• Positive vibes. Equities ended the week on a positive footing. Lower headline inflation in Europe and the US supported risk appetite. But core inflation, the focus for policymakers, remains high.

• OPEC+ cuts. Weekend news the OPEC+ group is cutting production could reignite inflation concerns, and dampen risk sentiment early in the week.

• AUD RBA focus. Will the RBA pause at tomorrow’s meeting? On net we think it will, but it is likely to be a closer call than many now think.

Risk assets had another relatively positive session on Friday, with another day of no new negative news on the banking-front supporting sentiment. The softer than expected headline Eurozone CPI and US PCE inflation data and stronger China PMIs also helped boost risk appetite. In terms of markets, European and US equities rose on Friday, with the US outperforming (S&P500 +1.4% vs Eurostoxx600 +0.7%). Elsewhere, bond yields gave back some ground with the US 2yr and 10yr yields falling by ~8bps to 4.02% and 3.47% respectively. In FX, month/quarter-end rebalancing flows counteracted the macro developments. The USD strengthened. EUR drifted back down towards 1.0840, USD/JPY ticked up above 133, and the AUD unwound its Asian session China PMI induced gains to end the week below $0.67.

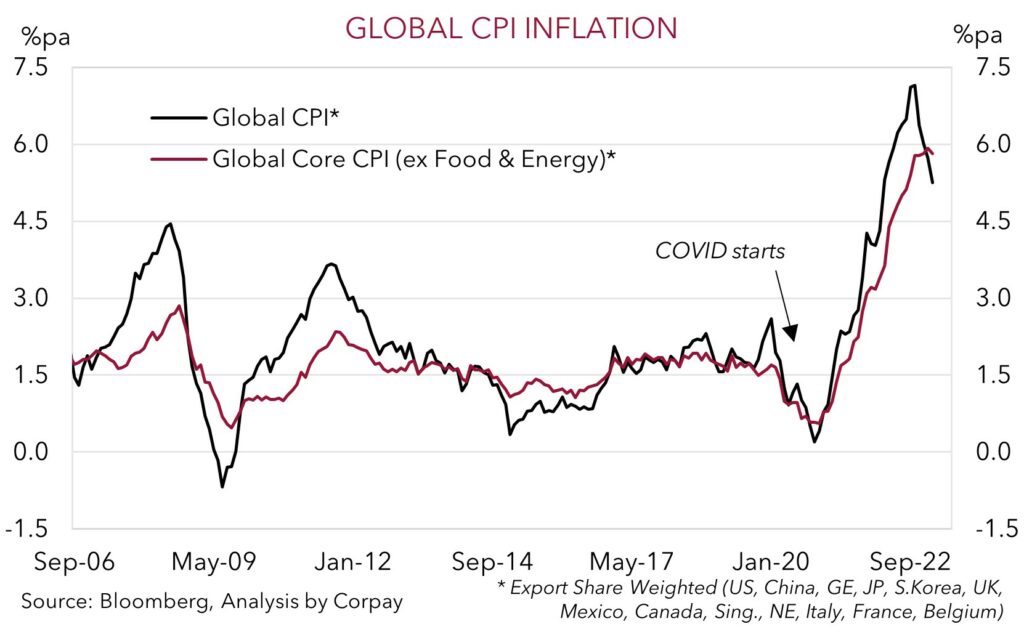

In terms of the US and Eurozone inflation data, the annual headline readings decelerated more than anticipated as past large increases in things like oil, gas, and other goods prices rolled out of calculations. Eurozone headline CPI slowed sharply from 8.5%pa to 6.9%pa, while the US PCE deflator edged down to 5%pa. That said, while headline inflation slowed, core inflation which strips out food and energy prices, remains sticky and elevated. As our chart shows, this is a global trend. In contrast to the headline measure, Eurozone core inflation touched a new high (now 5.7%pa), while US core PCE (now 4.6%pa) is still more than 2 times the Fed’s target. For core/underlying inflation to slow meaningfully, an extended period of very tight policy settings, slower growth, and higher unemployment is needed. In our view, the core inflation pulse continues to show that major central banks like the US Fed and ECB still have more work to do, and any thoughts of rate cuts coming through later this year look misplaced.

Indeed, the surprise weekend news that the OPEC+ group is cutting production by more than 1mn barrels a day, abandoning assurances that it would hold supply steady, may only add to the inflation challenge. Reduced supply, combined with China’s reopening, could stabilize and/or push oil prices higher. This may mean the easy inflation wins from lower commodity prices may soon run their course.

Globally, the data focus this week will be on the US labour market report (released Friday). Various indicators point to another robust print with risks tilted to the US unemployment rate (now 3.6%) declining. In our opinion, still tight US labour market conditions, coupled with a renewed positive inflation impulse from higher energy prices could see US interest rate expectations rebound, which in turn could support the USD. Though given Good Friday, full market reaction to the US data won’t occur until early next week.

Global event radar: RBA Meeting (Tues), RBNZ Meeting (Weds), US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD corner

The AUD/USD failed to hold onto Friday’s stronger than expected China PMI gains, with the pair now back near $0.6680 (~0.9% below Friday’s intra-day high). As discussed above, the flow-driven month/quarter-end USD strength outweighed the economic developments and more positive risk sentiment.

