• Mixed signals. Eurozone data undershoots, while the US Employment Cost Index indicates inflation pressures remain strong. China manufacturing PMI dips back into ‘contractionary’ territory.

• Central banks in focus. US Fed and ECB expected to hike rates again later this week. We think there are ‘hawkish’ risks given the inflation pulse.

• AUD & the RBA. We are forecasting the RBA to remain on hold once again. Weaker China data and diverging policy trends are AUD headwinds.

A positive end to April for risk markets with US equity indices rising by 0.7-0.8% on Friday on the back of solid earnings reports, and oil prices lifting by ~2.7%. Elsewhere, bond yields fell, led by a sizeable drop in Europe (German yields declined by ~15bps) following some weaker than expected data (see below). Moves in the US were more contained, with the 2-year yield down ~7bps to 4%, this unwound around half of the previous days increase. In contrast to the normally more short-sighted equity investors, bond market participants remained focused on signs of slowing economic growth and ‘sticky’ inflation. In FX, the USD was mixed, with EUR swinging around ~1.10, GBP outperforming, and the JPY weakening following the Bank of Japan’s decision to announce only cosmetic changes to its already redundant forward guidance on interest rates which had been indicating that further cuts were possible. USD/JPY spiked by ~1.7% to be back above ~136. The push-pull forces have kept the AUD near its lows, and it is now hovering just above ~$0.66.

