• Shaky sentiment. US equities and industrial metals eased back. The USD weakened, tracking the fall in US yields. EUR higher, USD/JPY lower.

• US labour market turning. US JOLTS report weaker than expected. Tighter conditions are starting to work. But there is still a long way to go.

• AUD underperformer. RBA pauses and waters down its guidance. RBNZ expected to hike by 25bps today, but could it also tweak its language?

A more cautious tone across markets with US equities giving back some ground (S&P500 -0.6%), industrial metals easing (copper dipped ~0.9%), and US bond yields falling. US 2yr yields declined sharply, down another 14bps to 3.82% as longer-dated US Fed rate cut expectations were added to following weaker US labour demand data. Elsewhere, oil prices have held onto their OPEC+ production cut induced gains, with brent crude still above US$85/brl, while gold (a safe-haven sought out during market turbulence) is within 2% of its record high (now US$2020/ounce). In FX, the USD has remained on the backfoot, tracking the move lower in US bond yields. Diverging policy expectations between the US Fed and ECB has boosted the EUR which is back up near 1.0950, while the interest rate sensitive USD/JPY has slipped towards 131.50. AUD has underperformed. Yesterday’s ‘pause’ by the RBA and expectations interest rates have peaked have taken the heat out of the AUD.

Further indications the US economy has turned down, and warnings that the banking-related turbulence may continue dampened sentiment. In his annual letter to shareholders, JPMorgan Chase CEO Jamie Dimon stressed that the episode is “not yet over” and will be felt for years. As we have pointed out, aggressive Fed tightening cycles, particularly ones where rates are moved well into ‘restrictive territory’ have a long track record of exposing excesses that have built up across the system, with the aftershocks and volatility continuing for some time (see Market Musings: Buckle up, volatility should continue).

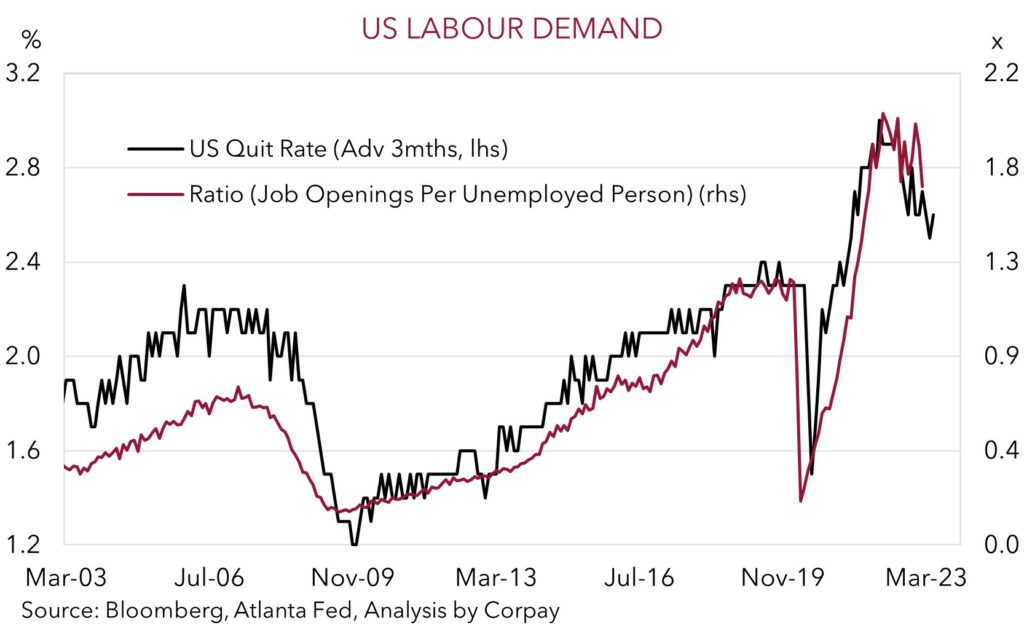

Macro-wise, the US JOLTS report, a gauge of labour demand, came in below expectations. Job openings fell to 9.9mn, a low since May 2021. Notably, the ratio of job openings to unemployed fell to ~1.7. As our chart shows this is off its highs, with tighter monetary/credit conditions reducing demand. However, there is still a long way to go. For wage growth to slow to a rate consistent with the Fed’s 2% inflation target the opening to unemployed ratio needs to fall to ~1, and for that to happen policy needs to remain tight for extended period for economic activity to run at a below trend pace. While the Fed’s tightening phase is nearing the end, we think expectations looking for rate cuts later this year are misplaced given the US’ still high services-driven inflation. US ADP employment (10:15pm AEST) and the services ISM (12am AEST) are released tonight. Given the recent run, we believe solid showings could see US rate expectations, and in turn the USD, bounce back.

Global event radar: RBNZ Meeting (Today), US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD corner

Despite the softer USD, the AUD has drifted back over the past 24hrs (now ~$0.6750), with the AUD underperforming on the crosses. AUD/EUR is over 1% below Monday’s high to be back near 0.6160, AUD/JPY is below 89, AUD/GBP touched a fresh 1-year low, and AUD/NZD has fallen towards 1.07. Yesterday’s RBA announcement was the catalyst for the AUD’s relative weakness.

