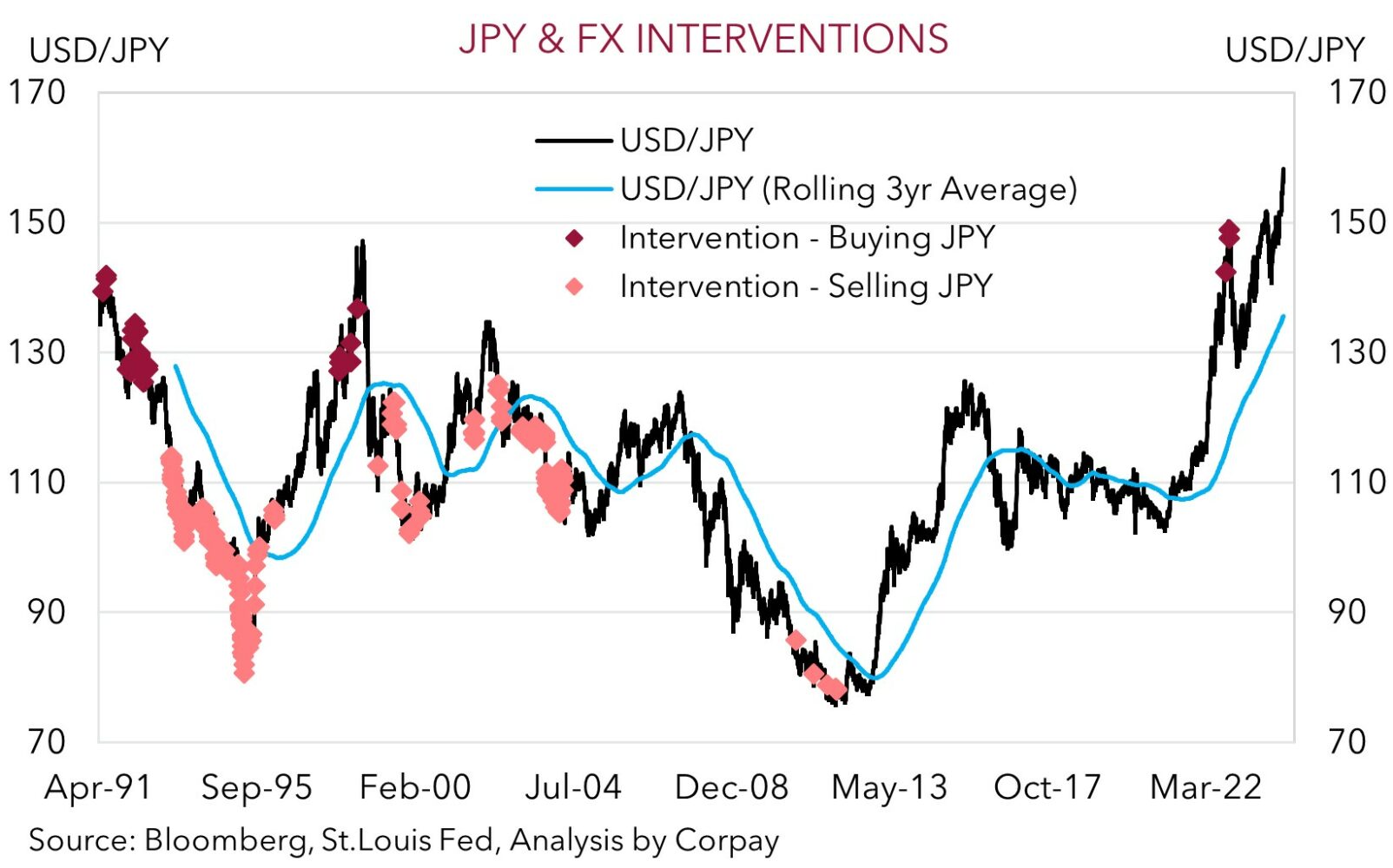

• JPY vol. USD/JPY dropped sharply yesterday. Intervention hasn’t been officially confirmed. Risk of action to prop up the weak JPY remains elevated.

