• US yields rise. US bond yields jumped up overnight, supporting the USD Index. The US ISM manufacturing survey was a bit better than expected.

• RBA in focus. We expect the RBA to keep the cash rate steady at 3.6%, however based on the tight labour market, we believe odds of a move may be a little higher than what markets are pricing.

• AUD risks. A RBA ‘surprise’ would see the AUD spike higher, however the slowing global economy and outlook for another US Fed rate hike later this week are ongoing headwinds.

Outside of a jump up in US bond yields, holiday impacted markets have had a quite start to the week. Though given the major data and central bank meetings over coming days volatility should pick up. US equities were flat, oil prices edged a little lower (WTI crude dipped 1.4% to US$75.70/brl), while US yields rose ~13-15bps across the curve with the 2-year lifting back up to 4.14% (a 1-week high). Various factors combined to push up US bond yields, such as slightly better than expected US ISM data, a ramp up in corporate debt issuance ahead of this week’s US Fed meeting, and some improved sentiment following JP Morgan’s acquisition of the beleaguered First Republic Bank via a government/regulator backed deal.

In FX, the USD index continued to inch higher, with EUR and GBP (both strong performers in April) giving back some ground. The JPY remains under pressure with markets appearing less convinced the Bank of Japan will end its ultra-accommodative policy any time soon following the limited changes to its guidance at last Friday’s meeting. At ~137.40 USD/JPY is near its 2023 highs, with AUD/JPY trading above 91 for the first time since early-March. Despite the slightly firmer USD, the AUD has held up, thanks to some outperformance on the crosses, and is hovering near ~$0.6630 with today’s RBA meeting in focus.

