• Fed in focus. US Fed hikes again, but adjusts guidance. Fed is now data dependent. That doesn’t mean hikes have ended or cuts are coming soon.

• Negative risk sentiment. Pushing back of rate cut hopes saw risk sentiment turn negative. US yields lower. USD lost ground against the EUR and JPY.

• AUD softer. AUD eased back, with AUD/EUR below pre RBA rate hike levels. ECB expected to hike again tonight. Pressure on AUD/EUR to continue.

The US FOMC decision was in focus earlier this morning. As widely expected, the FOMC raised rates another 25bps, taking the target range to 5.00-5.25%. This is a high since Q3 2007 and moves settings further into ‘restrictive’ territory (i.e. further above the ‘neutral’ rate which the Fed estimates to be at ~2.5%). In terms of the outlook, after delivering 500bps worth of hikes over the past year, the Fed has moved off autopilot (forward guidance that it “anticipates further policy firming may be appropriate” was removed), however Chair Powell was quick to point out that this didn’t mean rates had peaked and/or that cuts are likely any time soon.

According to the FOMC, “in determining the extent to which additional policy firming may be appropriate” it will be guided by incoming information. Indeed, Chair Powell clarified that this didn’t mean that the Fed has decided to ‘pause’, but rather, decisions will now be made on a meeting-by-meeting basis. In our view, the Fed has retained a bias towards further hikes, but isn’t committing to them. By the time of the Fed’s next meeting in mid-June, two more CPI and jobs reports will have been released (one of those jobs reports is due this Friday). In addition, Chair Powell again pushed back on pricing looking for rate cuts to kick off later this year by reiterating that if inflation evolves like the Fed thinks easing won’t be warranted.

In terms of markets, some initial equity market excitement that the Fed could be ‘pausing’ faded after Powell dashed hopes of near-term rate cuts. The US S&P500 (-0.7%) closed on its lows, while oil continued its slide (WTI crude fell another ~4%). Bond yields also tumbled, with the US 2-year yield down another ~16bps to ~3.8%. The bond market continues to have a far more bearish outlook on the economic landscape. Notably, FX markets were somewhat more contained. The USD index lost some ground, as the EUR edged up above ~1.1050, with expectations that the ECB will hike rates again tonight (10:15pm AEST) and flag that it still has more work to do a supportive factor. USD/JPY has tracked the move down in US yields, while AUD has remained in a tight range and is hovering below its 50-day moving average (~$0.6683).

