• Positive vibes. Equities and bond yields are higher as sentiment regarding the banking situation continues to improve.

• US Fed in focus. While a case can be made for the Fed to hold steady, we think it is more likely that it delivers another 25bp hike. And continues to stress that ‘restrictive’ settings will be needed for some time.

• AUD underperformer. Comments that the RBA will “reconsider” a pause in April have weighed on the AUD. Policy divergence can keep the AUD on the backfoot.

Risk sentiment has continued to recover. The recent moves by authorities to support the banking system and mitigate financial contagion risks have been reinforced over the past 24hrs via additional supportive rhetoric. Adding to yesterday’s reports that US officials were studying ways to guarantee all bank deposits (in the event of an escalation of the crisis), overnight, US Treasury Secretary Yellen stressed that the actions recently undertaken could be repeated if other smaller banks suffer deposit runs with authorities “resolutely committed” to mitigating financial stability risks.

Equity markets were higher again overnight, with Financials continuing to lead the way. The European benchmark index rose 1.5%, while the US S&P500 increased 1.3%. The easing in investor nerves also flowed through to bonds, with yields jumping up. European bond yields rose 15-25bps across the curve. In the US the 2yr yield increased another 19bps (now 4.17%, compared to an intra-day low of 3.63% on Monday), while the 10yr yield has edged up to 3.6% (~30bps above Monday’s low).

In FX, the USD Index has consolidated, with a higher EUR (now ~1.0770) counteracting the rise in USD/JPY which is back up near its 50-day moving average (132.55). Elsewhere, USD/CAD has ticked up with the rebound in Canadian bond yields held back by the lower-than-expected Canadian CPI. The deceleration in headline inflation, from 5.9%pa to 5.2%pa, and slowdown in the core measures supports the Bank of Canada’s recent decision to pause its hiking cycle. And despite the upbeat sentiment, the AUD has underperformed the USD and EUR, with yesterdays comments from the RBA indicating a “pause” is possible in April a factor.

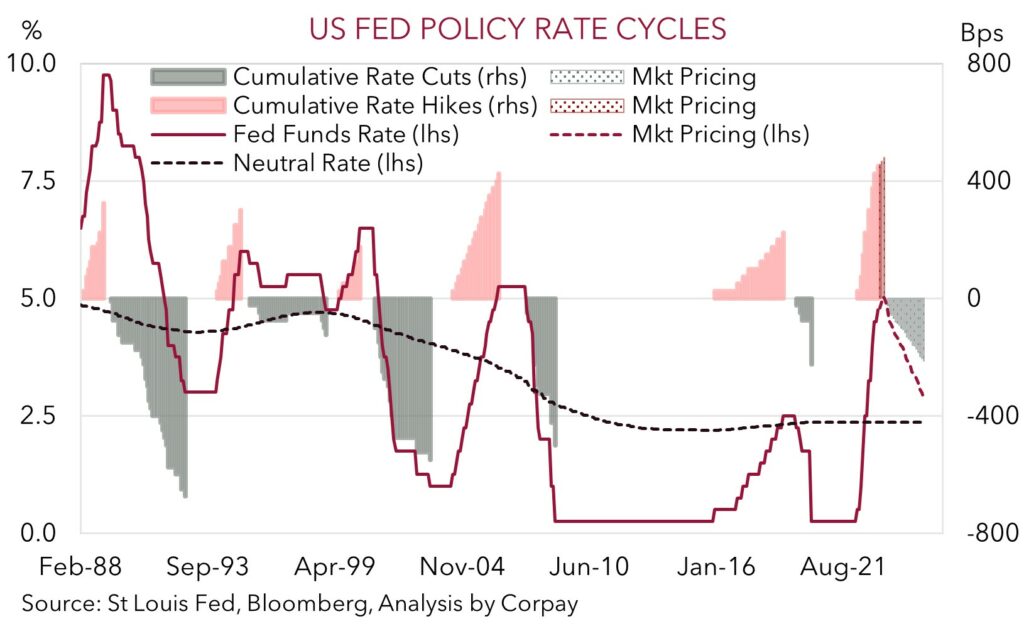

Market attention will be on tomorrows US Fed policy announcement (5am AEDT) and Chair Powell’s press conference (from 5:30am AEDT). It is a tricky situation. Given the ructions across the banking sector a case can be made for the Fed to ‘temporarily’ hold steady tomorrow, though our central case is for the Fed to press ahead and deliver another 25bp rate hike in its ongoing fight against very high inflation, particularly as other measures have been deployed to alleviate the financial sector pressures. Indeed, we think a ‘pause’ may be taken negatively by markets as it may trigger concerns about “what else does the Fed know?”, while a hike could be seen as a vote of confidence about the health of the broader system. In our view, another Fed hike and forecasts which show an interest rate path well above what the market is now factoring in is likely to provide the USD with some support.

Global event radar: US FOMC Meeting (Tomorrow), US Fed Chair Powell Speaks (Tomorrow), BoE Meeting (Tomorrow), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD corner

Despite the upswing in global equity markets and turn in risk sentiment, the AUD has underperformed the USD and EUR over the past 24hrs. AUD/USD has slipped back towards $0.6670 (down ~1% from Monday mornings high), while AUD/EUR is back under $0.62.

