• Upbeat tone. Equities rose while yields drifted back on Friday. The JPY’s slide continued. The shift in RBA pricing helped the AUD outperform last week.

• Priced in? A ‘hawkish hold’ expected from the US Fed. Rates markets already look to be factoring that in. A lot of positives appear priced into the USD.

• Event radar. Globally focus will be on the China PMIs (Tues), various US labour stats (including payrolls on Friday), & the US Fed meeting (Thurs).

Risk sentiment ended last week on positive footing. European and US equities rose with the S&P500’s 1% lift on the back of upbeat earnings reports from Alphabet and Microsoft helping the index record its first weekly increase in a month. A dip in bond yields also helped the mood. The US 2yr rate consolidated near ~5 and the benchmark 10yr yield drifted 4bps lower (now 4.66%). The March reading of the US PCE deflator, the US Fed’s preferred price gauge, largely match estimates with core inflation holding steady at 2.8%pa. Stickiness across services inflation remains, but as the March PCE data was not as high as some feared given the signals from the Q1 data released the day prior, markets breathed a sigh of relief.

In FX, the USD index ticked up to be broadly inline with where it was a week ago. However, this doesn’t tell the story beneath the surface. EUR eased slightly on Friday (now ~$1.07), as did GBP (now ~$1.2490), while the AUD held up near its 200-day moving average (~$0.6526) thanks to the strength in equities, firmer industrial prices (copper rose ~1%), and upward adjustment in Australian rate expectations. The relentless slide in the JPY underpinned the USD. The lack of a more ‘hawkish’ turn by the Bank of Japan at Friday’s meeting saw the JPY’s fall accelerate with USD/JPY jumping 1.5% to a fresh multi-decade high (now ~157.90). The JPY’s slump and whether Japanese authorities finally ‘walk the walk’ and step in to prop up the weak currency, or if other nations like China move to offset the impact on their export competitiveness is on the radar. Odds of FX intervention by the Japanese are elevated. If it occurs, we expect a knee-jerk rebound in the JPY, and this would have a cascading impact on the USD as USD/JPY is the second most traded pair.

