• Mixed signals. The divergence across markets continues. US equities are holding up, while bonds continues to price in a recession.

• Fed cycles. Bond markets have factored in the next Fed easing cycle. But compared to history and given the US’ inflation problem this looks to aggressive.

• AUD crosses. AUD/USD remains range bound. But we expect the slowdown in global/domestic growth to see the AUD continue to underperform on the crosses.

Markets continue to digest yesterday’s US Fed announcement. The ongoing divergence across asset classes continues to highlight the more challenging economic environment we are in, with uncertainty about how things could play out greater than what we had grown used to in the years after the GFC. US equities nudged up modestly, led by the interest rate sensitive NASDAQ (+1%), though stronger early session gains were pared back as the day rolled on.

By contrast, bond yields continue to fall, with the front-end of the curve leading the way. Based on the level of yields and shape of the yield curve, the bond market continues to have a far more bearish view of how things could unfold. The US 2yr yield is down another 12bps to be at 3.82%, near the bottom of its 6-month range as expectations that the US Fed could quickly reverse course and begin to loosen policy as a US recession takes hold over coming months continue to be priced in. Notably, the larger relative fall in US 2yr yields compared to 10yr yields has seen the 2s10s curve continue to “bull steepen”. As we have pointed out before, a re-steepening of a deeply inverted US yield curve has proven to be a useful timing tool for an impending US recession, with an economic downturn also typically a source of market volatility (see Market Musings: Buckle up, volatility should continue).

In FX, the USD has clawed back some of its recent falls. While USD/JPY has consolidated just above 130, EUR has drifted back below 1.0850, with GBP is also slightly lower (now ~$1.2285). This is despite the Bank of England delivering another 25bp rate hike overnight. This was the BoE’s 11th straight hike and it takes the policy rate to 4.25%, the highest since 2008. Inflation continue to trump financial stability risks, with the BoE noting it remains prepared to do more if inflation pressures persist. AUD continues to swing around intra-day, but at ~$0.6680, on net, it is little changed so far this week.

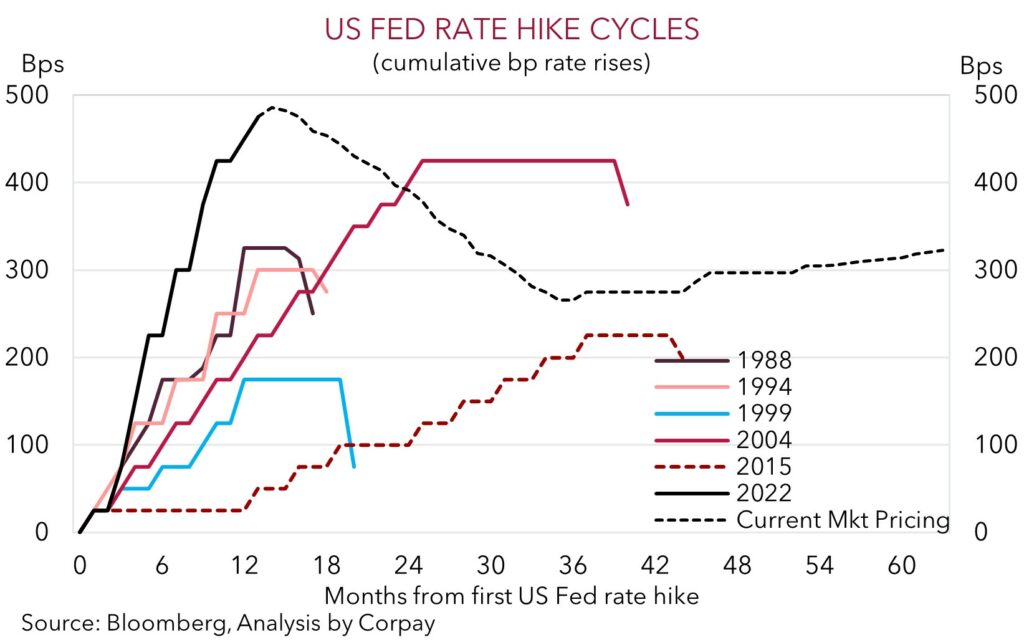

We continue to think the very ‘restrictive’ policy settings (i.e. interest rates well above equilibrium ‘neutral’ rates) should see activity slow materially over the next few months. A downshift in growth, at a time inflation is still uncomfortably high points to further bouts of volatility. Indeed, we believe markets have been too quick to price in the next easing cycle. As our chart shows, over the previous 5 US Fed cycles there has, on average, been a ~8mth gap between the last hike and first cut. Market pricing implies ~4-5mths this time. This seems unlikely given the Fed’s resolve to tackle sticky/high US inflation. We think an unwind of near-term rate cut bets would be an added source of uncertainty. Heightened volatility tends to favour the USD, EUR and JPY over cyclical currencies like the AUD.

Global event radar: Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD corner

AUD has continued to whipsaw around intra-day, but at ~$0.6680, on net the AUD is little changed so far this week. As discussed above, and yesterday following the US Fed announcement, we think the underlying signal across a range of asset markets, particularly the level of yields and shape of the US yield curve, indicates that participants are increasingly expecting the global economic environment to become more difficult as high interest rates and tighter credit conditions bite.

