• Upbeat tone. Last weeks larger than expected rate cut by the US Fed continues to wash through markets. US PCE deflator in focus this week.

• Global PMIs. Softer Eurozone PMIs weighed a bit on the EUR. US PMIs holding up. Cyclical currencies like the NZD & AUD remain firm.

• RBA today. In contrast to its peers the RBA is expected to keep rates on hold today. Divergence between the RBA & others is underpinning the AUD.

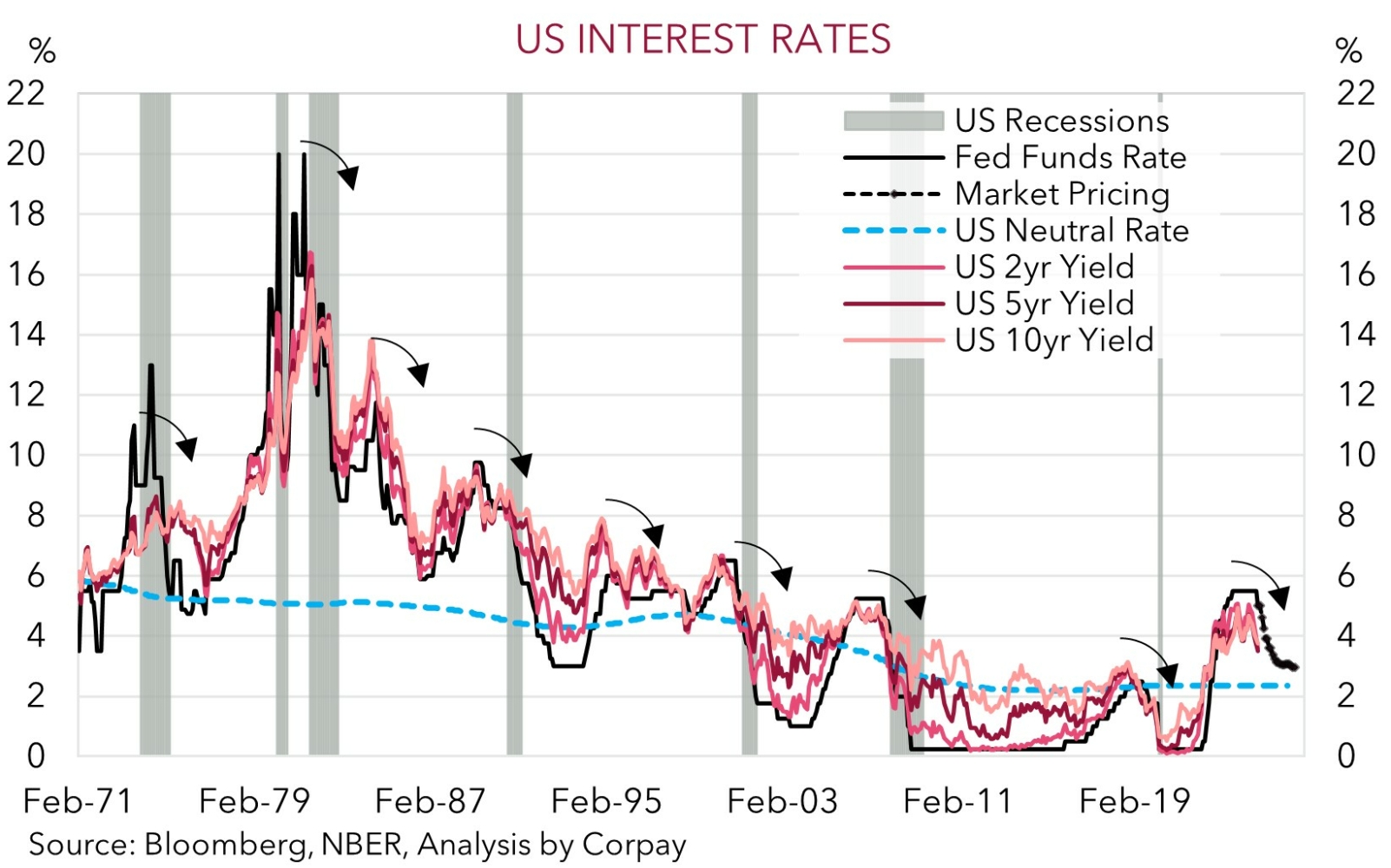

The implications of last week’s bigger than expected 50bp rate cut by the US Federal Reserve continues to be digested by markets. The Fed’s proactive step, with more to come, has bolstered expectations the US economy should experience a ‘soft landing’. This is underpinning risk sentiment with the US S&P500 tracking just below its recently touched record highs. Elsewhere, the US 2yr bond yield (now ~3.59%) is consolidating at the bottom of its cyclical range, while the benchmark 10yr rate (now ~3.75%) is also not that far from its ~1-year lows. Interest rate markets are factoring in another ~75bps of rate cuts by the US Fed over the remaining two meetings of 2024.

In FX, the USD index clawed back a little ground overnight though this largely reflected a weaker EUR (now ~$1.1115) after the latest batch of Eurozone business PMIs underwhelmed. The Eurozone composite PMI slipped back into ‘contractionary’ territory for the first time since February, rekindling concerns about the Eurozone’s growth trajectory. This exerted downward pressure on Eurozone bond yields as ECB rate cut expectations nudged up. By contrast, the US PMIs held up with the composite gauge holding in ‘expansionary’ territory, while the price components also suggested inflation pressures could be re-emerging. This is something that needs to be watched. Across the other FX majors the USD remained on the backfoot with GBP edging higher (now ~$1.3345, towards the top of the range occupied since Q1 2022), and USD/JPY drifting a touch lower (now ~143.60, ~11.4% from its early July multi-decade peak). USD/SGD (now ~1.2910) remains around low levels last traded a decade ago, while growth-linked currencies like the NZD (now ~$0.6265) and AUD (now ~$0.6835) have extended their upswings.