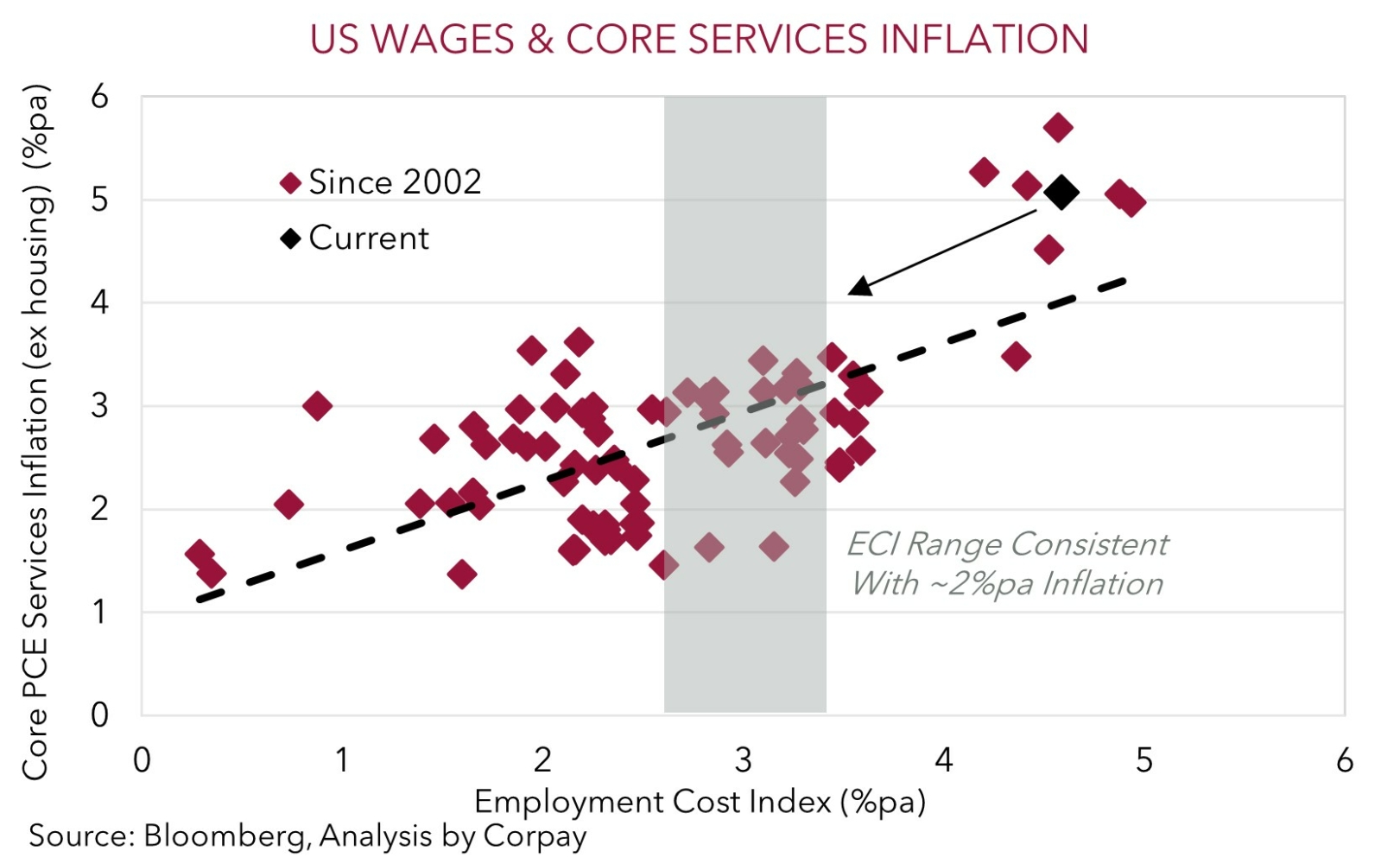

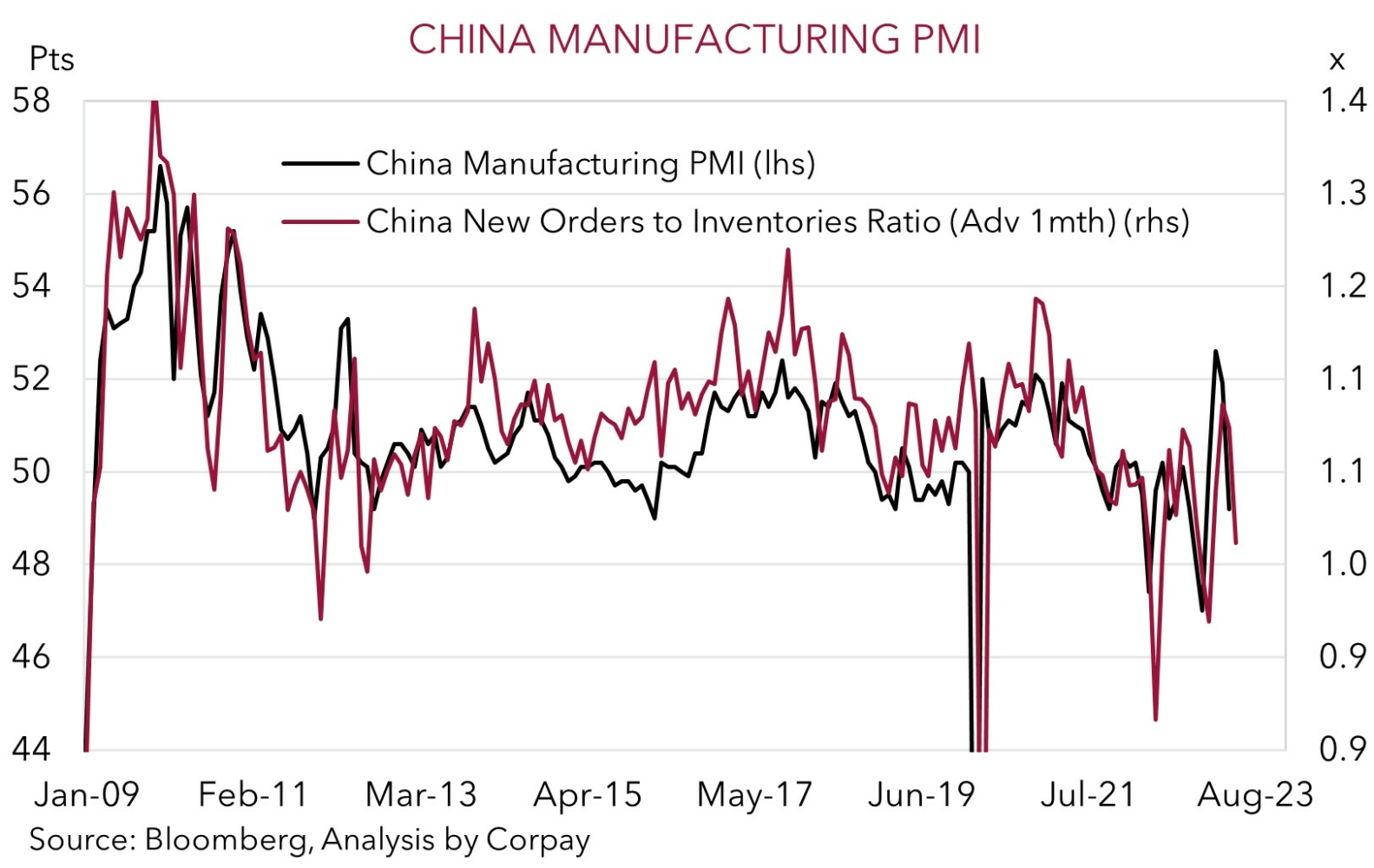

There was a lot of economic news to digest. In Europe, German inflation was lower than expected (CPI slowed to 7.6%pa), as was Eurozone Q1 GDP, with the economy growing by a tepid 0.1%. In the US, the core PCE deflator (the US Fed’s preferred inflation gauge) held steady at a still high 4.6%pa, and the Employment Cost Index (a wage measure the Fed follows closely) exceeded forecasts. In line with the still tight US labour market the ECI is running at ~5.1%pa. As our scatter chart shows, this is inconsistent with the Fed’s 2%pa inflation target, pointing to the need for policy to remain tight for some time yet. In China, the PMIs for April undershot expectations. China’s services PMI is holding up better as the easing of COVID restrictions supports activity by households, however the manufacturing PMI slipped back into ‘contractionary’ territory as the global slowdown impacts industrial activity.

