• Intra-day vol. Equity and bond markets have whipped around over the past 24hrs in response to the UBS/Credit Suisse deal. In the end risk appetite improved.

• Fed in focus. Measures deployed to suppress contagion risks should keep the door open for the Fed to hike rates again in its fight against inflation.

• AUD near a 2-week high. Positive risk sentiment can support the AUD further near-term, but the Fed decision could see it fall back later this week.

Markets continue to experience intra-day volatility, with global banking developments still centerstage. The news that UBS is buying Credit Suisse was initially met positively in yesterday’s Asian trade, before concerns about the complete wipeout of holders of CS’ additional tier 1 (AT1) notes got the market’s attention and dampened sentiment. However, this to was short-lived, with reassurances from EU officials and the Bank of England about the order in which shareholders and creditors should bear losses in the event of an insolvency easing concerns.

European and US equity markets ended the day higher, with benchmark indices up ~0.9-1.3%. US bond yields are also currently trading near the top end of their wide daily ranges. On net the US 2-year yield has risen by ~11bps to be back up near 3.95%, though this masks the ~40bp range it traded in over the past 24hrs. In FX, the USD has drifted a little lower. EUR has edging back above 1.07, USD/JPY is tracking down just above 131, while the AUD has nudged up towards $0.6720 (near the top of its 2-week range).

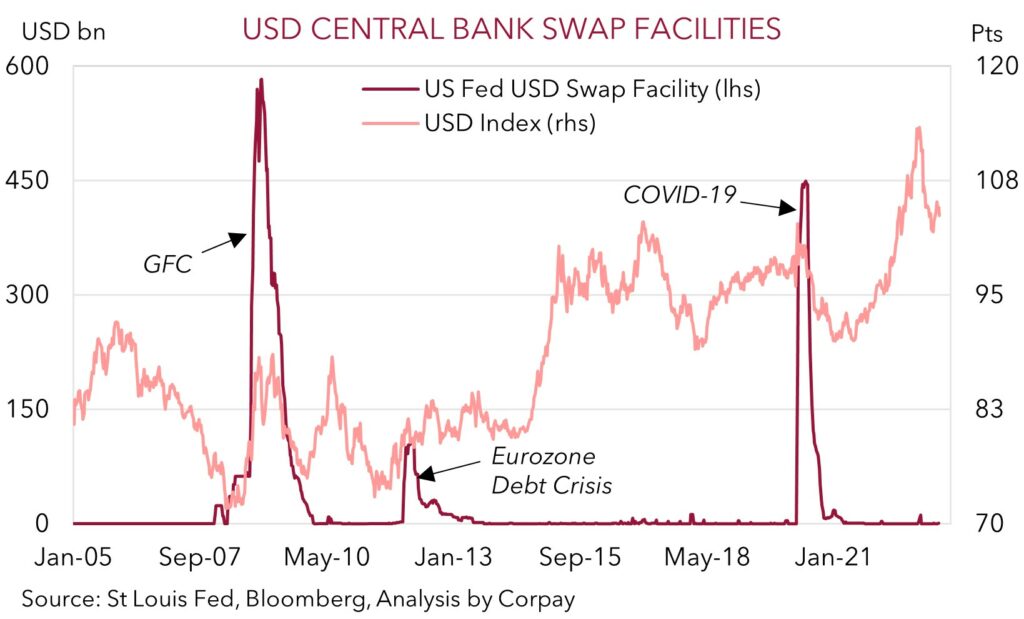

Authorities continue to do what they can to help calm market nerves and mitigate financial contagion risks. Yesterday, the US Fed and 5 other major global central banks announced an enhancement of the USD swap lines, a tool which has been deployed and used effectively during previous bouts of acute market/funding stress. The operations will run daily, rather than weekly over the next few weeks. But the initial signs are that the moves were pre-emptive, to help instill confidence, as opposed to trying to counteract issues that had built up in the financial plumbing. There was only a very small allotment (<$110mn) provided overnight. This is another indication that while there are some bank specific issues, stresses across the broader system remain contained, at least for now. This also supports our expectation that while the US Fed will note the increased uncertainty, it should continue to push ahead and deliver another 25bp rate hike later this week (Thursday morning AEDT) as it continues its battle against very high inflation. Another Fed hike and forecasts which show an interest rate path well above what the market is now factoring in should, in our judgement, provide the USD with some renewed support later this week.

Global event radar: US FOMC Meeting (Thurs), US Fed Chair Powell Speaks (Thurs), BoE Meeting (Thurs), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD corner

AUD endured a modest amount of intra-day volatility over the past 24hrs, tracking the shifts in risk sentiment following the announcement that UBS will buy Credit Suisse (see above). On net, the AUD is little changed from this time yesterday, and at ~$0.6720 is near the top of its 2-week range. As we discussed yesterday, based on its high correlation with global equities, the AUD may continue to grind up towards the 200-day moving average ($0.6764) over the early part of this week given the deal should nullify a potential source of global financial contagion. The release of the March RBA meeting minutes later today (11:30am AEDT) may generate some headlines, but we don’t expect the commentary to have a lasting impact on the AUD.

