• Burst of vol. Middle East tensions generated some vol. on Friday. The initial ‘risk off’ moves faded. US bond yields reversed course. The AUD rebounded.

• Lofty USD. US interest rates have repriced a lot recently. Less than 40bps of Fed cuts now assumed in 2024. The USD may need a new driver to go higher.

• Event radar. Locally, Q1 CPI is due (Weds). Offshore, Eurozone PMIs (Tues), US GDP (Thurs), US PCE deflator (Fri), & BoJ meeting (Fri) are in focus.

Geopolitical tensions generated another spurt of volatility on Friday, although for the most part the knee-jerk ‘risk off’ moves to news of Israeli attacks on sites in Iran faded as Iran indicated it had no plans for retaliation. After dropping during Asian trade US yields reversed to end the day little changed. The benchmark US 10yr rate is up near 4.62% while the 2yr rate is just below 5%. Similarly, oil’s initial spike unwound with brent crude down at ~US$87.40/brl (slightly above its 2-month average). However, US equities remained on the backfoot with a pullback in the tech-sector (NASDAQ -2%) ahead of this week’s earnings reports from a few Megacap stocks dragging on the S&P500 (-0.9%). The S&P500 is now close to 6% from its record highs, but after a strong start to 2024 it is still in positive territory for the year.

In FX, the USD index consolidated with EUR (now ~$1.0655) clawing back falls into the end of the session. USD/JPY (now ~154.50) snapped back after Middle East worries initially boosted JPY demand. The AUD rebounded after touching its lowest level since mid-November as sentiment improved to be broadly in line with where it was before the Israel/Iran headlines hit the wires. By contrast, GBP underperformed (now ~$1.2375, lowest since November) after soft UK retail sales and ‘dovish’ comments bolstered BoE rate cut bets. The BoE’s Ramsden noted inflation risks look tilted to the downside. Odds of the first BoE rate cut in June have risen to ~50%.

