• Hold the line. US S&P500 dipped, as did US yields & the USD. US ADP employment underwhelmed. But this hasn’t been a great guide for payrolls.

• US employment. Non-farm payrolls tonight. USD (& AUD) reaction likely to be binary. Stronger (weaker) data could be USD positive (negative).

• RBA rhetoric. Gov. Bullock held firm. Level of demand & inflation still high. Rate cuts look some time away. Policy divergence AUD supportive.

Recent market trends generally extended overnight, although the size of the moves has been more limited. The US S&P500 (-0.3%) slipped back for the third straight day, something which hasn’t happened since July, despite a bounce in the tech-sector (NASDAQ +0.3%). Copper (+1.5%) and energy prices (WTI crude +0.2%) also ticked up. Although if you take a step back oil is still hovering near its year-to-date lows (now ~US$69.30/brl). The pullback in US and European bond yields continued with the US 10yr rate shedding another ~3bps (now ~3.73%, around the bottom of its 1-year range). This exerted a bit more downward pressure on the USD. EUR (now ~$1.1111) and GBP (now ~$1.3180) nudged up, USD/CAD consolidated (now ~1.3505), and the interest rate sensitive USD/JPY eased further as yield differentials moved against the USD. At ~143.40 USD/JPY is ~11.5% from its early-July cyclical peak. The softer USD has given the NZD (now ~$0.6223) and AUD (now ~$0.6740) a helping hand.

Data wise there were more signs the US labour market is losing steam. The ADP report showed that private employers added just 99,000 jobs in August, the lowest in more than 3-years. And while the ISM services gauge held steady in ‘expansionary’ territory and new orders improved, hiring intentions moderated. This adds to the subpar US JOLTs job openings report released yesterday. The probabilities of the US Fed starting its interest rate cutting cycle in a few weeks with an outsized 50bp step remain elevated. Markets are factoring in a ~35bp move in September with ~172bps worth of easing discounted over the US Fed’s next 5 meetings.

