• Risks reemerge. Renewed US banking sector concerns have weighed on risk sentiment. Bond yields, equities & oil prices fell overnight.

• AUD volatility. AUD spiked after the ‘surprise’ RBA rate hike, but offshore developments have seen the AUD give back a lot of its gains.

• US Fed in focus. Tomorrow’s US Fed meeting is the next major event. Another hike is expected. We think the Fed could push back on expectations rate cuts could start in H2. This could give the USD a boost.

The relative calm across markets hasn’t lasted. Risk sentiment soured overnight as concerns about the US regional banking system re-emerged. PacWest Bancorp (-28%) and Western Alliance Bancorp (-15%) led the falls across the regional US banks with exposure to commercial real estate one of the factors investors focused in on. As we have pointed out before, US Fed tightening cycles typically expose excesses that have been built up in different parts of the system. This is just the latest iteration. We continue to expect the most abrupt policy tightening cycle in several decades to generate more ‘aftershocks’ and volatility over the coming months (see Market Musings: Buckle up, volatility should continue).

The anxiety over financial stability weighed on broader equities (the S&P500 fell ~1.2% with the financials and energy sectors underperforming), and saw US bond yields tumble. US yields fell ~14-17bps across the curve, with the 2-year yield back trading under 4%. Elsewhere, the developments have fanned global recession risks and this saw oil prices slump by ~5%. WTI crude oil is trading down near $71.50/brl, ~12% below its 1-year average price, while iron ore and copper have also lost some ground. FX markets have been relatively more sedate. The USD Index has eased slightly. EUR edged back above ~1.10 with the elevated Eurozone core inflation data (5.6%pa in April) reinforcing expectations for further ECB rate hikes. USD/JPY slipped ~0.9% from its highs as the negative backdrop boosted the JPY. After spiking ~1.3% higher following yesterday’s ‘surprise’ RBA rate hike, the AUD (now ~$0.6660) has given back a large chunk of its gains, tracking the turn in risk sentiment.

