• Shaky sentiment. A bit of a rebound in risk sentiment overnight following more turbulence on Friday after the US jobs report & Fed comments.

• Market swings. US yields near bottom of their range. USD has recovered some ground, while the NZD & AUD have lost altitude.

• Event radar. US Pres. debate (Weds), US CPI (Weds), & ECB meeting (Thurs) in focus this week. Will the USD’s revival continue?

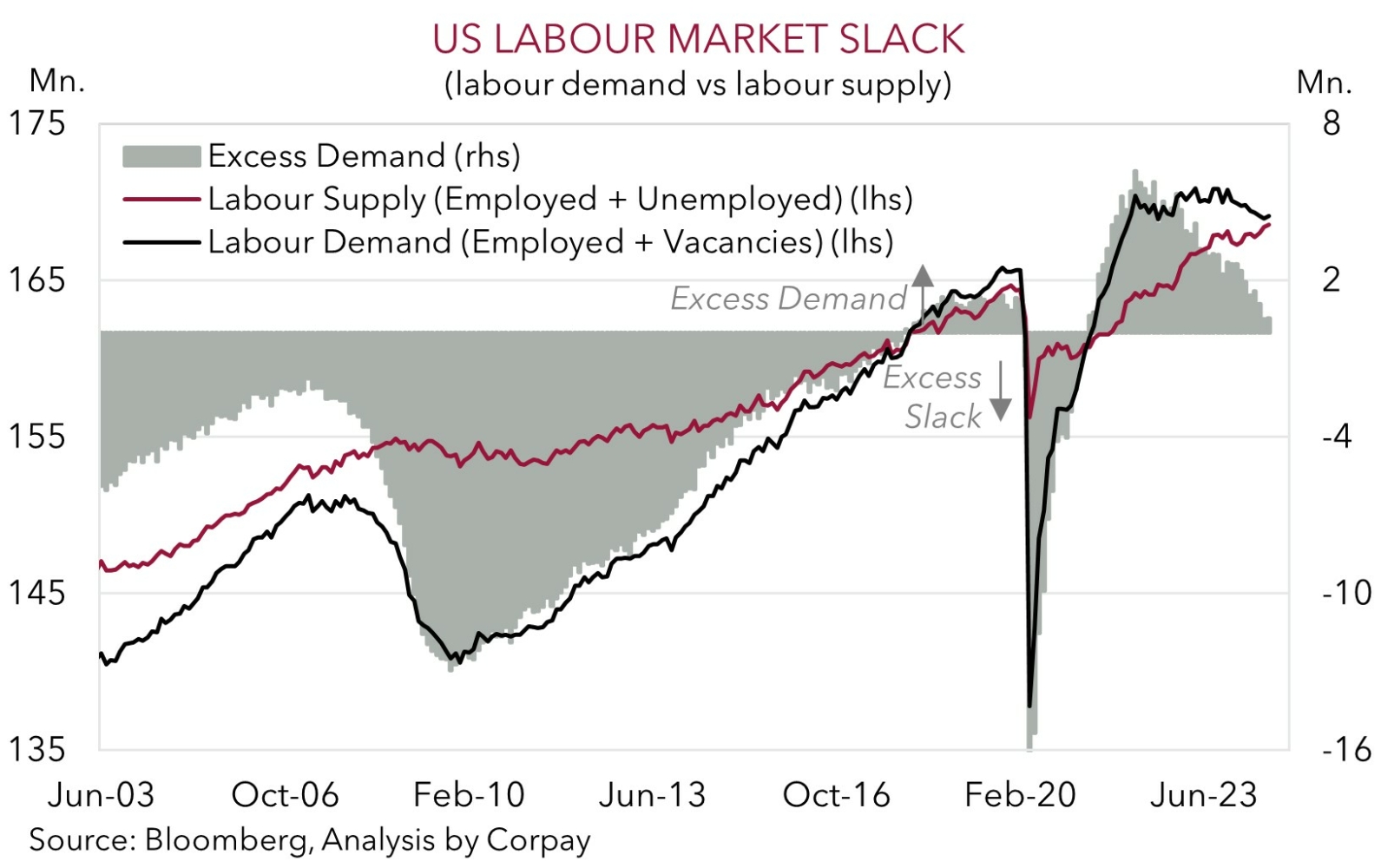

Markets have enjoyed a relatively more positive start to the week as the dust settled following Friday nights US jobs report and comments by Fed officials which generated further turbulence. From our perspective the US labour market report was reassuring as it suggests the slowdown is still gradual and something more sinister isn’t unfolding. US unemployment ticked back down (now 4.2%), non-farm payrolls improved in August (although there were downward revisions to prior months), and jobs growth in the household survey re-accelerated. As our chart shows, the US labour market has rebalanced with demand now matching supply. This supports our thinking the US Fed is likely to remove its policy restraint by lowering interest rates via a steady stream of 25bp steps from its upcoming meeting (19 Sep AEST). Outsized moves are possible down the track if US macro conditions worsen as the high level of rates (the funds rate is now ~5.25-5.50%) gives policymakers room to respond if it ends up being needed.

In terms of markets, US equities bounced back with the S&P500 and NASDAQ both 1.2% higher overnight. Gains were broad-based with all 11 sectors in the S&P500 in the green. Although this only partially unwinds last weeks loses, with the ~4.3% drop in the S&P500 its biggest since early-March. The more upbeat tone was also observed in commodities with base metals like copper (+1.7%) and iron ore (+2.7%) and oil (WTI +1.7%) rising. US bond yields consolidated, albeit at low levels. The US 2yr yield (now ~3.67%) is near the bottom of its multi-year range while the benchmark 10yr rate (now ~3.70%) is around its recent lows. In FX, the USD has clawed back more ground. This is something we were flagging in our commentary last week. EUR is tracking at ~$1.1035, GBP is near ~$1.3070, and USD/JPY has nudged up towards ~143. The NZD (now ~$0.6150) and AUD (now ~$0.6663) have lost altitude with the antipodean currencies ~1.2% below where they were at this time on Friday.

