• Consolidation. US stocks & yields range bound. USD index a touch firmer, but AUD holds its ground thanks to some outperformance on the crosses.

• Fed speak. Chair Powell didn’t generate fireworks. Data will guide the Fed, though US labour market trends are becoming more important.

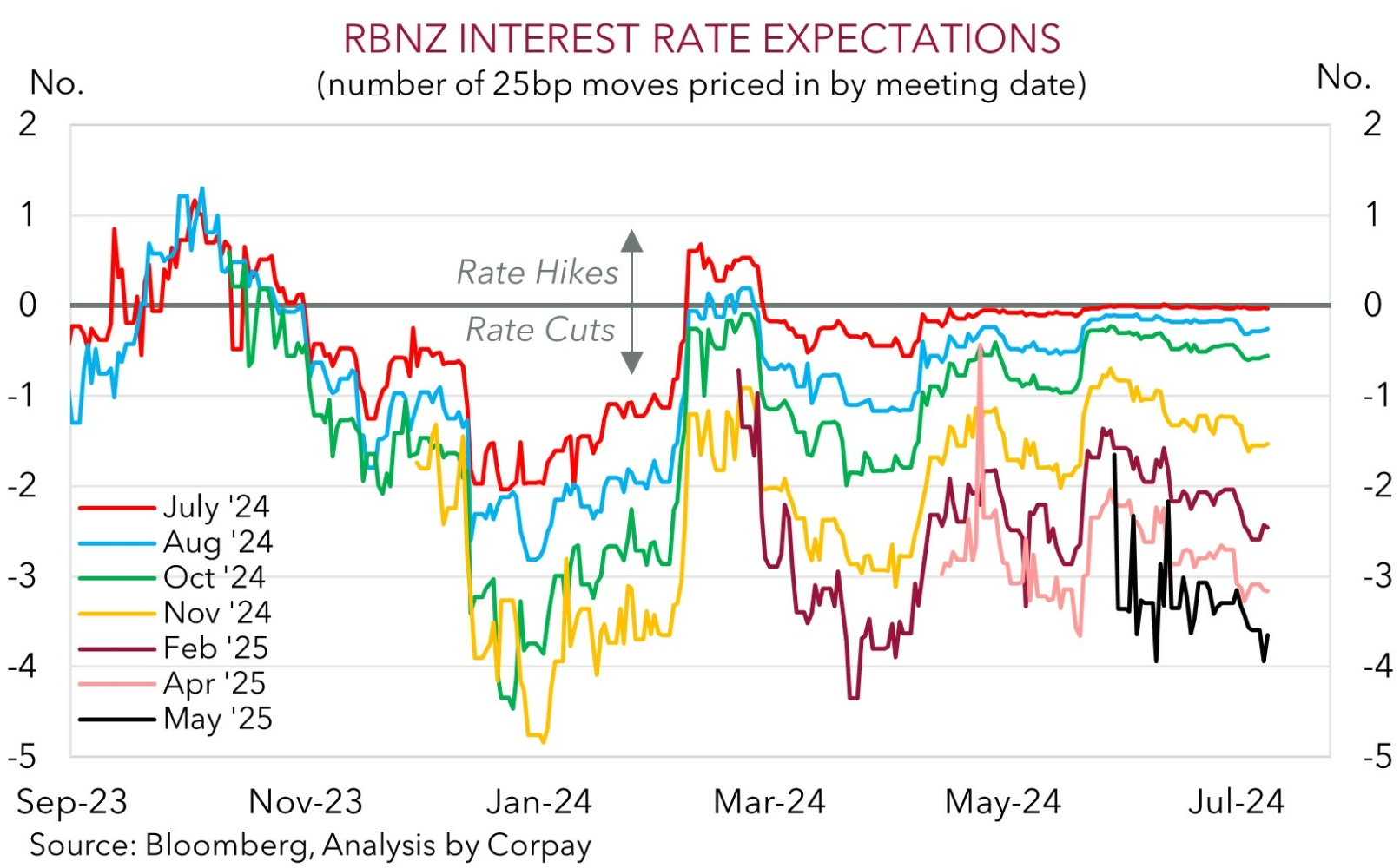

• RBNZ today. No change expected. This is a review not a forecast update. Leaning against the markets ‘dovish’ pricing could see AUD/NZD slip back.