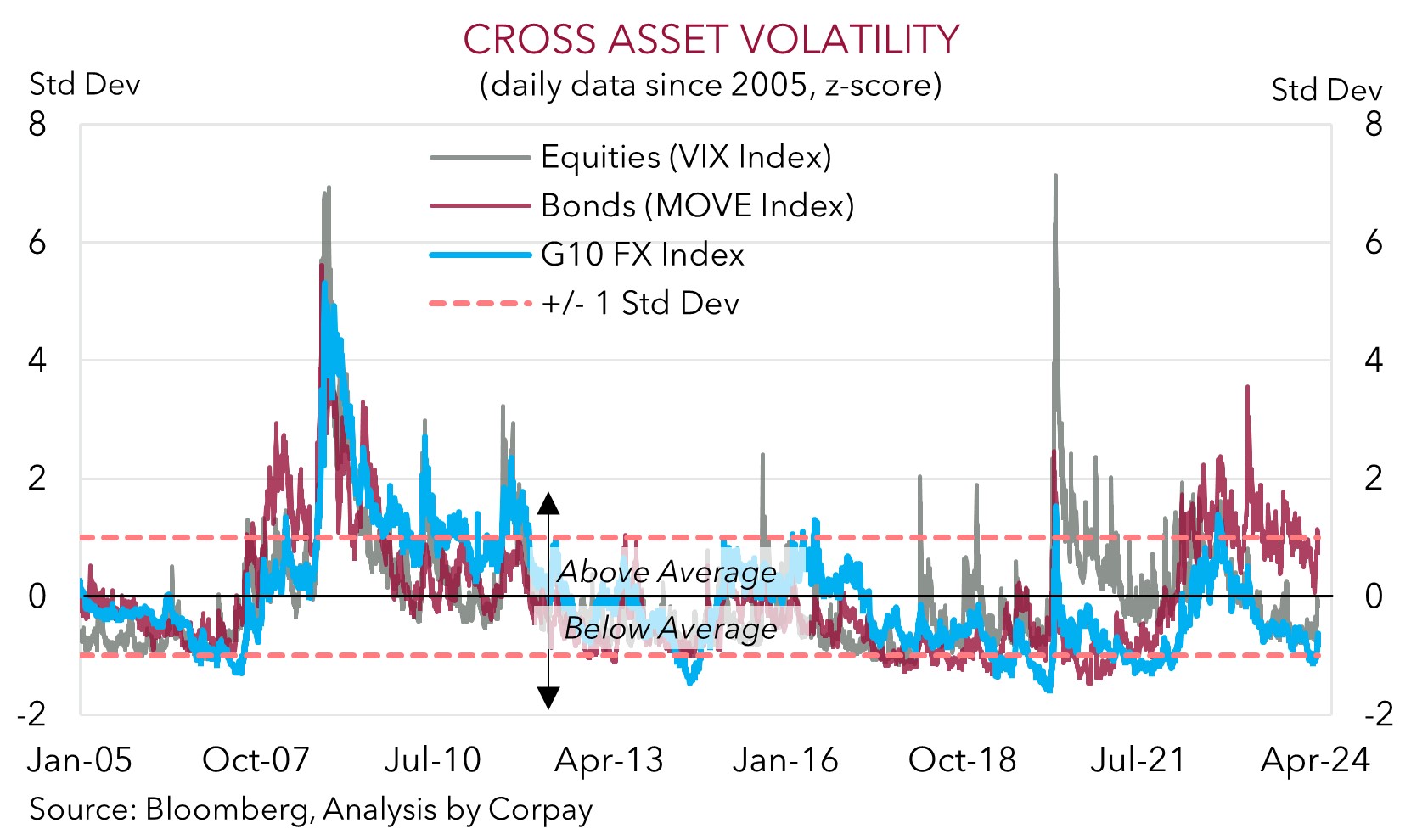

As mentioned previously, the situation in the Middle East remains fluid and bursts of volatility as sentiment waxes and wanes should be anticipated for a while. Some markets may not be factoring in enough risk premium given the geopolitical and economic uncertainties out there. As our chart shows, implied volatility for equities and G10 FX remains at or below average.

In addition to monitoring Middle East developments, US economics will be front of mind this week, although it will be data rather than Fed speakers in focus given policymakers are in a blackout period ahead of the upcoming meeting (2 May AEST). The first estimate of Q1 US GDP (Thurs AEST) and PCE deflator (Fri AEST), the Fed’s preferred inflation gauge, are focal points. Q1 GDP looks set to show the US economy recorded another quarter of slightly above trend growth, while the improvement in core inflation may have stalled. This type of mix should keep the USD firm, in our view. But with markets already assuming a ‘hawkish’ outlook (less than ~40bps of cuts by the US Fed are penciled in over 2024), more gains could be hard to come by especially if the Eurozone PMIs (Tues AEST) improve and/or upgrades to its inflation outlook sees the Bank of Japan (Fri AEST) keep the door open to further policy tightening. FX is a relative price and outcomes compared to expectations are what matter.

AUD Corner

The negative bout of risk sentiment during Friday’s Asian session on the back of Israel/Iran developments initially weighed on the AUD. However, after touching its lowest levels since mid-November, the AUD has clawed its way back to where it was tracking prior to the headlines (now ~$0.6417) as nervousness about the situation eased and the lift in base metal prices generated support (copper and iron ore rose ~1.1-1.2% on Friday). The AUD also recovered on the crosses with AUD/EUR (now ~0.6020) and AUD/JPY (now ~99.14) only slightly below where they were this time on Friday. By contrast, AUD/NZD (now ~1.09) and AUD/GBP (now ~0.5185) are a little higher, with soft UK retail sales and ‘dovish’ comments from the BoE’s Ramsden exerting pressure on GBP.

