• Oil spike. OPEC+ production cuts has seen oil prices lift. Oil sensitive currencies like the AUD, CAD, and NOK have outperformed.

• USD lower. A weak US ISM manufacturing survey reinforced recession worries. US bond yields reversed course and this weighed on the USD.

• AUD lift off. The terms of trade boost from higher energy prices has supported the AUD. RBA meets today. It is a close call, but we think the RBA will pause.

A somewhat volatile start to the week for financial markets as investors digested the surprise weekend news that OPEC+ was cutting back oil production and further signs the US economic downturn is unfolding. Oil prices have jumped up ~6.5% over the past 24hrs, with WTI crude back near $81/brl. Initial concerns that this latest oil price jolt could add to the global inflation challenge saw bond yields initially lift and the USD strengthen during yesterday’s Asian trade, but this knee-jerk reaction reversed course after the bellwether US ISM Manufacturing survey came in weaker than expected.

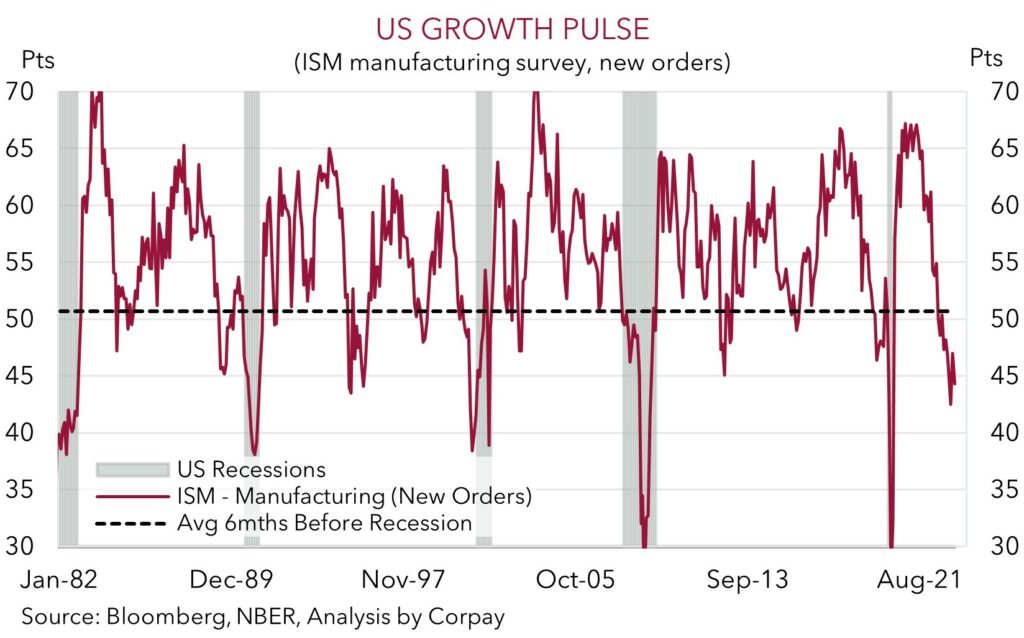

Outside of the initial COVID shock, the US ISM (now 46.3) is at its lowest level since 2009. Notably, new orders (a gauge of future activity) declined at a more rapid pace. Although the manufacturing sector is a small part of the US economy, as our chart shows, ISM new orders have a long history of foretelling slower growth and recessions. On the back of the weaker data the US 2-year bond yield, which is heavily driven by policy expectations, fell back down to 3.96%, ~18bps below yesterday’s high point as longer-dated Fed rate cut expectations were added to.

Elsewhere, equity markets were mixed, though unsurprisingly energy stocks outperformed. While in FX, after lifting early on, the USD index declined as US bond yields turned around. EUR has bounced back above 1.09 to be ~1% above yesterday mornings low, and the interest rate sensitive USD/JPY has slipped back below 132.50. Oil sensitive currencies like the AUD, CAD, and NOK have been the big movers, with the data-induced fall in the USD compounding the terms-of-trade tailwind generated by higher oil/energy prices. Ahead of today’s RBA announcement (2:30pm AEST) the AUD has squeezed up to ~$0.6780, ~1.9% above Monday’s intra-day low, and the highest level since late-February.

We are sceptical that the USD’s weakness can extend much further, particularly against cyclical currencies like the AUD, CAD, and NZD. While higher oil prices stemming from reduced supply can provide these currencies a short-term boost, it shouldn’t be forgotten that higher oil prices also act as a tax on households and businesses. In addition to generating inflation risks, an upswing in oil prices can also add to the downside global/US growth pressures created by the abrupt rise in interest rates and tighter credit conditions. We expect economic and market volatility to continue over the next few months as these forces play out (see Market Musings: Buckle up, volatility should continue). This is a global backdrop that has historically favoured currencies like the USD, EUR and JPY over the AUD and NZD.

Global event radar: RBA Meeting (Today), RBNZ Meeting (Weds), US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD corner

After some weakness early yesterday as risk sentiment soured on the back of the oil price rise, the AUD spiked higher overnight as the anticipated boost to Australia’s terms-of-trade from the jump up in energy prices and lower USD following weaker US ISM data (see above) took hold. At ~$0.6780 the AUD is ~1.9% above yesterday’s intra-day low and at its highest level since late-February.