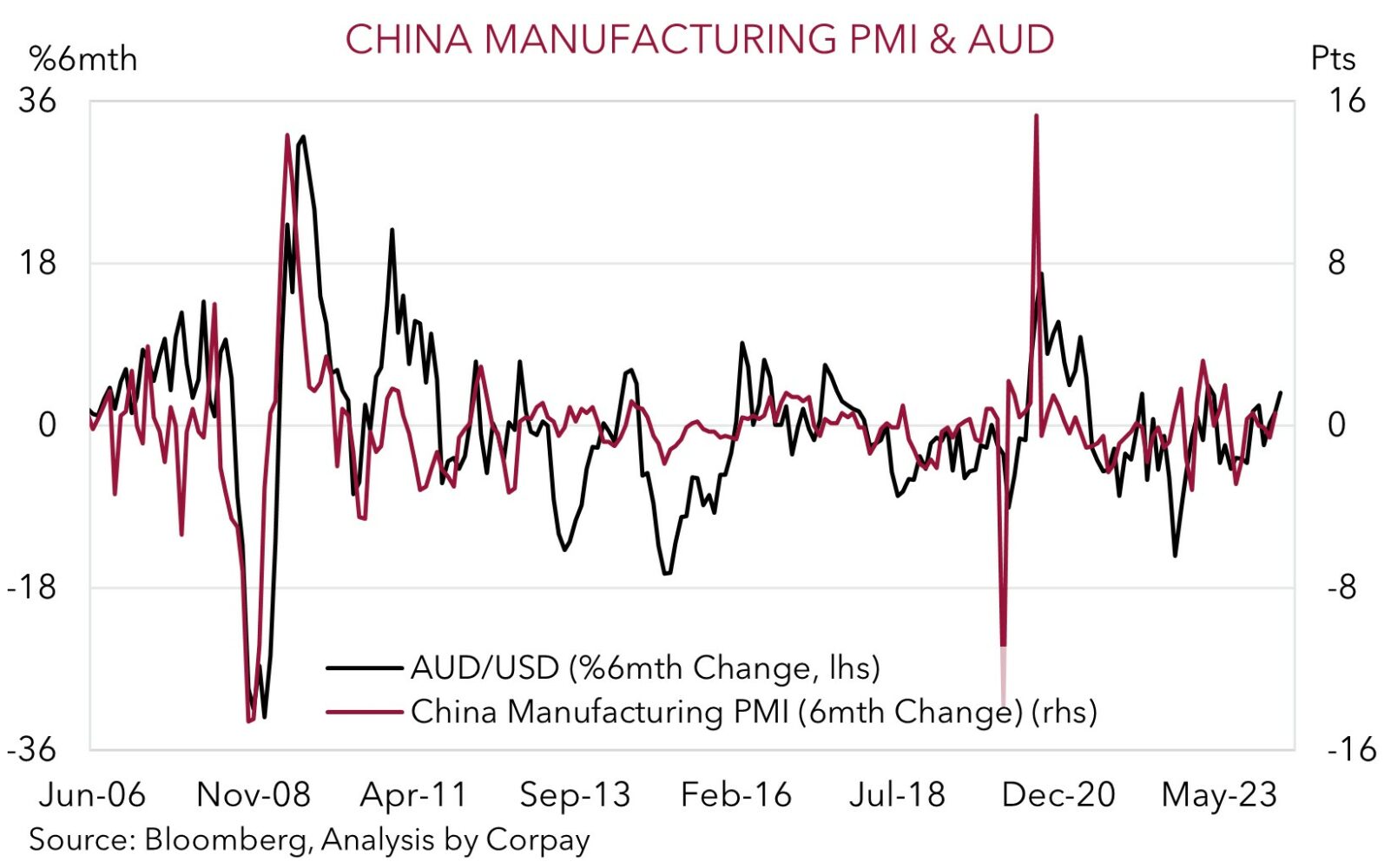

• AUD rise. AUD continues to grind higher. AUD is now more than 3% from its Israel/Iran risk aversion lows. China PMIs & AU retail sales due today.

• Global data. Tonight, Eurozone GDP/CPI & the US Employment Cost Index (a broad wages gauge monitored by the US Fed) are released.