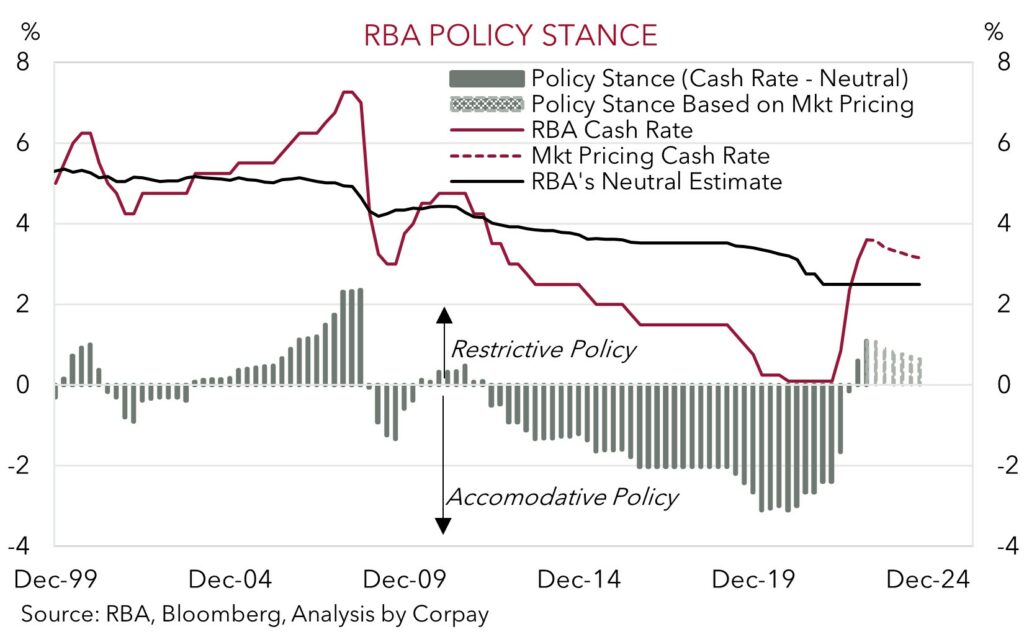

Indeed, as our chart below shows, the rapid rise in interest rates put through by the RBA means that domestic monetary conditions are the most ‘restrictive’ since before the GFC. Yet because of the policy lags (the full effect of interest rate changes are only felt after ~4-6 quarters) the broader economic impacts of the largest/fastest rate hiking cycle in a generation are still to be felt. We continue to foresee a sharp slowdown in domestic activity over 2023, with a material deceleration unfolding over Q2/Q3 as the jump up in mortgage costs squeezes indebted households (see Market Wire: Growth Momentum Slowing). Indeed, there could still be more of a cashflow hit to come, in our opinion, which would only add to the downside risks to the growth outlook. Although the RBA is nearing the end of its tightening phase, we think its work still isn’t done. While the RBA has started to talk about a ‘pause’ in its hiking cycle, in our view, the recent decisions by the US Fed, BoE, ECB and SNB to raise rates despite banking ructions, combined with stronger local employment data points to one more 25bp RBA hike in April or May.

In our view, the mix of slower global and domestic growth on the back of tight monetary conditions, and ongoing market volatility should create challenges for pro-cyclical currencies such as the AUD over Q2. And while we think AUD/USD should continue to find solid support ~$0.65-0.66 on the back of Australia’s current account surplus (now ~1% of GDP) and China’s reopening, we expect AUD to continue to underperform safe-havens and/or currencies tied to economies with relatively stronger growth momentum (i.e. JPY, EUR, and CNH).

AUD event radar: AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6650 / 0.6790, 0.6852

SGD corner

USD/SGD has consolidated just above 1.3250 over the past 24hrs. The modest retracement in the USD and softer EUR (see above) have helped USD/SGD level out. The slightly lower than expected Singapore CPI inflation data may have also provided some support to the pair. Headline inflation decelerated from 6.6%pa to 6.3%pa, while core inflation held steady at 5.5%pa. We think that signs that Singapore’s inflation pulse is starting to cool, along with the softer outlook for global demand eases some of the pressure on the Monetary Authority of Singapore to tightening policy aggressively at next month’s semi-annual meeting. That said, we still believe the MAS will err on the side of caution and implement a slight slope increase to its SGD NEER to help anchor medium-term inflation expectations.

As mentioned above, and yesterday following the US Fed announcement, beyond the very short-term, we think that the underlying swings across broader asset markets, particularly the bond market, shows that participants are becoming increasingly concerned about the economic environment with ‘restrictive’ policy and tighter credit conditions expected to meaningfully slow economic activity over coming months. This is normally a macro backdrop that generates spurts of market volatility, and typically creates headwinds for Asian FX. In time we think USD/SGD can recover some of its recent lost ground.

SGD event radar: Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr).

SGD levels to watch (support / resistance): 1.3150, 1.3200 / 1.3325, 1.3463