• Firmer USD. No major economic releases but bond yields & the USD rose overnight. USD/JPY around levels last traded in late-1986. AUD round trip.

• AU inflation. Monthly CPI higher than anticipated. Odds of another RBA rate hike as soon as 6 August have risen. Relative trends should be AUD supportive.

• Events. RBA Dep. Gov. Hauser speaks & US durable goods due. PCE deflator released Fri night. US Presidential Election debate tomorrow (Fri 11am AEST).

Financial markets have livened up a bit over the past 24hrs. Although outside of Australia where yesterday’s monthly CPI data surprised and triggered a repricing in RBA interest rate expectations there doesn’t look to be a specific macro catalyst behind some of the offshore moves. Month- and Quarter-end portfolio rebalancing flows could be a part of the story. Equities were mixed with European stocks losing a little ground (EuroStoxx50 -0.4%) and the US’ rebound extending (S&P500 +0.2%). By contrast, bond yields rose across all major regions with long-end rates in Europe up ~6bps, while the benchmark US 10yr is ~8bps higher (now 4.33%).

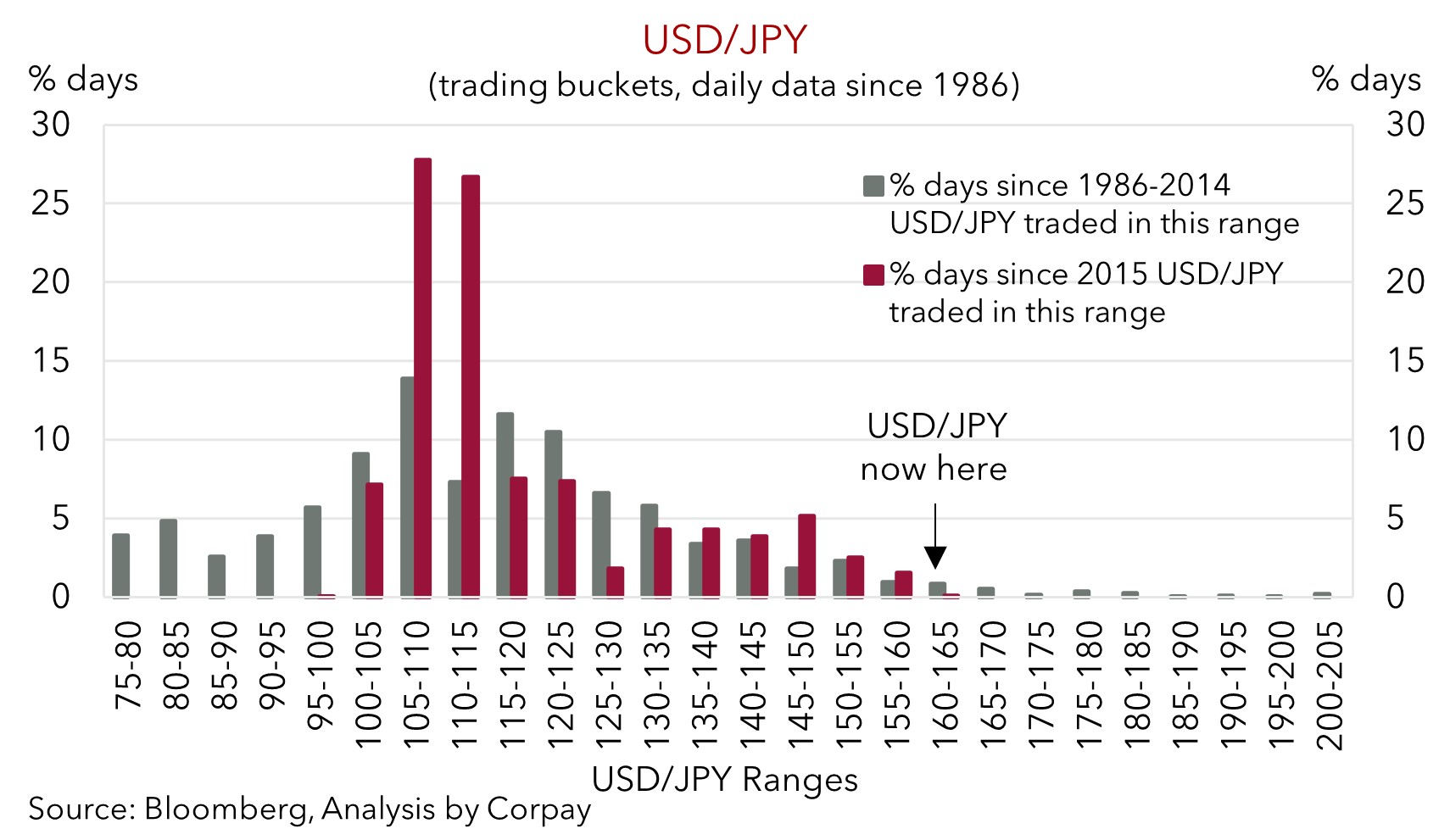

In FX, the USD index is firmer on the back of a pullback in the EUR (now ~$1.0680) and GBP (now ~$1.2620, the bottom end of its 1-month range), and a weaker JPY. USD/JPY’s upswing has continued with the pair breaching levels reached in late-April that triggered a bout of FX intervention by Japanese authorities. At ~160.75 USD/JPY is in rarefied air having last traded at such lofty heights in late 1986. The chances of another round of FX intervention are growing with each pip USD/JPY ticks higher, in our view. And although it may not change the underlying trend it can create more two-way risk in the JPY. If it were to occur a knee-jerk drop in USD/JPY would have a cascading impact across other