• Positive tone. Equities rose & bond yields slipped back. No new news was good news for markets. AUD edged higher & outperformed on the crosses.

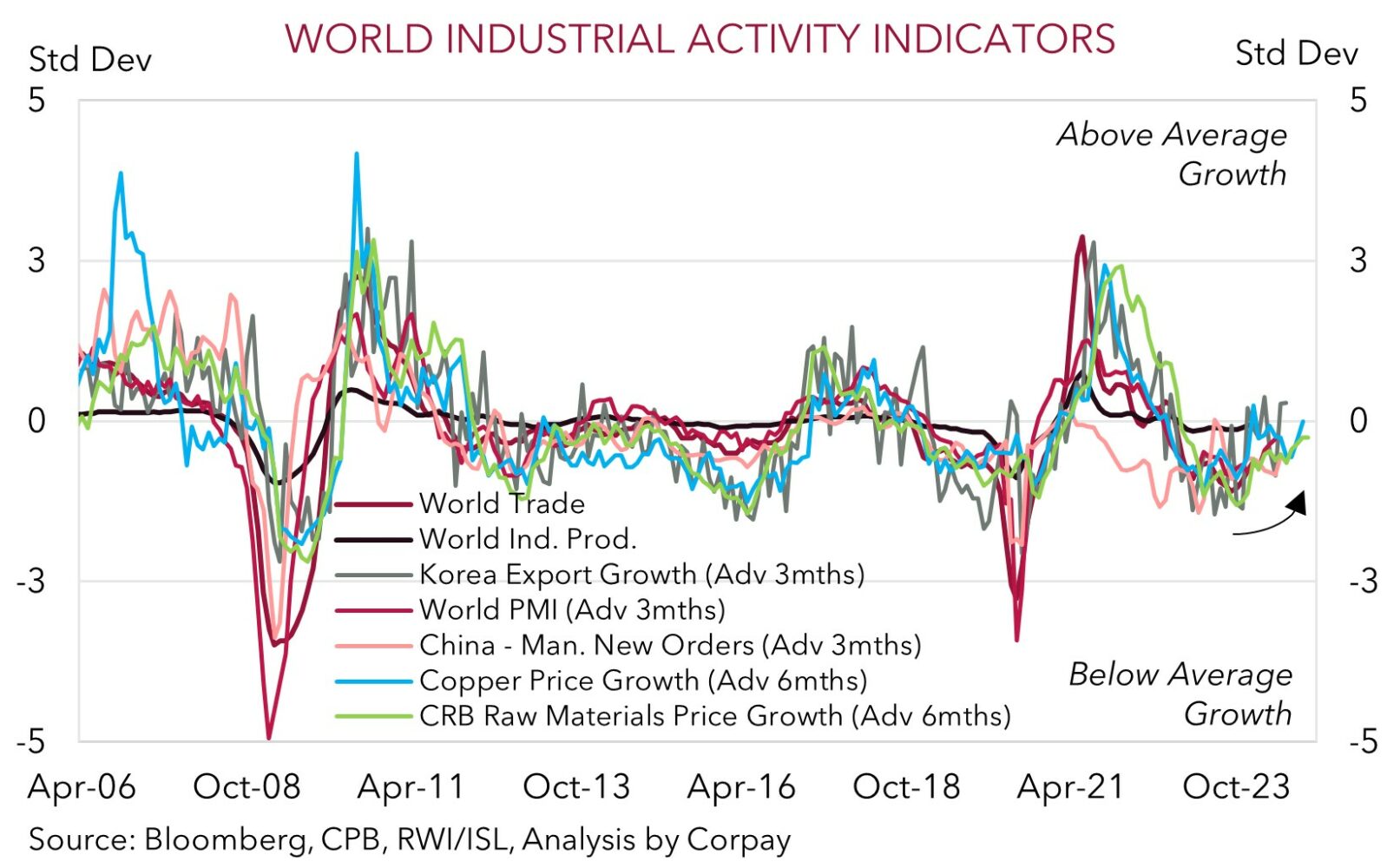

• Business PMIs. European & US PMIs released today. Leading indicators point to a pick up in global industrial activity over coming months.