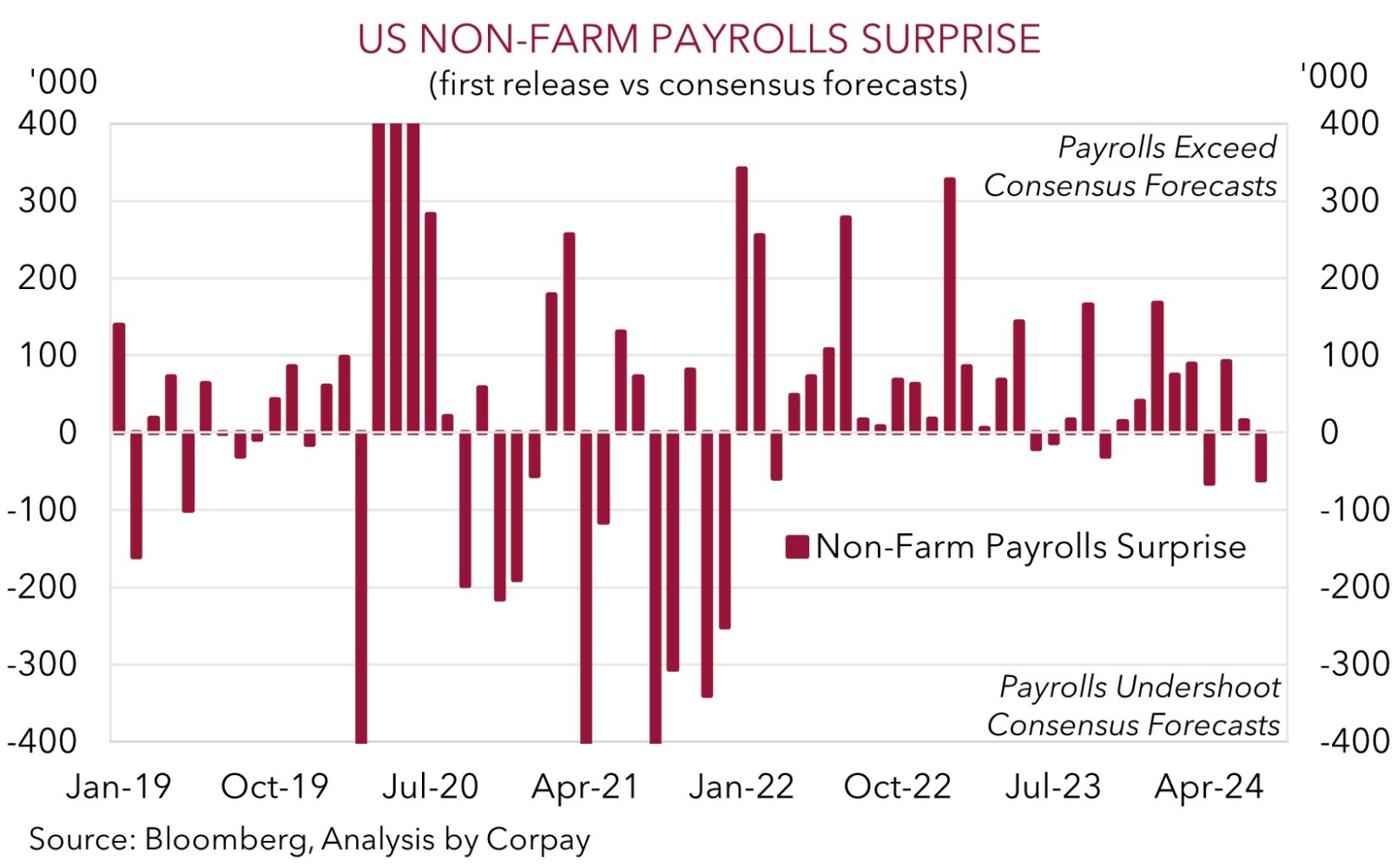

Market attention will be on tonight’s monthly non-farm payrolls report (10:30pm AEST). Consensus is forecasting non-farm payrolls to have grown by ~165,000 in August, unemployment to have edged down to 4.2%, and faster wage growth (from 3.6%pa to 3.7%pa). As our chart shows, US non-farm payrolls were weaker than anticipated last month, but this hasn’t been the norm over the past year. Indeed, a closer look at the July figures suggests weather disruptions played a role in holding down employment and pushing up unemployment. We think some statistical payback might come through in August. Given the data will make or break the case for a 50bp reduction by the US Fed later this month the reaction in US interest rates and FX could be binary with a stronger (weaker) US jobs report likely to be a USD positive (negative).

AUD Corner

A further decline in US bond yields and softer USD stemming from more signs the US labour market is losing momentum has helped the AUD drift higher. At ~$0.6740 the AUD is north of its 1-month average and ~1.2% from its recent multi-month peak. By contrast the AUD has tread water on the crosses. AUD/EUR (now ~0.6066), AUD/JPY (now ~96.67), AUD/GBP (now ~0.5114), and AUD/CNH (now ~4.7785) have consolidated, and while AUD/CAD ticked up (now ~0.9101) AUD/NZD (now ~1.0830) eased slightly.

Locally, RBA Governor Bullock spoke yesterday on “the costs of high inflation”. The commentary and underlying tone stuck to the recent script. According to the Governor, the RBA’s priority is to bring inflation down as it is still problematic, low stable inflation creates more certainty across the economy, the RBA remains wary of upside inflation risks, and policy settings will remain “sufficiently restrictive” until inflation is on a sustainable path to target. Moreover, when asked about the weak Q2 GDP Governor Bullock made similar points to what we have said. While growth rates have slowed the level of demand is still higher than the ability of the economy to supply goods and services (see Market Musings: Australia GDP: growth vs levels). This mismatch will take time to rebalance given the RBA wants to preserve as many of the COVID-era job gains as it can. Based on this trade-off, without a spike in unemployment, interest rate cuts in Australia look like a story for H1 2025. Indeed, Governor Bullock reiterated that “the Board does not expect that it will be in a position to cut rates in the near term”.