currencies given it is second most traded currency pair. Elsewhere, while the stronger USD has pushed up USD/SGD (now ~1.3585, a high since early-May) and weighed on the NZD (now ~$0.6080), the AUD is, on net, unchanged from where it was this time yesterday (now ~$0.6650, though it has traded in a ~0.8% range). The jump in Australian yields and stronger iron ore prices (+2.5%) helped offset the USD strength.

The US economic dataflow picks up over the rest of this week. Tonight, weekly initial jobless claims and durable good orders (a proxy for business investment) will be in focus (10:30pm AEST). Tomorrow night the PCE deflator (the US Fed’s preferred inflation gauge) is due. In between the first debate between President Biden and former President Trump takes place (Fri 11am AEST). As mentioned recently, the US Fed has become increasingly data-dependent. As such, we believe subdued durable goods orders, combined with a slowdown in the US core PCE deflator might reinvigorate US Fed rate cut bets. If realised, this could drag on the USD given its correlation with US bond yields.

AUD Corner

The AUD has endured a burst of volatility over the past 24hrs with the positive jolt stemming from the hotter than anticipated Australian CPI (see below) counteracted overnight by a firmer USD. It traded in a ~0.8% range, but on net, AUD/USD is little changed from where it was this time yesterday (now ~$0.6650). That said, the upward repricing in Australian interest rate expectations has helped the AUD outperform on the crosses. AUD/EUR (now ~0.6225) is near the upper bound of its one-year range, as is AUD/CAD (now ~0.9110). AUD/GBP (now ~0.5268) is around a six-week high, AUD/CNH (now ~4.8540) is at the top of its 2024 range, AUD/NZD (now ~1.0930) is at a one-month high, and AUD/JPY (now ~106.85) is at levels last traded in late-2007.