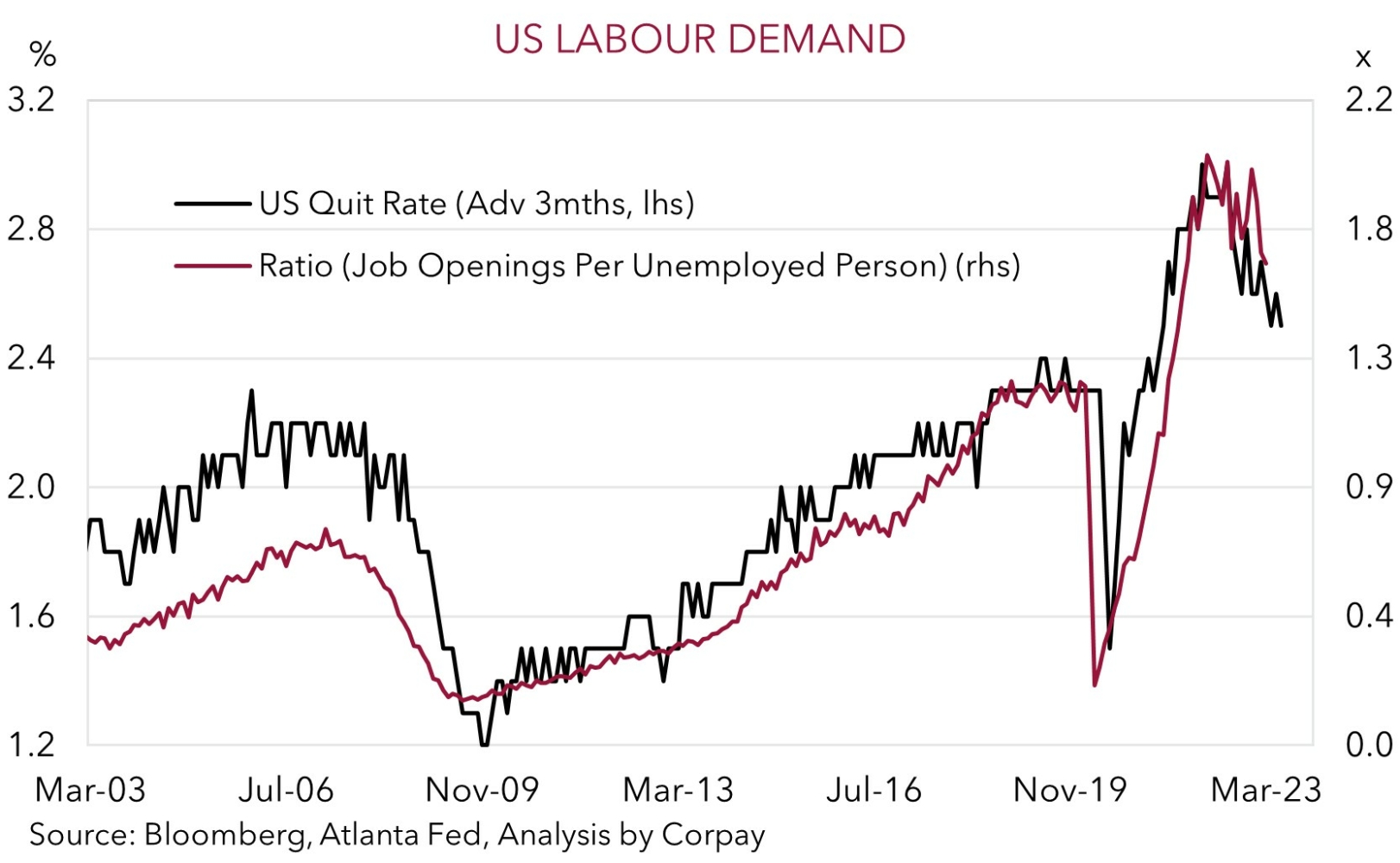

Over the next few days focus will be on the US Fed decision (Thursday 4am AEST), Fed Chair Powell’s press conference (Thursday 4:30am AEST), and the ECB meeting (Thursday 10:15pm AEST). We, and the broader consensus, are looking for another 25bp rate rise by the US Fed, but despite the regional banking sector jitters we think the rhetoric could be more ‘hawkish’ than markets are anticipating. Given the strong US inflation pulse and still tight labour market, we believe the Fed may want to keep the door open to more hikes, if needed, and/or push back against expectations looking for rate cuts later this year. Although the US JOLTS report released overnight showed that job openings dipped in March, and the ‘quit rate’ is easing, as our chart shows, conditions are still a long way from normal, and remain at levels inconsistent with the Fed’s inflation target. If realised, we think a paring back of future rate cut pricing could further rattle risk markets and be USD supportive.

Global event radar: US Fed Meeting (Tomorrow), Fed Chair Powell Speaks (Tomorrow), ECB Meeting (Tomorrow), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May).

AUD corner

It has been a volatile 24hrs for the AUD, with yesterday’s ‘surprise’ RBA rate hike pushing the currency ~1.3% higher before the reemerging concerns in the US regional banking system and turn in risk sentiment pushed it down overnight. At ~$0.6660 the AUD has slipped back under its ~2-month average.

