• Quiet markets. Small market moves overnight with reaction to the French election result minimal. Bond yields consolidated. USD a touch firmer.

• Fed commentary. Fed Chair Powell speaks tonight. Will he note the loosening in the jobs market & keep the door open to rate cuts later this year?

• AU data. Consumer confidence & business conditions due today. Diverging macro/policy trends in Australia’s favour are AUD supportive.

A quiet start to the week with the major asset markets confined to tight ranges. Reaction to the surprise result in the second round of the French parliamentary elections where the leftist alliance captured more seats and political gridlock looks set to ensue was rather subdued. There was only a modest underperformance in French equities (CAC -0.6% vs EuroStoxx50 -0.2%), a narrowing rather than a widening in the spread between French and German 10yr yields (this is gauge of inter-reginal risk), and a small dip in the EUR compared to where it closed last week (now ~$1.0815).

Elsewhere, the lack of fresh economic news saw US equities tick up (S&P500 +0.1%) and bond yields consolidate (US 10yr is at ~4.28%). In FX, the USD index is a fraction higher. GBP (now ~$1.2808) has tread water, USD/CAD is a touch lower (now ~1.3635), while USD/JPY (now ~160.80) remains near the upper end of its multi-decade range. There was limited spillover in the JPY yesterday from the quickening in Japanese wages. The full-time measure that excludes bonuses/overtime and uses the same sample accelerated to 2.7%pa, a cyclical peak. Japanese wages are beginning to capture the lift in the recent Shunto and Rengo bargaining outcomes. This in turn can flow through to Japanese inflation down the track. We think these trends could see the Bank of Japan revise up its inflation forecasts, a potential trigger for another rate hike at the late-July policy meeting. Across the other currencies, USD/SGD has moved sideways (now ~1.3498), ahead of tomorrows RBNZ meeting the NZD (now ~$0.6128) softened, and the AUD (now ~$0.6738) has been range bound.