We think it is too simplistic to extrapolate an upswing in oil prices as being a sustainable boost to the AUD. There are several moving parts for the AUD when it comes to energy prices. While Australia’s position as a net energy exporter means rising oil/gas prices should provide a lift to the terms-of-trade (i.e. ratio of export to import prices), the high overseas ownership share means that unlike iron ore a large chunk of the income benefit flows offshore rather than staying in the local economy. And from a domestic growth perspective, higher petrol prices only adds to the cost and interest rate pressures households and businesses are already feeling.

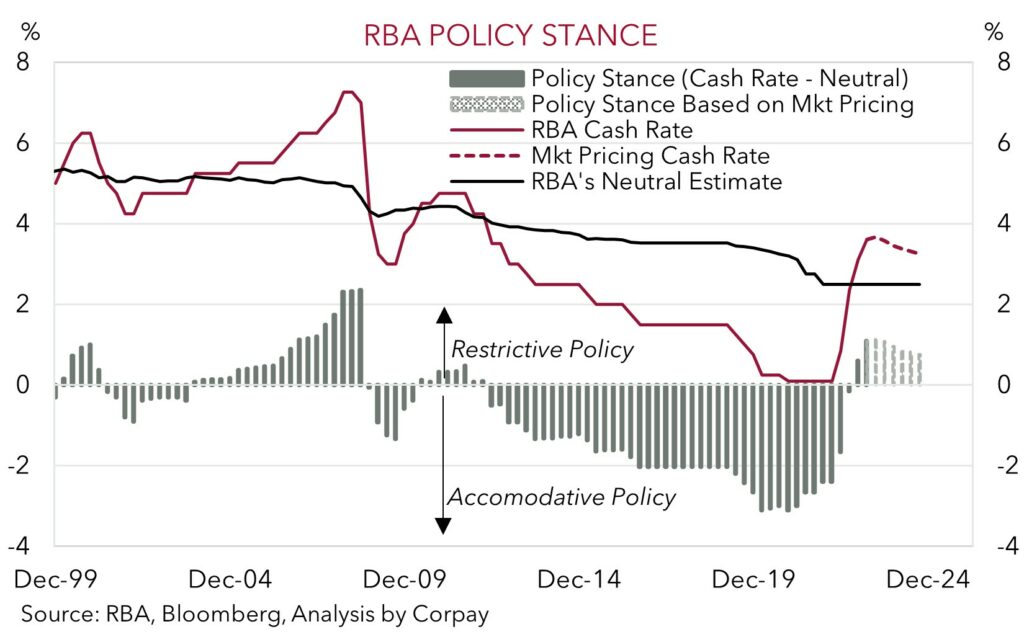

Today, the AUD focus will be on the RBA rate decision (2:30pm AEST). As we have run through over the past few days, on net, we think the data and the RBA’s focus on keeping the economy on “an even keel” supports the case a ‘pause’, though we don’t think it is as locked in as markets now predict. In our view, it should be a finely balanced call, with a case for another 25bp hike (rising global rate trend, tight local labour market, elevated business conditions) made just as easily as the case to hold (softer retail sales, turn in inflation, lagged effects of all the tightening in the system). This is also how the wider economist community sees it (11 of 27 analysts in the Bloomberg survey are looking for a rise, while 16 expect no change).

Based on the AUD’s bounce we think reaction to the RBA decision is likely to be more binary than it otherwise would have been. We think no rate change, even if the RBA retains a conditional tightening bias, could see the AUD given back some ground, while a ‘surprise’ hike should see the AUD add to its recent run. That said, we think any such RBA induced lift in the AUD is likely to be temporary. We believe the RBA is very close to the end of its tightening cycle, and it is a matter of when (i.e. April or May), not if it ‘pauses’. In our opinion, diverging monetary policy trends between the RBA and other central banks, combined with slower global growth and further bouts of volatility should continue to act as AUD headwinds over the next few months.

AUD event radar: RBA Meeting (Today), RBNZ Meeting (Weds), RBA Governor Lowe Speaks (Weds), US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), AU Jobs Report (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6680 / 0.6800, 0.6814

SGD corner

USD/SGD endured some volatility to start the week, with the pair trading in a ~0.7% range over the past 24hrs. After rising above $1.3340 early yesterday as the USD strengthened on the back of inflation concerns generated by the spike in oil prices, USD/SGD has fallen back towards Friday’s low (~$1.3260) as weaker US manufacturing data reignited recession worries. As discussed above, the USD has fallen broadly, tracking the retracement in US bond yields.

Despite the intra-day swings, we remain of the view that USD/SGD should consolidate over the near-term, and that it can push a bit higher over the period ahead. As detailed above, we think that the lift in energy prices is likely to not only add to inflation pressures, but compound the downside global growth risks created by higher interest rates and tighter credit conditions. This is normally a backdrop that weighs on cyclical currencies like Asian FX, especially ones that are net energy importers. Economically, the focus over the next few days should also shift to various US labour market and services sector data points. The services side is a much large part of the US economy, and this is where inflation pressures are still most acute. In our view, indications that labour conditions remain tight could see US interest rate expectations rebound, which in turn is likely to support the USD.

SGD event radar: RBA Meeting (Today), US Jobs Report (Fri), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3240 / 1.3338, 1.3420