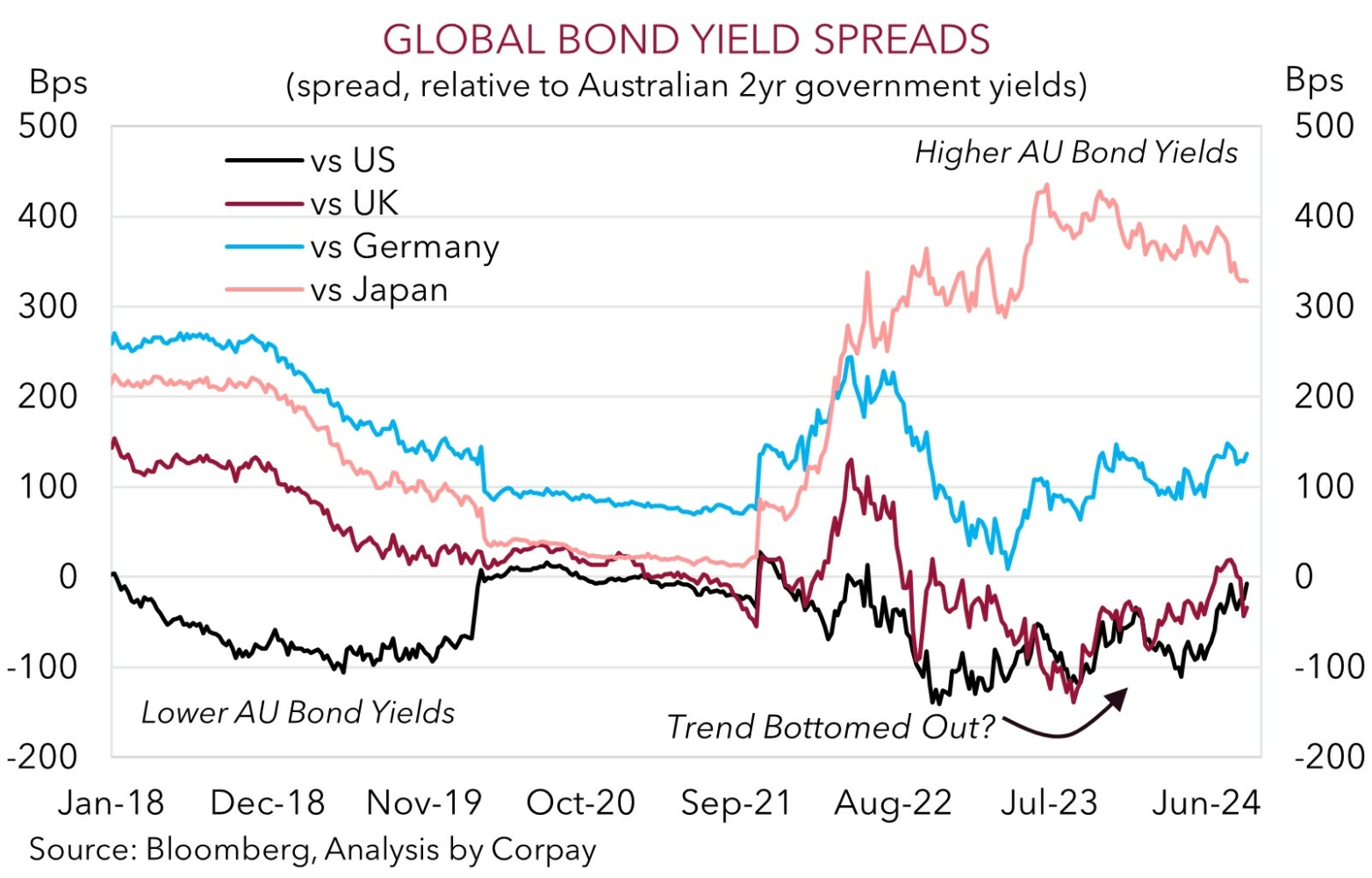

In our opinion, diverging monetary policy outlooks should be AUD supportive on crosses like AUD/EUR, AUD/CAD, AUD/GBP, and AUD/NZD where their respective central banks have started to lower rates. As our chart shows, yield differentials have been progressively turning more in the AUD’s favour over 2024. That said, for AUD/USD tonight’s US non-farm payrolls report (10:30pm AEST) is the near-term event risk. As discussed above, based on the current lofty market pricing and the approaching start of the US Fed’s rate cutting cycle, the short-term USD (and in turn AUD) reaction could be binary with a positive US jobs surprise (which is where we think the risks reside) likely to generate a positive knee-jerk reaction in the USD (drag on the AUD). The reverse is possible if the US data underwhelms and markets solidify expectations of a 50bp rate cut by the US Fed in September.