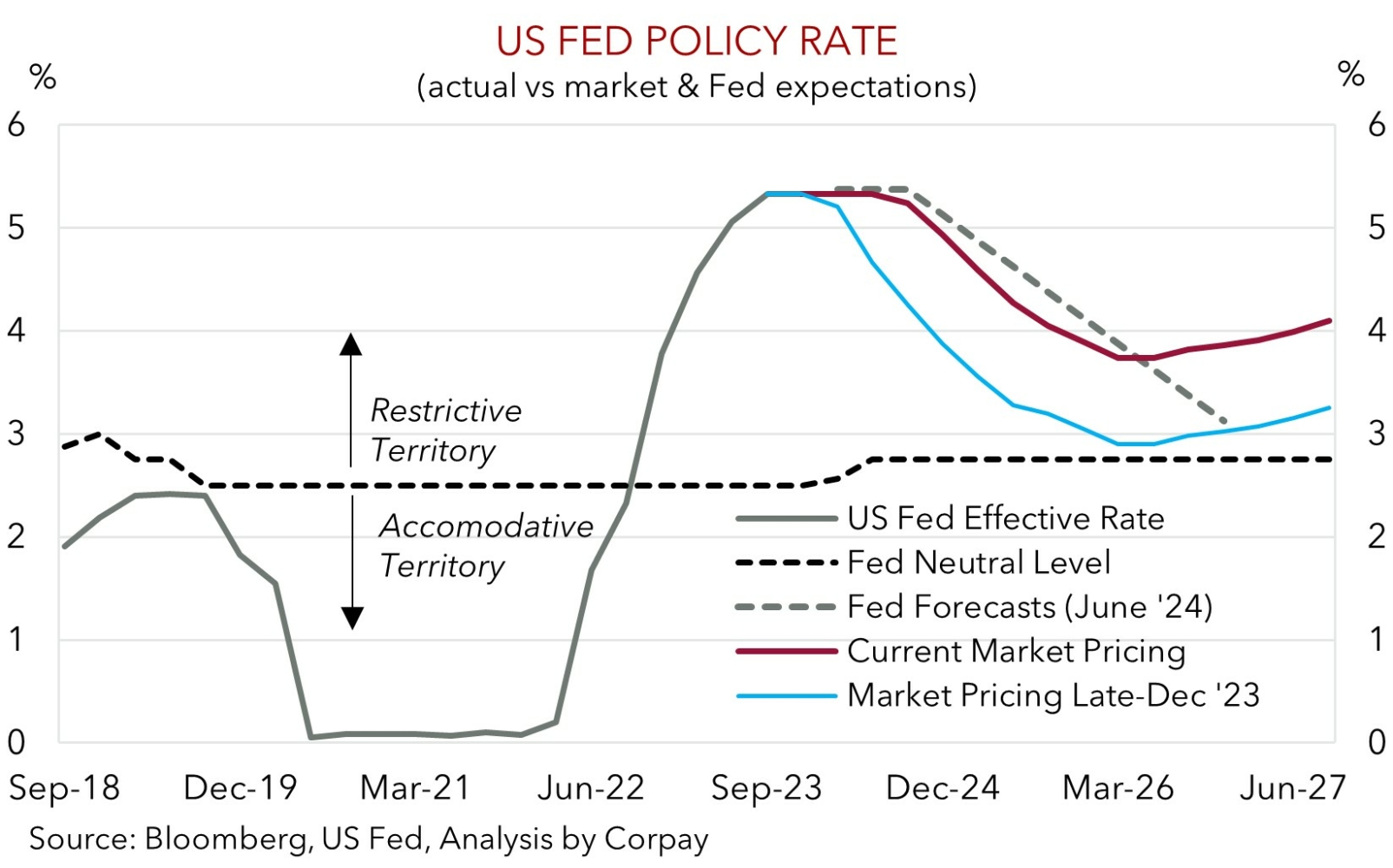

Focus tonight will be on US Fed Chair Powell’s Congressional Testimony (12am AEST), with the latest US CPI inflation data also looming on the horizon (Thurs night AEST). Chair Powell will be able to share his updated thinking following the latest US jobs data which showed conditions are loosening and whether the renewed downshift in US inflation may be sustained. We expect Chair Powell to reiterate that the Fed will be guided by the data when it comes to the start of the easing cycle, but based on how it thinks things could pan out it should be appropriate to begin to dial back its ‘restrictive’ settings later this year with 1-2 cuts anticipated. In our opinion, this type of message might reinforce the downward adjustment in US rate expectations (which now look similar to the Fed’s baseline projections), exerting some pressure on the USD.

AUD Corner

At the start of the new week the AUD has consolidated near ~$0.6740, the upper end of the range it has occupied since early-January. As mentioned above there has been little new information to move the dial overnight with reaction to the French parliamentary election results minimal. On the crosses, the AUD has generally drifted back a touch with it shedding ~0.1% against the ER, GBP, CAD, and CNH over the past 24hrs. That said, in level terms the AUD remains elevated. AUD/EUR (now ~0.6225), AUD/CNH (now ~4.9085), and AUD/CAD (now ~0.9188) are still up towards the top end of their respective ~1-year ranges, and AUD/JPY (now ~108.35) is near a multi-decade high.

