• Another Fed hike. Inflation trumps banking concerns with the Fed delivering another 25bp rate hike. Though its forward guidance was watered down.

• Mixed reaction. Volatility around the announcements, but in the end US equities and bond yields fell with the more challenging outlook hitting home.

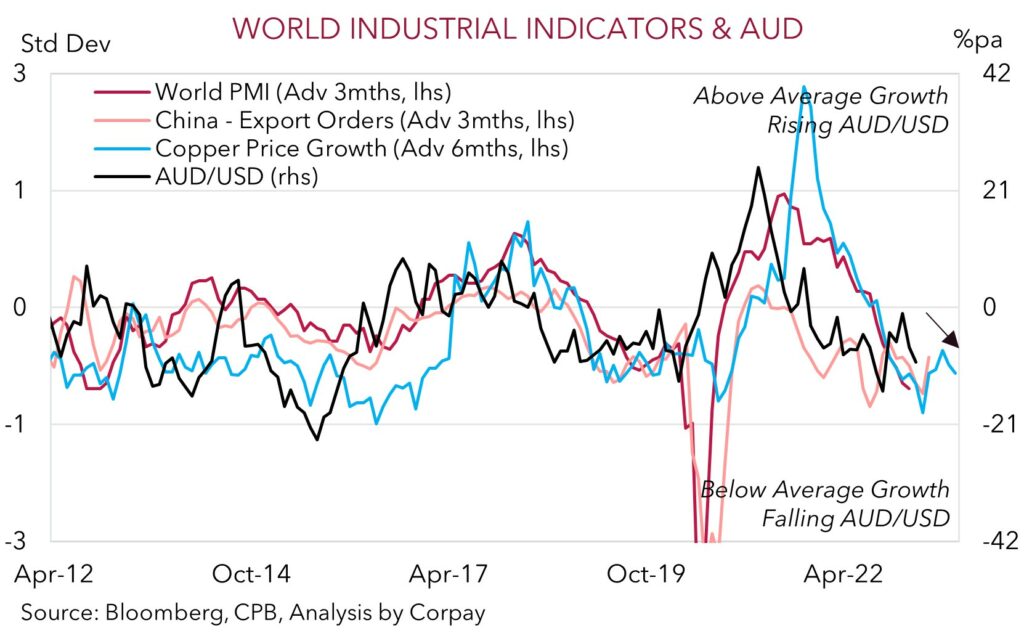

• AUD underperforms. AUD/USD was on net little changed, but the AUD underperformed on the crosses as global growth risks intensify.

The US Fed announcement and Chair Powell’s press conference was the focus overnight, and as is usually the case there was some intra-day volatility across different markets as participants digested the range of comments flying around. Developments in parts of the banking system made the Fed’s decision trickier than it had been for some time. But in the end, and as we had expected, while a ‘pause’ was considered the inflation fight won out, with the broader banking system deemed to be “sound and resilient” despite pockets of stress. The FOMC unanimously voted in favour of raising the funds target range by another 25bps, taking it up to 4.75-5.00%, its highest level since Q3 2007.

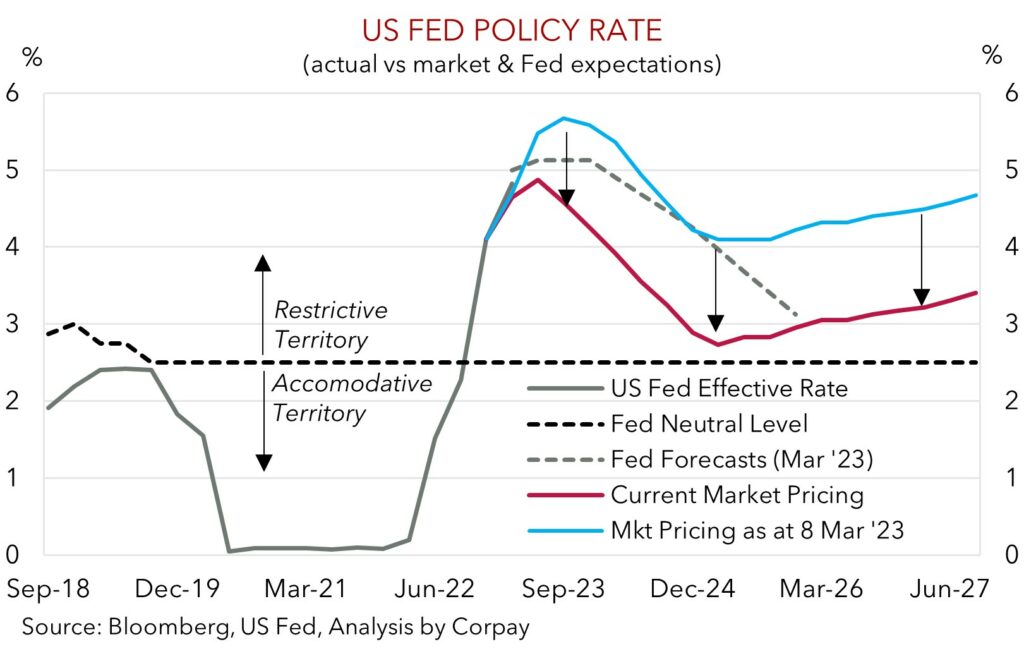

That said, in a sign the tightening phase is nearing the end, the Fed did also soften its forward-looking guidance, now noting that “some additional policy firming may be appropriate” to get settings to the level needed to get inflation back down to target, compared to the last meeting when “ongoing increases” in rates were anticipated. The tightening in credit conditions generated by the banking issues will do some of the work for the Fed. Indeed, the Fed’s updated interest rate projections were little different, with a peak of ~5.125% this year still in place. This implies the Fed thinks there is still a chance the hiking cycle isn’t over. Some modest policy easing continues to be projected by the Fed over 2024 and 2025, though we would also highlight that even with this turn around rates are predicted to remain ‘restrictive’ for several years.

