• Mixed markets. Divergence between US & European equities, while long-end bond yields & the USD gave back a little ground. AUD a touch firmer.

• US macro. Fed Chair Powell noted there has been “quite a bit” of inflation progress. But more is needed. The ‘quits rate’ points to lower wages/inflation.

• Data flow. Australian retail sales due today. UK election tomorrow. In the US, ADP employment, services ISM, & jobless claims released tonight.

While there was a bit of divergence in equities overnight (the major European markets slipped back ~0.5% and the US S&P500 rose ~0.6% to be within striking distance of its record high), long-end bond yields and the USD generally gave back ground. After ticking up over recent sessions the benchmark US 10yr rate shed ~3bps (now ~4.43%) with similar sized moves coming through in the UK 10yr. This in turn exerted a little downward pressure on the USD. Across the FX majors, EUR drifted a touch higher (now ~$1.0745), USD/JPY consolidated (now ~161.40), and ahead of Thursday’s UK General Election where polling points to a change of government GBP ticked up (now ~$1.2685). Elsewhere, NZD (now ~$0.6077) and USD/SGD (now ~1.3564) tread water, and the AUD nudged up (now ~$0.6666).

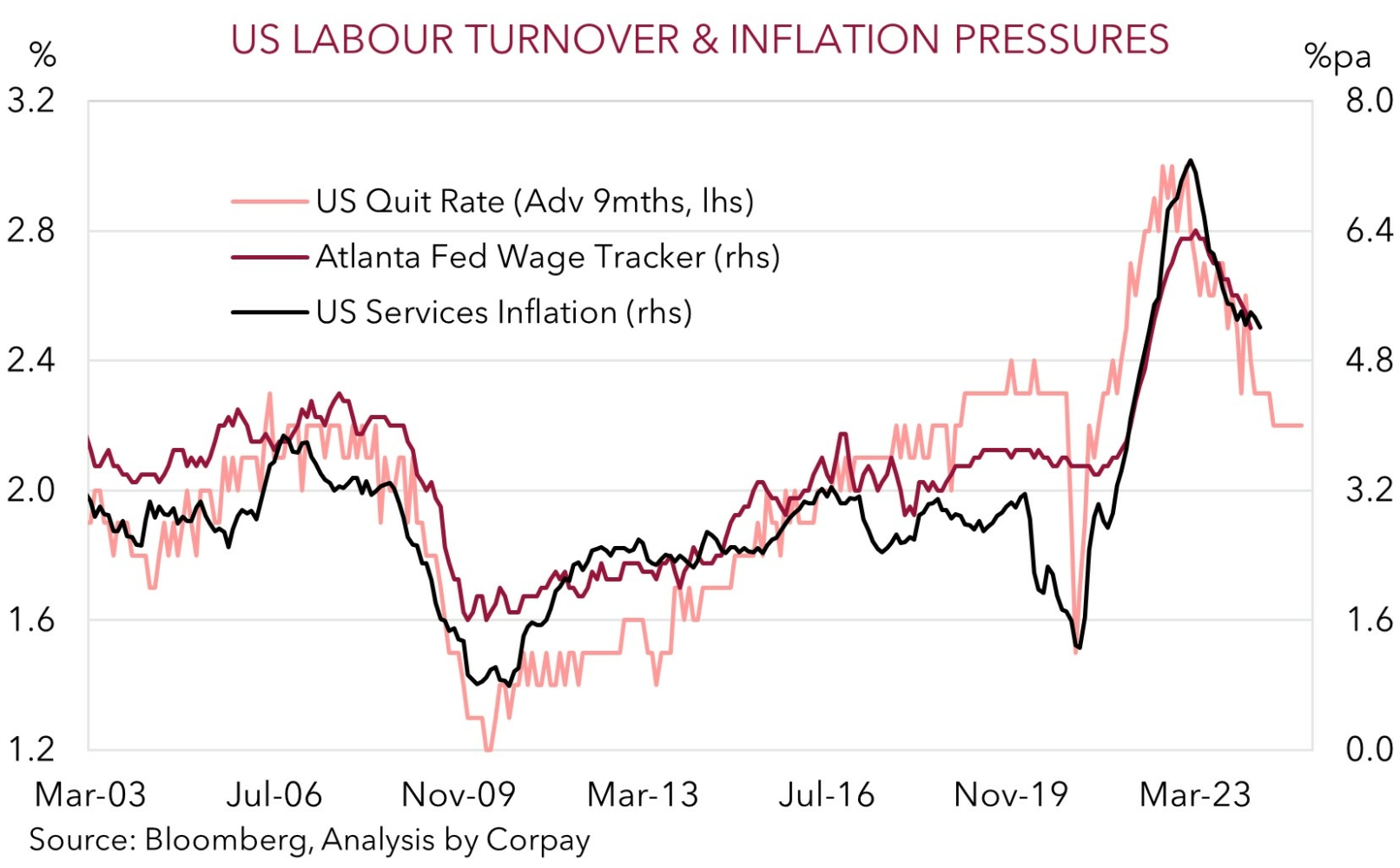

Macro wise, the US was in focus with Fed Chair Powell speaking and the latest JOLTS job openings released. Notably, according to Chair Powell “quite a bit of progress” in lowering inflation has occurred, though he tempered this by also stressing he would like to see these trends continue with policymakers needing to see more data before having the confidence to lower interest rates. On the data front, there are signs things are heading in the right direction. Although job openings unexpectedly increased in May the underlying detail still indicates that the US labour market is getting into better balance and price pressures should continue to recede. As our chart shows, the ‘quits rate’ (a measure of voluntary job leavers and a leading indicator for wages and services inflation) held steady at 2.2%, its lowest since 2020. The ‘hiring rate’ has also moved lower over the past year, inline with the US’ slower growth momentum, tighter credit conditions, and subpar confidence.

