• Positive sentiment. US and European equities higher with another night of no new news helping sentiment improve. This has weighed on the JPY.

• Will it last? More macro/market aftershocks from the very aggressive hiking cycles are likely over coming months. US earnings expectations look too high.

• RBA pause. AUD remains on the back foot. The step down in AU inflation has solidified the case for the RBA to hold steady at next weeks meeting.

Another night of no new news on the banking front has helped sentiment continue to improve. Although the moves across the different markets have differed from recent days. While European bond yields rose (up 2-7bps across various curves), US yields are little changed. The US 2yr yield nudged up to 4.09%, ~2bps higher on the day. Elsewhere, oil prices eased back by ~0.5%, while base metals edged a bit higher. Equities had a positive session. The main US and European indices rose by 1-1.8%, with banking stocks continuing to recover. As a result, the VIX Index (the measure of expected volatility of the S&P500) has fallen to levels it was tracking at before the banking risks flared up a few weeks ago.

Across FX, the USD index has ticked up, with a weaker JPY on the back of the positive market vibes the main mover. The safe-haven JPY tends to be inversely correlated to risk sentiment. USD/JPY is back up near ~133, ~2.5% above last Friday’s low. EUR and GBP have held fairly steady, while the AUD and NZD have given back some ground despite the improved risk appetite. The weaker Australian CPI (see below) has reinforced expectations the RBA could be about to hit ‘pause’ on its tightening cycle, and expectations the RBNZ could soon follow are growing, particularly as the NZ economy is already on the cusp of another recession. German CPI inflation is released tonight (11pm AEDT). Consensus is looking for a step down in annual inflation as some past large price increases roll out of calculations. If realised, we think this may weigh on the EUR slightly and give the USD a slight lift, especially if US initial jobless claims (11:30pm AEDT) also show that the US labour market remains very tight.

More broadly, we doubt the renewed sense of calm across markets will last. Given the lags, we expect the aftershocks from the very aggressive policy tightening delivered by the US Fed and other central banks to continue to show up in the economic data and markets over the next few months. Slowing growth and recession risks, at a time inflation should still be uncomfortably high is a recipe for more bouts of volatility. In our view, lofty US earnings expectations are at risk of being cut back. As the US economic downturn takes hold corporate earnings should come under pressure. As our chart shows, earnings expectations for the S&P500 are only ~4% below their cyclical peak despite the building headwinds. Over the next few months we think cuts in earnings forecasts in line with past US recessions could exert renewed pressure on equities. This is normally an environment that favours the USD, EUR, and JPY over cyclical currencies like the AUD and NZD.

Global event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

AUD corner

Despite the lift in equity markets and base metal prices (see above), the AUD has remained on the backfoot with domestic economic developments counteracting the improved risk sentiment. AUD/USD has slipped back below $0.67, while AUD/EUR and AUD/GBP remain mired down near the bottom of their respective multi-month ranges. AUD/JPY has bounced back towards ~89, on the back of the broad-based JPY weakness, but the move, in our view, doesn’t look to be on solid footing.

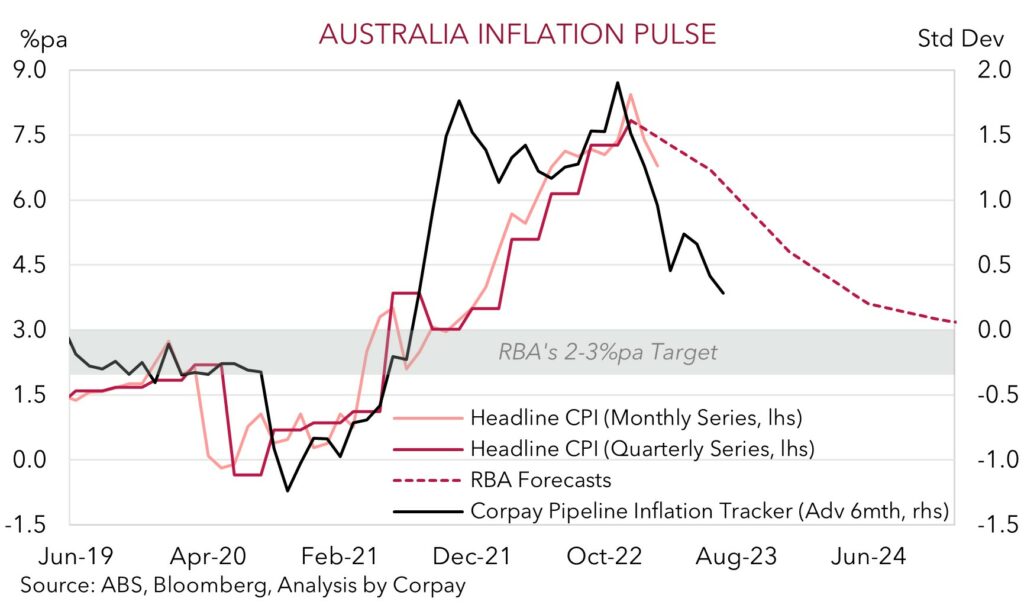

Importantly, data released yesterday showed that the pullback in Australian inflation continues to come through with annual growth in the monthly indicator slowing more than expected in February. Annual growth decelerated to 6.8%pa, this is down from a peak of 8.4%pa in December. And as our chart shows, the underlying pulse across a range of leading indicators we track points to annual inflation decelerating over 2023, with the RBA’s recent forecasts at risk of being too high. Unlike the US where the inflation is being driven by very high wages and services prices, the bulk of Australia’s inflation upswing has reflected things like commodities, goods prices, and construction costs, all of which are turning.

While the monthly indicator doesn’t include all the components of the detailed quarterly series, we think it clearly supports the case for the RBA to ‘pause’ its hiking cycle at next week’s meeting. While one more rate hike can’t be completely ruled out this cycle if the labour market remains strong, retail sales bounces back, and/or the quarterly inflation print released in late-April remains high, it is becoming increasingly clear, in our opinion, that the RBA is very close to the end of its tightening phase (if it hasn’t reached it already). We expect the looming shift from the RBA to keep the AUD under pressure against currencies like the EUR, GBP, and a lesser extent the USD where the central banks retain a tightening bias, or the JPY where we believe the Bank of Japan could be about to embark on a policy normalisation path.

AUD event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), AU Jobs Report (13th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6620 / 0.6754, 0.6798

SGD corner

USD/SGD has drifted a bit higher over the past 24hrs, with the pair ticking up towards ~1.33. This has been in line with the slight lift in the USD Index, which has overridden the support for the SGD normally generated by positive risk sentiment (see above). The economic calendar picks up tomorrow with the release of Eurozone inflation, the PCE deflator (the Fed’s preferred inflation gauge), and the China PMIs. Following the sharp jump last month on the back of the post-COVID reopening, we think the China PMIs are at risk of underwhelming in March as softer global activity offsets the pick-up in domestic growth. In our view, a weaker than forecast set of China PMIs is likely to weigh on Asian FX, and could push USD/SGD a little higher.

More broadly, as discussed above and over the past few weeks, we continue to expect further bouts of market volatility over the next few months as the global economy feels the effects of the very abrupt lift in interest rates delivered by the US Fed and other central banks over the past year. Slower growth mixed with renewed bouts of risk aversion typically create headwinds for Asian FX, like the SGD, which are heavily leveraged to the global cycle.

SGD event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3240 / 1.3333, 1.3434