After hiking for 10 straight meetings the RBA held rates steady at 3.6%. The door to doing more remains open, however we think the bar has risen and future steps have become more contingent on the activity and inflation data exceeding expectations. The RBA retained a softened ‘conditional’ tightening bias, with the Board indicating that it expects “some” further tightening “may well be needed”. This is far less assertive than before. Given we see inflation falling over the next few quarters, growth slowing materially as the impacts of higher mortgage costs bite, and the unemployment rate rising, our base case is that RBA’s tightening phase is now complete (see Market Wire – RBA: over and out). RBA Governor Lowe speaks later today on “Monetary Policy, Demand and Supply” (12:30pm AEST). The speech may generate some AUD vol, but we doubt interest rate expectations will meaningfully shift.

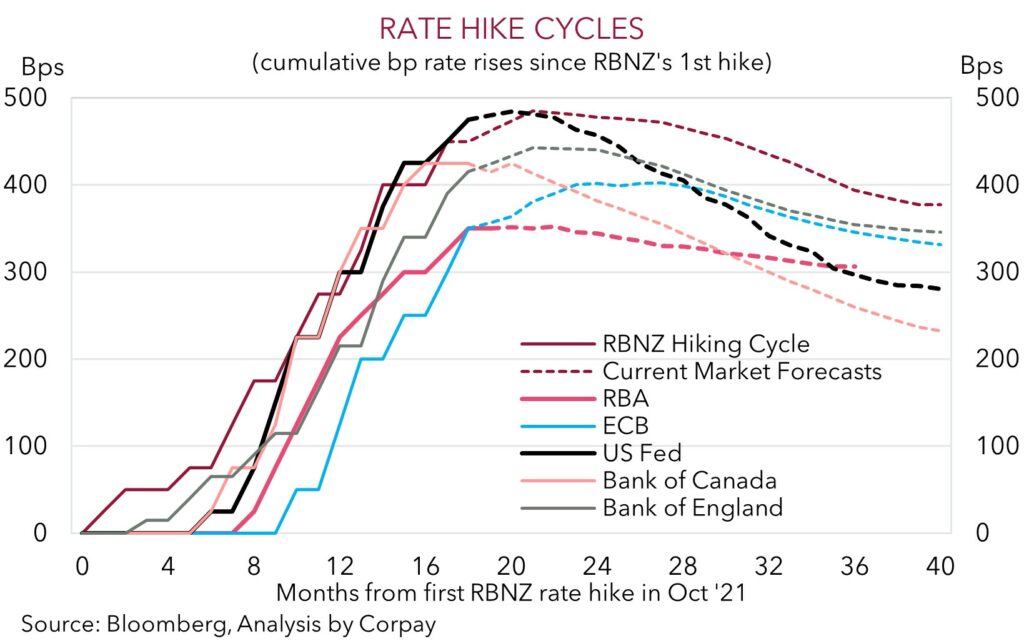

We continue to think that the AUD faces an uphill battle over the next few months as the effects of the very fast global tightening cycle continue to show up. Increased volatility and slower growth has historically been a backdrop that has worked against currencies like the AUD that are leveraged to the global cycle. Additionally, we believe diverging policy expectations should keep the AUD on the backfoot against currencies like the EUR, GBP, and a lesser extent the USD where the central banks still have more work to do to get on top of inflation, or the JPY where we think the Bank of Japan could be about to embark on a policy normalisation path.

AUD/NZD is in focus today. Ahead of RBA Governor Lowe’s speech, the RBNZ rate decision is announced (12pm AEST). With the NZ data deteriorating sooner than expected, we are looking for the RBNZ to step down the pace of hikes and announce a 25bp rise, taking the OCR up to 5%. We also see risks the RBNZ uses this meeting, a steppingstone to the more detailed May MPS, to soften its guidance by indicating it “could” tighten further “if needed”. If realised, a more dovish tilt could see still lofty RBNZ expectations pared back, pushing up AUD/NZD.

AUD event radar: RBNZ Meeting (Today), RBA Governor Lowe Speaks (Today), US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), AU Jobs Report (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6680 / 0.6800, 0.6808

SGD corner

USD/SGD has drifted a bit lower, but in the context of a weaker USD environment (see above), the moves have been modest. At ~$1.3255 USD/SGD is only ~0.1% below where it was trading this time yesterday. The softer risk sentiment has counteracted the pull-back in the USD, with cyclical currencies underperforming.

We continue to think that USD/SGD is likely to consolidate over the near-term, and that it can push a bit higher over the period ahead. The negative economic and market consequences from the most abrupt global tightening cycle in several decades should continue to show up over the next few months, in our view. This is normally a backdrop that weighs on cyclical currencies like Asian FX. More near-term, the focus over the next few days will be on the US labour market and services data. The services side is a much large part of the US economy, and this is where inflation pressures are still most problematic. The ADP employment report and services ISM are released tonight. As mentioned above, we believe that based on the recent negative run, a solid set of data could see US interest rate expectations and the USD (and USD/SGD) claw back some ground.

SGD event radar: US Jobs Report (Fri), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3220 / 1.3339, 1.3415