Interest rate markets continue to factor in the first US Fed rate cut by November, with a second move fully discounted by January. The US Fed’s data dependency means interest rate expectations and the USD will be quite sensitive to the incoming economic news. In the US, ahead of the 4th of July holiday, ADP employment (10:15pm AEST), initial jobless claims (10:30pm AEST), and the ISM services index (12am AEST) are due tonight, with the monthly non-farm payrolls data released later in the week (Friday night AEST). In our opinion, indications the heat is continuing to come out of the US labour market could bolster US Fed rate cut bets, which if realised may drag on US bond yields and the USD.

AUD Corner

The slightly softer USD on the back of the modest dip in long-end US bond yields, coupled with the firmer US equity market has given the AUD a little support (see above). At ~$0.6666 the AUD is ~0.6% from its multi-month highs. On the crosses, the AUD has been mixed. Over the past 24hrs the AUD has ticked up by ~0.1-0.2% against the EUR, JPY, NZD, and CNH, while it has slipped back by ~0.2-0.3% versus GBP and CAD.

Locally, the minutes of the last RBA meeting, which pre-dated the upside inflation surprise, were released yesterday. According to the minutes the RBA needs to remain “vigilant” to upside CPI surprises, with the Board also discussing whether the current policy stance was “sufficiently” restrictive to get inflation back to target in a timely manner. The recent domestic data would suggest it isn’t. The positive domestic inflation impulses, resilient labour market, and still high level of demand across the private sector means the pressure on RBA to tighten policy further is growing. Failure to tighten policy again would likely just mean that interest rates might need to stay where they are for some time to deliver the required economic effects to drag down inflation.

Australian retail sales for May are due today (11:30am AEST). An uptick in retail spending is looked for (mkt +0.3%), which if realised could reinforce RBA rate hike pricing. We remain of the view that the RBA is on a different path to its peers, and that the diverging monetary policy and economic trends should be AUD supportive over the medium-term, particularly on crosses like AUD/EUR, AUD/CAD, AUD/NZD, and AUD/GBP.

