• Stagflation concerns. Slower US growth & sticky inflation rattled nerves. US yields rose. Equities slipped back. But on net the USD eased.

• AUD rebound. The positive Q1 Australian CPI surprise & repricing in RBA rate expectations has underpinned the AUD over the past few days.

• BoJ today. No changes expected, but upgrades to inflation forecasts could see the BoJ deliver a ‘hawkish’ message. JPY intervention risks still elevated.

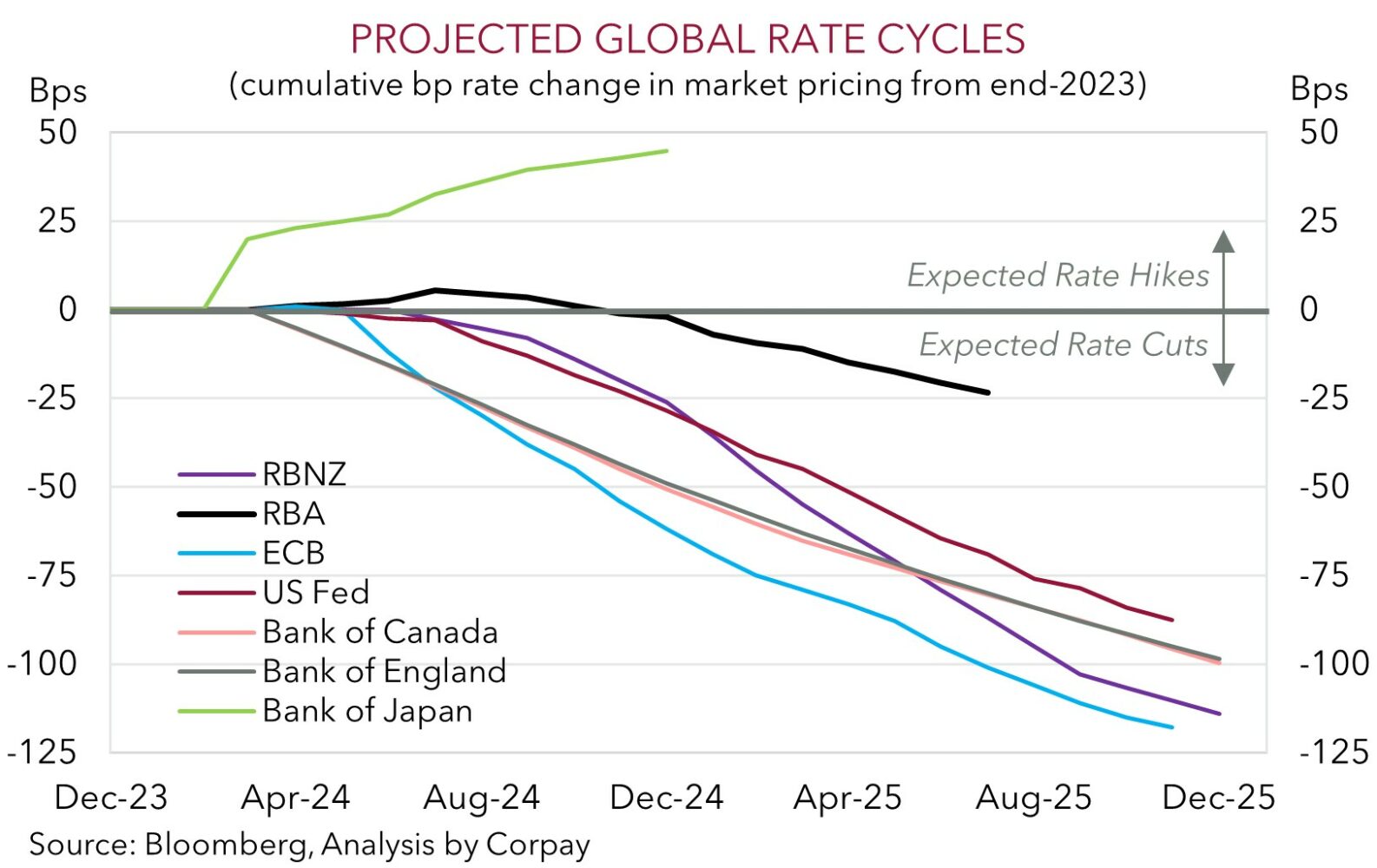

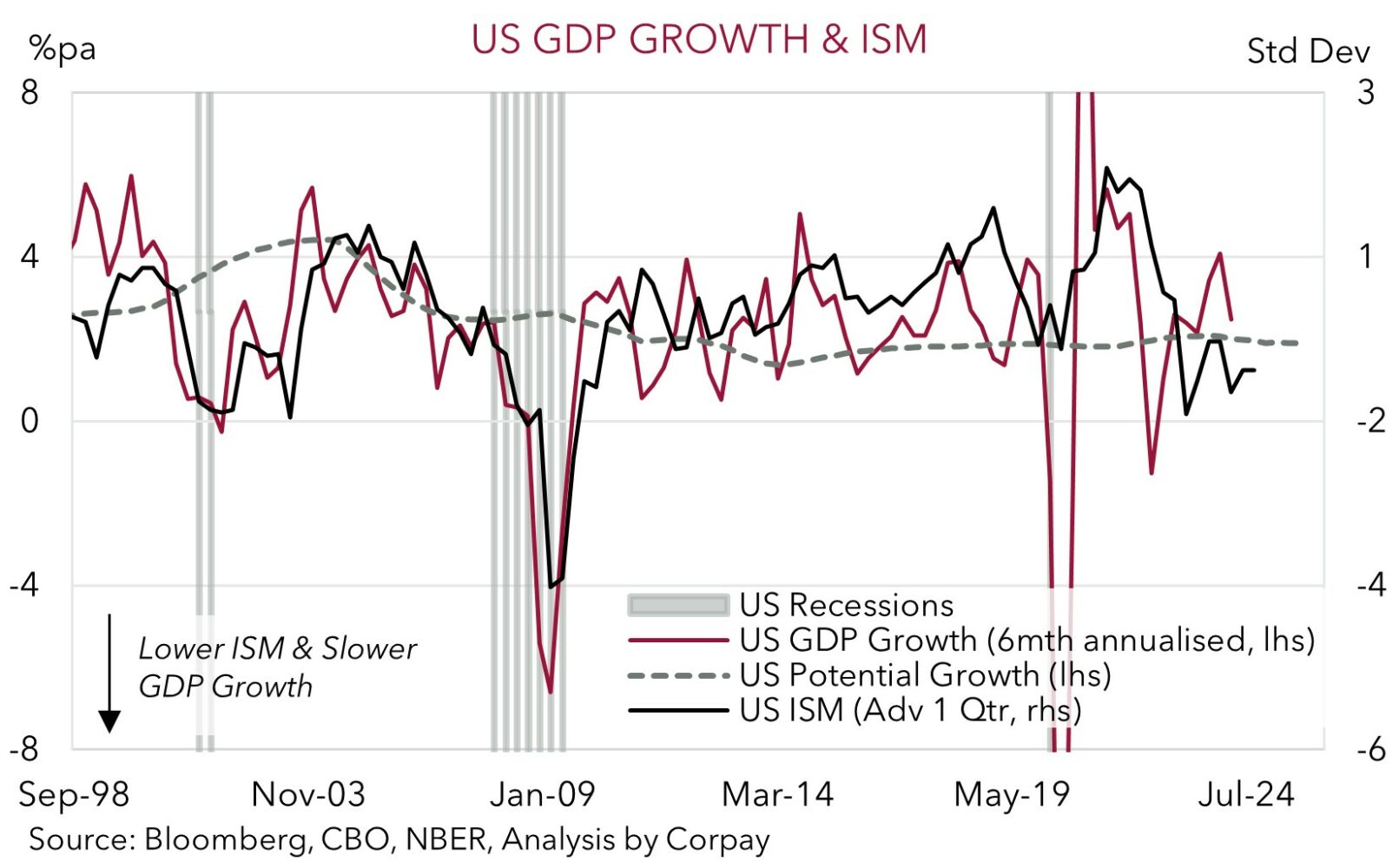

The Q1 US GDP report rattled a few market nerves overnight as “stagflation” concerns (i.e. slow growth and high inflation) returned. Bond yields rose with rates in the US rising by 6-7bps across the curve. The benchmark US 10yr yield is up at 4.7%, its highest level since early November, with markets pushing out their expectations for the first US Fed rate cut (now assumed to be in December 2024) and paring back how far rates could fall this cycle (the fed funds rate is estimated to bottom out at ~4.2% in early-2026, a little more than 100bps lower than where it now is). Equities slipped back, though after being down as much as 1.6% during the session due to the US data/bond yield shift and in reaction to Meta’s earnings results, the S&P500 pared its loses as the day rolled on (-0.5%).

