• Banking concerns. Worries about Deutsche Bank weighed on European equities, bond yields and the EUR at the end of last week.

• USD rebound. Lingering banking sector risks supported the USD. A broader set of signals points to a more difficult backdrop over the period ahead.

• AUD pressure. The bounce back in the USD has pushed the AUD lower. AU retail sales, the monthly CPI, and the China PMIs are released this week.

Markets remained volatile at the end of last week, with banking sector concerns still bubbling away. On Friday Deutsche Bank came under pressure, with the share price down ~15% early on before comments from German Chancellor Scholz, stressing that the bank had reorganised its business over recent years and had returned to profitability, helped to somewhat steady the ship. Deutsche Bank ended the day ~8.5% lower, and this dragged on the broader bank-heavy EuroStoxx600 (-1.4%). The negative sentiment also weighed on European bond yields and the EUR (now ~1.0775, ~1.4% below last week’s post US-Fed meeting high).

Despite the banking jitters, US shares managed to bounce back as the day rolled on, with the three main indices all ending Friday in positive territory (S&P500 +0.6%). However, US bonds markets continue to take a more bearish underlying view, with yields continuing to edge lower. The US 2yr yield closed the day down another ~7bps. At 3.77% the US 2yr yield is now near its lowest since mid-September. The relatively larger falls at the front end has seen the US yield curve continue to re-steepen. As we have flagged previously, a ‘bull steepening’ of a deeply inverted US yield curve has proven to be a useful timing tool for an impending US recession, with an economic downturn typically a source of market volatility (see Market Musings: Buckle up, volatility should continue).

In FX, the weaker EUR and European banking nerves gave the USD a boost, with last week’s US Fed-induced falls unwinding. That said, USD/JPY remains down near 130 with safe-haven demand for the JPY counteracting the lift in the USD. By contrast, cyclical currencies such as the NZD and AUD have been on the backfoot, with the AUD now down near $0.6650 (~1.5% below last week’s high).

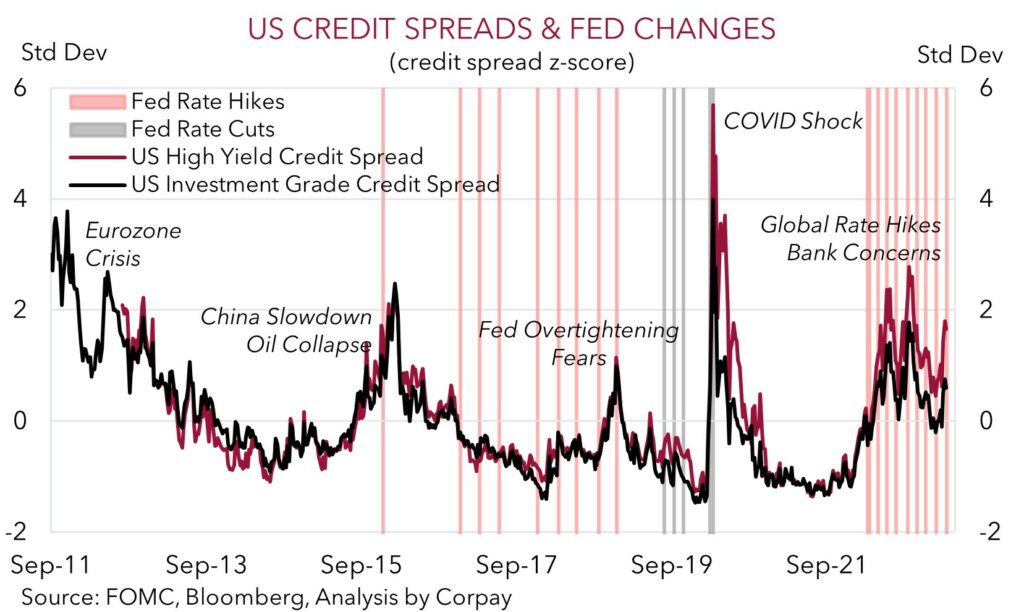

We continue to think that the ‘restrictive’ interest rate settings now in place in many economies should see growth slow materially over the next few months, with stress points in markets also likely to continue to flare up as the spillovers from the most abrupt tightening cycle in several decades continue to manifest. As our chart below shows, US credit spreads have widened over recent weeks. Credit is the lifeblood of an economy. Given tighter conditions tend to stifle the flow of credit, we see the widening in spreads as another sign that the macroeconomic environment should become more challenging over the period ahead. In our view, the mix of ongoing volatility, slowing growth, and still high inflation should favour the USD and JPY over currencies like the AUD and NZD.