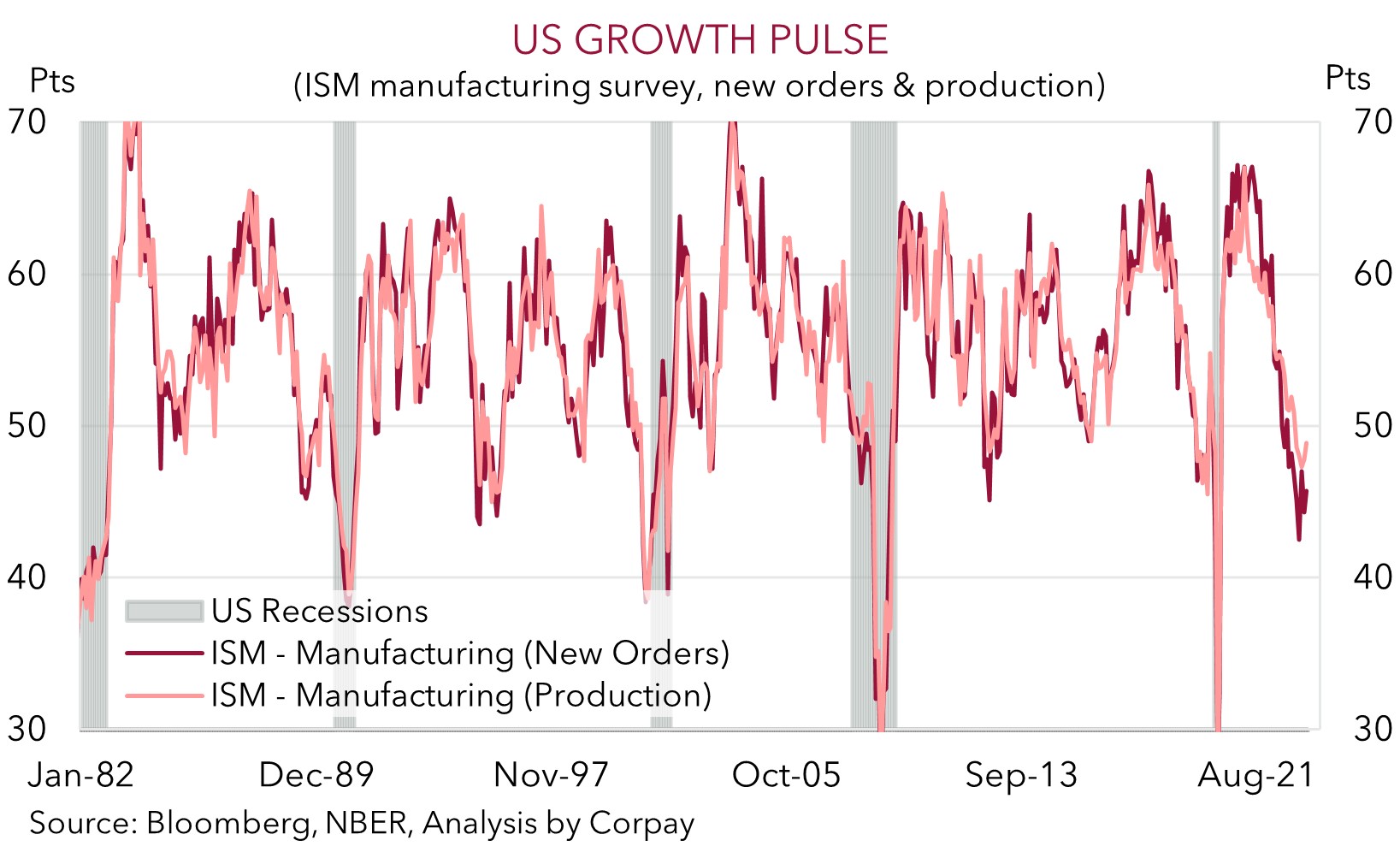

Data-wise, the US ISM manufacturing survey was the only release of note. The ISM index ticked up a little more than predicted, but at 47.1 it remained in ‘contractionary’ territory for the 6th straight month. As our chart shows, the new orders and production gauges remain near levels normally associated with a US recession, however, at the same time the increase in prices paid in April is another reminder that the US Fed has more work to do to tame inflation.

Eurozone CPI is due tonight (7pm AEST), and it is expected to show still high inflation, though consensus is looking for core inflation to nudge down to 5.6%pa. We are looking for the ECB to deliver a 25bp hike on Thursday, but a positive inflation surprise could tip the balance to a 50bp rise. Further ahead the US Fed meeting is the focal point this week (Thurs morning AEST). We are forecasting another 25bp Fed rate rise, but we think the rhetoric could be more ‘hawkish’ than markets are anticipating. Given the strong US inflation pulse, we believe the Fed may want to keep the door open to more moves and/or push back against expectations looking for rate cuts later this year. If realised, an upward adjustment in US rate pricing could be USD supportive.

Global event radar: RBA Meeting (Today), Eurozone CPI (Tonight), US Fed Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May).

AUD corner

The AUD (now ~$0.6630) has edged up a little at the start of this week thanks to some relative outperformance on the crosses which has counterbalanced the firmer USD (see above). As mentioned above, AUD/JPY is near its highest level since early-March, with the JPY’s post BoJ weakness continuing over the past 24hrs.