Notably, in FX the knee-jerk positive reaction in the USD to the US data wasn’t sustained. On net, EUR edged higher (now ~$1.0730), as did GBP (now ~$1.2510), while ahead of today’s Bank of Japan meeting USD/JPY consolidated around its multi-decade peak (now ~155.55). Elsewhere, USD/SGD ticked below ~1.36, USD/CNH unwound its previous days rise (now ~7.2553), NZD is just under ~$0.60, and the AUD is grinding up towards its 200-day moving average (~$0.6527) with copper prices (+1.6%) and oil (WTI crude +1.2%) supportive.

In terms of the US data, topline GDP growth undershot consensus forecasts. The US economy expanded at a 1.6% annualised pace in Q1 (mkt 2.5%saar), while the core PCE price index accelerated more than predicted (3.7%saar vs mkt 3.4%saar). At a headline level the combination of softer GDP growth and stronger inflation presents an uncomfortable backdrop for US Fed policymakers. But a closer look at the details suggests things may not be as bad as they seem. The large step down in US growth reflected the volatile net trade and inventories components with momentum in private demand not slowing that much. Similarly, the pickup in core inflation appears to reflect a rise in volatile airline fares. The quarterly core PCE data does pose upside risks to consensus forecasts for tonight’s monthly PCE deflator figures (mkt 2.7%pa) (10:30pm AEST). However, it probably won’t surprise the US Fed (or markets after last night’s data/moves) who are assuming core PCE inflation held steady at 2.8%pa.

Overall, the failure of the USD to strengthen overnight on the back of the lift in US yields reinforces our thinking that a lot of good news is baked into the currency. And that based on stretched market positioning and negative seasonal factors the USD pull-back can extend a bit further near-term, especially if upgrades to its inflation outlook sees the BoJ (today, no set time) keep the door open to further policy tightening and/or Japanese authorities crystalise their vocal threats to intervene to prop up the undervalued JPY.

AUD Corner

While the US GDP report generated some gyrations in bonds and equities, as discussed, the pass through to the USD (and intra-day dip in the AUD) wasn’t sustained. On net, the AUD has extended its push higher with the currency (now ~2.5% above last Friday’s risk aversion low) edging closer to its 200-day moving average (~$0.6527).

On crosses, the AUD has generally held on to its post Australian CPI inspired gains. AUD/EUR has nudged above its 100-day moving average (~0.6072), AUD/GBP is hovering above its 100-day moving average (~0.5207), AUD/NZD (now ~1.0960) is at the upper end of the range it has occupied since last June, and AUD/JPY (now ~101.45) touched its highest point since late-2014. AUD/JPY is now historically high (since 1995 it has been above current levels less than 2% of the trading days). Given its lofty starting point we see more downside than upside potential from here. A ‘hawkish’ turn by the BoJ at todays meeting (no set time) or actions to boost the undervalued JPY could see AUD/JPY fall back quickly.

In terms of the local data, on Wednesday the Q1 CPI report positively surprised and indicated that the battle against inflation is far from over. Headline inflation eased from 4.1%pa to 3.6%pa in Q1 while core inflation (i.e. trimmed mean) nudged down to 4%pa. The moderation in inflation was less than anticipated and importantly stickiness across domestic and services prices remains because of the tightness in the labour market, elevated wages, and other inputs like rents. For more detail see Market Wire: RBA: Inflation challenges remain. The Q1 CPI data, coupled with the resilient labour market, the incoming stage 3 tax cuts, and a few other factors underpin our long held belief that the RBA will lag its peers in terms of when it starts and how far it goes in the next global easing phase. We continue to think that the start of a modest and limited RBA rate cutting cycle remains a story for late 2024, at the earliest.

For the AUD, we feel that diverging monetary policy expectations and Australia’s sturdier economic fundamentals should support pairs like AUD/EUR, AUD/GBP, and AUD/NZD. With respect to AUD/USD we believe there is scope for a further lift near-term given: (a) bearish market positioning (as measured by CFTC futures) is quite large; (b) the upswing in the USD may have run its course as the ‘higher for longer’ US interest rate outlook and US growth outperformance looks factored in; (c) the uptick in industrial metal prices; and (d) the capital flow/valuation support in place. The average across our suite of models is indicating AUD ‘fair-value’ is now ~$0.6650.