In contrast to some of the moves in Europe it was another relatively quiet night in US markets with the major asset classes range bound. In Europe, nervousness about the political situation in France as talks to form a government got underway crept back in with equities falling (EuroStoxx600 -0.9%) and the spread between French and German bond yields widening (this is a gauge of inter-regional stress). That said, the EUR is only slightly lower compared to 24hrs ago (now ~$1.0815). By contrast, in the US the stockmarket (S&P500 +0.1%), rates (US 10yr +2bps to 4.30%), and the USD only had small net moves. Across the other FX majors, GBP slipped back (now ~$1.2785), USD/JPY edged higher (now ~161.25), the NZD softened a fraction ahead of today’s RBNZ meeting (now ~$0.6125), and the AUD held steady (now ~$0.6740).

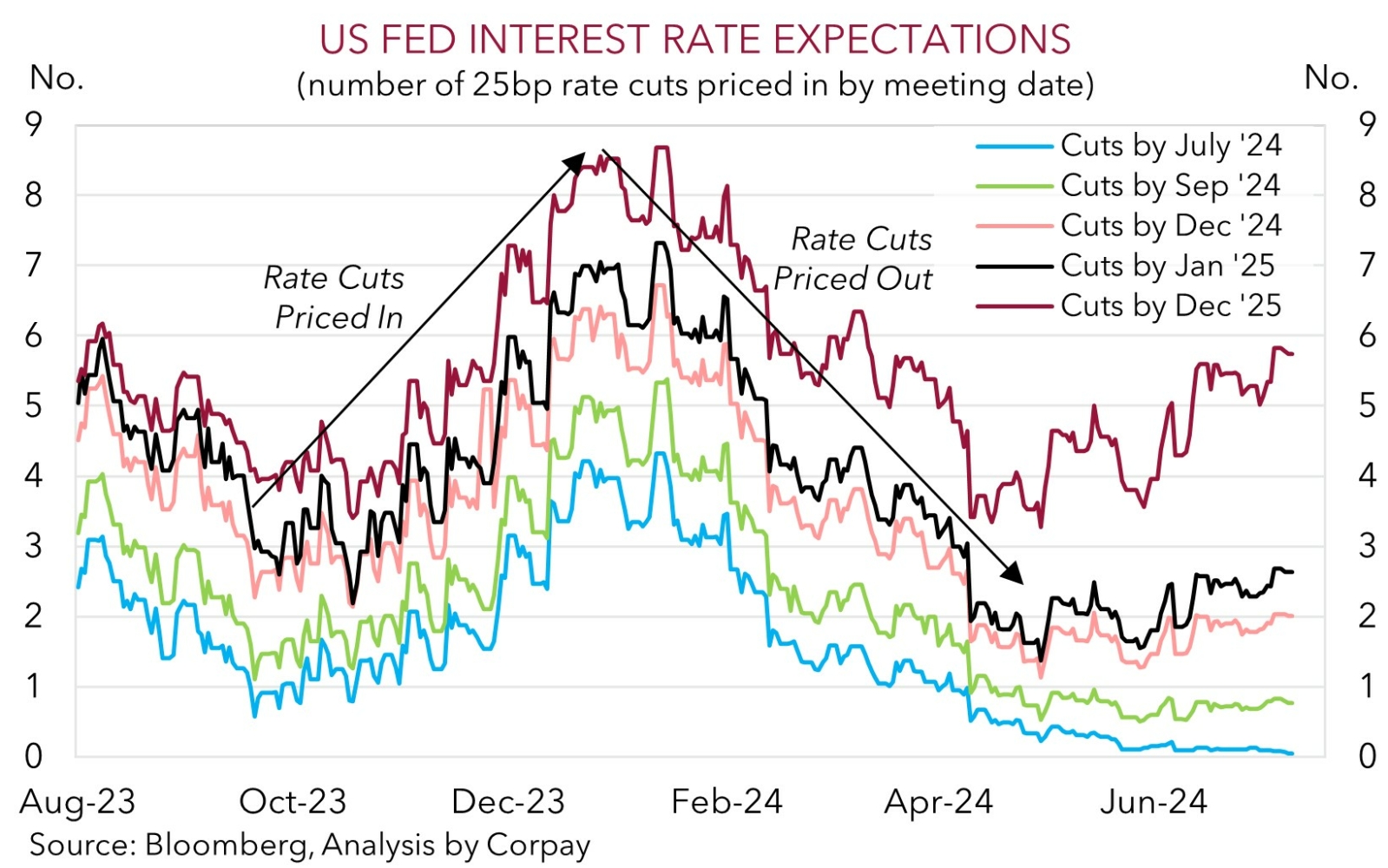

US Fed Chair Powell’s Congressional Testimony was in focus overnight, and he failed to generate market fireworks. Chair Powell largely reiterated the recent script, though he added context around the US data. According to Chair Powell, inflation readings point to “modest further progress” and that the data shows “a pretty clear signal that labour market conditions have cooled considerably”. While he did not commit to a timeframe for interest rate cuts, with the Fed taking things “meeting by meeting”, Chair Powell noted that “more good data would strengthen our confidence” inflation is heading back to target, and that inflation isn’t the only risk policymakers face as a weakening jobs market could “be a case for loosening policy”. Markets are pricing in next to no chance of a move by the Fed at the late-July meeting, however a rate cut in mid-September is ~70% priced in. There are three US CPI inflation and two jobs reports ahead of that meeting. We think more signs US inflation pressures are receding, and the labour market is cooling could see the US Fed deliver the first of a series of rate reductions in September.

Fed Chair Powell speaks again tonight (12am AEST), but he is unlikely to say anything new. Rather, the next major focal point for markets will be June US CPI inflation (released Thursday night AEST). In our opinion, due to some lower prints this time a year ago, the annual run-rate of US core CPI looks set to hold near 3.4%pa. However, the monthly pulse may again be on the softer side, thanks to slowing rents and wages. We feel markets should take more of a signal from the monthly rather than the annual data. If realised, we believe indications the monthly US inflation pulse has stepped down could bolster US Fed rate cut expectations, dragging on US yields and the USD.

