• US holiday. Quiet trading with the US shut for Independence Day. European equities, yields, & EUR higher on the back of easing French political risks.

• AUD upswing. Softer USD & relative macro trends supporting the AUD. AUD/USD near the top of the range it has occupied since early-January.

• US jobs. US non-farm payrolls released tonight. Signs the US jobs market is cooling could bolster Fed rate cut expectations which would drag on the USD.

With the US markets shut for Independence Day it was relatively quiet overnight. There was a bit of a ‘risk on’ vibe in European trading with regional equities rising (EuroStoxx600 +0.6%) and bond yields ticking higher (German & UK 10yr rates rose ~2bps). Across commodities, copper (+0.7%) and energy (WTI crude +0.2%) prices also edged up.

Supporting the positive risk tone was a further easing of French political concerns. Latest polling ahead of this Sunday’s second round of voting showed the far-right parties should fall short of a majority in French parliament, meaning the ability to push through their agenda would be significantly hindered. Staying with politics, the exit polls in the UK indicate the opposition Labour Party looks set to win the General Election with a huge majority. While in the US, after his very poor showing in last week’s debate President Biden has slipped back in opinion polls and betting market odds, with the latter now favouring Vice-President Harris as the Democratic nominee. President Biden is due to have a sit down interview with US ABC News over the next few days.

In FX, as the UK election results look largely as anticipated the initial impact on GBP has been limited with the currency treading water near ~$1.2760. However, reduced French political worries have helped the EUR extend its upswing. At ~$1.0810 EUR/USD is near a ~1-month high. This, and a modest dip in USD/JPY (now ~161.20), has exerted more downward pressure on the USD. The backdrop has helped NZD nudge up (now ~$0.6115) with the AUD also drifting towards the top of the range it has occupied since early-January (now ~$0.6725).

