• Negative vibes. Large fall in US equities overnight. Copper fell further. AUD & NZD remain on the backfoot. BoC cut rates again & flagged more moves.

• JPY swings. JPY revival continues. AUD/JPY dropped sharply from mid-July peak. This looks to be a factor behind the AUD’s broader underperformance.

• Data flow. US Q2 GDP released tonight. US PCE deflator due tomorrow. Next week Q2 AU CPI, the US Fed meeting, & US jobs report will be in focus.

The pull-back in equities stepped up a notch overnight, particularly in the US where a tech-sector led sell-off dragged on the overall index. The S&P500 fell 2.3% while the NASDAQ tumbled 3.6%, its biggest one-day drop since Q4 2022. Underwhelming earnings results and a subsequent large decline in a few megacap stocks (Tesla -12%, Alphabet -5%) was a key driver, but there were also pockets of weakness across several other sectors. The moves do come after an extended upswing, so perspective is also needed. The NASDAQ is still up ~23% compared to a year ago.

That said, moves across other asset classes weren’t entirely consistent with a traditional ‘risk off’ tone. Long end bond yields ticked higher with the UK and US 10yr rates rising ~3bps. There was a fall in the US 2yr yield (-6bps to 4.43%), though this looks to have been a function of: (a) an opinion piece by former NY Fed Dudley who noted he has changed his view and that “the Fed should cut, preferably at next week’s policy-making meeting”; and (b) the ‘dovish’ rate cut by the Bank of Canada. As anticipated the BoC delivered its second 25bp reduction, lowering its policy rate to 4.5%. BoC Governor Macklem reiterated that it’s “reasonable” to foresee further moves with the downside risks to growth getting more attention from policymakers. Markets are discounting nearly another two BoC cuts by year-end, with the first US Fed move comfortably factored in by September. Elsewhere, while the retracement in copper prices continued (-2%), energy prices consolidated (WTI crude +0.7%).

In FX, the USD index is on net little changed from this time yesterday. Although there are important swings still unfolding below the surface. Soft Eurozone business PMIs saw EUR edge a touch lower (now ~$1.0840), an upside surprise in the UK PMIs helped GBP tread water (now ~$1.2905), and the BoC outcome pushed USD/CAD (now ~1.3805) to its highest point since mid-April. At the same time, there was another sizeable dip in USD/JPY. At ~153.80 USD/JPY is now ~5% below its recent multi-decade peak with expectations the BoJ will take another policy normalisation step next week ramping up. The shaky risk environment coupled with the relatively steeper unwind in AUD/JPY and NZD/JPY over recent weeks (these pairs have dropped by ~7.5-8%) has exerted pressure on AUD (now ~$0.6580) and NZD (now ~$0.5930).

Q2 US GDP is released tonight (10:30pm AEST). High frequency data points to a slight pick up in growth momentum (mkt 2%saar vs 1.4%saar in Q1). That said, this type of run rate is below the US’ potential. If realised, we think this, and a step down in the US PCE deflator (released Friday AEST) would be welcomed by the US Fed and reinforce thinking the policy easing cycle is approaching. In our opinion, this could help risk sentiment stabilise and drag on the USD.

AUD Corner

The AUD’s weaker run has continued with the negative risk vibes, as illustrated by the drop in US equities and increased volatility, exerting more downward pressure (see above). At ~$0.6580 is around the bottom of its two-month range and a little below its six-month average. The ‘shoot first ask questions later’ environment has also seen the AUD lose more ground on the crosses. AUD/EUR (now ~0.6070) is near a three-month low, AUD/GBP (now ~0.51) is at its lowest point since last September, AUD/CNH (now ~4.7815) is approaching its one-year average, AUD/CAD (now ~0.9085) is tracking in its June range, and AUD/JPY (now 101.20) has tumbled to early-May levels.