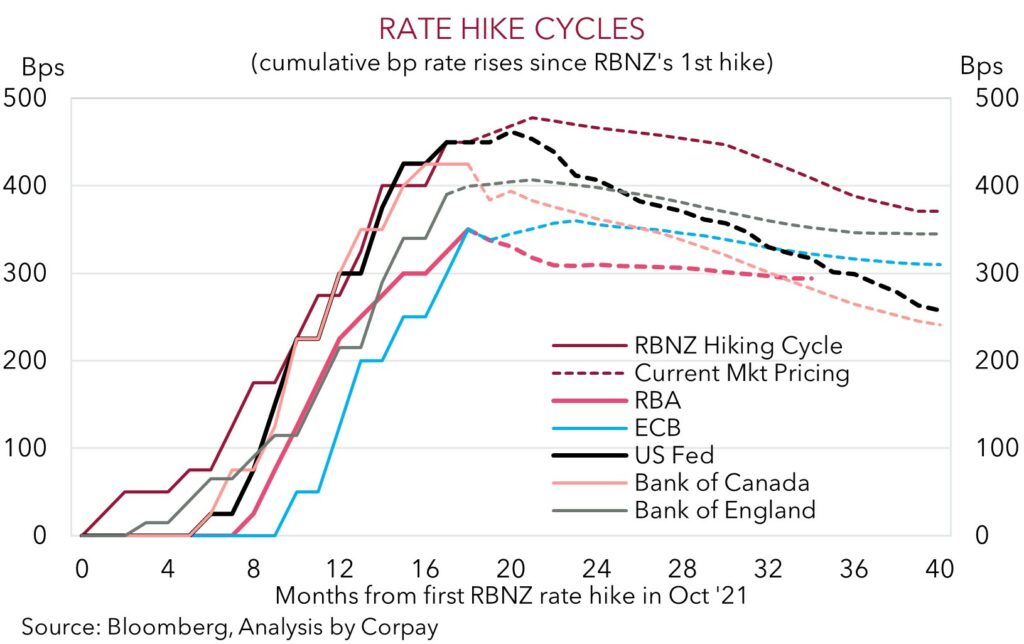

Looking ahead, we also remain of the opinion that all the measures being deployed by global authorities to mitigate financial sectors risks should also mean that central banks can continue to use monetary policy in their fight against rampant inflation, albeit at a more measured and limited pace than what we have seen the past year. As our chart below shows, markets have moved aggressively over recent weeks with expectations of further rate hikes replaced with thoughts rate cutting cycles may kick off later this year. The adjustment in interest rate pricing has been most pronounced in the US. We believe markets have gone too far too fast. We continue to expect the US Fed to deliver another 25bp rate hike this week (Thursday morning AEDT) and think the underlying message that settings will need to stay ‘restrictive’ for some time to bring down inflation will be maintained. Relative to the markets current interest rate pricing this type of outcome would be a ‘hawkish’ result. If realised, we think this could provide the USD with some support (and weigh on the AUD) later this week.

AUD event radar: US FOMC Meeting (Thurs), US Fed Chair Powell Speaks (Thurs), AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6660 / 0.6764, 0.6866

SGD corner

USD/SGD has continued to drift back and is trading sub-1.34 for the first time in nearly a month. The softer USD and (eventual) improvement in risk sentiment (see above) has combined to weigh on USD/SGD. As we mentioned yesterday, our take was that the UBS/Credit Suisse deal should ultimately be taken well by markets, and this should see USD/SGD ease back a bit further near-term. The 50-day moving average (1.3325) looks to be in USD/SGD’s sights.

However, we also remain of the view that the measures being deployed to suppress financial stability risks should also keep the door open for central banks to continue in their battle against inflation. The US Fed meeting (Thursday morning) is this week’s main economic event. As discussed above, we think that the US Fed will deliver another 25bp rate hike, with its updated projections also set to show policy is expected to remain ‘restrictive’ for a while. In our opinion, given how far US interest rate expectations have fallen, this type of outcome and/or a further improvement in risk appetite could see US yields continue to rebound. This in turn may reinvigorate the USD (and USD/SGD) later this week.

SGD event radar: US FOMC Meeting (Thurs), US Fed Chair Powell Speaks (Thurs), Singapore CPI (Thurs), BoE Meeting (Thurs), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr).

SGD levels to watch (support / resistance): 1.3324, 1.3350 / 1.3489, 1.3520