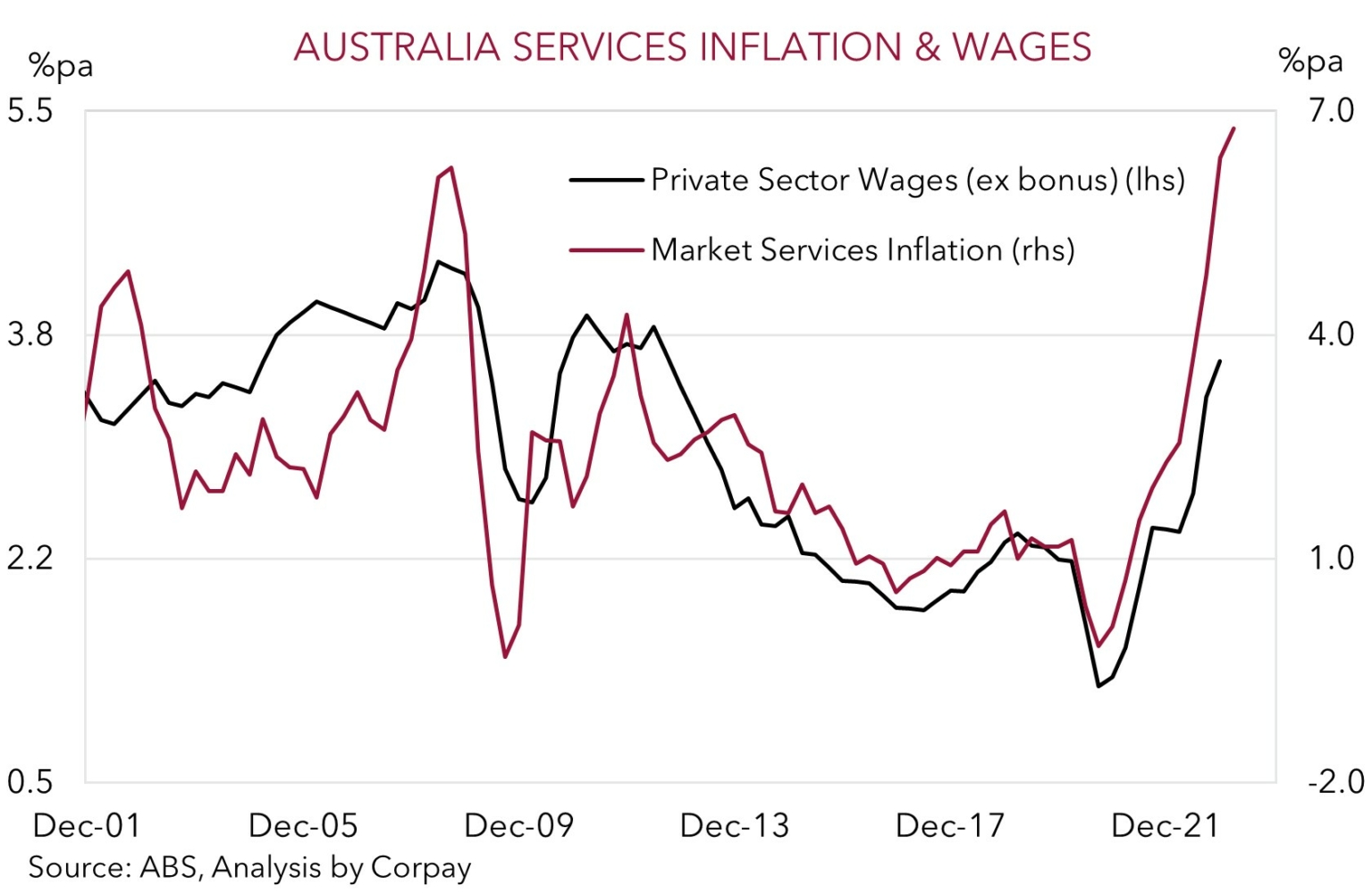

In terms of the RBA, the latest 25bp rise has lifted the cash rate up to 3.85%. From the RBA’s perspective, while inflation has “passed its peak” at 7% it is “still too high and it will be some time yet before it is back in the target band”. And the “importance” of getting inflation back down in a “reasonable timeframe” and concerns about the upswing in ‘sticky’ services inflation (which is heavily linked to the labour market and wage trends, see our chart below) underpinned the decision. The RBA has retained a conditional hiking bias, noting that “some further tightening” of policy “may be required”, however this will be based on how things evolve. In our view, while the RBA is still talking tough and has left the door ajar, we doubt the economic trends will justify further hikes from here. Indeed, in a speech overnight RBA Governor Lowe noted that the decision was again finely balanced, so future moves will remain data dependent. We think the risks around the RBA’s growth and inflation forecasts are tilted to the downside, with the large jump up in mortgage rates a substantial hit to indebted households which we believe could generate a meaningful hit to activity (for more see Market Wire: RBA: Once more, with feeling).

In today’s Asian trade, given the RBA’s focus on consumer spending, Australian retail sales could generate intra-day AUD volatility (11:30am AEST). Consensus is looking for a modest 0.2% lift. But the main event for the AUD is tomorrow’s US Fed announcement (4am AEST) and Fed Chair Powell’s press conference (4:30am AEST). As outlined above, we expect another 25bp Fed rate hike, and think there are ‘hawkish’ risks to its guidance compared to market thinking. In our opinion, a push back by the US Fed on the markets rate cut pricing for later this year could see US interest rates adjust upward, supporting the USD and potentially dragging the AUD down towards its recent lows.

AUD/NZD has traded in a ~1.2% range over the past day, with the jump post the RBA rate hike unwinding overnight. Q1 NZ labour market data was released this morning. It was a mixed bag. Employment growth was stronger than predicted (+0.8%qoq), which helped the unemployment rate hold steady at a low 3.4%. But wages look to have come in a bit softer. Private sector labour costs rose 0.9% in the quarter. On net, we think the data supports the case for the RBNZ to deliver one last hike in late-May. But this is already largely priced in. Medium-term, we continue to see AUD/NZD moving higher. Once tightening cycles end, the focus should shift to other relative differentials such as growth. And in our view the RBNZ’s more aggressive steps should cause a greater negative impact on the NZ economy over time.

AUD event radar: AU Retail Sales (Today), US Fed Meeting (Tomorrow), Fed Chair Powell Speaks (Tomorrow), ECB Meeting (Tomorrow), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Fed Chair Powell Speaks (19th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6525, 0.6595 / 0.6726, 0.6790

SGD corner

USD/SGD continues to consolidate near ~$1.3350, while EUR/SGD is tracking just under 1.47. The flare up in US banking sector concerns, and resultant negative risk sentiment (see above) looks to have had little direct impact on the SGD. But in our view, it could be a matter of time. The developments reinforce our thinking that further market gyrations are likely over the coming months as the large jump up in global interest rates and tighter credit conditions slow growth and continue to expose vulnerabilities that have built up across the financial system. This is typically a negative environment for cyclical currencies like the SGD and broader Asian FX.

Near-term, we continue to think that USD/SGD can nudge up towards ~$1.3450 and that EUR/SGD can push higher. Over the next few days attention will be on the US Fed and ECB meetings. As discussed, we are looking for 25bp hikes from both central banks, however we think ‘hawkish’ messages are likely given the still high core inflation readings in the US and Eurozone. In terms of the US Fed, we believe that despite the wobbles across parts of the regional US banking system, the ’sticky’ services inflation and tight labour market conditions could see the Fed maintain the option of more tightening down the track and/or lean against market pricing looking for rate cuts later this year. If this does come through we expect the shift up in interest rate pricing to be USD (and USD/SGD) positive.

SGD event radar: US Fed Meeting (Tomorrow), Fed Chair Powell Speaks (Tomorrow), ECB Meeting (Tomorrow), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3290 / 1.3377, 1.3420