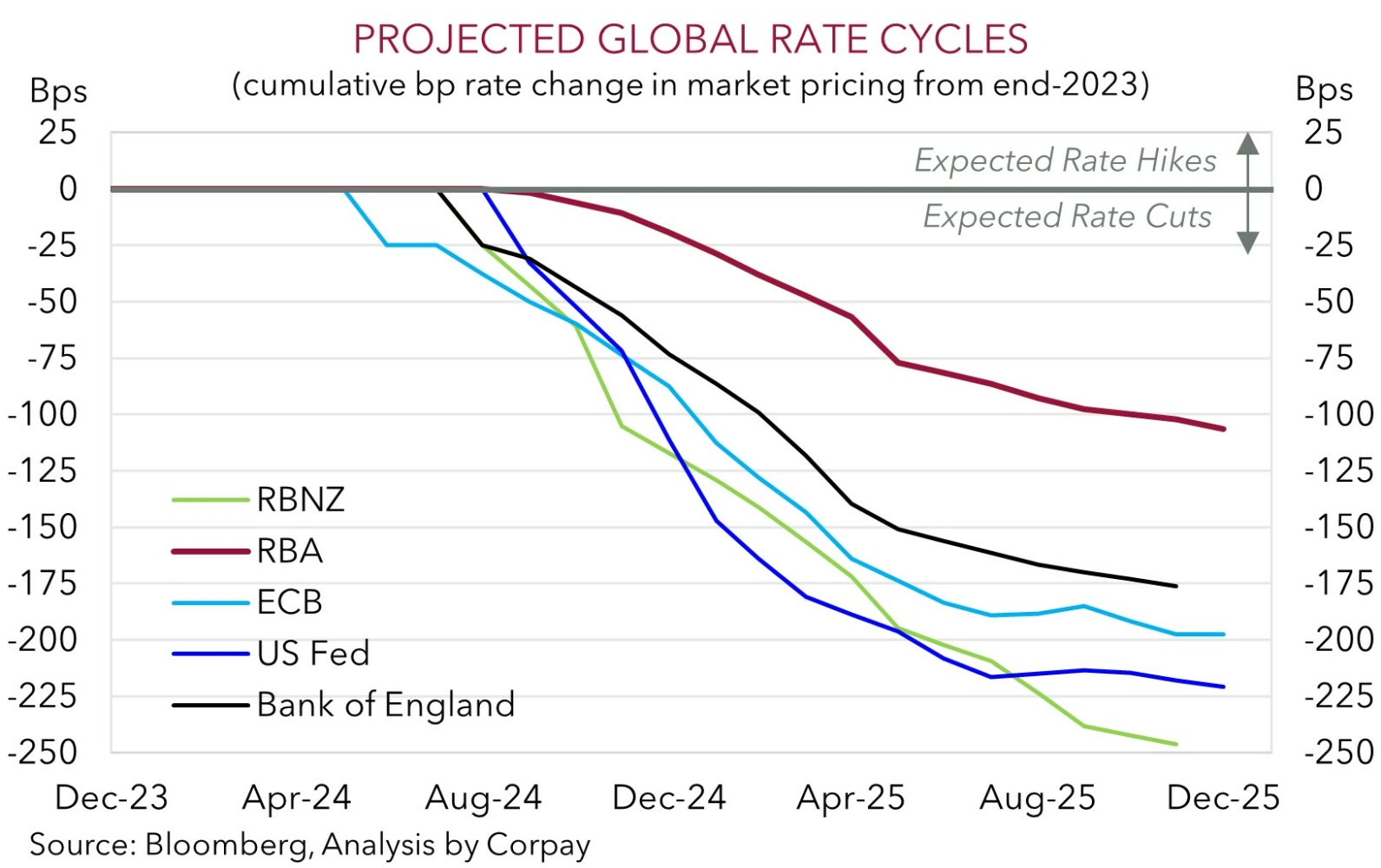

Looking ahead, the US Presidential Debate (Weds 11am AEST), US CPI inflation (Weds 10:30pm AEST), and ECB decision (Thurs night AEST) will be in focus this week. In our opinion, the economic and political events may generate additional volatility. A solid (poor) showing by Vice President Harris in the debate might temper (revive) various ‘Trump trades’ linked to his policies aimed at imposing tariffs on US imports (particularly from China) such as a weaker CNH/stronger USD. Fundamentally, we think the incoming releases may give the USD more renewed support. Signs US core inflation is leveling off at an above target rate could see markets pare back their aggressive Fed rate cut expectations. Markets are factoring in a ~33bp cut by the Fed in September with ~182bps worth of easing discounted over the next 5 meetings.

AUD Corner

The USD rebound and shaky risk sentiment over the past few sessions has dragged down the AUD. At ~$0.6663 the AUD is inline with its 3-month average and ~1.9% below where it was trading this time a week ago. The AUD has also lost ground on the major crosses over recent days, although it did perk up a little overnight. AUD/EUR (now ~0.6035), AUD/CNH (now ~4.7442) and AUD/NZD (now ~1.0840) are just below their respective 1-year averages, AUD/GBP (now ~0.5098) is towards the bottom of its 1-month range, and AUD/JPY (now ~95.40) has slipped to its 2-year average.