Global event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

AUD corner

AUD came under renewed downward pressure at the end of last week as global banking concerns dampened risk sentiment and generated renewed support for the USD (see above). At ~$0.6650 the AUD is ~1.5% below last week’s post US Fed meeting high.

We think the AUD is likely to remain on the backfoot this week as global and domestic factors work against the currency. In our view, ongoing banking worries should continue to provide support for safe-haven currencies like the USD and JPY, as should signs that the global economy is entering a more challenging phase. The lower level of bond yields, the re-steepening of the US yield curve, and the widening in credit spreads are all signals pointing to a more difficult macro and market environment over the period ahead as the impacts of the aggressive rate hikes delivered around the world over the past year continue to show up. This week the global macro focus will be on the China PMIs (released Friday). Following the sharp reopening bounce, the China PMIs (released Friday) are predicted to have given back some ground in March with the weaker global environment offsetting the domestic revival.

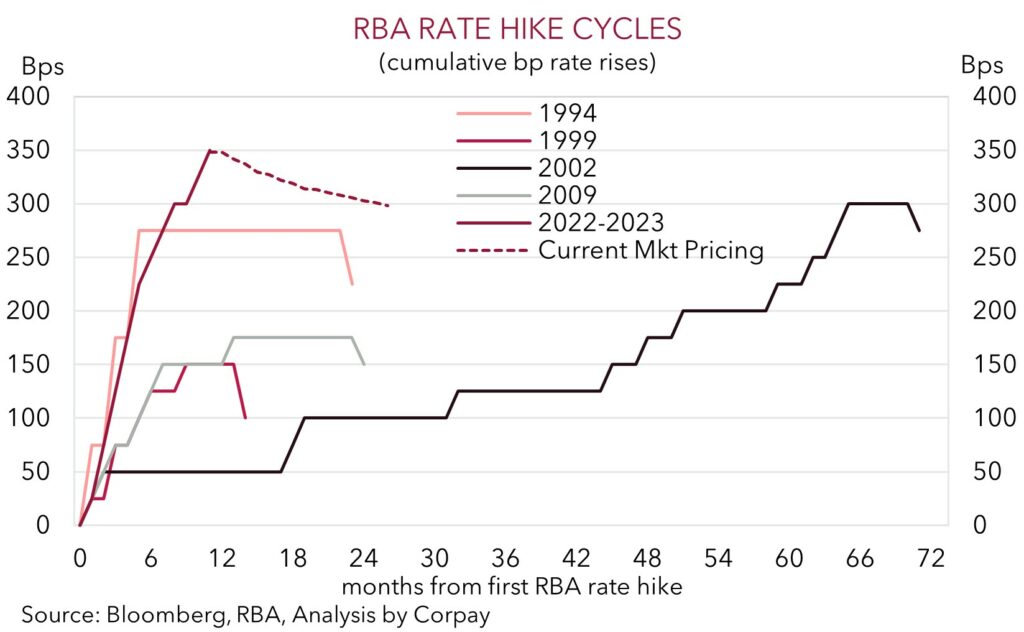

Locally, February retail sales data (released Tuesday) and the February reading of the monthly CPI indicator (released Wednesday) are due. The data will be used by the RBA in its assessment of whether to ‘pause’ its rate hiking cycle at next week’s meeting. Given the cost-of-living squeeze, cashflow hit on indebted households from rising mortgage rates, and below average consumer confidence, we think retail sales could once again underwhelm. At the same time, base-effects as some of last years large increases roll out of calculations point to a slowdown in inflation. If realised, we believe this mix should reinforce market pricing looking for the RBA to hold steady in April, and in turn, this can weigh on the AUD.

AUD event radar: AU Retail Sales (Tues), AU CPI Indicator (Weds), China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), AU Jobs Report (13th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6620 / 0.6756, 0.6794

SGD corner

USD/SGD has clawed back some lost ground, with the pair rising back up to ~$1.3330. The falls following last week’s US Fed meeting were unwound on Friday with European banking concerns dampening risk sentiment and generating renewed support for the USD (see above).

As discussed above, we think the lingering banking sector concerns, coupled with the generally trickier global economic environment as the effects of tighter monetary and credit conditions act to constrain activity should generate ongoing bouts of market volatility. This is a backdrop that normally creates headwinds for Asian FX given it is heavily leveraged to the global economic cycle. Later this week the March reading of the China PMIs are released. Following the sharp jump last month on the back of the economic reopening, we think the China PMIs are at risk of underwhelming in March as softer global growth offsets the pick-up in domestic activity. In our opinion, a weaker than forecast set of China PMIs is likely to weigh on Asian FX and push USD/SGD a little higher.

SGD event radar: China PMIs (Fri), Eurozone CPI Inflation (Fri), RBA Meeting (4th Apr), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3260 / 1.3377, 1.3449