• Calm markets. Perceived financial stability risks continue to fade. Equities higher, while the USD has lost some ground.

• Sticky German inflation. European yields and EUR rise as German inflation falls back less than expected. Eurozone inflation is released tonight.

• AUD mixed. AUD up a little against the USD, but remains under pressure against EUR, GBP, and NZD. China PMIs due during todays Asian trade.

Another night of relatively calm market conditions, as perceived financial stability risks continue to fade. Equities were higher across Europe and the US. The major indices rose by another 0.5-1.3%, though ‘hawkish’ rhetoric from several US Fed officials did take some of the steam out of the US rally. Non-voting Fed members Collins and Barkin reiterated that persistently high inflation means there is still more work to do on the policy-front, while 2023 voter Kashkari emphasised the commitment to the 2% inflation target and that further action may be necessary to bring the services side of the economy into better balance.

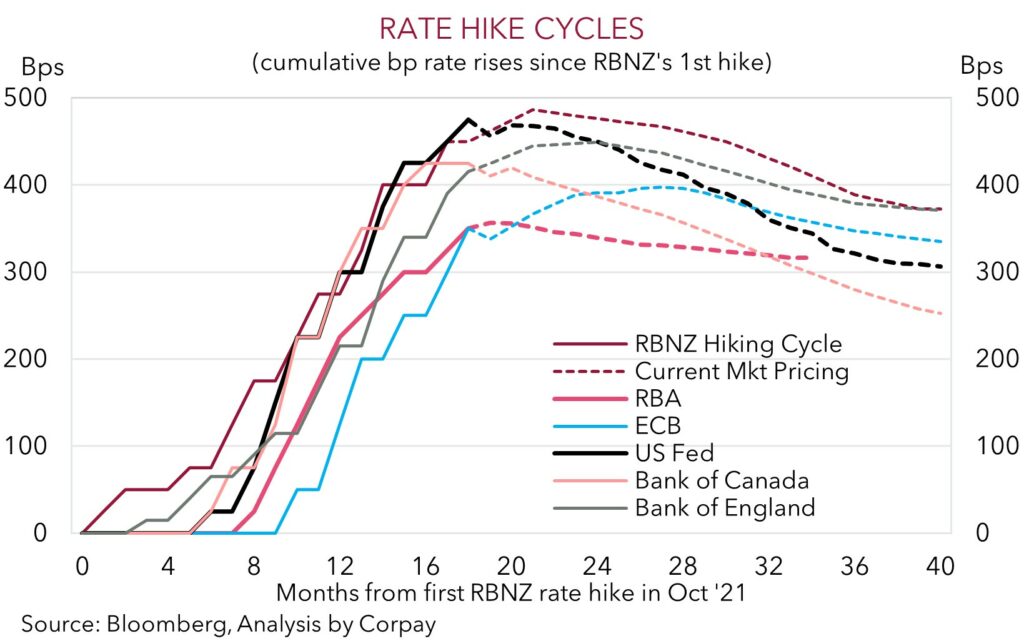

Across the bond market, US yields consolidated, with large moves coming through in Europe. German bond yields rose 5-10bps across the curve, with the front-end leading the charge. The German 2yr yield is now at 2.75%, over 50bps above last Friday’s Deutsche Bank concern induced low point. Markets moved to price in even tighter ECB policy, with another 10bps of hikes added to the path for rates this year, after German inflation once again exceeded expectations. While German inflation decelerated from 9.3%pa to 7.8%pa, as the big lift in gas prices last year dropped out of the annual calculations, the declined was less than anticipated with core inflation proving to be quite sticky. Uncomfortably high core inflation points to further ECB rate hikes over coming months. As our chart shows, in contrast to pricing for many other many central banks, markets are still penciling in additional tightening by the ECB.

The adjustment in ECB rate expectations has boosted the EUR, which has moved back above 1.09. This has translated to a softer USD (note, the EUR accounts for ~58% of the USD index). GBP has edged up towards 1.24, USD/JPY is holding above 132.50, while the AUD and NZD have risen as improved risk appetite compounded the softer USD. That said, AUD/USD (now $0.6710) is only trading where it was two days ago, with the AUD remaining on the backfoot against the EUR, GBP, and NZD.

The global economic calendar heats up today. In addition to Eurozone inflation (8pm AEDT), the US PCE deflator (the Fed’s preferred inflation gauge) is released (11:30pm AEDT), with the China PMIs due during Asian trade (12:30pm AEDT). Eurozone and US core inflation are predicted to remain high, while the China PMIs are projected to give back some ground. This mix could reignite concerns about the outlook. This mix normally favours the USD and EUR over cyclical currencies like the AUD.

Global event radar: China PMIs (Today), Eurozone CPI Inflation (Today), US PCE Deflator (Today), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

AUD corner

The AUD/USD has perked up a bit over the past 24hrs, ticking up towards $0.6710 on the back of calmer markets, more positive risk sentiment, and a softer USD (see above). However, in the context of the broader conditions, the AUD’s lift has been fairly muted. The AUD’s relative underperformance against the stronger EUR, GBP and NZD has kept a lid on AUD/USD.