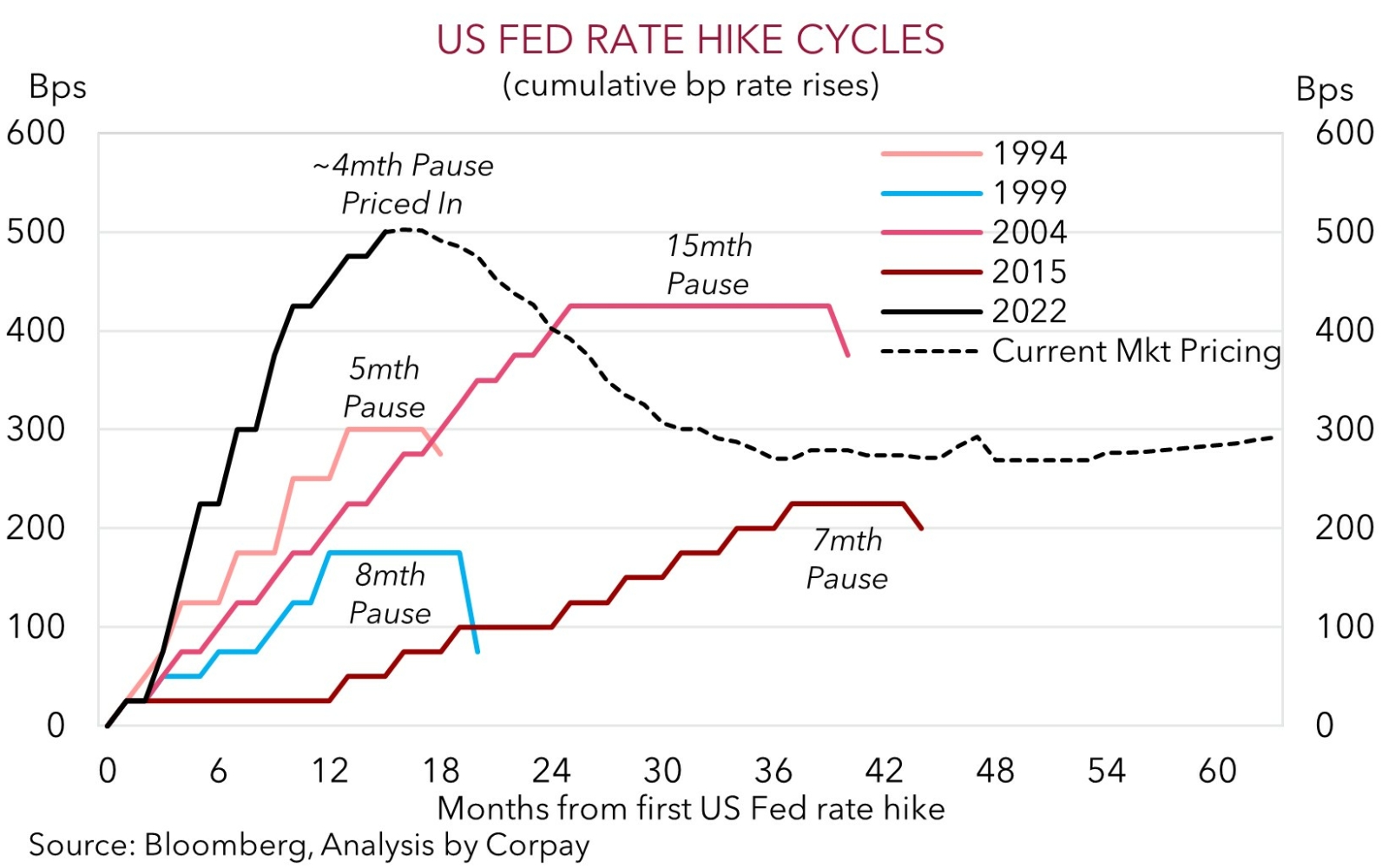

In our opinion, while the Fed’s hiking phase may be at, or very near the end, expectations looking for rate cuts to occur by as soon as September look misplaced. As our chart shows, this would be the shortest gap between the last Fed hike and first cut since the 1994 cycle. And this one is occurring with US inflation still well above the Fed’s target. We believe an adjustment towards a ‘higher for longer’ rates view should give the USD some renewed support down the track, however it would also likely generate further market volatility. We think this, and the unfolding global growth slowdown, should continue to favour currencies like the EUR, USD, and JPY over cyclical ones like the AUD, NZD and Asian FX.

Global event radar: ECB Meeting (Tonight), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May).

AUD corner

The AUD endured a bit of volatility around this morning’s US Fed rate hike decision and Chair Powell’s press conference. On net, at ~$0.6650 the AUD is now a touch lower compared to this time yesterday (and ~1% below its post RBA rate hike highs), with the turn in risk sentiment following Chair Powell’s push back on near-term rate cut expectations and slide in oil prices exerting some downward pressure.

As we have run through above, while the US Fed has tweaked its forward guidance, this doesn’t mean that the door has been shut to further hikes or that rate cuts should be anticipated any time soon. US inflation remains uncomfortably high and the labour market is still tight. We think that the Fed’s shift to a more data-dependent approach could mean that US rate expectations, the USD, and the AUD are more volatile around upcoming major data releases. The next one is this Friday’s US non-farm payrolls report. We believe a strong showing could see pricing for another Fed hike at the next meeting lift and/or expectations for rate cuts later this year pared back, which in turn could give the USD a boost and weigh on the AUD.