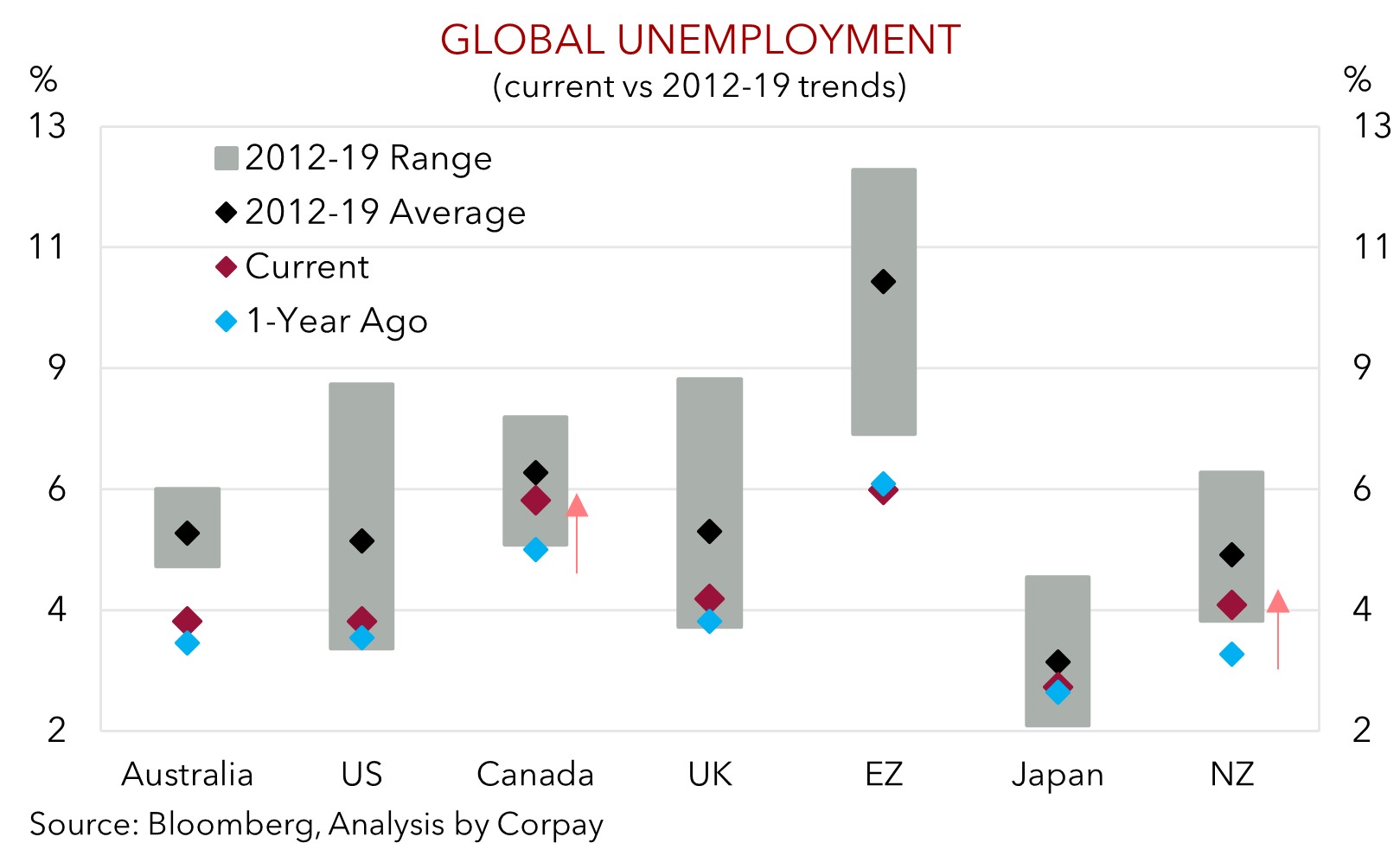

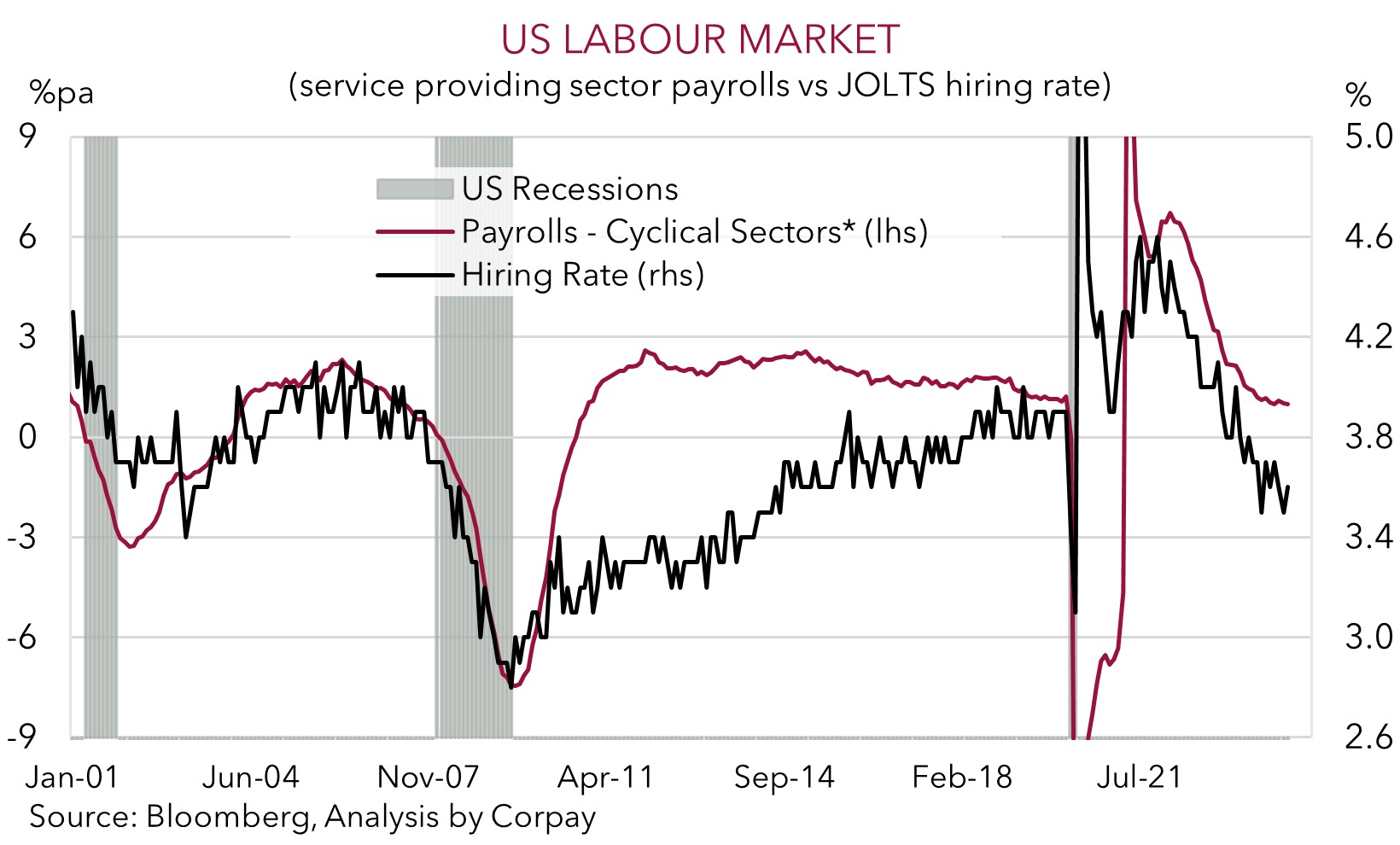

Tonight, attention will be on the June US non-farm payrolls report (10:30pm AEST). Trends in the US labour market have an important bearing on US monetary policy. The US Fed’s data dependency means interest rate expectations (and the USD) will be quite sensitive to the incoming news. Interest rate markets continue to price in the first US Fed rate cut by November with a second move now close to being fully discounted by December. In our view, based on the slowdown in US growth, tighter credit conditions, and decline in leading indicators such as the ‘hiring rate’ and employment intentions, risks are tilted to the jobs report underwhelming forecasts. Market analysts are looking for non-farm payrolls to rise by 190,000 in June, unemployment to hold steady at 4%, and wage growth to decelerate to 3.9%pa. We think more signs the heat is coming out of the US jobs market could bolster US Fed rate cut bets. This in turn may drag on US bond yields and the USD.

AUD Corner

In US holiday impacted trade the softer USD and risk positive undertone across markets has supported the AUD (see above). At ~$0.6725 the AUD is at the upper bound of the range it has traded in since early-January. The AUD’s outperformance on the crosses has also continued. AUD/EUR (now ~0.6220) is near its 1-year high. AUD/NZD (now ~1.0999) and AUD/CAD (now ~0.9157) are less than ~0.3% from their respective 1-year peaks. AUD/CNH (now ~4.9050) touched its highest point since last July, AUD/GBP (now ~0.5272) is around the upper end of its multi-month range, and AUD/JPY (now ~108.48) is near levels last traded in the early-1990s.