Looking ahead, speakers from the US Fed and the US PCE deflator (the Fed’s preferred inflation gauge, released Friday) will be in focus over coming days. The headline US PCE deflator looks set to slow further, while we expect the various Fed officials to stress that to stick the soft economic landing and extinguish the downside risks in the jobs market further rate cuts over the next year are in train. The US Fed funds target range (now ~4.75-5.0%) remains well north of the equilibrium ‘neutral’ zone which is estimated to be ~2.75-3.0%. As the Fed delivers more ‘growth supportive’ rate cuts and US bond yields continue to fall we believe the USD should deflate over the medium-term.

AUD Corner

The upbeat tone in risk markets and downward pressure on the USD in the lead up to and post the US Fed’s outsized interest rate cut last week has underpinned the AUD. At ~$0.6835 the AUD is within striking distance of its late-December 1-year highs. The backdrop has also been helping the AUD strengthen on most of the major crosses. AUD/EUR (now ~0.6150) and AUD/CNH (now ~4.8265) are hovering near the top of their respective two-month ranges, AUD/JPY (now ~98.17) has edged up towards its ~1-year average, AUD/NZD is back above ~1.09, and AUD/CAD (now ~0.9250) is around the upper end of the range it has occupied since Q1 2023.

Today, attention will be on the RBA policy decision (2:30pm AEST) and Governor Bullock’s press conference (from 3:30pm AEST). In contrast to the moves offshore, no change in interest rates is anticipated from the RBA today. At the last meeting in August and subsequent speech Governor Bullock pushed back against market pricing looking for interest rate cuts by the end of 2024. From our perspective the domestic economic data since then has generally panned out in line with the RBA’s predictions. Importantly, the Australian labour market remains on solid footing. Unemployment held steady at a low 4.2% in August, and job creation is positive. While growth rates have slowed, particularly across the interest rate sensitive and ‘goods-producing’ sectors, the level of activity (especially across labour intensive ‘services-providing’ sectors) is elevated. The mismatch between demand and supply is underpinning the jobs market and keeping domestic inflation ‘sticky’. With this in mind, we expect the RBA to reiterate that it “remains vigilant to upside risks to inflation” and that the “Board is not ruling anything in or out” when it comes to interest rates.