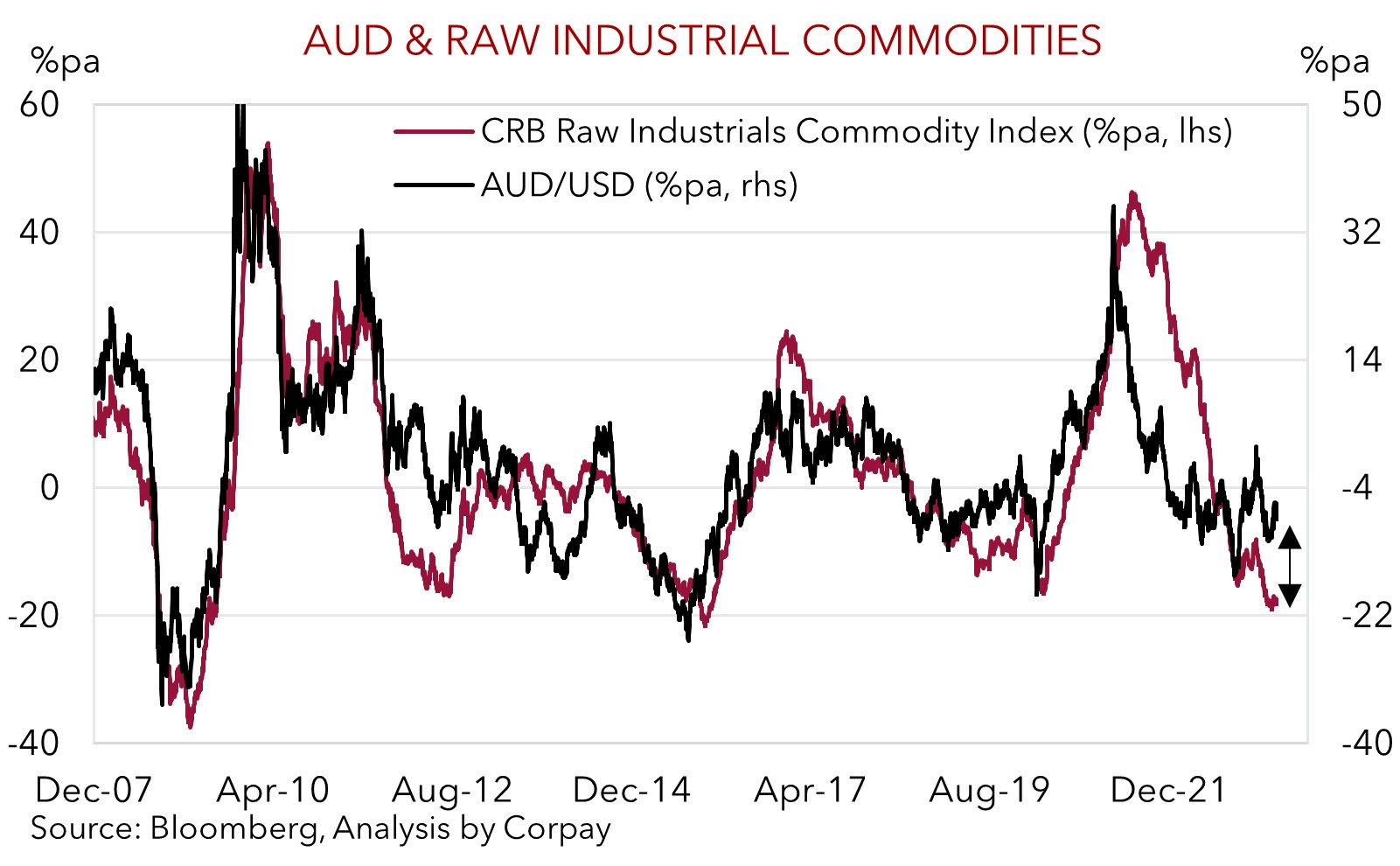

More broadly, we continue to think near-term upside in the AUD should be limited, and downside risks remain. Financial market volatility, slowing global growth, and weaker commodity demand are fundamental AUD headwinds. As our chart shows, a gap has opened between the AUD’s performance and trends in Raw Industrial commodity prices. This index tracks ~22 basic/raw commodities that are heavily influenced by changes in economic conditions. The recent falls are another signal the world economy is slowing. This is normally a negative environment for the growth sensitive AUD.

On the crosses, AUD/EUR has more than unwound its RBA rate hike induced spike, and is back down near ~0.60. The ECB policy decision is in focus tonight (announcement 10:15pm AEST, press conference 10:45pm AEST). Another 25bp rate rise is anticipated, and we think that given the elevated core Eurozone inflation, the ECB is likely to flag further hikes are possible over upcoming meetings. The policy impulse should remain in favour of the EUR, in our view, and this is compounding the down shift in global growth which AUD/EUR is heavily correlated with.

AUD event radar: ECB Meeting (Tonight), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Fed Chair Powell Speaks (19th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6525, 0.6595 / 0.6726, 0.6790

SGD corner

USD/SGD has slipped back towards ~$1.33, with the USD Index easing in the wake of the US Fed’s latest rate hike but removal of its commitment to further rises, and resultant falls in US bond yields (see above). Consequently, EUR/SGD has ticked back above 1.47, and the SGD has underperformed the JPY. As discussed above, although the Fed has adjusted its guidance to a more data-dependent approach, that does not mean that rate hikes have ended, and importantly, that rate cuts should be expected any time soon. We think the USD and US rate expectations could be quite volatile around upcoming data releases. The next major one is this Friday’s US non-farm payrolls report.

Tonight, the focus for markets will be on the ECB rate decision and President Lagarde’s press conference. We are looking for the ECB to hike rates by another 25bps, and think that given the high Eurozone core inflation, the ECB should continue to point to further tightening over future meetings. If realised, this should give the EUR (and EUR/SGD) further support.

Medium-term, as outlined above, we think market pricing looking for US Fed rate hikes over H2 2023 is unlikely to materialise. In our view, an unwind of these expectations should, over time, give the USD (and in turn USD/SGD) some support but may also weigh on risk sentiment. This mix is normally a headwind for Asian currencies.

SGD event radar: ECB Meeting (Tonight), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3290 / 1.3377, 1.3420