• AU CPI. Australian quarterly inflation due tomorrow. Signs the improvement in core inflation is stalling could push out RBA rate cut expectations.

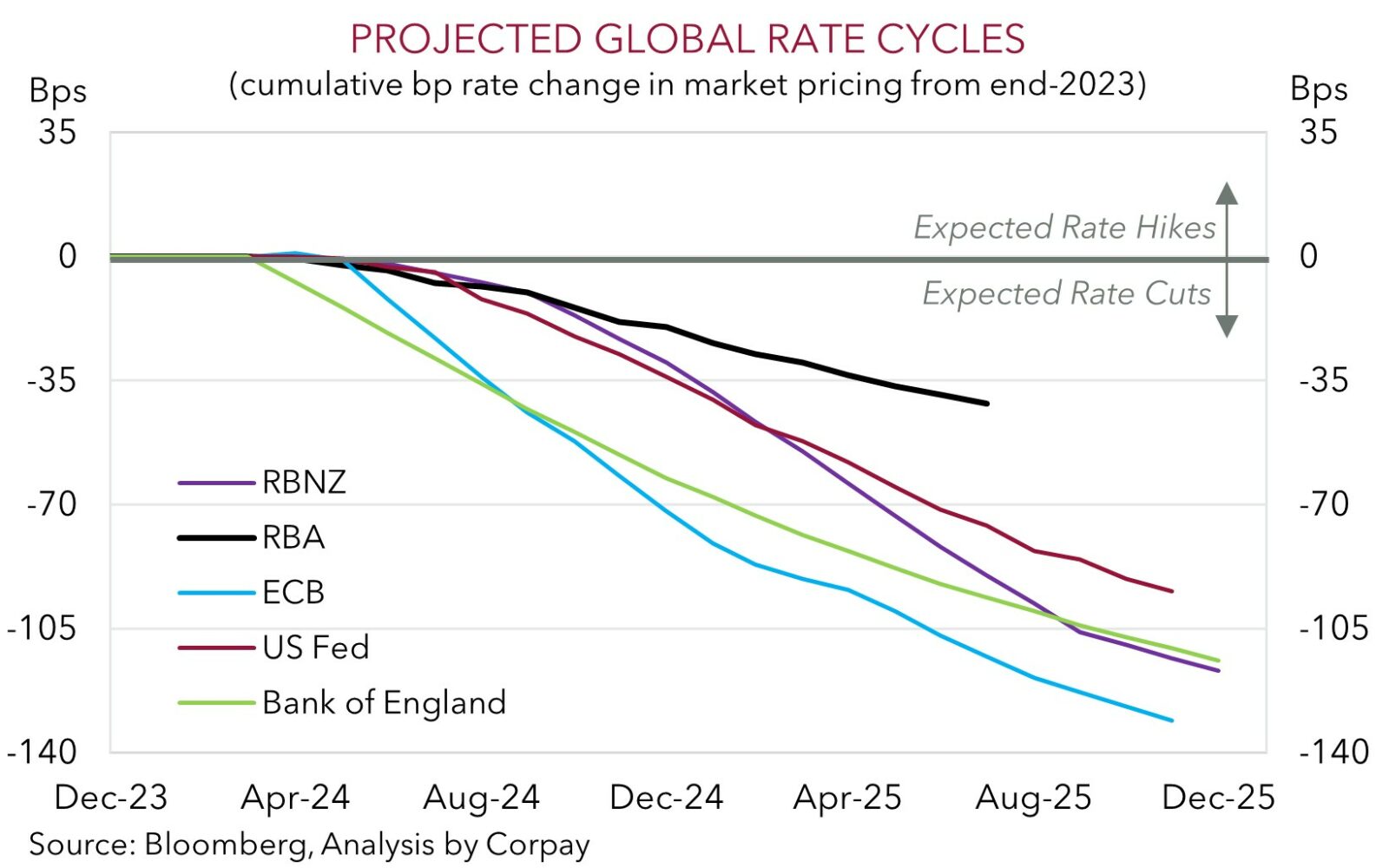

No news is good news with the limited new economic information and a simmering down of Middle East tensions supporting risk sentiment overnight. Equities rose with the US S&P500 (+0.9%) recording its first positive session in over a week. Bond yields gave back a bit of ground with US rates down 1-2bps across the curve (the US 10yr yield is now 4.61%). There were relatively larger moves across Europe. Germany bond yields are 2-4bps lower, and in the UK the policy expectations driven 2yr yield fell ~6bps as markets position for an easing cycle following last Friday’s comments by the BoE’s Ramsden that UK inflation risks are tilted to the downside. The BoE’s Haskel (6pm AEST) and Pill (9:15pm AEST) speak today. Focus will be on whether they share Ramsden’s assessment. Odds of a BoE rate cut by June now sit at ~64% compared to ~40% a week ago with investors assuming over 2 reductions by year-end. By contrast traders are penciling in less than 2 cuts by the US Fed by end-2024, with the first move not fully discounted until November. The first RBA cut now isn’t factored in until early 2025, while over 3 cuts are anticipated by the European Central Bank over this period.

Elsewhere, commodities consolidated with brent crude hovering around ~$87/brl (slightly below its 1-month average), copper is tracking near its highest level since mid-2022, and iron ore (now ~$115/tonne), which has snapped back over April, is above its 6-month average. In FX, the USD index has tread water with EUR moving sideways (now ~$1.0650), USD/JPY ticking up to its cyclical peak (now ~154.80), and GBP extending its pull-back (now ~$1.2350). The improvement in risk appetite helped the cyclical commodity currencies outperform. NZD has poked its head back over ~$0.59 and the AUD is just shy of ~$0.6450.

Ahead of Q1 US GDP (Thurs AEST) and US PCE deflator (Fri AEST) later this week, the latest global business PMIs are due today (Eurozone 5:15-6pm, UK 6:30pm, and US 11:45pm AEST). As our chart shows, leading indicators such as Korean exports, new orders from China, raw material demand, and the copper price are pointing to a pick-up in global industrial activity over coming months. In our view, signs of improvement in the more globally exposed Eurozone economy and/or a softening in US momentum could see the lofty USD slip back particularly as the ‘higher for longer’ US Fed interest rate outlook now appears well priced.