Diverging economic and monetary policy expectations continue to underpin the AUD. Over the past two weeks Australian monthly CPI inflation, retail sales, and building approvals have been better than expected, while other indicators like export and import growth (the latter is a guide to domestic demand) improved. While growth rates/momentum have slowed, particularly across the interest rate sensitive and goods-producing sectors, the level of activity (especially in the labour-intensive services providing sectors) remains above its pre-COVID trend. This is important as it is the level of demand compared to supply which drives inflation. As such, we think the pressure on the RBA to tighten policy a little more remains in place. The 6 August RBA meeting should be considered ‘live’ for a change (the market is assigning a ~32% chance of another rate rise), with the June jobs data (due 18 July) and Q2 CPI (due 31 July) important inputs into the equation.

We remain of the view that the RBA is on a different policy path to its peers. We believe the unfolding policy and economic trends, and shifting yield differentials in Australia’s favour, should be AUD supportive over the medium-term, particularly on crosses like AUD/EUR, AUD/CAD, AUD/NZD, and AUD/GBP. Near-term, the monthly US and Canadian jobs reports are released tonight (both 10:30pm AEST). In our view, indications the US labour market is cooling and/or that the cracks in the Canadian labour market are widening should see markets factor in more policy easing by the US Fed and Bank of Canada. If realised, this may weigh on the USD (and CAD), and in turn give the AUD a further boost.