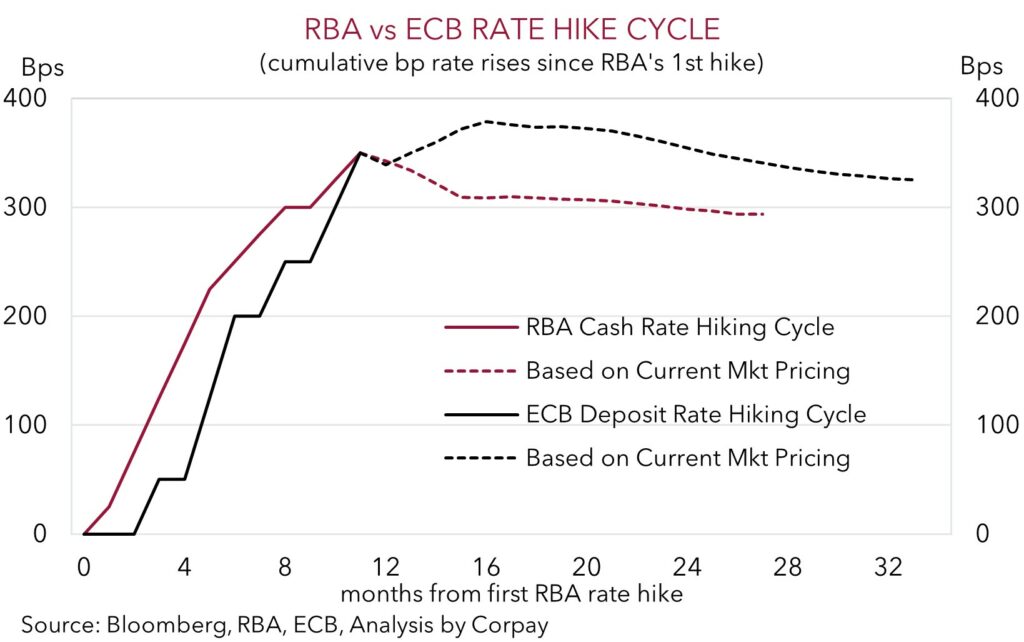

Comments contained in the March RBA meeting minutes, released yesterday, have exerted some pressure on the AUD. According to the RBA, while it continues to judge that more tightening could be needed this cycle, the Board did agree to “reconsider the case for a pause” at the April meeting as it looks to assess the state of play. In our mind, this isn’t that groundbreaking. The forward-looking policy guidance contained in the March post meeting statement had already shifted to a more measured and staggered data-dependent approach, with the possibility of a pause something we had already been anticipating given the impacts the rapid-fire rate hiking cycle were already having across the economy (see Market Wire: RBA in the home straight). Indeed, RBA Governor Lowe had also recently flagged that based on how high interest rates now are, and given the policy lags, a ‘pause’ was logically coming into view. That said, the diverging RBA and ECB policy outlooks (as shown in the chart below) is something we think can continue to build and is a factor behind our prediction looking for AUD/EUR to move down to ~$0.60 (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations).

The US Fed announcement (5am AEDT) and Chair Powell’s press conference (from 5:30am AEDT) are the main market events over the next 24hrs. As discussed above, while a case can be made for the Fed to hold steady, we remain of the opinion that the high US inflation and improvement in the banking situation on the back of the various measures that have been implemented, should see the Fed to hike rates by another 25bps. Moreover, we expect the Fed to reiterate that the macro outlook still requires settings to remain ‘restrictive’ for an extended period. Relative to the markets interest rate expectations, which are now penciling in rate cuts from mid-year, this type of outcome would be a ‘hawkish’ result. If realised, we think this could be USD supportive, with shifting interest rate differentials also likely to keep the AUD under pressure.

AUD event radar: US FOMC Meeting (Tomorrow), US Fed Chair Powell Speaks (Tomorrow), AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6650 / 0.6763, 0.6862

SGD corner

USD/SGD has remained on the backfoot, with the pair continuing to drift down towards its 50-day moving average (1.3325). The positive risk sentiment pulsating through markets on the back of the easing in banking sector fears is supportive for Asian FX, and this has been outweighing the rebound in US bond yields (see above).

However, we doubt this run can extend much further. Market attention will be on tomorrow mornings US Fed announcement and Chair Powell’s press conference. As mentioned above, while an argument can be made for the Fed to ‘temporarily’ hold steady, we think that on balance, the Fed will show its ongoing commitment to bringing down inflation and its confidence in the broader banking system by hiking interest rates by another 25bps. This would take the Fed funds range up to 4.75-5.00%. More importantly, we also believe that the Fed’s interest rate projections will continue to show that policy is expected to remain ‘restrictive’ for some time. And based on where interest rate expectations have fallen to, we think this could trigger an upward repricing, which in turn may see the USD (and USD/SGD) recover some lost ground.

SGD event radar: US FOMC Meeting (Tomorrow), US Fed Chair Powell Speaks (Tomorrow), Singapore CPI (Tomorrow), BoE Meeting (Tomorrow), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr).

SGD levels to watch (support / resistance): 1.3325, 1.3350 / 1.3481, 1.3520