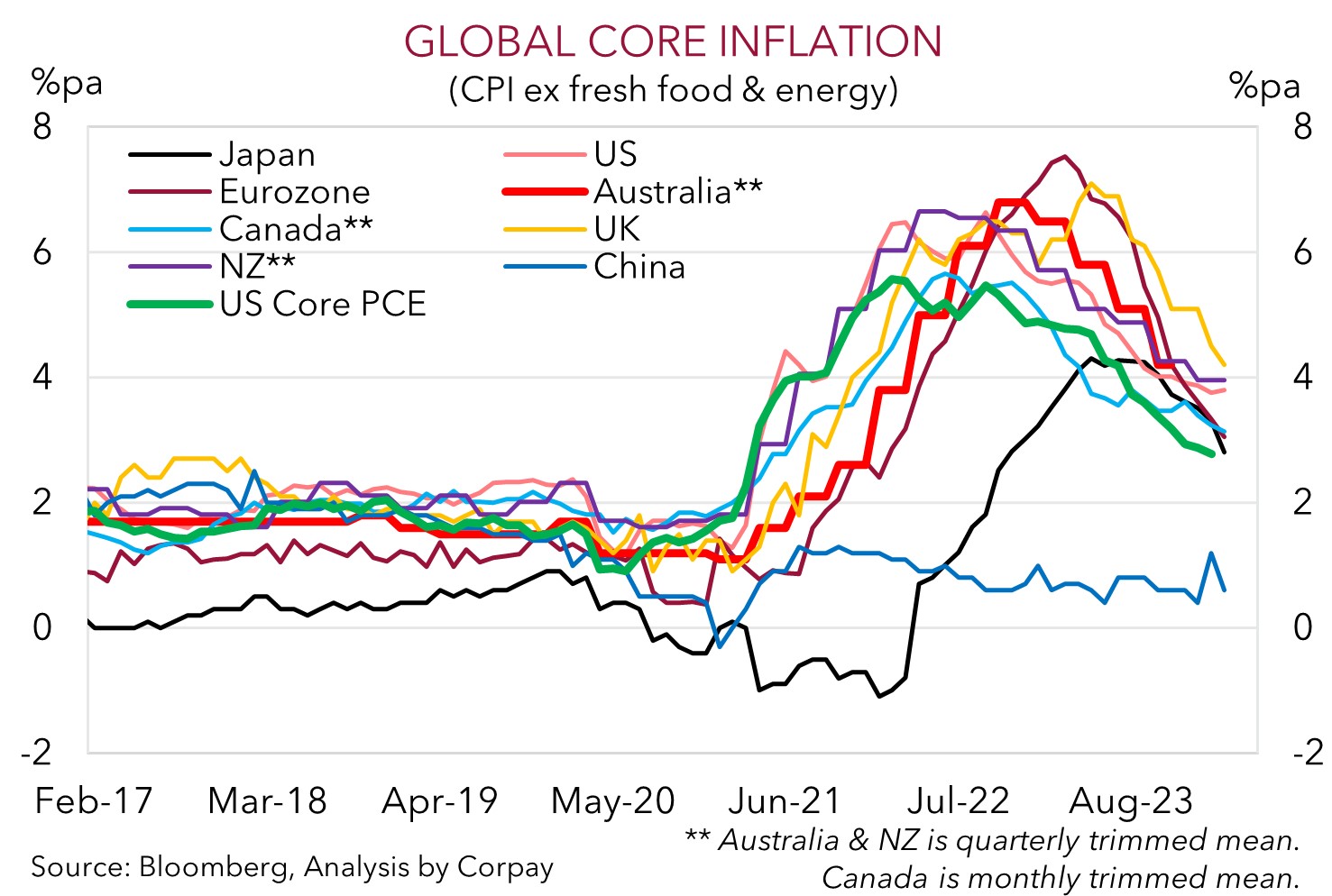

Q1 Australian CPI (Weds) takes center stage locally in a shortened week given the ANZAC Day holiday on Thursday. Annual rates of headline and core inflation should moderate given positive base effects from last year are still rolling through. Analysts are looking for headline inflation to drop to 3.5%pa, and for core inflation to slow to 3.8%pa. However, we think inflation risks holding up a bit more than predicted given the stickiness across services prices due to wages and other things like rents because of the demand/supply imbalance in housing, and with regulated price rises in areas like education kicking in in Q1. Signs that the improvement in Australian inflation may be stalling, especially when combined with the ongoing resilience in the labour market, could see RBA rate cut expectations water down or pushed out further.

For the AUD, given bearish market positioning (as measured by CFTC futures) is already quite large, and with it trading at a ~2 cent discount to the average across our suite of fair value models, we believe that if risk sentiment improves, positive Australian CPI data could see the AUD recoup lost ground. This is particularly the case for crosses like AUD/EUR, AUD/GBP, and AUD/NZD which we feel are too low based on the respective interest rate outlooks and given Australia’s relative stronger economic fundamentals. Although we also think AUD/USD could edge higher as we also believe a lot of good news and the ‘higher for longer’ US interest rate outlook is now largely baked into the lofty USD. Statistically, there also look to be asymmetric risks for the AUD down at current levels. Since 2015, when Australia’s capital flow dynamics turned more supportive, the AUD has only traded below ~$0.64 ~4% of the time.