• Improved sentiment. Banking concerns have eased, at least temporarily. Equities a little higher, while a shift in expectations has pushed up bond yields.

• Stable USD. Positive sentiment has weighed on the JPY, while stronger German data and hawkish ECB and BoE rhetoric boosted EUR and GBP.

• AUD cross-check. AUD under pressure on the crosses. AU retail sales released today. The data will shape the RBA’s near-term interest rate thinking.

Banking sector induced volatility continued overnight, although in a change from the recent trend sentiment was more positive with confidence about the resilience of the system improving. Reports that US authorities are considering ways to expand an emergency lending facility for banks in ways that would give troubled institutions, such as First Republic Bank, more time to bolster its balance sheet boosted sentiment. As did news that First Citizens (the 30th biggest US bank) would be buying what remains of the embattled Silicon Valley Bank.

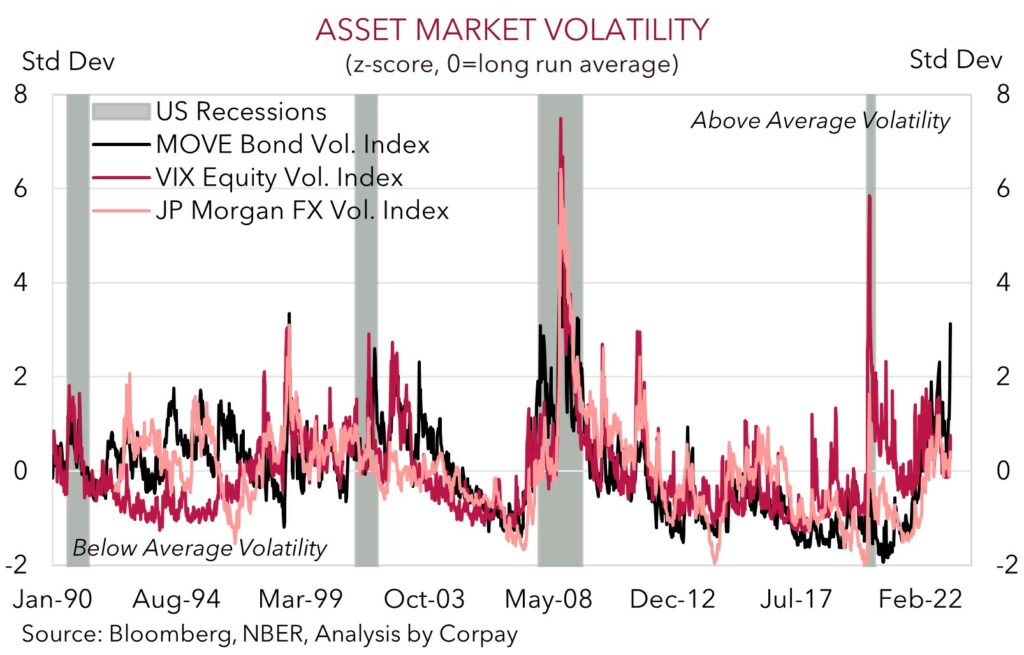

US and European equities rose. The benchmark indices were up 0.2-0.9%, with financials outperforming. There has also been a modest easing in bank CDS spreads (a measure of default risk), although they remain at somewhat elevated levels. Elsewhere, the latest bout of positivity towards the banking sector flowed through to bonds with yields rising overnight as interest rates expectations were repriced higher. Expectations the US Fed could deliver another 25bp hike at the May meeting increased, while future rate cut bets were also pared back. This saw US 2yr yields jump up by ~25bps to 4.02%, with the 10yr yield rising by ~16bps (now 3.58%). As our chart shows, volatility in bonds remains well above average as markets continue to be whipsawed around by the evolving banking sector situation, still high inflation, and central bank policy tightening in the face of slowing growth.

By contrast, the moves in FX markets have been modest. The USD Index has tracked in a tight range, with the weaker JPY stemming from the bounce in equities and bond yields offset by a firmer EUR and GBP. USD/JPY has rebounded back above 131.50, while EUR/USD has edged up towards 1.08 with stronger than expected German IFO data and reports heavyweight ECB policymaker Schnabel was pushing for the last meeting statement to signal further hikes were possible despite banking ructions providing support. AUD is little changed near $0.6650.

The global data calendar heats up later this week with the release of Eurozone inflation, the US PCE deflator (the Fed’s preferred inflation gauge) and the China PMIs. In broad strokes, we remain of the view that the ‘restrictive’ interest rate settings now in place in many economies should see growth slow meaningfully over coming months, with market volatility likely to continue as aftershocks from the most abrupt tightening cycle in several decades continue to show up. We expect the mix of ongoing volatility, slowing growth, and still high inflation to favour the USD and EUR over cyclical currencies like the AUD.

