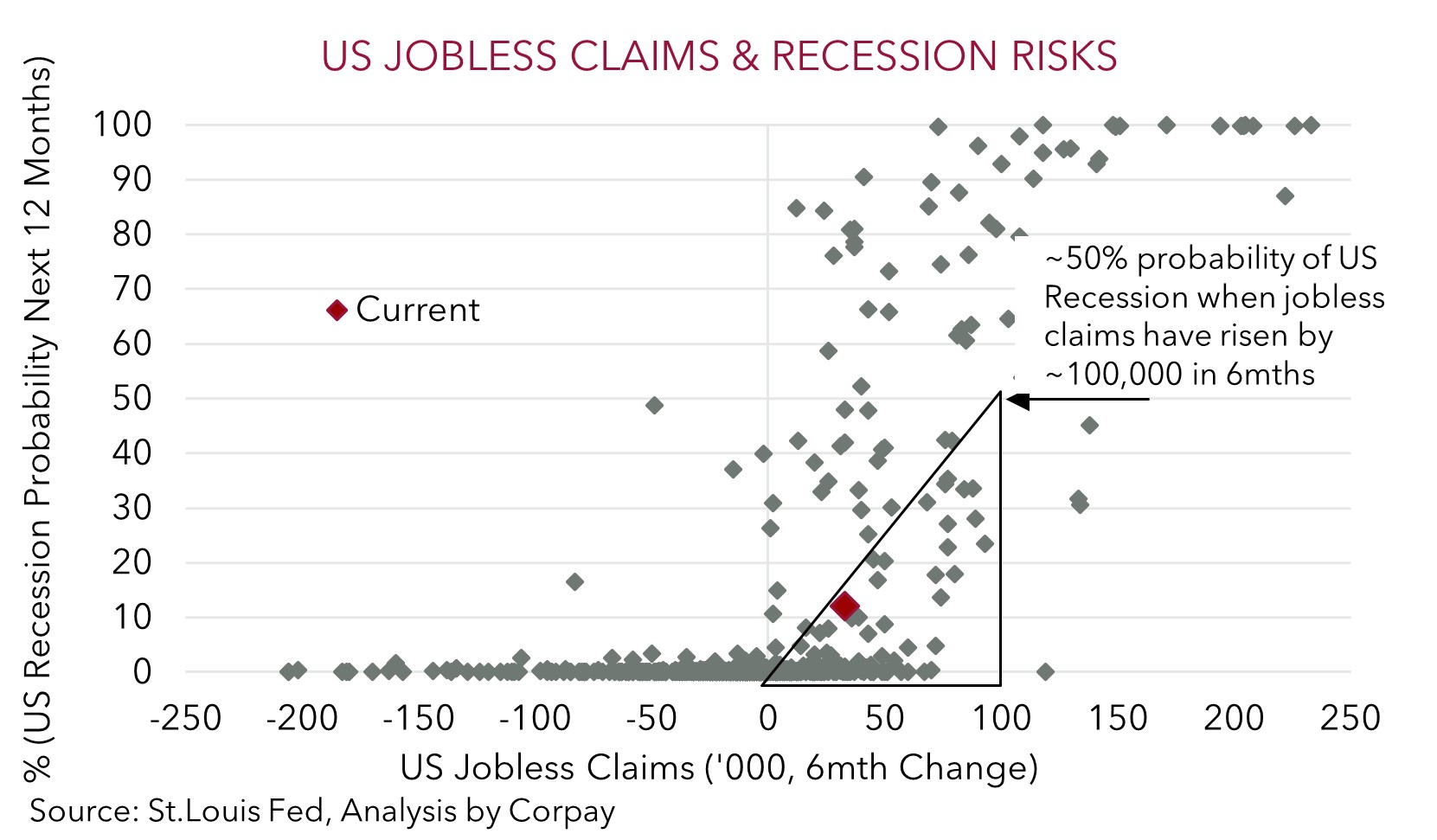

• Fading concerns. Lower US jobless claims eased US recession fears. US equities surged. Cyclical currencies like the AUD outperformed.