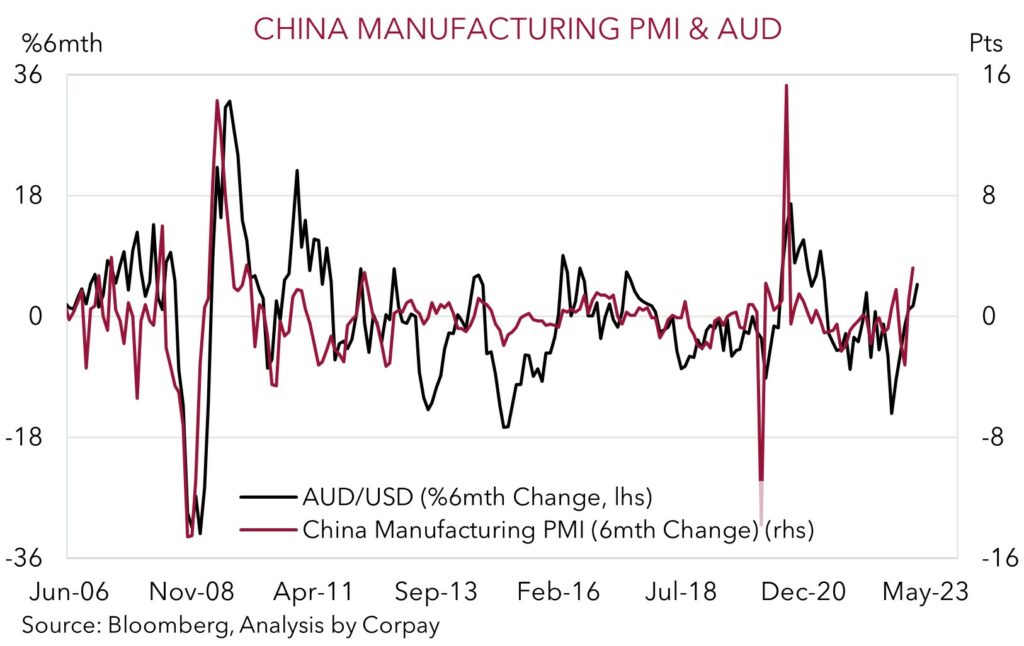

We think these underlying trends should remain in place over the near-term, with AUD/USD expected to remain contained within its recent range and the AUD’s weaker run on the crosses set to extend. In today’s Asian trade the AUD focus will be on the March readings of the China PMIs (12:30pm AEDT). Following the sharp reopening bounce, the China PMIs are projected to have given back some ground with the weaker global environment offsetting the domestic revival. As our chart shows, the AUD’s performance tends to track changes in the China manufacturing PMI. A softer PMI print is likely to generate AUD headwinds.

Beyond the China data, Tuesday’s RBA meeting is the next major AUD-centric event. We think the recent run of data supports the case for the RBA to ‘pause’ its hiking cycle, though we don’t think it is as locked in as many in the market now seem to believe. It is still likely to be a finely balanced decision. The RBA could point to the ongoing global hiking trend, still tight local labour market, and elevated business conditions as justifications for another 25bp rise, just as it could use the turn in inflation and lagged effects of all the past policy tightening as reasons to hold. Based on market interest rate pricing, we would expect a larger AUD reaction to stem from a ‘surprise’ hike, although we think any such lift should only be temporary. We believe the RBA is very close to the end of its tightening phase. The diverging policy trends and expectations should, in our opinion, keep the AUD under pressure against currencies like the EUR, GBP, and a lesser extent the USD where the central banks still have more work to do to get on top of inflation, or the JPY where we believe the Bank of Japan could be about to embark on a policy normalisation path.

AUD event radar: China PMIs (Today), Eurozone CPI Inflation (Today), US PCE Deflator (Today), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), AU Jobs Report (13th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6620 / 0.6753, 0.6799

SGD corner

USD/SGD has eased back towards the bottom of this week’s range (now near ~$1.3280) with the combination of a weaker USD and more positive risk appetite exerting downward pressure on the pair (see above). The economic calendar picks up today with the release of Eurozone inflation, the US PCE deflator (the Fed’s preferred inflation gauge), and the China PMIs during Asian trade. In our view, the China PMIs are at risk of underwhelming as softer global momentum counteracts the domestic pick up following the shift away from COVID zero. Given the linkages to global/China growth we think weaker than forecast China PMIs could weigh on Asian FX and generate a bit of an intra-day bounce back in USD/SGD.

More generally, as we have been highlighting over recent days, we doubt that the renewed calm across markets can be sustained, with volatility expected to pick up once again as the aftershocks from the aggressive policy tightening delivered by the US Fed and other central banks over the past year continue to show up in the real economy. The combination of slower growth mixed with renewed bouts of risk aversion/volatility typically create headwinds for currencies like the SGD which are tethered to the global cycle.

SGD event radar: China PMIs (Today), Eurozone CPI Inflation (Today), US PCE Deflator (Today), RBA Meeting (4th Apr), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3240 / 1.3334, 1.3429