This week the local economic calendar is light. Australian consumer confidence (10:30am AEST) and business conditions (11:30am AEST) are due today. Offshore, China trade data for August (no set time) is also set for release. Signs in the business conditions report that price pressures and capacity constraints remain in place across the economy despite slower growth momentum could reinforce expectations that the RBA is on a slightly different path to its peers. The high level of demand across labour intensive sectors and fiscal/income support that is flowing underpins our long-held assessment that the RBA is set to lag other major central banks in terms of when it starts to cut interest rates and how far it goes during the next easing cycle. Over the medium-term we think this should be AUD supportive on crosses like AUD/EUR, AUD/CAD, AUD/GBP, and AUD/NZD where their respective central banks have started to lower interest rates. Indeed, we expect the ECB to cut rates again this week (Thursday night AEST) and indicate it has more to come.

That said, we believe AUD/USD could face more short-term headwinds. The US Presidential Debate (Weds 11am AEST) and US CPI inflation (Weds 10:30pm AEST) are important USD focal points this week. A strong (poor) showing by Vice President Harris might boost (lower) her chances of capturing the White House in early-November. This in turn may soften (strengthen) the USD as former President Trump’s trade/economic policies are priced out (priced in). Beyond the political theatre, we think the incoming US data might also aid the USD’s recovery. Signs US core inflation is ‘sticky’ may see markets temper their aggressive US Fed rate cut bets. If realised, we feel an upward adjustment in US rate expectations could be a USD tailwind.