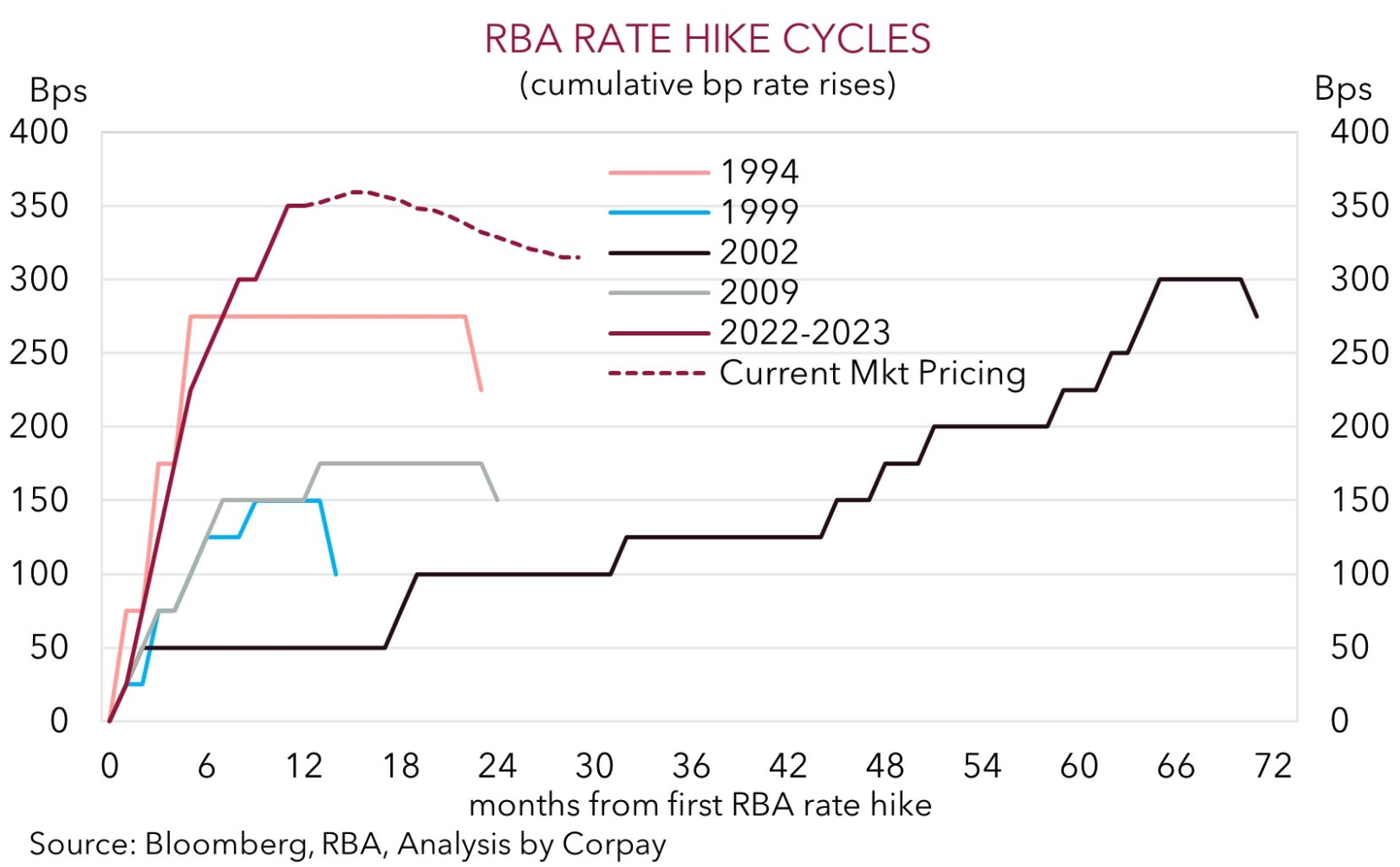

There are several major global and domestic economic events scheduled for the rest of this week which suggests AUD volatility should lift. Today, the RBA meeting is in focus (2:30pm AEST) with Governor Lowe also set to speak tonight (9:20pm AEST). Our base case is that the RBA keeps rates on hold at 3.6% given signs inflation is turning, the substantial amount of ‘natural tightening’ that will occur as the pool of fixed rate loans are refinanced at higher rates, and based on the RBA’s aim of navigating a ‘soft landing’. However, we do expect the RBA to keep the door open to doing more, if needed, down the track.

No change in the cash rate is the consensus economist expectation, with markets also assigning little chance of a move by the RBA today. While we agree the argument for another RBA ‘pause’ is stronger, given the RBA’s tightening bias and strong labour market, we do believe the odds of another hike do look a bit higher than what markets are factoring in. As such there look to be uneven AUD risks today with a ‘surprise’ rate rise likely to generate a relatively larger short-term spike higher compared to the move on the back of no change.

That said, bigger picture, even if the RBA springs a surprise today, we continue to think near-term upside in the AUD should be limited. Slowing global growth, weaker commodity demand, financial market volatility, and further tightening by the other major central banks are ongoing AUD headwinds. Indeed, as outlined, later this week we are looking for the US Fed (Thurs morning AEST) to hike interest rates by another 25bps and think there are ‘hawkish’ risks to its guidance compared to market thinking based on the still strong US inflation pulse. In our opinion, a push back by the Fed on the markets rate cut pricing for later this year could see US interest rates adjust upward, supporting the USD and dragging the AUD lower.

AUD event radar: RBA Meeting (Today), RBA Gov. Lowe Speaks (Tonight), Eurozone CPI (Tonight), AU Retail Sales (Weds), US Fed Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Fed Chair Powell Speaks (19th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6525, 0.6565 / 0.6692, 0.6735

SGD corner

USD/SGD picked up a bit overnight on the back of the lift in US bond yields and firmer USD (see above), but at ~$1.3360 the pair remains within its recent range. We continue to think that USD/SGD can nudge up towards ~$1.3450 over the period ahead, and that EUR/SGD can extend its upward trend.

This week the focus will be on the ECB and US Fed policy meetings (both Thursday). We are looking for 25bp hikes from both central banks, however we think ‘hawkish’ messages are where the risks reside. Indeed, we believe there is a chance the ECB could deliver another larger than usual 50bp hike if tonight’s Eurozone CPI inflation data comes higher than forecast. And based on the still tight US labour market and ‘sticky’ US services inflation, we think the US Fed could maintain the option of more tightening down the track and/or lean against market pricing looking for rate cuts later this year. Broadly speaking, slowing global growth (as illustrated again over the weekend by the weaker than forecast China PMIs), combined with further policy tightening by the US Fed and ECB should support currencies like the USD and EUR over the SGD which is leveraged to the global cycle.

SGD event radar: RBA Meeting (Today), Eurozone CPI (Tonight), US Fed Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3290 / 1.3377, 1.3420