• Positive vibes. No new news on the banking front has supported risk sentiment. Bond yields have moved higher, with oil & base metal prices firmer.

• Softer USD. Despite the upswing in US yields the USD has drifted lower. AUD & NZD have been boosted by the more positive risk appetite.

• AU data pulse. Retail sales were sluggish. CPI indicator for February due today. A larger pull-back in annual growth could open the door to a RBA pause next week.

Mixed fortunes across markets overnight, although there has been a relative sense of calm with no new news regarding the banking issues which have dominated the headlines over recent weeks. The easing of banking contagion and systemic fears, if only temporarily, has seen European and US bond yields push higher as interest rate expectations are repriced. The US 2yr yield rose another 13bps, and at 4.08% it is around 50bps above last Friday’s intra-day low. The US 10yr yield nudged up slightly to be back up at 3.57%.

Elsewhere, oil and base metal prices were firmer, rising by ~0.5-1.6%, and while the financials heavy European equity markets rose slightly, the US indices ended the day lower, with the tech-focused NASDAQ underperforming (-0.5% vs -0.2% for the S&P500) as the bounce back in bond yields pressured valuations. In FX, the USD Index has drifted lower despite the upswing in US yields, with EUR grinding back up towards 1.0850, USD/JPY hovering below 131, and GBP (now ~1.2340) near the top of its 2023 range. AUD and NZD have also been boosted by the improved risk sentiment, with the antipodean currencies up ~0.9% from this time yesterday.

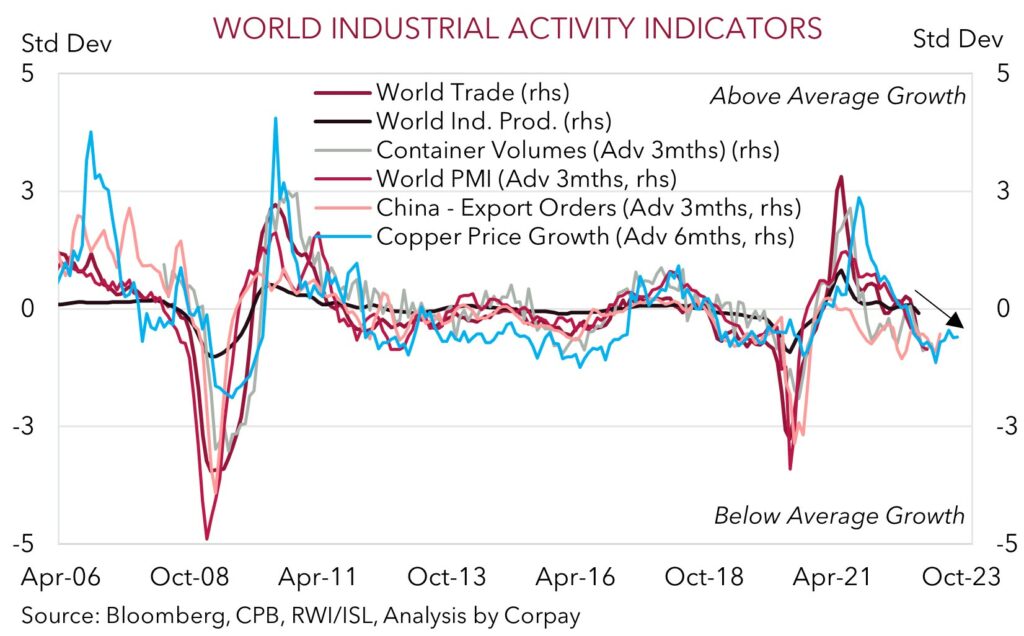

There was minimal economic data released overnight, with US consumer confidence the pick of the bunch. US consumers were marginally more optimistic in March, with the still strong labour market outweighing the banking sector turmoil for the average person on the street. That said, sentiment remains below its 5-year average, with the survey also noting that US consumers plan to spend less on highly discretionary items going forward, with tighter credit conditions and cost-of-living pressures looking like they are starting to bite. Given its size trends in US household spending are important for the global economy. On its own the US household sector is the 3rd largest economy in the world. A further slowdown in US consumer spending should negatively impact trade and production in other countries. As our chart shows, this is what the forward-looking indicators for global industrial activity are pointing to. A deceleration in activity over coming months as interest rate rises and ‘restrictive’ policy settings constrain spending and investment is expected to keep volatility elevated. This backdrop is an environment that typically favours currencies like the USD, EUR and JPY over ones like the AUD and NZD which are leveraged to global growth.

Global event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

AUD corner

After a muted start to the week, the AUD has picked up over the past 24hrs. The AUD has edged back above ~$0.67, where it was trading late last Thursday, with a softer USD and more upbeat risk sentiment (see above) outweighing another sluggish Australian retail sales print and shift in a range of relative interest rate expectations in favour of the US.

