• Market turbulence. Banking developments continue to drive markets. Will the UBS/Credit Suisse news act as a circuit breaker?

• Fed in focus. The US Fed meets later this week. Despite the banking issues, high inflation still points to the Fed hiking by another 25bps, in our view.

• AUD volatility. AUD has edged higher recently. Another Fed rate hike and a relatively ‘hawkish’ message could see the USD bounce back.

Developments in the global banking system continue to drive markets. It has been a tumultuous week, with fears of bank contagion weighing on risk appetite once again on Friday. More regional US banks have come under the spotlight. In a move to boost confidence and support the system, First Republic Bank (FRB) was offered liquidity support by several major US banks. But this failed to calm nerves.

Led by financials, US and European equities declined another ~1% on Friday. Elsewhere, credit spreads widened, and global bond yields continued to fall back towards the lows from earlier in the week. The US 10yr yield (now 3.43%) is down near where it was trading in early-February, ~65bps below its March highs. The US 2yr (now 3.84%) has plunged by ~123bps since 8 March as banking concerns triggered a sharp reassessment of the monetary policy outlook. In FX, the USD came under some modest downward pressure, with the JPY continuing to benefit from the turbulence and narrowing rate differentials. USD/JPY is under 132 for the first time in a month. EUR has edged up towards 1.07, while the AUD (now ~$0.6710) is near a 2-week high.

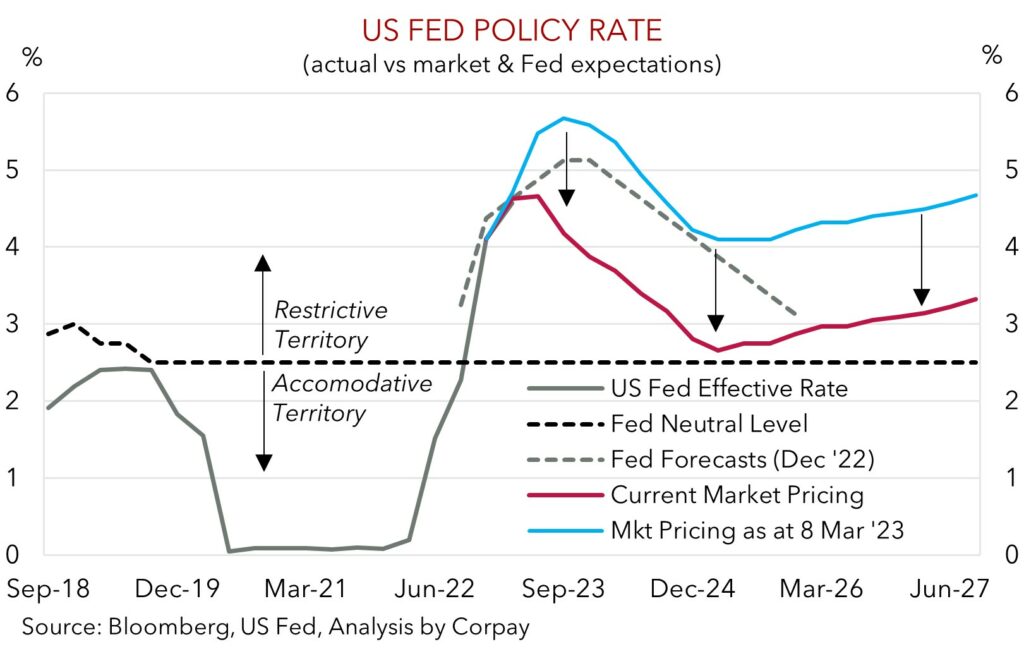

Banking-related news should continue to dominate at the start of this week. The announcement that UBS will buy the beleaguered Credit Suisse is another potential circuit breaker, as a source of possible global contagion risk has been quashed. The news should set the tone for markets, and it may also have flow on implications for the US Fed’s policy decision (Thursday morning AEDT). As our chart shows, markets have drastically adjusted their expectations for the rest of the Fed cycle over recent weeks, with thoughts of further rate hikes giving way to cuts kicking in from mid-year.

We think US interest rate expectations have moved too far too fast. In the absence of the banking turbulence, the recent US labour market and inflation data would have likely seen the Fed consider another larger than usual rate hike this week. But given the issues the debate should be centered on whether the Fed ‘pauses’ or raises rates by 25bps. In our opinion, the very high US inflation makes it difficult for the Fed to hold steady, particularly as other measures have been deployed to mitigate financial stability issues. We believe the Fed could follow the ECB’s lead by raising rates in line with expectations (i.e. 25bps), highlight that near-term uncertainty has risen, but also signal a continued tightening bias via its forecasts which should show an interest rate path well above what the market is now factoring in. In our view, this mix could see the USD recover lost ground later this week.

Global event radar: US FOMC Meeting (Thurs), US Fed Chair Powell Speaks (Thurs), BoE Meeting (Thurs), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD corner

Despite the pockets of stress in the global financial system, the AUD has managed to grind up over the past few sessions. At ~$0.6710 the AUD is near a 2-week high. The softer USD, last Thursday’s stronger than anticipated Australian labour market report, and Friday’s announcement that China’s central bank (the PBoC) was reducing the reserve requirement ratio (RRR) for most banks by 0.25% combined to support the AUD over the back end of last week.