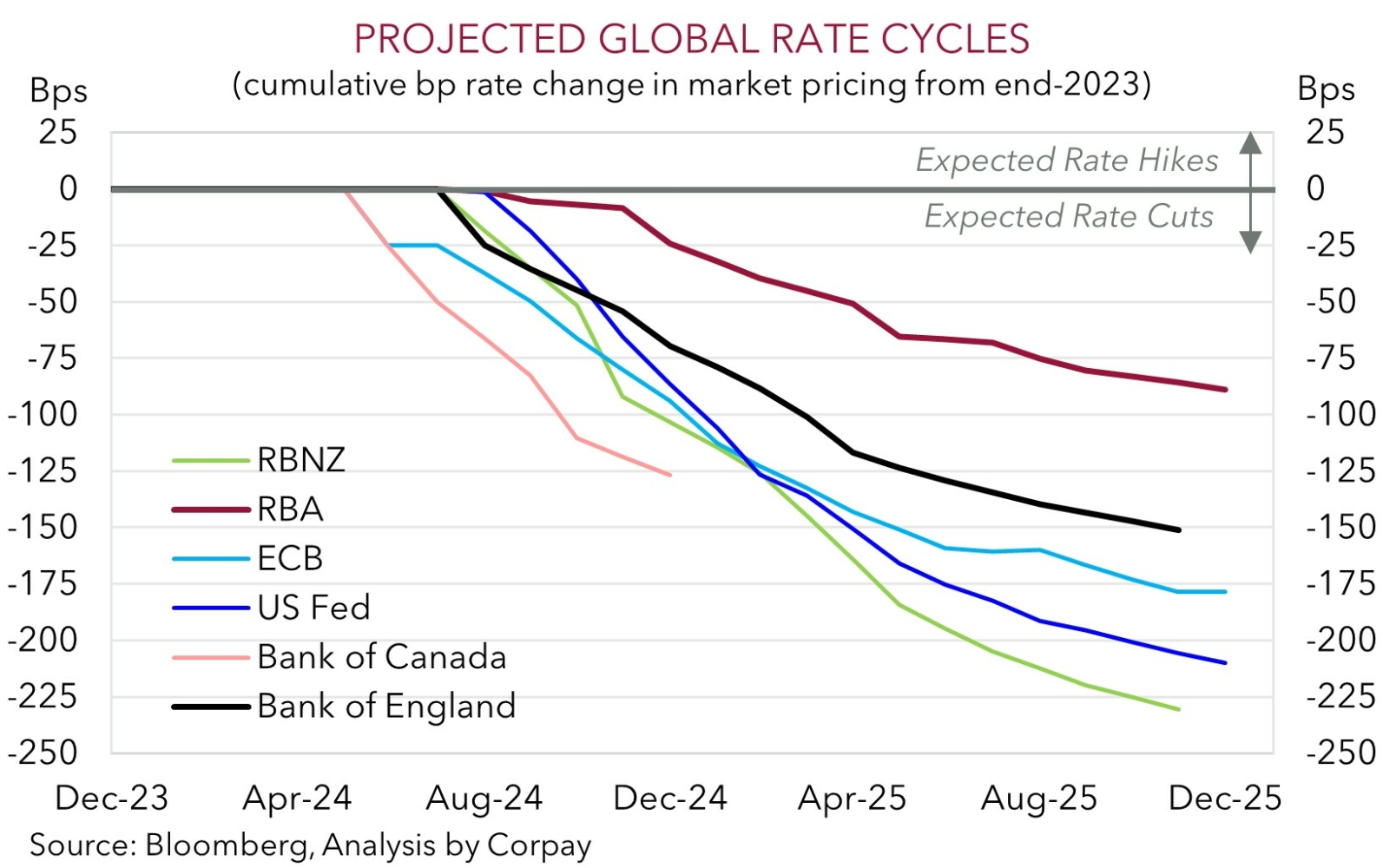

• RBA hawks. ‘Hawkish’ rhetoric from RBA Gov. Bullock also supported the AUD. The RBA is diverging from the pack. We think this is AUD positive.

• Event radar. Limited data today. Several releases next week including US CPI/retail sales, China data, RBNZ meeting, & AU jobs/wages.