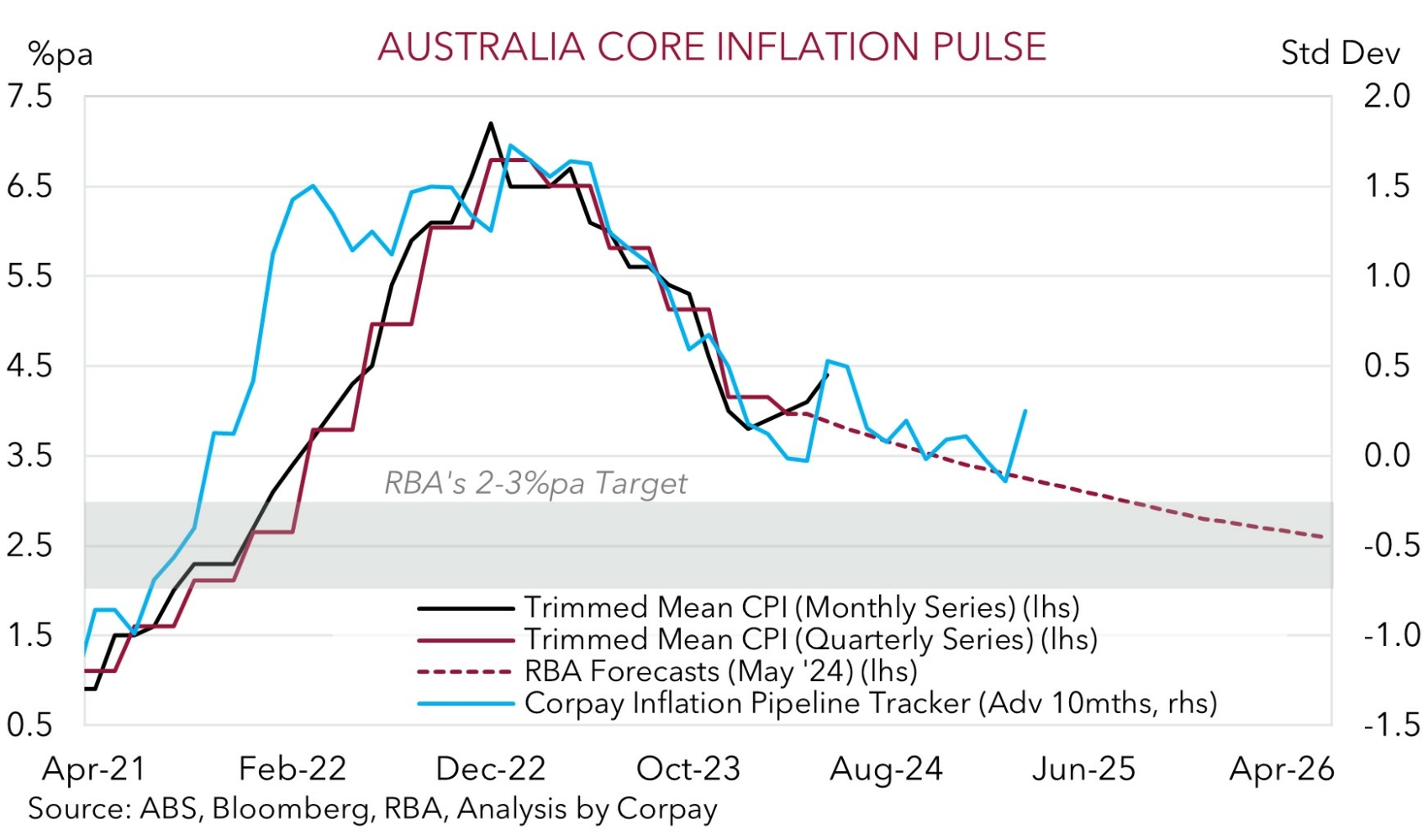

Yesterday’s data indicated that Australia’s inflation genie is struggling to be put back in the bottle. Headline inflation re-accelerated to 4%pa (from 3.6%pa in April), its fastest pace in seven-months. Positive base-effects were a factor but the detail under the hood would also be on the RBA’s radar given it has limited tolerance for upside surprises. Disinflation across ‘goods’ prices looks to be stalling, and ‘services’ price pressures remain robust. As a result, underlying/core inflation is still north of the RBA’s target band (the trimmed mean stepped up to 4.4%pa).

The monthly CPI indicator doesn’t have all the bits and pieces included in the full inflation dataset. The Q2 quarterly CPI print will be released on 31 July. Nevertheless, the May data shows Australia’s inflation pulse remains strong with things tracking above the RBA’s projections. While growth rates have slowed, particularly across interest rate sensitive and ‘goods producing sectors’, the level of activity across the private sector (and services providing industries) is still above of its pre-COVID trend. This is keeping labour market conditions rather tight, wages elevated, and in turn domestic/core inflation sticky. The pressure on the RBA to tighten its policy settings a little more over the near-term is growing with another rate hike at the 6 August meeting a real possibility (markets are now assigning it a ~42% chance). Failure to deliver further tightening would likely just mean that the current level of interest rates will need to be maintained for some time to deliver the required economic effects to drag down inflation. For more see Market Wire: Australia’s inflation problem.

More insights into the RBA’s views about the economic state of play, especially after yesterday’s CPI data, could come through tonight when Deputy Governor Hauser speaks (8pm AEST). Overall, the latest CPI data supports our prior assessment that the diverging economic and monetary policy trends between Australia and others, the swing in yield differentials, and a reduction of still bearish ‘net short’ positioning (as measured by CFTC futures) should be AUD supportive over the period ahead, particularly on crosses like AUD/EUR, AUD/CAD, AUD/GBP, and AUD/NZD (see Market Musings: RBA: No retreat, No surrender).