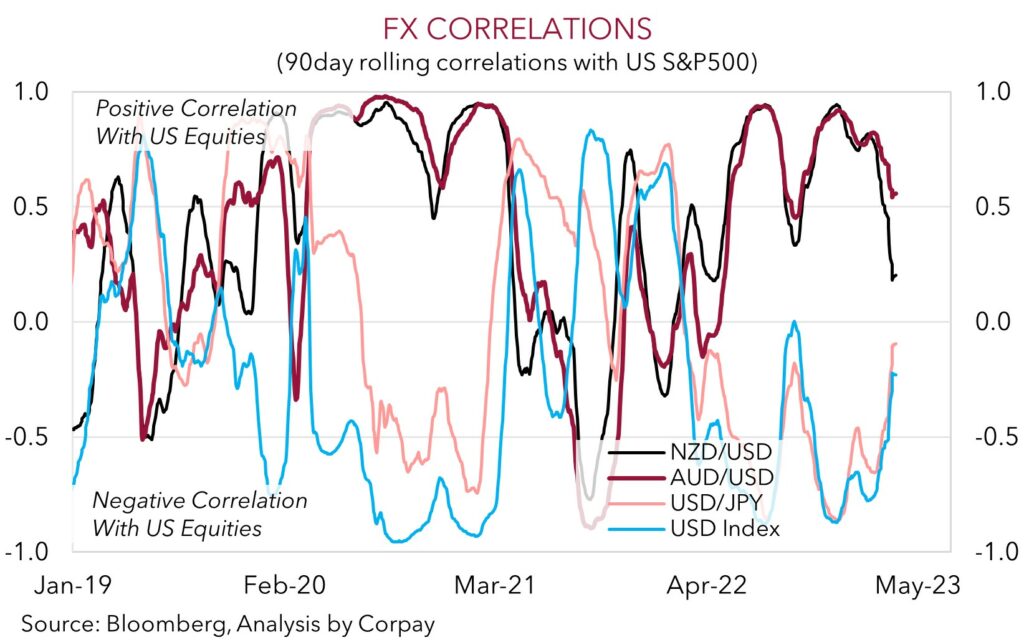

In our view, weekend news that UBS will buy Credit Suisse should help improve market sentiment as a potential source of global financial contagion has been somewhat nullified. Based on the AUD’s elevated correlation with global equities (see chart below), we think this may give the AUD a further boost early this week, with a move up to the 200-day moving average (0.6764) on the cards.

However, we also think that moves which help alleviate financial sector risks should also allow macroeconomic fundamentals to reassert themselves, and on this score, as we discussed above, US interest rate expectations may also start to bounce back. The US Fed policy announcement and Chair Powell’s press conference (both Thursday morning AEDT) are the main economic events later this week. Despite the market turbulence we think the high US inflation and tight labour market should see the Fed raise rates by another 25bps. We also think the Fed will continue to stress that although uncertainty has picked up, policy settings will need to stay ‘restrictive’ for some time in order to be confident inflation will head back down to target over the next few years. Relative to the markets current US interest rate pricing, which has fallen back a long way over the past few weeks, this type of message would be a relatively ‘hawkish’ outcome. If realised, we think it should provide the USD with some renewed support, exerting some renewed downward pressure on the AUD later this week.

AUD event radar: US FOMC Meeting (Thurs), US Fed Chair Powell Speaks (Thurs), AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr), US Jobs Report (7th Apr), US CPI (12th Apr), Bank of Canada Meeting (12th Apr), US Retail Sales (14th Apr).

AUD levels to watch (support / resistance): 0.6522, 0.6660 / 0.6764, 0.6867

SGD corner

USD/SGD has drifted back towards ~1.34 with the downshift in US interest rate expectations and lower US bond yields weighing on the USD (see above). In our opinion, the weekend news regarding UBS and Credit Suisse should help lift market sentiment, at least in the early part of the week. This may see USD/SGD ease back a bit further near-term.

However, we also think that the various steps being taken around the world to mitigate financial stability risks should also allow central banks to continue their fight against inflation. This week we believe the US Fed (Thursday morning) will raise rates by another 25bps, with the underlying higher-for-longer interest rate message being maintained despite the pockets of banking sector stress. US inflation is still too high for the Fed to let up, and last week’s ECB decision to hike rates in the face of the banking turmoil shows that central banks remain focused on dealing with the macroeconomic challenges. In our judgement, given how far US interest rate expectations have fallen, another Fed hike and message that rates will need to stay elevated for some time may give the USD (and USD/SGD) some renewed support later this week.

SGD event radar: US FOMC Meeting (Thurs), US Fed Chair Powell Speaks (Thurs), Singapore CPI (Thurs), BoE Meeting (Thurs), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), US Jobs Report (7th Apr), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr).

SGD levels to watch (support / resistance): 1.3325, 1.3377 / 1.3490, 1.3520