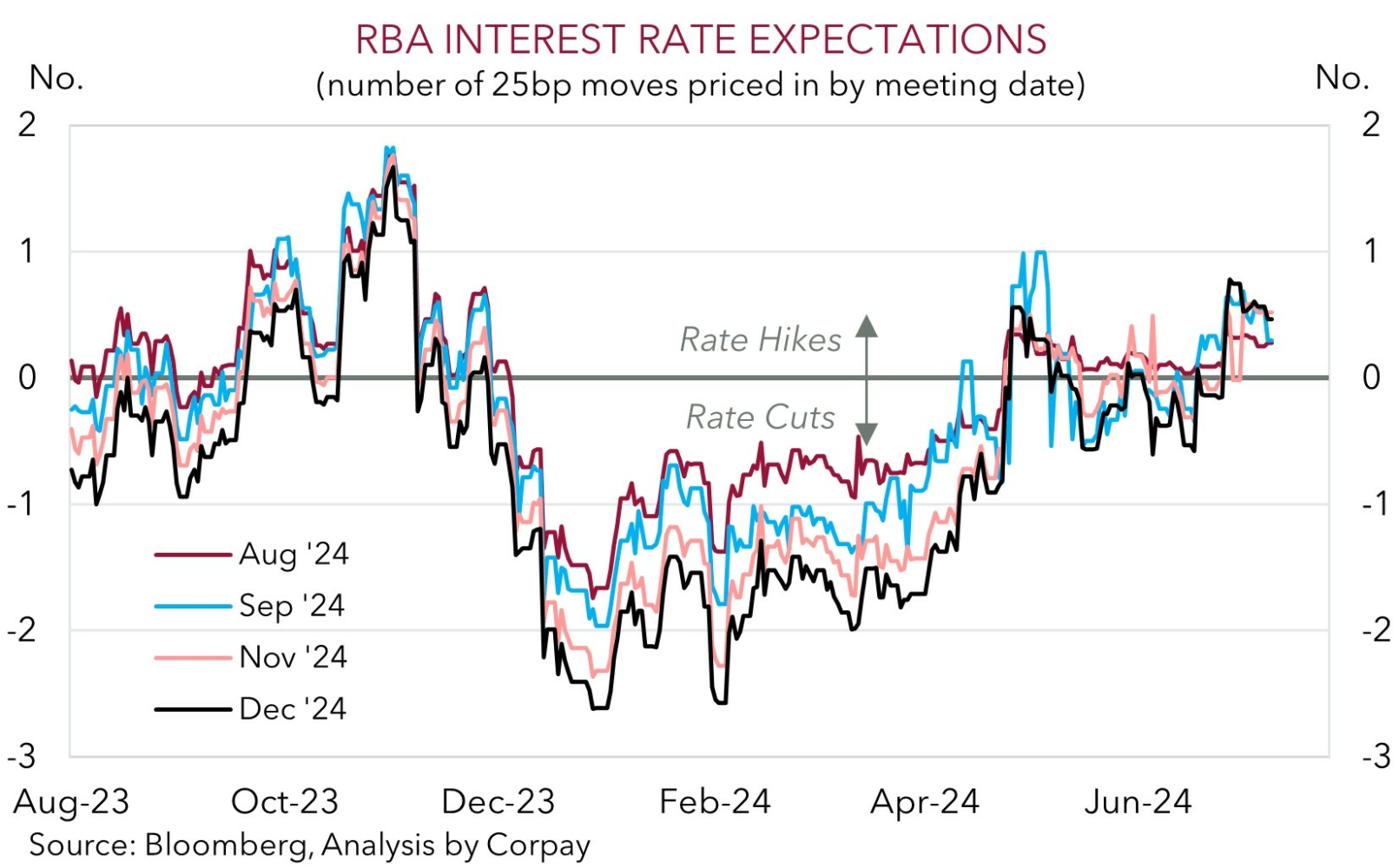

Locally, the latest reads on consumer confidence (10:30am AEST) and business conditions (11:30am AEST) are due today. The business conditions series is something policymakers monitor as it provides a good real-time guide on a wide range of areas across the economy such as forward orders, hiring intentions, prices/costs, and underlying demand. In our view, more indications the economy is still operating in a state of ‘excess demand’ could support market pricing which is factoring in a chance of another RBA rate hike over coming months. We think the resilience in the Australian labour market, sticky domestic inflation, and fiscal/income support that has begun to flow is keeping the pressure on the RBA to tighten policy a little more. The 6 August RBA meeting should be considered ‘live’ for a change (the market is assigning a ~30% chance of a rate rise at this meeting, with it ~60% discounted by November). The upcoming June jobs data (due 18 July) and Q2 CPI (due 31 July) will be important inputs into the policy equation.

Recent trends reinforce our thoughts that the RBA is on a different path to many of its global counterparts. We think the macro/policy divergence, and shifting yield differentials in Australia’s favour, should be AUD supportive over the medium-term. These dynamics could be bolstered by comments from Fed Chair Powell (tonight 12am AEST) if he keeps the door open to rate cuts later this year. We also believe crosses like AUD/EUR, AUD/CAD and AUD/GBP should remain supported. That said, AUD/NZD may be an exception in the near-term. We feel that the RBNZ could hold its ‘hawkish’ stance at tomorrows meeting as it waits for next weeks NZ CPI data. After its recent strong run the RBNZ leaning against the markets ‘dovish’ expectations could see AUD/NZD slip back in the short-term, in our opinion.