AUD Corner

A more upbeat market mood, as illustrated by the lift in European/US equities, has helped the AUD claw back ground (see above). At ~$0.6450 the AUD is ~1.4% above last Friday’s Israel/Iran ‘risk off’ low. The backdrop has also supported the AUD on the crosses. AUD/EUR (+0.6%) is approaching its 100-day moving average (~0.6073), AUD/GBP (+0.7%) is near the top of the range it has occupied since mid-January (now ~0.5220) as the repricing in BoE rate expectations has continued to wash through, AUD/JPY is at a ~1-week high (now ~99.84) and over 2% above its recent low, and AUD/CNH (+0.5%) is ~1% from its 1-year average.

After its recent torrid spell we believe the AUD can continue to pick itself up off the canvas over the near-term, especially on crosses like AUD/EUR, AUD/GBP, and AUD/NZD which we feel are still too low based on the respective interest rate outlooks and given Australia’s sturdier economic fundamentals. As discussed above, attention today will be on the European and US business PMIs (Eurozone 5:15-6pm, UK 6:30pm, and US 11:45pm AEST). Indications global growth is turning the corner should, in our opinion, be supportive for risk sentiment and cyclical currencies such as the AUD. Tomorrow, Q1 Australian CPI inflation is released and we think core inflation may hold up more than forecast given stickiness across services prices due to wages and other things like rents, and with regulated price rises in areas like education kicking in. Signs that the improvement in Australian inflation may be stalling might see RBA rate cut assumptions pushed out further.

More generally, we remain of the view that there are uneven risks for the AUD down around current low levels. Bearish market positioning (as measured by CFTC futures) is already quite large, the AUD is tracking at a ~2 cent discount to the average across our suite of ‘fair value’ models, and since 2015, when Australia’s capital flow dynamics turned more supportive, the AUD has only traded sub ~$0.6450 ~6% of the time.