This week the focus will be on central banks. The RBA (Tues AEST), US Fed (Thurs morning AEST) and ECB (Thurs night AEST) hand down their decisions. In contrast to the RBA, which we expect to stay on hold, the ECB and Fed are predicted to raise rates by another 25bps, though we believe a larger 50bp hike by the ECB is still on the table. For the US Fed, in our mind, the still strong inflation pulse suggests there are “hawkish” risks. While this may be the last Fed rate hike, we think policymakers may want to keep the door open to more moves if needed and/or push back against market pricing looking for rate cuts later this year. If realised, an upward adjustment in US interest rate pricing could be USD supportive.

Global event radar: RBA Meeting (Tues), Eurozone CPI (Tues), US Fed Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May).

AUD corner

The AUD remains pinned down near its lows and is currently trading just above ~$0.66 with Friday’s lift in global equities and energy prices providing only modest support. The global economic calendar is jam-packed this week, which suggests AUD volatility should lift. However, on net, based on our expectations for the major events we think the downward pressure on the AUD should remain in place.

On the AUD side of the ledger, the weaker than anticipated China PMIs (released over the weekend) provides another sign that the global economy is losing steam. The drop in the manufacturing PMI back into ‘contractionary’ territory indicates that industrial activity is weakening, and this is a negative backdrop for commodity demand and in turn the AUD. And as our chart shows, the slump in new orders points to further falls in the PMI over the period ahead.

The RBA meeting (Tues AEST) is the main local event. Given the RBA retains a conditional tightening bias, and based on the strength in the labour market an argument can be made for the RBA to hike rates again. However, we and the market consensus think the stronger case is for the ‘pause’ to continue given signs inflation is turning around, the large amount of ‘natural tightening’ that will unfold as the pool of fixed loans are refinanced at higher rates, and the RBA’s desire to minimise job losses and achieve a ‘soft landing’.

Offshore, the US Fed (Thurs morning AEST) and ECB (Thurs night AEST) meetings are in focus. As discussed above, we are looking for another 25bp rate hike from both but think there are ‘hawkish’ risks to the guidance relative to market thinking given the still strong inflation pulse, particularly in the US. In our opinion, rhetoric from the US Fed that it could hike rates further if the inflation situation doesn’t improve as expected, and/or that rate cuts baked into markets for later this year are unlikely to occur could generate an upward repricing in US interest rate expectations, supporting the USD.

Similarly, we believe AUD/EUR should remain on the backfoot as diverging RBA and ECB policy decisions push interest rate spreads in favour of the EUR. Added to that, the relative strength in China’s services sector (as illustrated by the still high services PMI compared to the manufacturing gauge) should remain a greater positive impulse for the EUR. As outlined before, the Eurozone has stronger ties to the services side of China’s economy (see Market Wire: China’s sector divergence & AUD/EUR).

AUD event radar: RBA Meeting (Tues), RBA Gov. Lowe Speaks (Tues), AU Retail Sales (Weds), Eurozone CPI (Tues), US Fed Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Fed Chair Powell Speaks (19th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6525, 0.6565 / 0.6692, 0.6735

SGD corner

USD/SGD continues to oscillate around ~$1.3350, with the slight lift in the USD index (thanks largely to the weaker JPY following Friday’s BoJ announcement, see above) counteracting the uptick in risk sentiment. We continue to think that USD/SGD can nudge up towards to the top of its ~$1.3150-1.3450 range over the period ahead, and that the EUR should continue to outperform the SGD.

This week the focus will be on the ECB and US Fed policy meetings (both Thursday). We are looking for 25bp hikes from both central banks, however we think ‘hawkish’ messages are where the risks reside. Indeed, we believe there is a chance the ECB delivers another larger than usual 50bp hike given the very high Eurozone inflation. And we think that based on the still tight US labour market and ‘sticky’ US services inflation, the US Fed could preserve the option of more tightening down the track if needed and/or lean against market pricing looking for rate cuts later this year. Broadly speaking, slowing global growth (as illustrated once again over the weekend by the weaker than forecast China PMIs), combined with further tightening by the US Fed and ECB should favour currencies like the USD and EUR over ones like the SGD which are tethered to the global economic cycle.

SGD event radar: RBA Meeting (Tues), Eurozone CPI (Tues), US Fed Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US Jobs Report (Fri), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), China Activity Data (16th May), Fed Chair Powell Speaks (19th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3290 / 1.3377, 1.3420