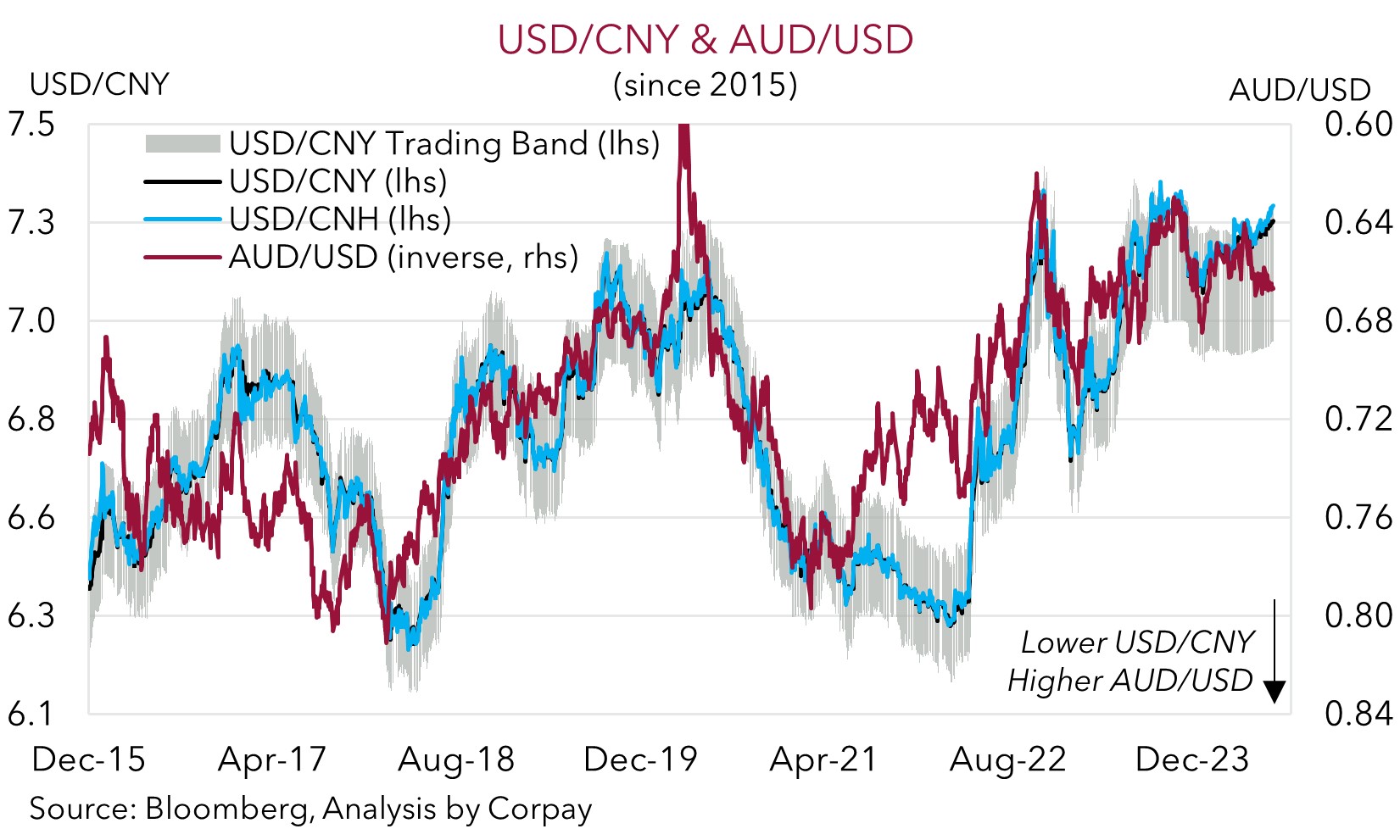

That said, it isn’t all one-way. A handbrake on the AUD are CNY trends. The Peoples Bank of China has been adjusting its USD/CNY reference rate higher, with the pair now at levels last traded in November as policymakers try to offset economic and capital flow pressures. Given the correlation between the currencies further weakness in CNY (i.e. a higher USD/CNY) could be a drag on the AUD. But as observed recently we believe this would be more akin to a handbrake that partially offsets AUD positive factors like upbeat risk sentiment, elevated base metal prices, and divergence between the RBA and others, rather than something that pushes the AUD lower.