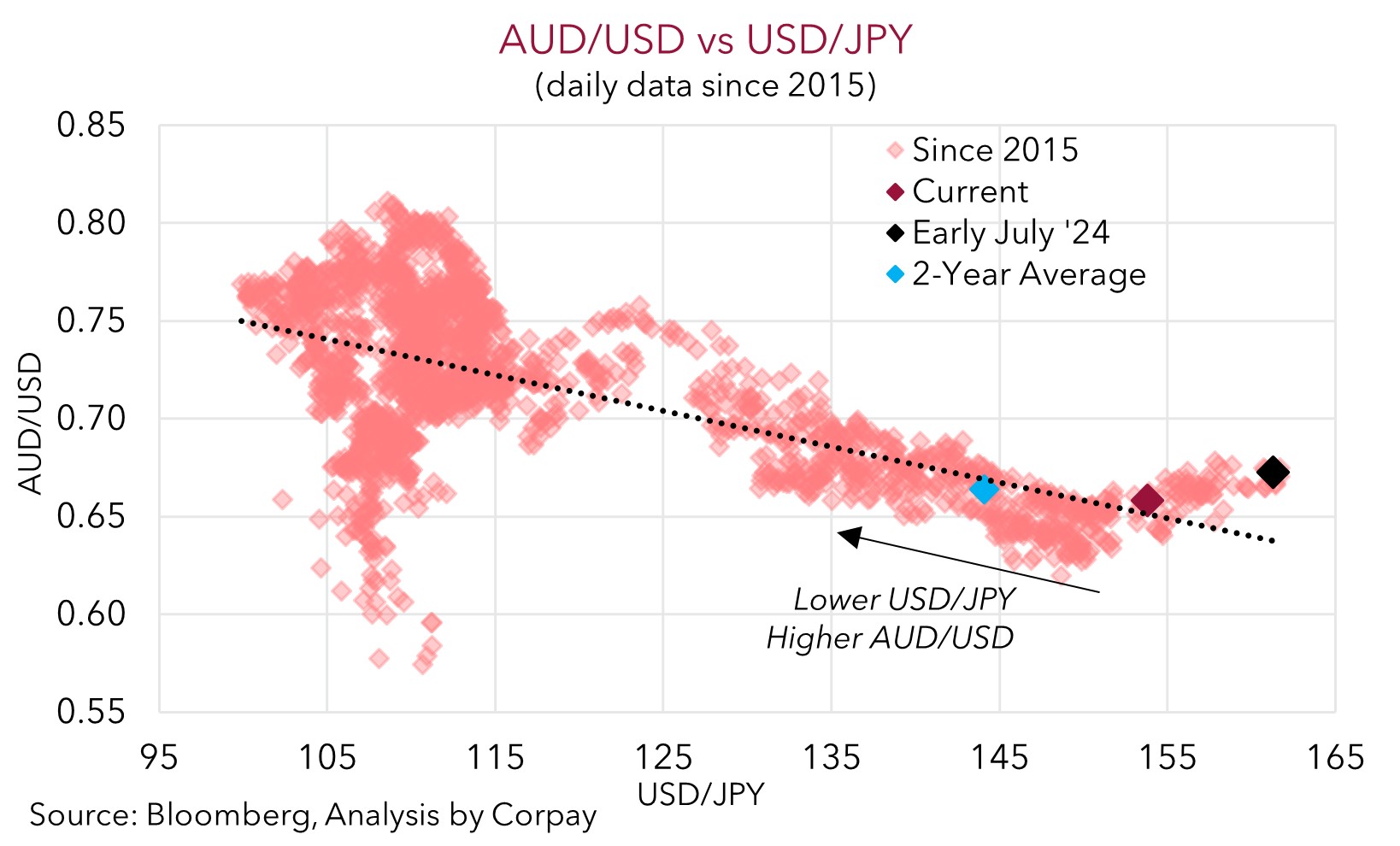

As mentioned above, AUD/JPY has fallen sharply recently (-7.5% since 11 July). This is larger than the decline in USD/JPY over the same period, and in our view, the sharp realignment on the JPY side looks to be one of the influences behind the AUD’s underperformance. That said, as our scatter chart above shows, unlike a few weeks back, the AUD and USD/JPY are now more inline. Hence, we think further falls in USD/JPY from here, which we believe is possible as the BoJ continues to normalise policy while most other major central banks lower interest rates, may start to drag on the USD and generate AUD support. This is the more usual (inverse) relationship between USD/JPY and AUD/USD.