Market reaction has been mixed. The initial bump up in US equities unwound, with the S&P500 ending the day lower (-1.7%) following Chair Powell’s push back on the markets 2023 rate cut pricing and his shot across the bow that the Fed remains prepared to raise rates by more than expected if needed, and comments by Treasury Secretary Yellen that the government isn’t considering ‘blanket’ deposit insurance to stabilise the system. By contrast, the bond market continues to factor in the end of the tightening cycle (and a more difficult economic environment) with US yields falling by 17-24bps across the curve as expectations the Fed could deliver rate cuts later this year to counteract a recession build. FX has been caught in the middle. The USD Index lost some ground, tracking the fall in US yields, with EUR moving up towards 1.09 and USD/JPY declining towards 131. AUD has whipsawed around, following the swings in equity markets, and on net is little changed on the day.

In our mind, the diverging market reactions further highlights the more challenging macro environment we have entered, as the spillover effects from the fastest/largest tightening cycle in over a generation continue to manifest. While we think the USD can remain on the backfoot against the EUR and JPY, we also believe the heightened volatility and slowing economic activity should also create lingering headwinds for growth-linked currencies like the AUD.

Global event radar: BoE Meeting (Tonight), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD corner

AUD whipped around following the US Fed rate hike announcement and Chair Powell’s press conference as different markets absorbed the messages coming through from policymakers (see above). On net, while AUD (now ~$0.6680) is little changed against the softer USD, we would note that this masks the AUD’s relative underperformance against the EUR, JPY, GBP, CNH and NZD.

Based on the post-Fed reaction across an array of asset markets (equities and bond yields lower, and the weakness on the AUD crosses), our take is that participants continue to come around to the view that the global economic environment is becoming increasingly difficult with recession risks rising on the back of the ‘restrictive’ policy settings and with credit conditions tightening. As the impacts from the aggressive rate hike cycles continue to manifest over coming months, we continue to think that market volatility should remain elevated (see Market Musings: Buckle up, volatility should continue). In our opinion, the mix of slower global (and domestic growth), and ongoing volatility should create challenges for pro-cyclical currencies such as the AUD over Q2, and although we think AUD/USD should continue to find solid support ~$0.66, we expect the AUD to remain on the backfoot on the crosses.

More specifically, given the still somewhat ‘hawkish’ European Central Bank, more attractive valuations, and positive spillovers to the Eurozone from the unfolding recovery in China’s services sectors, we think the EUR should remain supported. And with markets continue to factor in a divergence in the policy outlooks for the RBA and ECB, we remain of the view that AUD/EUR can continue to edge down towards ~$0.60 (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations).

Similarly, in the short-term, we think the downward pressure on AUD/GBP (which touched a fresh 2023 low overnight) can be maintained. The stronger than expected UK CPI data for February, with headline and core inflation re-accelerating, is expected to see the Bank of England deliver another 25bp rate hike at tonight’s policy meeting (11pm AEDT). The stickiness across services inflation, on the back of higher UK wages, could also see the BoE flag that further hikes may be needed down the track. This is contrast to the RBA where expectations a “pause” is nearing have risen.

AUD event radar: AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6650 / 0.6787, 0.6858

SGD corner

USD/SGD has continued to grind lower, with the softer USD/stronger EUR following the US Fed announcement (see above) the key driver. In the wake of the Fed’s 25bp rate hike decision, and slightly less hawkish forward-looking guidance, US interest rate expectations and bond yields have repriced lower. This has seen USD/SGD dip below its 50-day moving average (1.3326) for the first time since mid-February. This downward run in USD/SGD may continue over the near-term, particularly with Singapore CPI (released later today) projected to show a further acceleration in core inflation. Another elevated CPI print would keep the pressure on the MAS to tighten policy further at its upcoming meeting (note, the MAS review is due by mid-April).

But beyond the very short-term, we think that the underlying message from the US Fed, and the reaction across broader asset markets shows that participants are becoming increasingly concerned about the economic environment with ‘restrictive’ policy settings and tightening credit conditions expected to materially slow US/global economic activity over coming months. This is normally a macro backdrop that generates ongoing bouts of market volatility, and typically creates headwinds for Asian FX. We expect this to happen once again, and in time we think USD/SGD can recover lost ground.

SGD event radar: Singapore CPI (Today), BoE Meeting (Tonight), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr).

SGD levels to watch (support / resistance): 1.3150, 1.3200 / 1.3324, 1.3472