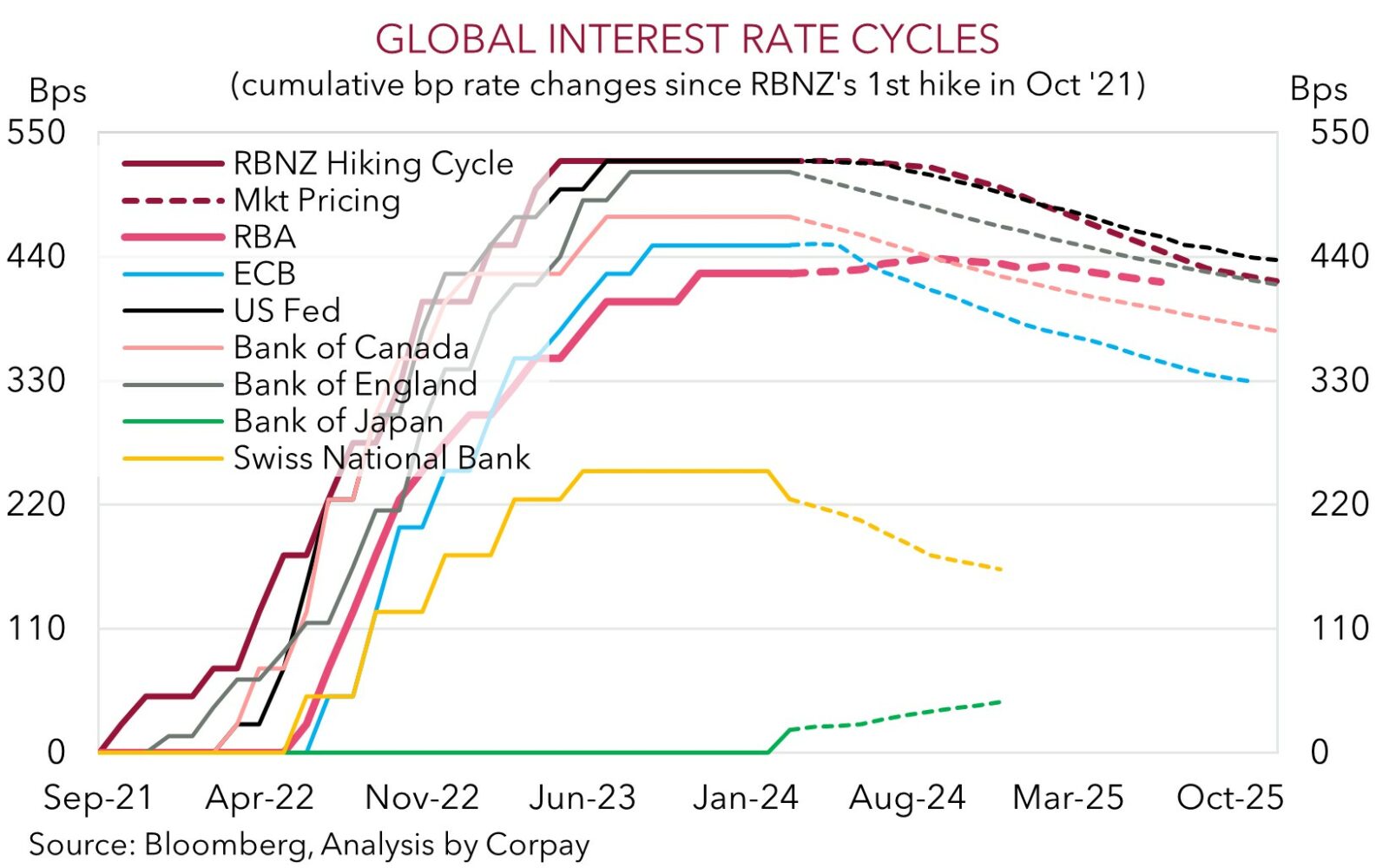

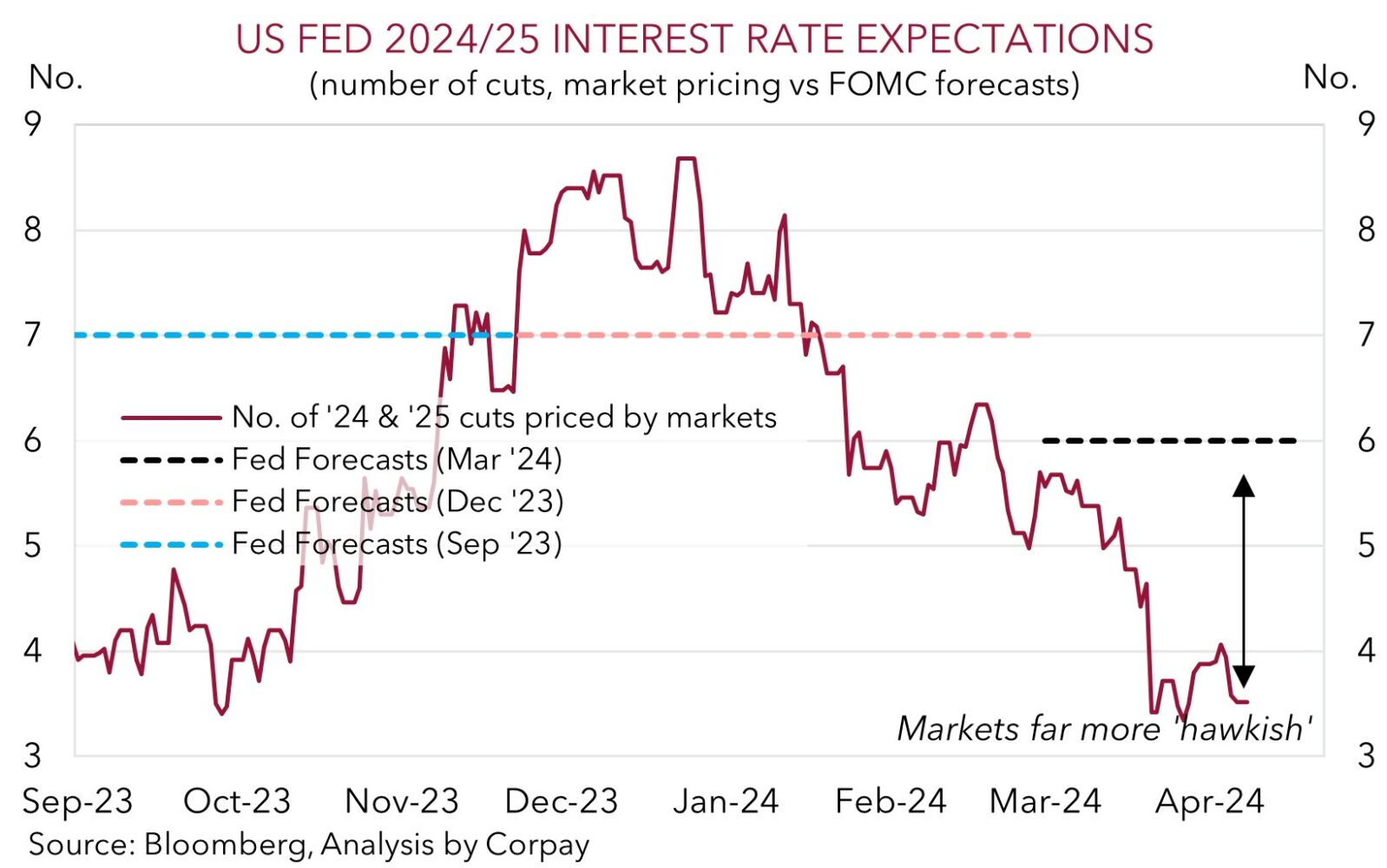

Macro wise the US is center stage this week. A range of labour market indicators are due including the Employment Cost Index (Tues AEST), JOLTs job openings (Thurs AEST), and monthly payrolls report (Fri AEST). On top of that the US Federal Reserve hands down its decision and Chair Powell holds a press conference (Thurs morning AEST). Given a new set of projections won’t be provided at this meeting, attention will be on the Fed’s latest guidance. A ‘hawkish hold’ appears to be the market consensus with Powell likely to note rate cuts aren’t on the table near-term, and that while policy re-calibration later this year is still the base case it will depend on the data. In our opinion, with traders already pricing in a ‘higher for longer’ view (just over 3 cuts are now factored in by end-2025 compared to the Fed’s last assessment 6 might eventuate), the lofty USD may lose ground if the Fed keeps the door open to an easing cycle and/or the incoming data shows employment and wage pressures are cooling.

AUD Corner

The positive tone across risk markets, as illustrated by the lift in US and European equities, coupled with a further rise in copper, and upward shift in Australian interest rate expectations following last week’s Q1 CPI surprise has supported the AUD. Markets are now toying with the idea of another RBA hike with a ~50% chance of a 25bp move by September priced in. A week ago, markets were factoring in half a rate cut by this time.

At ~$0.6530 the AUD has poked its head above its 200-day moving average to be at a ~2-week high (and ~2.8% from its recent Israel/Iran tension lows). The backdrop has also helped the AUD outperform on the crosses. AUD/EUR (now ~0.6106) and AUD/GBP (now ~0.5230) are near the top of their respective multi-month ranges. At ~1.10 AUD/NZD is at levels last traded in June 2023, while the uptrend in AUD/JPY has extended with the JPY’s slump compounding the positive AUD forces. At ~103.10 AUD/JPY is ~5% higher than where it started April and around levels it hasn’t been at since 2013.