AUD Corner

The AUD has tread water over the past 24hrs with the currency hovering near ~$0.6740, the upper end of the range it has occupied since early-January. Despite a slightly firmer USD, thanks in part to a softer EUR (see above), relative strength on the crosses has held up the AUD. AUD/EUR (now ~0.6235) is around the upper bound of its ~1-year range with renewed French political jitters exerting a bit of pressure on the EUR. AUD/CAD (now ~0.9190) and AUD/CNH (now ~4.9135) are near their respective multi-quarter peaks, while AUD/JPY (now ~108.70) is at levels last traded in 1991.

The latest reading on Australian business conditions was released yesterday. There was something for everyone in the data. While indicators like forward orders and hiring intentions suggest growth momentum across the economy is continuing to slow, other measures like capacity utilization remain well above average. This indicates that the level of activity remains elevated. This is important as it is the level of demand compared to supply which drives inflation, not necessarily growth rates. With the economy still operating in a state of ‘excess demand’ we think there is a possibility the RBA delivers another ‘inflation insurance’ rate hike over coming months. Markets agree with ~30% chance the RBA moves in August factored in (or a ~50% probability it occurs at the late-September meeting). The upcoming June jobs data (due 18 July) and Q2 CPI (due 31 July) will influence the RBA’s decision.

Recent developments support our long-held view that the RBA is on a different path to peers. We think the economic and monetary policy divergence, and swings in yield differentials in Australia’s favour, should be AUD supportive over the medium-term. Signs US inflation pressures are cooling in the upcoming CPI report (released Thursday night AEST) could reinforce this theme are give AUD/USD a boost. We also think crosses like AUD/EUR, AUD/CAD and AUD/GBP should remain supported.

That said, AUD/NZD may be an exception in the near-term. The RBNZ meets today (12pm AEST). This is an interim review, not a meeting where the RBNZ updates its forecasts. We feel the RBNZ could play a straight bat and hold off from jettisoning its ‘hawkish’ stance at this meeting, particularly with NZ CPI inflation not released until 17 July. After its recent strong run the RBNZ leaning against the markets ‘dovish’ expectations could see AUD/NZD slip back in the short-term, in our opinion.