It has been a relatively quiet start to the new week for most markets, with positive risk vibes continuing and swings in the JPY getting the most attention. US equities ticked higher with the S&P500 (+0.3%) recording its 5th positive session out of the past 6 trading days. A 15% jump in the Tesla share price helped support the overall index. Elsewhere, the drift lower in long end bond yields continued with the benchmark US 10yr rate shedding ~5bps (now 4.61%). There were similar moves in Europe with the German 10yr yield 4bps lower (now 2.53%) as softening core inflation in Spain and Germany eased some concerns about persistent price pressures.

In FX, the USD index slipped back. EUR (now $1.0720) and GBP (now $1.2560) nudged up, as did the AUD (now $0.6566) with firmer industrial metal prices (copper rose another 2.3%) helpful, while there was a relatively sharp drop in USD/JPY. After reaching a fresh multi-decade high just above 160, USD/JPY rapidly declined by ~3.5% during yesterday’s trade before settling around 156. The prospect of intervention by Japanese authorities to prop up the weak JPY has been a hot topic recently. There hasn’t been formal confirmation steps were taken with vice minister for international affairs Kanda stating “I have nothing to say about whether or not Japan had intervened in the market”. Given Japan was observing the Showa Day public holiday, and liquidity was thinner than usual, it may have been an opportune time to wade in. Keeping market participants in the dark should mean traders remain jittery near-term and might act to draw a line in the sand for the JPY. As our chart shows, Japanese FX interventions aren’t normally one-offs. We believe bouts of intervention to support the undervalued JPY look probable. Given USD/JPY is the second most traded currency pair this could have a cascading negative drag on the USD.

The global economic calendar heats up today with the China PMIs (11:30am AEST), Q1 Eurozone GDP and April CPI inflation (7pm AEST), and the US Employment Cost Index (10:30pm AEST) due. The China PMIs are projected to moderate but remain in ‘expansionary’ territory. In the Eurozone, the economy is forecast to have emerged from recession with very modest growth anticipated (mkt +0.1%qoq), while core inflation looks set to decelerate. And in the US, the ECI (a broad gauge of wage pressures looked at closely by the US Fed) is predicted to slow when measured on an annual basis. In our view, the mix of positive activity signals in China and Europe, and softening wages in the US could see the USD lose ground as lofty US interest rate expectations are potentially pared back and growth differentials narrow.

AUD Corner

The AUD has continued its grind higher. At ~$0.6566 the AUD is more than 3% above its recent Israel/Iran risk aversion low. The uptick in US equities, and firmer industrial metal prices on the back of speculation more policy support could be injected into the Chinese property sector following news Chengdu had relaxed home-buying rules and a major developer had reached a restructuring agreement, compounded the softer USD.

The backdrop has also supported the AUD on most of the major crosses. AUD/EUR (now 0.6125) is near its highest level since mid-January, AUD/CNH (now ~4.7568) is above its 1-year average, and AUD/NZD (now ~1.0985) is hovering around levels last traded in June 2023. We believe the upswing in AUD/NZD can extend with the Q1 NZ labour market report (Weds 8:45am AEST) forecast to show conditions softened. This would bolster views the RBNZ may start lowering interest rates ahead of the RBA. Interest rate markets are ~50% chance the RBA delivers another 25bp rate hike by September, while a RBNZ rate cut is fully priced in by November.

By contrast, the rebound in the JPY on potential intervention by Japanese authorities has seen AUD/JPY slip back. That said, at ~102.60 AUD/JPY remains at elevated levels. Looking ahead, although we have a positive bias for the AUD on most crosses, we think AUD/JPY could move against the grain over the medium-term given the pair looks to be trading well north of levels implied by fundamentals such as longer-term rate differentials.

In today’s Asian session, in addition to monitoring JPY developments, the China PMIs and Australian retail sales are due (both 11:30am AEST). As discussed, the China PMIs they look set to remain in ‘expansionary’ territory. This is normally a positive for commodity demand and the AUD. Locally, we think Australian retail sales may come in a bit stronger than predicted (mkt 0.2%) because of the earlier Easter and positive impacts from the Melbourne Grand Prix. This type of data mix could, in our opinion, give the AUD some more support. As would signs US wage pressures are moderating (the quarterly Employment Cost Index is released at 10:30pm AEST) as we feel this might revive US rate cut expectations and weigh on the USD.