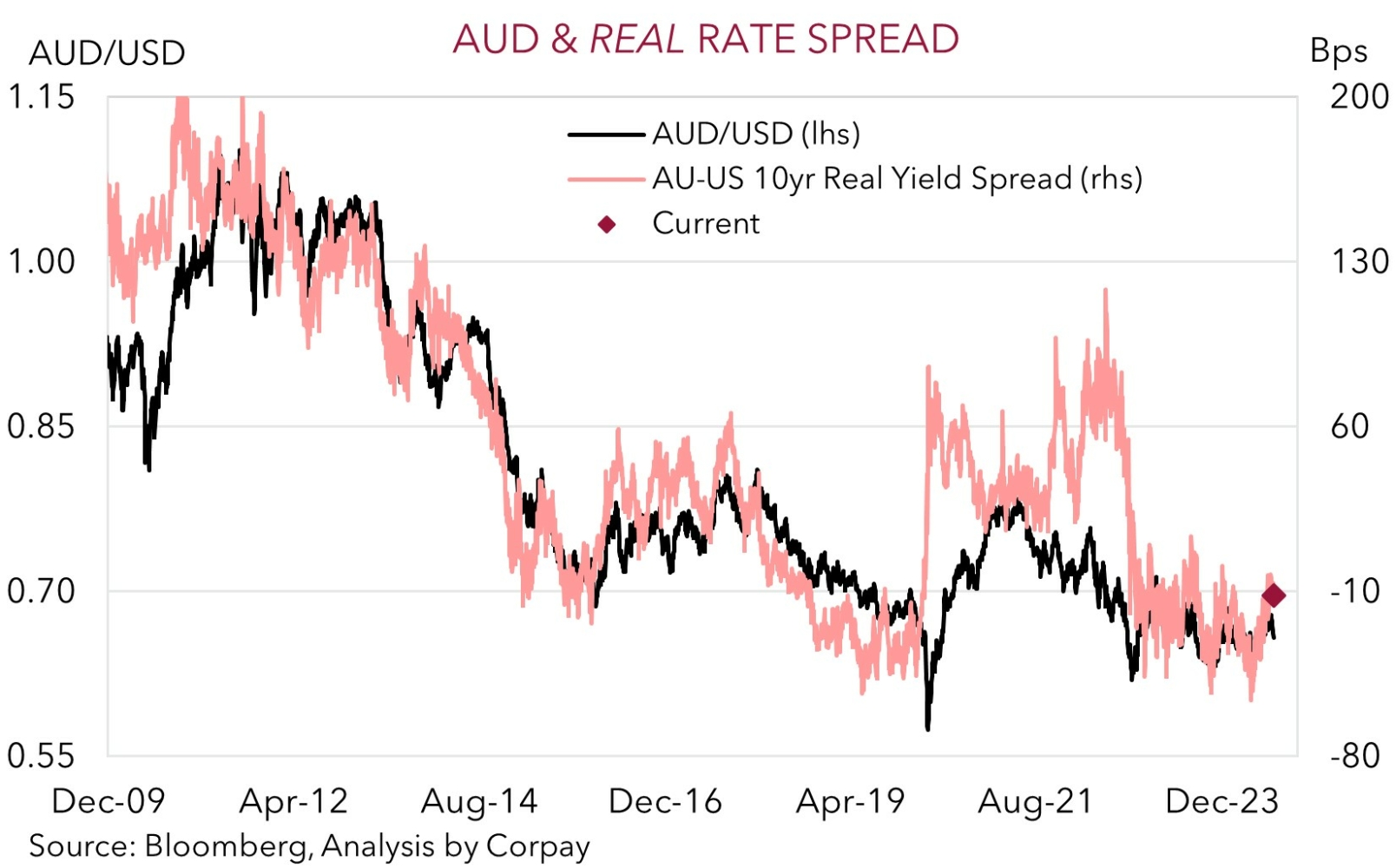

The negative influence on the AUD from the JPY’s revival also supports our general thinking that the bulk of the AUD’s recent slide has been momentum/technical driven. The swings in the AUD’s underlying drivers haven’t all be one-way, and the level of various important indicators such as nominal/real yield spreads, equity markets, and commodity prices, suggest the AUD has been unduly beaten up. Putting everything into the mix the average across our suite of models indicates the AUD may now be ~2 cents too low. We believe the positive AUD macro divergence between Australia and others could soon re-assert itself.

Importantly, unlike the rate cuts being factored in for most major central banks, markets are assigning a ~33% chance the RBA hikes again by September, with the first RBA rate reduction not fully discounted until mid-2025 due to the resilience in the Australian labour market, sticky inflation, and fiscal/income support flowing to the household sector. The upcoming Q2 CPI inflation data (released 31 July) is likely to make or break the case for another near-term RBA rate hike. But irrespective, we are still of the view RBA rate cuts are some time away, and as a result yield spreads look set to progressively move in a more AUD supportive direction over time. On top of the AUD side, we feel the incoming US GDP (10:30pm AEST), US PCE Deflator (Fri AEST), and US Fed meeting (Thurs morning AEST) could reinforce views that the Fed’s easing cycle is nearing which might weigh on the USD.