AUD volatility looks set to continue this week. We think the surprise decision by OPEC+ to cut back its production is likely to rattle risk markets at the start of this week, with inflation concerns potentially reigniting. And while this may dampen sentiment and support the USD, Australia’s position as a net energy exporter should act as an offsetting factor for the AUD.

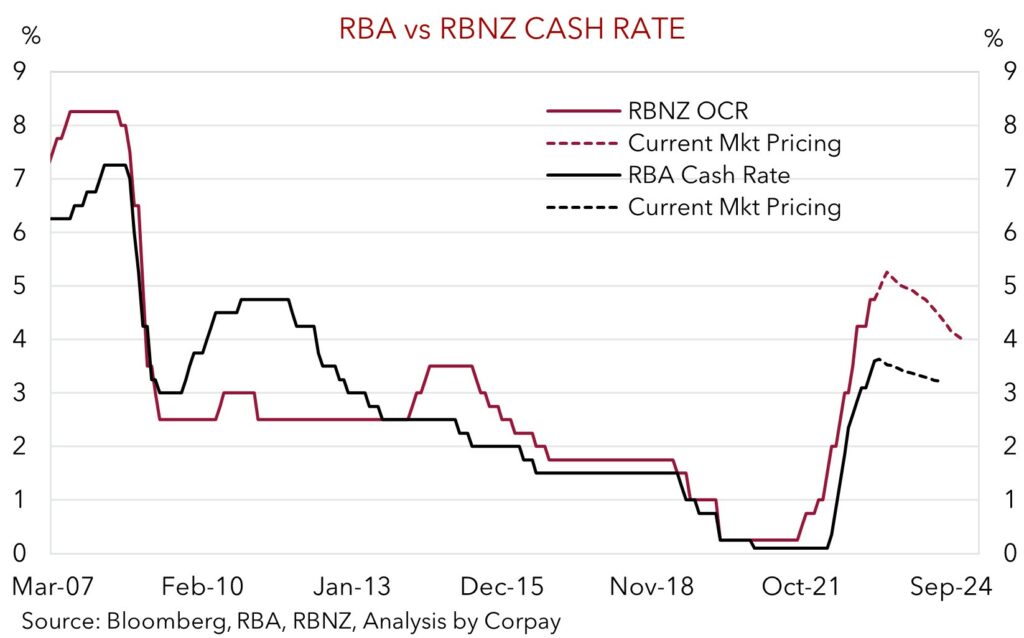

Economically, tomorrow’s RBA meeting is the major AUD-centric event, with a speech by RBA Governor Lowe (Weds), the RBNZ rate decision where the market is looking for another 25bp hike (Weds), and the US labour market report (Fri) the other focal points. With respect to the RBA, on net, we think the recent data supports the case a ‘pause’ in its hiking cycle, though we don’t think it is as locked in as many now predict. In our view, it should be a finely balanced call, and we expect the RBA to retain some form of data-dependent tightening bias no matter the April interest rate decision. The RBA could point to the global hiking trend, still tight local labour market, and elevated business conditions as reasons for another 25bp rate rise in April, just as it could use the turn in inflation, softer retail sales, and lagged effects of all the policy tightening running through the system as reasons to hold.

Based on market interest rate pricing, we would expect a larger AUD reaction to stem from a ‘surprise’ RBA hike, although we think any such lift is likely to be temporary. We believe the RBA is very close to the end of its tightening phase, and it is a matter of when (i.e. April or May), not if the bank ‘pauses’. In our view, diverging monetary policy trends, combined with the unfolding slowdown in global growth should limit near-term AUD upside and keep it on the backfoot against currencies like the EUR, GBP, and a lesser extent the USD where expectations for further policy tightening remain in place.

AUD event radar: RBA Meeting (Tues), RBNZ Meeting (Weds), RBA Governor Lowe Speaks (Weds), US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), AU Jobs Report (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6620 / 0.6750, 0.6799

SGD corner

USD/SGD has nudged up, with the pair back near $1.3325, ~0.7% above the 23 March intra-day low. The USD supportive month/quarter-end flows more than counteracted the lift in global equities and stronger China PMIs that normally support Asian FX and the SGD (see above).

In our view, the bias is for USD/SGD to consolidate and push a little higher over coming sessions, with a move back up towards the 100-day moving average (~$1.3421) possible in the near-term. As outlined, we think the weekend news that the OPEC+ group is cutting back oil production could generate renewed inflation concerns. This may exert some upward pressure on interest rate expectations and/or weigh on risk sentiment. This is typically an environment that is USD supportive, and creates headwinds for global growth linked currencies like Asian FX, particularly ones that are net energy importers. Later in the week, we also think that the US labour market report could show that conditions remain quite tight, with the unemployment rate potentially falling back down. If realised, this could feed through and support a turnaround in US rate expectations and bolster the USD as thoughts of cuts by the US Fed later this year are pared back.

SGD event radar: RBA Meeting (Tues), US Jobs Report (Fri), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3240 / 1.3339, 1.3420