Global event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

AUD corner

Despite the improved sentiment, as illustrated by the pickup in US and European equities and bond yields (see above), AUD has remained in a tight range near $0.6650 over the past 24hrs. That said, in line with our thinking, AUD has continued to underperform on most crosses with AUD/EUR and AUD/GBP down near the bottom of their respective multi-quarter ranges. Stronger than anticipated German IFO data and hawkish commentary from ECB officials has supported Eurozone rate hike expectations and the EUR. We continue to see more downside in AUD/EUR, with the diverging macro trends projected to push the pair down to ~0.60 over the period ahead (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). GBP has also extended its run of relative outperformance against the AUD after Bank of England Governor Bailey expressed confidence that the UK can weather the banking storm and stressed that monetary policy operates separately to financial stability, hence further tightening may be delivered if high inflation persists.

From the AUD side of the ledger the focus over the next two days will be on the February retail sales data (today at 11:30am AEDT) and the February reading of the monthly CPI indicator (released tomorrow). The data will be used by the RBA in its assessment of whether to ‘pause’ its rate hiking cycle at next week’s meeting, so AUD volatility could be elevated around the releases.

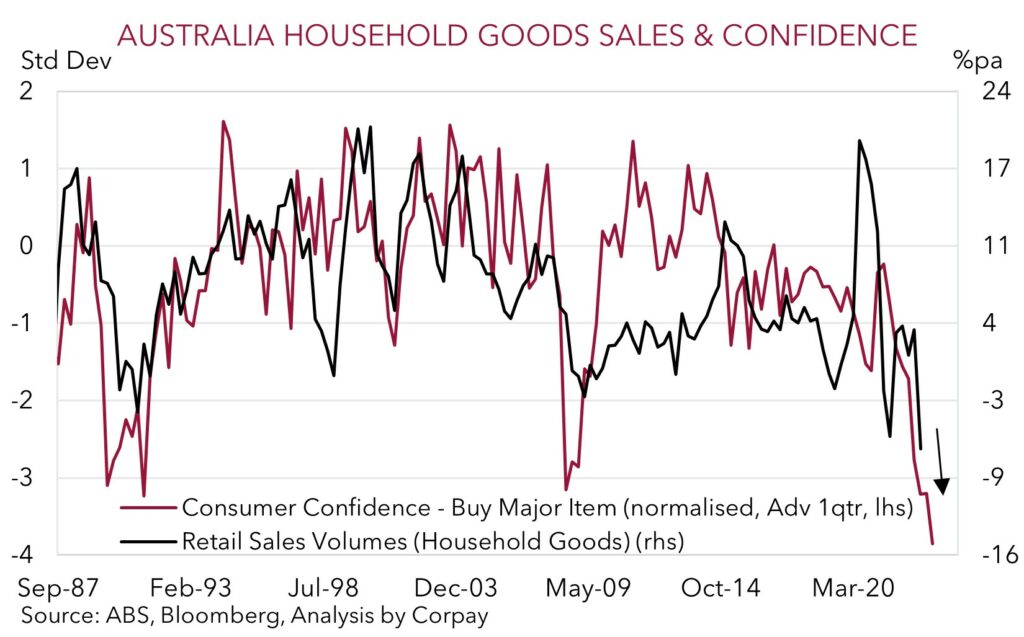

Following the January bounce, which only partially unwound the steep December fall, we think February retail sales are at risk of underwhelming (mkt +0.1%). Retail sales data are ‘goods’ heavy. Household goods, clothing & footwear, and department stores account for ~50% of non-food retail turnover. Spending on ‘goods’, a winner during COVID lockdowns, is an area of household consumption that has been most under pressure from the rotation back into ‘services’, the cost-of-living squeeze, jump up in mortgage costs, and housing downturn. As our chart shows, the slump in consumer confidence points to a material slowdown in household spending, particularly on big ticket discretionary items, over coming months. In our opinion, a softer retail sales print is likely to reinforce the shift in thinking looking for the RBA to hold steady in April, and in turn, if realised, this can keep the pressure on the AUD.

AUD event radar: AU Retail Sales (Today), AU CPI Indicator (Weds), China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), AU Jobs Report (13th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6620 / 0.6756, 0.6794

SGD corner

After bouncing back late last week, USD/SGD has traded in a tight range near $1.3320 over the past 24hrs. As discussed above, the USD has remained range bound with the latest bout of positive banking system sentiment weighing on the JPY at a time improvement in the German IFO and hawkish ECB rhetoric has boosted the EUR.

We doubt that the volatility in markets and banking system issues are set to fully subside. As we have flagged over recent weeks, we think the global economy and markets have entered a trickier phase as the lagged effects of the aggressive policy tightening delivered over the past year begin to manifest in the real world and across pockets of the financial system. In our view, this should generate further bouts of volatility down the track, and this is a backdrop that normally creates headwinds for Asian FX given it is heavily leveraged to the global cycle. The global data calendar picks up later this week with the release of Eurozone inflation, the US PCE deflator (the Fed’s preferred inflation gauge), and the China PMIs. Following the sharp jump last month on the back of the post-COVID reopening, we think the China PMIs are at risk of underwhelming in March as softer global activity offsets the pick-up in domestic growth. We think a weaker than forecast set of China PMIs is likely to weigh on Asian FX, and could push USD/SGD a little higher.

SGD event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3260 / 1.3377, 1.3449