Market fears have continued to fade with cyclical assets enjoying a positive 24hrs. Concerns a US recession is around the corner eased further after the latest read on initial jobless claims fell to a multi-week low (now 233,000). The unwind of Hurricane Beryl weather disruptions drove the pull-back. These weather impacts were also a factor behind the recent lackluster US labour market report. Jobless claims are a real-time read on the US economy as they measure the number of people applying for unemployment benefits from week to week. As our chart shows, jobless claims have been a leading indicator for US economic downturns since the late-1960s with a ~100,000 increase over a ~6-month period typically translating to a ~50% chance of a recession in the next year. Current conditions look a long way from that. The data supports our analysis from earlier in the week which correctly showed markets were overreacting. US credit spreads, a truer reflection of underlying fundamentals, had barely moved despite the pickup in volatility in bonds and equities.

US equities surged with the tech-focused NASDAQ outperforming (+2.9% vs S&P500 +2.3%). This was the largest daily gain in the S&P500 since November 2022 with all major subsectors rising. US bond yields increased with the benchmark 10yr rate ~4bps higher (now ~3.99%) and the 2yr rate up ~8bps (now ~4.04%) as ‘emergency style’ US Fed policy easing assumptions continue to be trimmed. Markets are factoring in a ~40bp Fed rate cut in September, down from ~50bps earlier in the week, although ~125bps worth of easing is still discounted by January. In FX, an initial burst of USD strength post the US jobless claims data wasn’t sustained. EUR consolidated (now ~$1.0920), GBP ticked up (now ~$1.2745), while higher US yields and positive risk sentiment saw USD/JPY lift a little (now ~147.25). The backdrop and ‘hawkish’ vibes from RBA Governor Bullock yesterday boosted the AUD (now ~$0.6595) and helped it outperform on the crosses, with NZD also drifting over ~$0.60.

The US economic calendar is limited today. We think ‘no news could be good news’ for markets with the USD likely to lose some ground, as per the signal from the lower level of US interest rate expectations. That said, volatility might return next week with several important global releases on the horizon including US PPI (Tues night AEST), US CPI (Weds night AEST), the China data batch (Weds AEST), and US retail sales (Thurs night AEST).

AUD Corner

The AUD has continued to pick itself up off the canvas with strong gains coming through over the past day. At ~$0.6595 the AUD is up over 1% compared to this time yesterday (or ~3.8% above Monday’s equity market panic low point). The AUD also outperformed on the crosses with gains of ~1.2-1.5% against the EUR (now ~0.6040), JPY (now ~97.10) and CNH (now ~4.7363) coming through, and relatively more subdued increases of ~0.7-0.9% against GBP (now ~0.5175), NZD (now ~1.0965), and CAD (now ~0.9055) recorded.

The more positive tone in markets (as illustrated by the strong gains in US equities and higher copper/oil prices) compounded ‘hawkish’ rhetoric from Governor Bullock that supports the view the RBA is on a different trajectory to other central banks. In a speech yesterday Governor Bullock noted that “although growth in the economy has been weak, estimates suggest that the gap between aggregate demand and aggregate supply in the economy is larger than previously thought and this is resulting in persistent inflation”. This is the argument we have been making as it is the level of activity (which is still above its pre-COVID trend, especially across the labour-intensive services providing sectors) that drives inflation. And as such, according to Governor Bullock, “the Board explicitly considered whether another interest rate rise was required” and it “will not hesitate” to hike again “if it needs to”.

Another rate rise from the RBA probably won’t occur, but rate cuts still look some time away, in our view. We think this is a story for Q1 2025 at the earliest. The comments from the RBA over recent days and the underlying Australian inflation pulse reinforce our long-held thesis that the RBA is set to lag its global peers in terms of when it starts and how far it goes during the next easing cycle. We believe the more positive risk appetite in markets should help the AUD converge up towards levels implied by relative yield spreads. The underlying dynamics could also be AUD positive on crosses such as AUD/EUR, AUD/GBP, and AUD/NZD given their respective central banks have already started to ease policy, or in the case of the RBNZ we think it is a matter of time before it kicks things off. In our judgment there is a high chance the RBNZ cuts rates at next Wednesday’s meeting.