As flagged, trends in the JPY and whether Japanese authorities (or other nations around Asia trying to counteract the impact on their export competitiveness) step into markets is in on the radar. In our view, chances of a bout of interventions to boost the undervalued JPY are high. If it occurs this could trigger a sharp knee-jerk reversal in the JPY and AUD/JPY which we think is trading above levels implied by various fundamentals such as longer-term rate differentials.

More broadly, we believe that the AUD’s revival can continue given: (a) the still large amount of bearish ‘net short’ positioning in place; (b) the China PMIs (Tues) are predicted to show conditions remain ‘expansionary’; (c) Australian retail sales (Tues) may come in stronger because of this years earlier Easter and positive impacts from the Melbourne Grand Prix; (d) downside risks we see to consensus forecasts for the key US labour market stats (including non-farm payrolls on Friday) based on signals from various indicators; (e) the shift in relative yield differentials owing to the change in thinking about the RBA and our thoughts US rate expectations have already repriced a lot and the US Fed (Thurs morning AEST) may not be able to exceed the markets ‘hawkish’ assumptions; (f) the valuation support. The average across our suite of models is indicating AUD ‘fair-value’ is now ~$0.6650; and (g) further strength on some crosses. We believe the AUD/NZD upswing might continue with the Q1 NZ labour market report (Weds) forecast to show conditions softened. This would reinforce views the RBNZ could start lowering interest rates well ahead of the RBA.