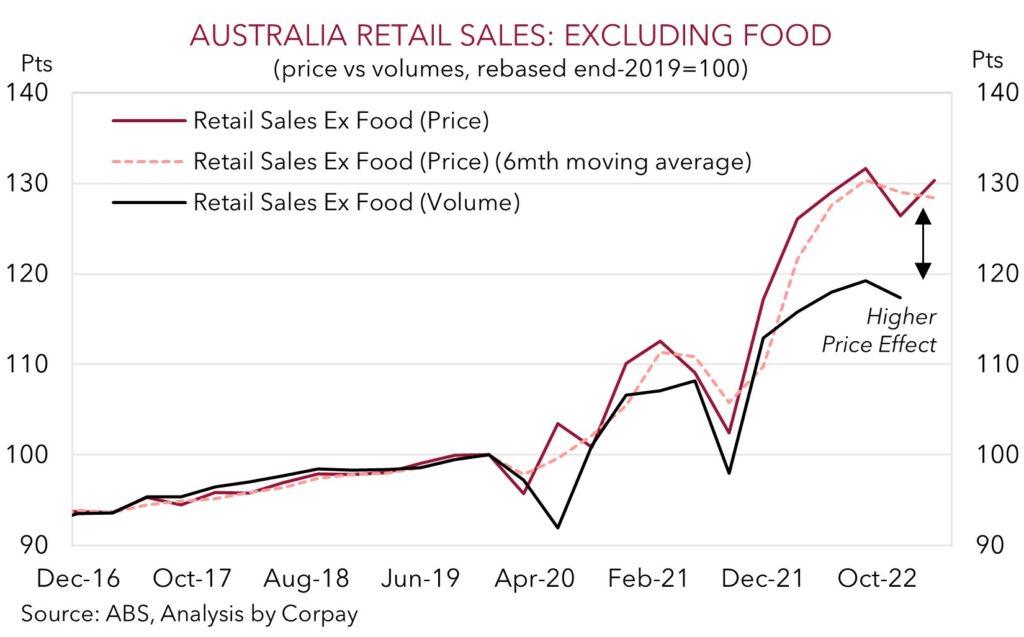

In our view, the squeeze higher in the AUD looks to be on unstainable shaky ground, and we doubt the rebound can extend much further given the evolving domestic and global economic trends. Locally, retail sales rose by a lackluster 0.2% in February, with spending across non-food industries such as household goods weighed down by rising mortgage costs and cost-of-living pressures. Taking a step back from the month-to-month volatility, as our chart shows, retail turnover has now essentially been flat over the past ~6-months and given this is a ‘nominal’ measure that includes higher prices, volumes (the better guide to underlying demand) look to be going backwards again in early-2023. From our perspective, various drivers (below average confidence, large cashflow hit on indebted households from rising rates, reduced housing market turnover) point to a material slowdown in consumer spending, particularly on discretionary items, over coming months.

Today, the February reading of the monthly CPI indicator is due (11:30am AEDT). Australian inflation looks to have topped out at the end of 2022. The February estimate is expected to show annual growth has slowed further as past large increases in categories like fuel and travel costs roll-out of calculations. Indeed, the pulse across various forward-looking price indicators we track suggests the risks are tilted to annual growth coming in below consensus estimates (mkt +7.2%pa). If realised, this combined with signs consumer spending is losing steam, should reinforce expectations that the RBA could ‘pause’ its hiking cycle at next week’s meeting. In our view, it is a matter of when, not if the RBA stops raising rates to allow past hikes to work through the economy, with a pause anticipated in either April or May. Broadly speaking, we think the looming shift from the RBA should keep the AUD on the backfoot against currencies like the EUR, GBP, JPY and a lesser extent the USD where the central banks retain a tightening bias, or like the BoJ could be about to embark on a long overdue policy normalisation path.

AUD event radar: AU CPI Indicator (Today), China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), AU Jobs Report (13th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6620 / 0.6755, 0.6796

SGD corner

USD/SGD gave back some ground yesterday to be back trading back near ~$1.3280, where it was tracking a few days ago. As mentioned above, no fresh news on the banking front has been taken as good news by markets, with the softer USD and improved risk appetite exerting downward pressure on USD/SGD.

Will the decline in market volatility be sustained? As we have been discussing over recent weeks, we doubt it will given the global economy and markets have entered a more challenging part of the cycle where the lagged negative impacts from the rapid-fire policy tightening delivered over the past year show up more and more across the real economy and markets. In our opinion, this backdrop should generate further bouts of volatility down the track, and this typically creates headwinds for Asian FX, like the SGD, which are tethered to the fortunes of the global economy. The calendar is light today, but things should heat up later this week with the release of Eurozone inflation, the PCE deflator (the Fed’s preferred inflation gauge), and the China PMIs.

SGD event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3240 / 1.3331, 1.3377