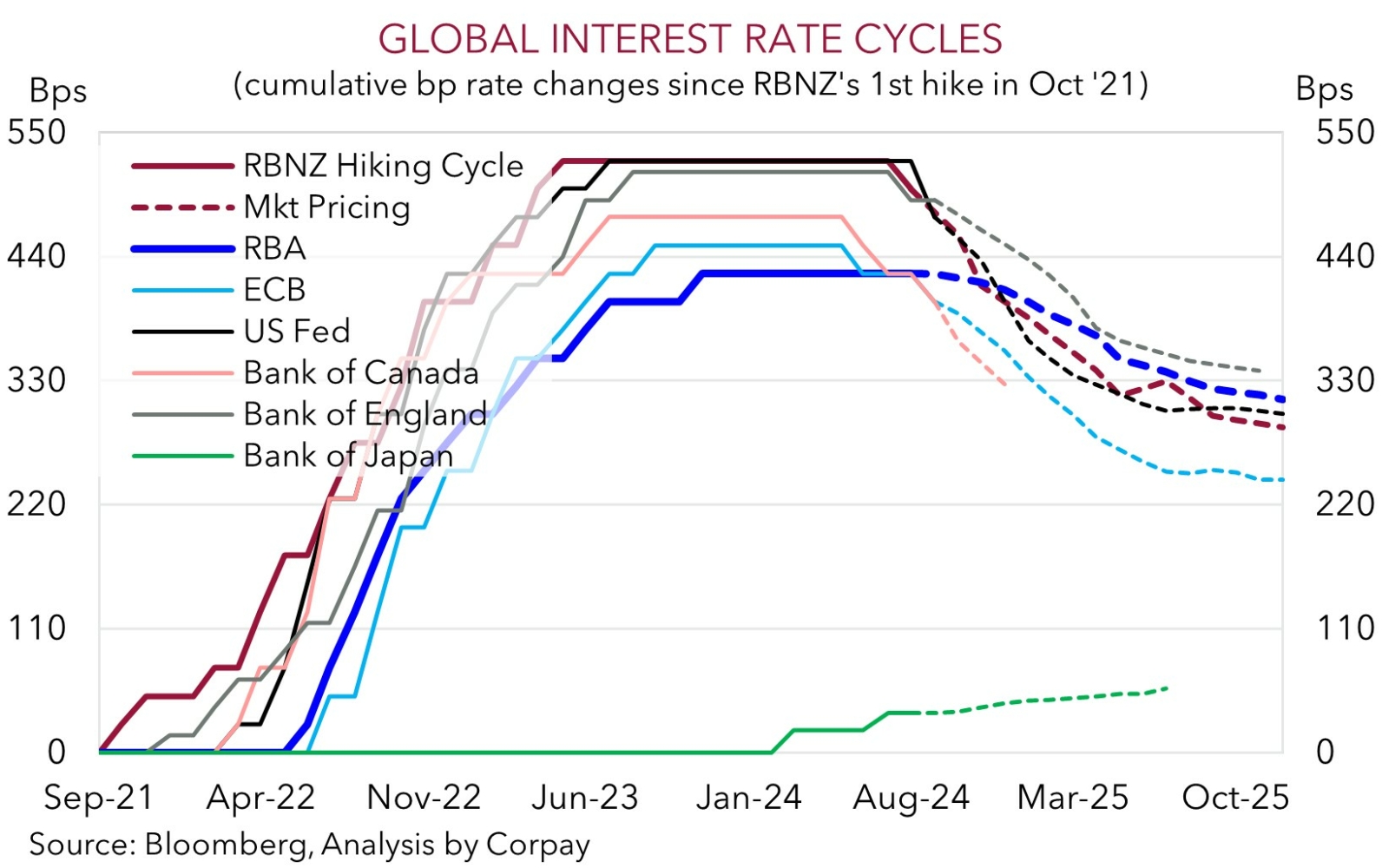

As pointed out previously, the RBA diverged from its peers during the interest rate hiking phase, and based on domestic inflation/jobs trends, the fiscal/income support that is flowing, and its relatively lower starting point, we believe it will also lag on the way down in terms of when it starts and how far it goes during the rate cutting cycle. The ongoing adjustment in interest rate differentials in Australia’s favour, coupled with upbeat risk sentiment should be AUD supportive not just against the USD but also against currencies like the EUR, CAD, NZD over the medium-term, in our opinion.